Why is the competition, why is the competition increasingly "fierce"?

Author:Shanxi Economic Daily Time:2022.08.12

"Exclusive financial management, once a year, the highest annualized yield of 8.18%, the chief investment advisory interpretation of investment and wealth management strategies, star fund managers sharing investment methods, new customer exclusive financial management, and first binding officer to win cash gift packages." Enter to enter In August, major securities companies began to start the "8 · 18 Wealth Management Festival". So, what are the characteristics of securities firms' financial management? What is the difference between securities firms and banking financial management?

In early August, Cathay Junan Securities, Xingye Securities, Guoxin Securities, Huaan Securities and many other securities firms successively launched the "8 · 18 Wealth Management Festival" activities. The reporter asked a number of brokerage staff to learn that starting from mid -to -late June, some brokers promoted publicity on their own APPs and WeChat public accounts to start warm -up activities. In August, marketing methods are more diverse. In addition to launching their own special investment services and live video broadcasts, special financial products with an annualized return rate of about 8%have also become the "standard" of the event. In order to attract consumers, fierce competition has also begun. Among them, Guotai Junan's "August 18 Finance Festival" opened premiere, and more than 5 million people watched. From August 8th to 12th, there were two live video broadcasts on each trading day. Dozens of industry insiders such as fund managers, investment consultants, and market analysts interpreted market hotspots through live video live broadcasts and shared investment concepts.

It is understood that the "8 · 18 Finance Festival" began in 2017 and was a financial event organized by brokerage firms. In the past two years, as securities firms have paid more and more attention to product marketing, the resources invested in wealth management festivals have also increased. Compared with previous years, the number of brokers participating in the financial festival this year is more, the promotion time is longer, and the activities are richer. As of now, more than 60 brokers have participated in the event.

Where is the difference between the wealth management products of the brokerage and the bank? Most investors do not know well. Zhang Jin is an investment consultant of Datong Securities. He told reporters that the difference between the financial management and bank wealth management of securities firms is mainly to issue the main body, product type and customer group. The wealth management products currently sold by banks and securities firms are mainly divided into two types of issuance and sales. Bank issuance products mainly use banks' high credit rating to achieve low -cost financing, and then conduct investment bonds. The current wealth management products issued by securities firms are mainly based on income vouchers. The revenue voucher is the principal guarantee financial product, and the biggest advantage is that the contract stipulates the principal and fund guarantee type. After the product issued the product, it is mainly used to supplement the own cash flow of the broker, so it is a product with high security in wealth management products.

At present, the wealth management products of banks and securities firms are highly overlapped, involving public funds, private equity funds, asset management plans, insurance, etc. familiar to investors. The bank is mainly public funds and insurance wealth management products, and securities firms are mainly public funds, private equity funds, and asset management plans, focusing on different directions. In addition, due to the influence of the initial contact product category, the main body of bank customers is deposit customers, and the risk tolerance of the product is relatively low. Therefore, wealth management products are biased towards customers with lower risk tolerance. The customer of the securities firms is mainly stock customers. Most of the risk tolerance is far beyond bank customers, and wealth management products are biased towards customers with high risk tolerance.

In the context of the reconstruction of net worth, wealth management products no longer agreed to expire, and more to allow investors to accept the view that "financial management has risks". The transformation of net worth can also allow banks and securities firms to use their self -advantages to upgrade the product. From the perspective of security, whether investors buy products from brokers or banks, the direction of the same type of products is highly consistent, and the yields they get are similar. From the current product structure, there are more low -risk product types than brokers, and the income is relatively low. However, for high -risk fund products, brokers occupy their professional advantages, product types and investment suggestions better.

At present, it coincides with the "8 · 18 Wealth Management Festival", and each broker has launched different types of wealth management products for investors to choose from. Low -risk products have a reference to 8.18%of products to help out. Other securities firms cooperated with fund companies to launch customized products for investors. For investors, it may be a good time to allocate wealth management products annually.

During the interview, many investment consultants said that investment and financial management cannot only buy one or more products, but to maximize the yield through a reasonable investment portfolio. Both banks and securities firms require investors to learn more and learn more. You know, investment is risky, and you need to be cautious in entering the market.

Shanxi Economic Daily reporter Li Ruonan

- END -

Heavy!Huitianfuzhong 1000ETF Fund is officially launched

The recent market performance of the CSI 1000 Index is too strong! According to Wi...

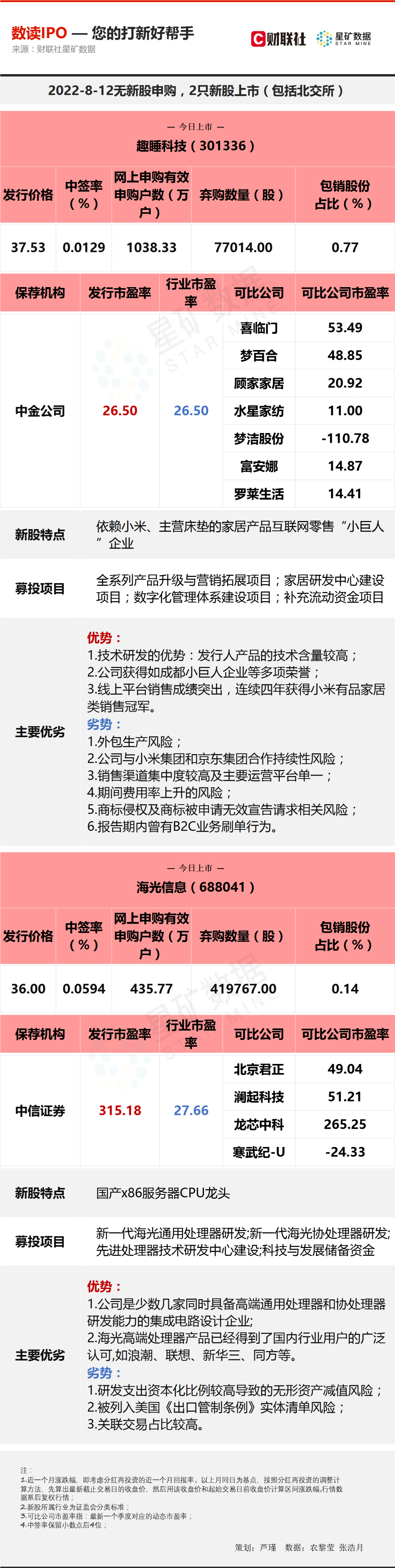

Issuing price -earnings ratio is higher than the industry 10 times the domestic CPU leader is listed today

There are no new shares to purchase today; the two new shares are listed, which ar...