Local reported the third batch of policy development financial instruments projects, and invested in four fields such as expansion to the airport

Author:21st Century Economic report Time:2022.08.11

The 21st Century Economic Herald reporter Yang Zhijin reported that the Guo often pointed out on July 29 that the Guohui held on July 29 pointed out that the market -oriented method is used to make good use of policy development financial instruments. It is mainly invested in infrastructure and new infrastructure of transportation, energy, logistics, agriculture and rural areas, and shall not be used for land reserves and make up for local fiscal revenue and expenditure gaps. The project must be mature, effective, and can play a role as soon as possible, and the competitive industry must be fully developed by marketization.

Recently, the meeting held by the relevant ministries and commissions requested the above financial instruments. On August 1st, the People's Bank of China held a work conference in the second half of 2022 stated that using policy development financial instruments and focusing on supporting the construction of infrastructure fields. On the same day, the National Development and Reform Commission held a notification meeting for the first half of the year's development and reform situation, requiring to accelerate the funds of policy development financial instruments and form a physical workload as soon as possible.

The 21st Century Economic Herald reporter learned from a number of local investment and financing persons that recently some places have reported to the third batch of policy development financial instrument projects, and the investment field has also expanded to the airport, new power infrastructure, nuclear power stations, and oil and gas trunk lines. Instant pipelines and other fields. According to the requirements, these projects should strive to start in the third quarter to form a physical workload.

Report the third batch of projects

The executive meeting of the State Council held on June 29 decided to use policy and development financial instruments to raise 300 billion yuan through the issuance of financial bonds to supplement major project capital including new infrastructure, but not exceeding all capital 50%of the gold, or the capital of the special debt project. This is considered an incremental policy tool, because it can be used for project capital, the tool is also called "soft loan" by the market.

The 21st Century Economic Herald reporters learned that in mid -to -early July, various places have begun to report to policy, developing financial instruments (funds) projects. Recently, some places have been reported to the third batch of projects.

According to a person from a city of southern a city, we requested that the project must obtain project approval or approve or filing documents, and fill in the number number or filing number. At the same time The logo is "the third batch of fund alternative projects in 2022".

The list of alternative projects obtained by the reporter shows that there are about 30 projects in the city, including the project name, project unit, project approval number, main construction content, investment area, expected time of construction, total project investment, total investment in the project, total project investment , Project capital, project return method, project return rate, pull effect, etc. Among them, the eight projects in the city are special debt bridge projects, but at present, eight projects have not received special debt funds.

The so -called special debt bridge, that is, some projects may not obtain capital through the issuance of special bonds in the short term. First, the special fund is used to make capital investment. After the special bond issuance funds are successfully in place, the fund is replaced and exited.

In this year's practice, since the special debt was basically issued by the end of June, some special debt projects that will start in the third quarter can apply for policy development financial instruments (funds) for project construction. Special debt replacement fund is issued. In contrast, the fund recovery period of such projects is short and the repurchase funds are guaranteed, and the recovery period of other project funds is about 20 years. Whether the project's income can cover the fund is also doubtful.

Relevant person in charge of the central bank previously introduced that policy and development of banks used financial instruments to focus on three types of projects: First, the five major infrastructure key areas of the 11th meeting of the Central Finance and Economics Committee, which are network foundations such as transportation and water conservancy and energy. Facilities, information technology, logistics and other industrial upgrading infrastructure, underground pipe corridors and other urban infrastructure, high -standard farmland infrastructure and national security infrastructure. The second is major scientific and technological innovation fields. Third, other projects that can be invested by special bonds of local governments.

According to people from a certain city in the western province, four investment and reform systems have recently added four investment fields such as "airports, new power infrastructure, nuclear power plants, and oil and gas trunk transmission pipelines", but the project must ensure that construction can be started in the third quarter.

Detailed capital requirements

The capital system of China's fixed asset investment project has been established since 1996, and has been adjusted 4 times before. After the adjustment in September 2015, most of the capital ratio of China's infrastructure projects is above 20%, such as airports, ports, coastal and inland river shipping, and postal industries of 25%. It's 20%.

In the fifth time in 2019, the proportion of capital was adjusted to reduce the minimum capital ratio of some infrastructure projects, and the minimum percentage of capital, coastal and inland shipping projects was reduced from 25%to 20%.

In addition, infrastructure projects such as highways, railways, urban construction, logistics, ecological and environmental protection, and social livelihood of the shortcomings are under the premise The range does not exceed 5 percentage points. In other words, if highways and railway projects meet the above requirements, the proportion of capital can be as low as 15%.

