The three major stock indexes of the "Daily Evaluation" fell across the board, and multiple stocks fry the board. The index rebounded again?Next week may face direction selection

Author:Federation Time:2022.08.12

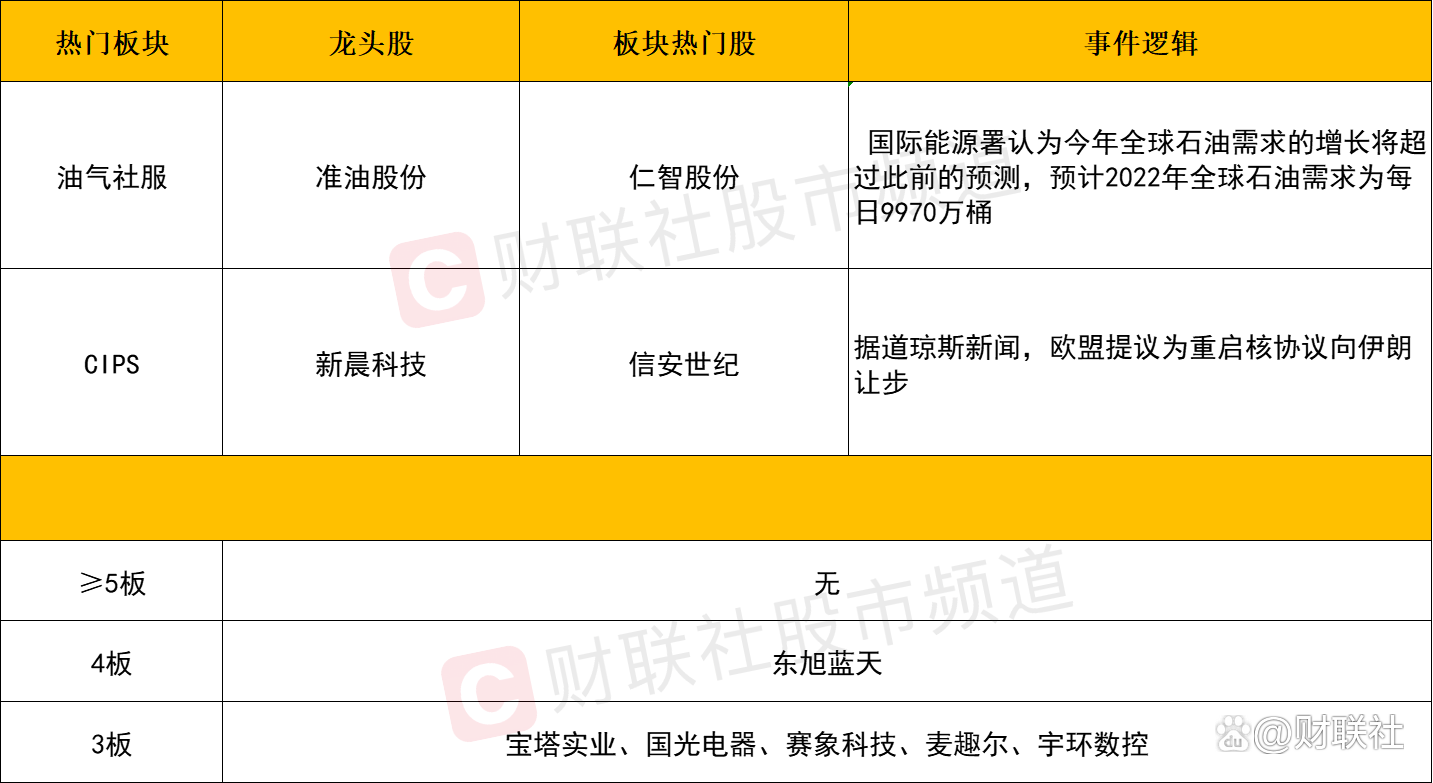

The three major indexes collectively recovered today, of which the entrepreneurial board fell more than 1%. The consumer electronics and large finances that rose yesterday failed to strengthen. In the early stage, the main line photovoltaic, semiconductor, military industry and other sectors were adjusted. The short -term popular stocks such as Dagang, Ovi Communication, and Sunrise Oriental fell sharply, resulting in market sentiment rapidly Cooling. There are many daily limit of individual stocks, such as Yuhuan CNC, Wenyi Technology, Kerry Technology, Xiangxin Technology, etc. On the whole, the large and small -cap stocks show a differentiation trend, and over 2,500 stocks of the two cities have fallen. In terms of sectors, cross -border payment, oil and gas, coal and other sectors have risen the top, and in terms of decline, photovoltaic, military, semiconductor and other sectors have fallen first.

