Global oil tankers are tight, and freight rates rise sharply

Author:PetroChina Time:2022.06.17

Text/Wang Nengquan

Similar to the international oil market, the world oil transport market also fluctuates frequently, and the range of fluctuations is often greater than fluctuations in oil prices.

Since the popularity of the new crown epidemic, in March to September 2020, the price of world oil transportation is like a roller coaster — from mid-March 2020 from the Arab Bay to the Japanese route VLCC reached $ 54 per metric ton, setting the highest level since 2000; However, September fell to $ 5.50 per metric ton, setting the lowest level since 2003. Under the stimulus of the Russian and Ukraine War, the global oil transport market is currently changing the downturn in 2021. The shipping costs of various types of oil rings have risen significantly, and the world oil transport market is heating.

In view of the factors such as the construction of the new ship's construction and channel restrictions, unlike the previous round of the global oil transport market roller coaster due to the new crown epidemic, it is expected that before the end of the Russian and Ukraine War, especially the relationship between major energy importing countries such as Russia and Europe, Before improving and normalization, the freight rate of some routes may be large and may remain at a higher level in a longer period of time. Of course, how long the world's oil transportation market can last for observation.

The current situation of the world oil transportation market

According to the statistics of Clarkson, the shipping industry consulting agency, as of early May, there were 2,298 crude oil tankers worldwide with a load tonnage of 440 million tons: 859 VLCC, with a load tonnage of 265 million tons. 98.93 million tons; 1078 Aphrara oil tankers, with a permid tonnage of 119 million tons. In addition, according to another type of statistics in the shipping industry, the total scale of the global medium -sized oil ship fleet is about 1,600 ships.

From a professional perspective, the tanker transported oil is generally divided into two categories: cleaning oil and dirty tankers. Cleaning tankers mainly refer to petroleum products containing low -sulfur, including refined petroleum products, such as car gasoline, diesel, aviation fuel and petroleum oil, etc.; And dirty tankers are mainly carried crude oil, and also carrying high -sulfur oil such as fuel oil product.

From the perspective of historical data, the tanker rate will increase during the period when oil demand is low, because after the oil storage facilities on the land are filled, the need for oil tankers as flexible floating oil storage facilities will increase. In April 2020, due to the response to the new crown epidemic, global oil consumption declined sharply, the supply of crude oil and refined oil was severe, and the rates of cleaning oil and dirty tankers reached a record level. After the increase in oil demand and decrease in supply, the rate of oil tankers will decline. From September 2020 to September 2021, global oil tankers have remained at a relatively low level.

The Russian and Ukraine War became a pusher

The Russian and Ukraine War not only impacted the global energy market, but also had a secondary impact -the price of world oil transportation rose sharply. Data show that since the outbreak of the Russian and Ukraine War, due to the influence of war and the rise in fuel prices, the freight of clean oil tankers has risen significantly. In April, the yield of refined oil tankers in European routes has risen to a record high level.

Since February, due to the uncertainty of geopolitics and premiums of insurance risks, the cleaning tanker rates in Russia and European port have risen. Clean oil products are usually transported by medium -sized tankers, which are generally smaller than dirty tankers. Recently, the rate of medium clean oil tankers has risen to the highest level since April 2020.

It measures that the oil tanker rate index of the shipping industry is measured by the shipping rate index of the shipping industry. From January to April, the medium-sized tanker rate of the Baltic-British route increased by 63%. At the end of April, Russian Petroleum Corporation, Russia's second largest state -owned holding company, announced in May that the export of diesel exports from Poronask, Polnisk, Polonus, Polonusk, to zero. Under the stimulus of this news, compared with April, the clean oil turn rate from the Baltic Sea to the British route rose by 97%in the first half of May.

According to trade media and ship tracking service agencies, in order to make up for the reduction of imported diesel from Russia, Europe is increasing the import of diesel from other sources, especially the United States. As of the beginning of May, the number of exports of fuel oil from all destinations for all destinations has been at the top of the 5-year average (2017-2021). From January to April, the clean oil turn rate of the clean oil tanker along the Bay Coast of Mexico and the British route increased by 233%because it increased the demand for transportation of clean oil products from the United States to Europe. During the same period, the rates of the Atlantic coastal routes between the Arabia -Japan and the United Kingdom and the United States increased by 78%and 59%, respectively.

