Nan Zhao: Building the "Golden Bridge" to relieve the mushroom farmers

Author:Henan Daily Client Time:2022.08.12

Henan Daily client reporter Meng Xiangdong Wang Juan correspondent Liao Tao Li Ziying

"I really didn't expect that the loan didn't need to run the bank, so it would be done so quickly on the mobile phone!" Loans landed in the rejoicing and surprise of farmers, and five farmers of China CCB Nanzhao Branch issued loans, with a total of more than 800,000 yuan in credit.

"This year I leased 4 greenhouses in the village to plant shiitake mushrooms. Under the guidance of the customer manager of China Construction Bank Nanzhao Sub -branch, the loan business was successfully completed after downloading the client on the mobile phone. The "shiitake mushroom loan" in Nanzhao County was officially launched. Once launched, it effectively solved the financing problem of the shiitake mushroom industry, and promoted the bigger and stronger of the shiitake mushroom industry.

This year, China Construction Bank Nanyang Branch and Nanzhao County People's Government signed a strategic cooperation agreement for rural revitalization. It was coordinated and promoted by Nanzhao County Financial Department. As the first key cooperation project, it came into being.

China Construction Bank Nanzhao Branch and the county agricultural department fully dock, summarize the county's shiitake mushroom planting data and industrial characteristics, and use digital financial concepts to upload the obtained shiitake mushroom planting information to the online help platform to explore the new development of financial support of the mushroom industry. Road. It is understood that the "shiitake mushroom loan" adopts the online mobile terminal processing model, which is the "Yu Nong Fast Loan Product Pack" sub -product under the "1211" rural revitalization service system of China Construction Bank. The use of new financial concepts focuses on solving the problem of farmers '"financing difficulties and expensive financing", and is committed to reducing the process of farmers' application loans, reducing the cost of financing of farmers, and solving the difficulty of loan in agricultural industry.

今年上半年,受疫情影响及市场形势变化,南召县金融部门紧急出台了多个抗击疫情、助力复工的一揽子政策和举措,包含贷款期限延长、无还本续贷、减免罚息、利率优惠、 Measures such as online services, supporting small agriculture, etc., try their best to help the epidemic affected by the affordable business owners and farmers, actively adopt convenient and convenient measures to support the affected people with greater influence, increase the "agriculture, farmers", consolidate the results of poverty alleviation, and other fields. Loan investment is fully supported to comprehensively support the re -production of enterprises.

In 2022, Nanzhao County optimized the business environment, standardized the services and fees of banking financial institutions, and established the "Credit Service Supervision Reporting Platform", "First Loan (Renewal) Direct Loan Center", "Bank Enterprise 'Interconnection+' Service Center" Essence The "First Loan (Renewal) Direct Loan Center" is led by the county financial service center to open the "first loan (renewal) service window" in the county administrative service hall, and receive enterprise financing demands for multi -channel receiving enterprises to provide enterprises with "Gold Store Primary Er" service According to the business status of the enterprise, the banks that can be connected can be connected. The "send orders" go to the corresponding bank, track the whole process, and complete the loan. The "CB Enterprise 'Connect+' Service Center" is established by the county financial service center and county taxation, development and reform, science and technology, market supervision and other departments to establish a long -effect communication and communication mechanism. The banks with credit services actively set up the "golden bridge" of "government banks".

Nanzhao County gives full play to the service advantage of the "one platform, two centers". It is convenient for banks to connect with each credit subject in a timely manner; the “one -on -one” docking of “one -to -one” by “first loan (renewal) direct) and small and medium -sized enterprises, formulate corporate relief assistance policies to help enterprises solve financing problems.

According to statistics, this year Nanzhao County passed the "one platform, two centers" to connect to the service enterprise, merchants, individuals, and farmers of 877. Nanzhao County issued a total of 29 new emergency relief loans and 11.94 million yuan; 8 delay loans, 9.17 million yuan ; 23 renewal loans and 30.48 million yuan; 28 first loans and 27.43 million yuan were issued. The "CB Enterprise 'Connected+' Service Center" collects the bidding and procurement information of the county finance bureau, and successfully builds the central paid to docking the service platform with the county finance department. In the first half of this year, it has successfully issued a "political lending" 5 million yuan.

- END -

The latest report of the central bank!New changes in monetary policy signals

China News Service, August 12th (China Singapore Finance Palace Hongyu) On the 10t...

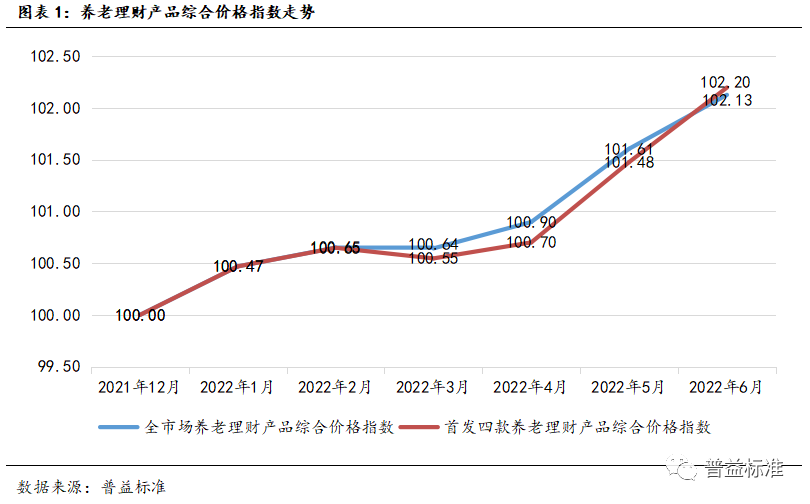

There are counts | Pension wealth management products

As of July 25, 2022, five pilot financial management issues (including Belaide CCB...