Plate

In terms of sectors, let's pay attention to the direction of consumer electronics that led yesterday. In the context of the great influx of funds yesterday, today's feedback is not good. The overall opening of the sector is high and the internal differentiation is sharply different. The stock trend of the concept of Xiaomi is relatively strong. Among them, the national optoelectronics and Kerry technology 3 consecutive boards, and the victory is precision 2 consecutive boards. However, there were no premiums between Lixun Precision and Goer's two leaders. Lixun Precision has fallen down all the way. As of the closing section, the overall decline has increased. Although the market continues the trend of high and low switching today, the "one -day tour" market of consumer electronics will still cause significant suppression of the market's subsequent emotions.

Today's market gain is the top direction of the stock cycle stocks. Oil, gas, coal, shipping and other sectors have risen before, and then the funds extended to the concept of CIPS. The fiber rose exceeded 10%, and PetroChina Capital and Rindong Holdings had daily limit. From the perspective of theme hype, the concept of CIPS is a new theme of currently preferred funds, and there is also a weekend fermentation time. It is expected that there will still be a certain high momentum next week. But essentially, today's strong cycle stocks are similar to yesterday's consumer electronics. It belongs to the sector's rotation and overlook it. Its continuity may be difficult to guarantee.

As the U.S. inflation is alleviated and the expectations of interest rate hike decline, the northbound capital began to return yesterday. In this context, the core assets of the northbound capital preferred in the past two trading days have ushered in a rebound, and the performance of Shanghai Stock Exchange 50 is also relatively strong. However, it should be noted that the medium -term short trends of most of the stocks have not been reversed, and the above -mentioned heavy -duty selling pressure is still overwhelmed. At this time, the rebound is also a heavy low -level replenishment meaning, and its continuation continues Sex needs to be continuously observed. For investors who want to take low -absorbing core assets, they still respect the trend first, and the medium -term trends such as patience can be reversed, or confirming the formation of the bottom form and then dialing layout, or have higher funding efficiency.

Individual stocks

At present, the market as a whole still continues the style of high and low switching, so the relatively high -level track stocks have a significant differentiation. Among them, Ovi Communications, Sunrise Oriental, Yihua Co., Ltd., and Xiangdian Co., Ltd. fell, and high -level popular stocks such as Changguang Huaxin, Jiang Bolong, and Guangliwei fell more than 10%. The weakening of these stocks, or a certain loosening group in the direction of the track. At the end of the end, Wenyi Technology, Xiangxin Technology, and Kerry Technology have exploded one after another. Its Chinese technology staged "Floor Floor" in just 10 minutes, which is also a manifestation of the continued weakening of market emotions. Whether it can usher in the restoration next Monday is particularly critical. Once the high -level stock kills the fall, then driven by panic emotions, the individual stocks that originally moved the trend will usher in the risk of high -level complement.

In addition, some investors believe that due to the deep degree of capital involvement in the track of the track, in the current market that there is no better main line, the direction of the new early track is still expected to further rise after experiencing sorting. However, in fact, each wave of tracks leading the segment and individual stocks are different. As far as the stock level is concerned, once there are obvious weak doubts in the early stage, the probability of completing the two -wave two waves in the future is getting lower and lower. Therefore, from the perspective of funding security, considering the doubts of the short -term price of individual stocks, it is still more cautious in response, and it is more secure to have a high time to stand at the risk control party in time.

Join market analysis

As of the close, the turnover of the Shanghai and Shenzhen cities reached 999.5 billion throughout the day, which was 67.2 billion from the previous trading day. The northbound funds bought 3.878 billion yuan throughout the day, the Shanghai Stock Connect net purchase was 3.023 billion, and the Shenzhen Stock Connect net purchase was 855 million.