At the same time, due to the rising cost of the Russian and Ukraine, rising fuel costs, and premiums of insurance risks, from January to April, the rates of dirty oil tankers in the Black and Baltic Sea rose by 217%and 447%, respectively. Some reasons for the high rate of high tankers in Poronusk Afrah's oil tanker at the Polo Port of Russia is that they use Aphrara -type oil tankers instead of VLCC to transport Russian Ural crude oil to the Far East. Due to the fewer Aphrara talked ships available, the dirty torque rates from the Baltic Sea to the British route increased from $ 8.53 per metric ton in January to 41.38 US dollars in April.

Because of sanctions on Russian energy and shipping companies, European crude oil buyers were forced to find the source of imported oil from other channels. Since the week of April 15, the number of US crude oil exports has been higher than the average level of five years. In addition, from January to April, the tannel rates from the Bay of Arabia to Japan and the Mexico Gulf route rose by 34%and 53%, respectively. The increase in fuel oil costs also affects the rate of all types of oil. From December 2021 to March 2022, the prices of ships with high sulfur fuel oil and ultra -low sulfur fuel oil rose 51%and 58%, respectively.

According to the global medium -sized tanker assessment data of an investment bank in the United States, as of the week of May 20, 2022, the tanker's current rent rose by $ 10,000, which was already higher than $ 47,000. The rent is only $ 7,200.

The main route rate rises sharply

According to OPEC's "Monthly Petroleum Market Report" in May, in April 2022, the prices of dirty oil rings or cleaning tankers rose to varying degrees.

For example, in April, the VLCC spot rate increased by 24%monthly. Among them, from the Middle East to the east line, the monthly increased by 14%, the average WS50 point, and 52%year -on -year. 41%; West Africa to the east line rose by 30%monthly, with an average of 57 points of WS, an increase of 63%year -on -year.

In April, the tanker rates of all routes rose: 15%of the monthly increase, and 77%year -on -year, of which the west of the Suez Canal rose to the west of the route, rising by more than 20%on a monthly basis.

On the basis of a sharp rise in the last month, the Middle East to East routes in April to the east to east of the cleaning tanker rose only 2%monthly, with an average of 59%of WS189 points, which rose 59%year -on -year. On average, WS223 points, rising 52%year -on -year.

- END -

Supreme Law: Four aspects of escort New Third Board and the North Stock Exchange reform and development

25JUNWen | Wu Xiaolu Meng KeIn order to give full play to the role of the people's...

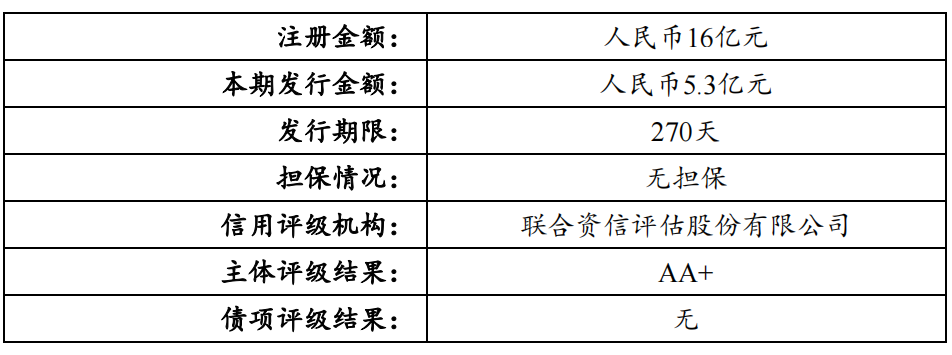

Nanyang Investment Group plans to issue 530 million yuan ultra -short -term integration to repay interest debt

[Dahecai Cube News] On June 27, Nanyang Investment Group issued the second phase o...