Today, the three major stock indexes are adjusted on the entire line. The better is not effectively falling below the 5 -day moving average, and the short -term rebound structure has not been completely destroyed. Therefore, next Monday, there will be a choice of follow -up direction. When we can attack the upper pressure level on the top of the week, the subsequent trend of the index is more worth looking forward to. On the contrary Broken, the probability of the index will once again bottom out. At that time, it must be paid to the corresponding position control of the position, and the market risks such as patience will be fully released.

Bohai Securities believes that the relative relief of overseas pressure this week has brought about the inflow of foreign capital, and the continuity of foreign capital in the future will have an important impact on the market. In addition, the domestic fundamentals are still in the stage of waiting for incremental changes. Economic data will be announced next week, and economic pressure in July needs to be verified. At this stage, the market still requires the changes in fundamental expectations to break the existing balance, otherwise the market will still be difficult to break through the vibration pattern. The changes in the mid -term economic forward -looking and policy -looking may become the key to the expected difference. The opportunity for the market is still to be confirmed by the individual stocks. It has increased by 1976, a decrease of 1,709 from the previous trading day. In the case of excluding ST shares and new stocks, there are 55 daily limit, a decrease of 16 from the previous trading day; 24 frying boards, a decrease of 6 compared with the previous trading day; Home, a decrease of 5 compared to the previous trading day; the limit of 0 losers is the same as the previous trading day.

In terms of emotions, although yesterday's strong consumer electronics differentiation and some high -level stock calls, today's emotions have shown a lower fluctuation and declining trend. As of today's closing, it has been near the downturn area.

Focus on the market

1. The Ministry of Cultural Tourism: Strengthen comprehensive law enforcement with the focus of rectification of "unreasonable low -cost tour"

Financial Press August 12th, the General Office of the Ministry of Culture and Tourism issued a notice on strengthening industry supervision and further standardizing the tourism market order. Documents pointed out that localities should further strengthen the tourism market law enforcement, investigate and punish "unreasonable low -cost travel" in accordance with the law, and specify Specific shopping venues, forced tour guides, or in disguised shopping markets such as violations of laws and regulations, timely release of guidance cases, deterring illegal illegal business behavior, and further regulating the tourism market order. All localities must scientifically and accurately implement the "melting" mechanism of cross -provincial tourism business activities, guide and urge travel agencies to strictly implement the "Guide to Prevention and Control Work of the New Crown Pneumonia Epidemic Epidemic Epidemic Epidemic Epidemic Epidemic Epidemic Epidemic", pay close attention to the renewal of cross -provincial tourism fuse areas, and adjust the team in time to adjust the team Itinerary, strengthen the management of key links, and prevent and control measures from various outbreaks from details.

2. The Ministry of Industry and Information Technology's Raw Materials Industry Department went to the Metallurgical Chamber of Commerce for investigation and discussion

Financial Press, August 12th, Zhang Haiden, deputy director of the Ministry of Industry and Information Technology, led the relevant comrades of the Iron and Steel Office to the Metallurgical Chamber of Metallurgical Chamber of Metallurgical Chamber of Metallurgical Chamber of Metallurgical Chamber of Commerce on August 11. The two sides conducted in -depth exchanges on the operation of the steel industry in the current situation and the next development. Zhang Haiden introduced the work ideas and measures of the Ministry of Raw Materials Industry to guide the transformation and upgrading of the steel industry and promote high -quality development.

- END -

The person in charge of the relevant departments of the China Banking and Insurance Regulatory Commission answered the reporter's question on the "Administrative Measures for the Financial Company (Draft for Soliciting Opinions)"

In order to strengthen the supervision of the financial company of the enterprise group, promote the high -quality development of the industry, and further enhance the quality of the real economy, the

The huge Chinese market is the "lifeblock" of foreign companies

For some time, some Western media have been keen to rendering foreign companies are evacuating China. However, the facts are better than arguments. Regardless of whether the actual amount of foreign