The so -called project capital refers to the capital contributed by investors in the total investment of the investment project, which is a non -debt fund for investment projects. The proportion of contributions can enjoy the owner's rights and interests in accordance with the law, or it can also transfer its capital, but it cannot be withdrawn in any way. In the context of the current decline in fiscal revenue and land sales revenue, the capital pressure of local governments is particularly obvious, and policy development financial instruments can alleviate the capital pressure of the project to a certain extent. "Since this year, affected by the excellent factors such as the new crown pneumonia's epidemic, my country's economy has faced a certain downward pressure, and infrastructure construction investment has become an important means of stable macroeconomic. According to the executive meeting of the State Council, last month, the People's Bank of China has increased development. Policy banks' credit quota will increase loan support for long -term useful and short -term feasible infrastructure construction projects. But at present, the difficulty of project capital has become one of the important factors to restrict project construction and loans. " Director Zou Lan, director of the Policy Department, said at the State New Office conference on July 13.

According to the reporter's understanding, during the declaration of this fund, the regulatory department requested that the project's capital was not less than 20%of the total investment of the project, and the accumulated funds accumulated in the project accounted for less than 50%of the project capital. In addition, after deducting various central financial funds and special bonds and funds for project capital, local and project units's capital capital contribution ratio shall not be less than 5%of the total project investment.

The aforementioned southern city development and reform system explained that assuming a total investment of a project of 200 million yuan, then capital costs 40 million yuan, local and project units need to invest at least 10 million. Suppose the project had previously received 20 million capital, and the current gap is 20 million, but only 5 million funds can be declared as project capital, namely (20 million-10 million)*50%.

"Timely capital in place is a necessary condition for the construction of the project. It is understood that many projects have basically implemented the source of capital, but there are still gaps with about 20%of project capital requirements in the infrastructure field. It takes a little time in place to affect the construction of the project as soon as possible. Financial instruments can be in place in a short period of time to meet the project capital requirements and make the project construction as soon as possible. "Zou Lan said.

Follow the fund's subsequent exit problem

The State Frequently pointed out on July 21st that policy efficiency of policy development financial instruments and special bonds still has a considerable space, and it can leverage a large number of social funds to use marketization. The meeting also requested that the funds for policy development in accordance with laws and regulations should be done in accordance with laws and regulations, strengthen incentives, do not engage in local cuts, and more support for mature projects will be supported. Guide commercial banks to provide supporting financing accordingly, and policy banks should be put in time in a timely manner.

The State Council held on June 1st said that the increasing policy bank was 800 billion credit quotas and supported infrastructure construction. According to the latest requirements of the National Council, policy development financial instruments+policy bank loans/commercial bank loan financing models can be formed, which plays a leveraged role.

From the perspective of public information, the first batch of policy development financial instruments have been launched one after another. For example, in Hunan, on July 29, the first batch of policy and development financial instruments (funds) in Hunan landed in Yongzhou City, and funds will be used to solve the capital of the Xiangjiang River Basin's ecological governance project.

Another example is the development financial instrument established by the State Development Bank -National Kaisha Infrastructure Fund Co., Ltd. on July 31st to support the support of the Susai Expressway Nanxun to Tongxiang section and Tongxiang to Deqing Link Line (Phase II) (hereinafter referred to as the "Sutai Expressway (Phase II)") project. The first 138 million yuan of funds have been successfully put in place, which is also the first place in Zhejiang after the establishment of the National Kaikai Infrastructure Fund Co., Ltd.

Commercial bank supporting financing also landed. On July 31, after the capital of 138 million yuan in Capital Fund was put in place, Agricultural Bank also completed a loan of 132 million yuan in the Su Taiwan high -speed project to achieve supporting financing of the first infrastructure fund project of commercial banks across the country.

Zou Lan said that in accordance with the requirements of financial instruments accounted for no more than 50%of the project's capital, it is expected that financial instruments will account for not more than 10%of the total investment in each project. After the capital is in place, the early 800 billion yuan policy, developmental medium- and long -term credit funds can be followed in time. Social capital such as commercial bank loans will also be followed up quickly to jointly help form the physical workload of the project, stabilize the macroeconomic economy The market.

According to the reporter's understanding, policy and development financial instruments mainly adopt equity investment and shareholders' loans to invest in projects to supplement project capital gaps. After the funding expires, the equity repurchase, equity transfer, public listing, and ABS withdrawn.

Some fiscal systems are worried that after the issuance of about 14 trillion special bonds from 2018-2022, local-income projects have greatly reduced. How to avoid new hidden debt in the future will be a matter of attention.

The decline in economic downlink in 2014-2015, and the special construction fund was launched as an important tool for steady growth.The method is to raise funds for special construction bonds to the State -owned Bank of China and Rural Issuance to the State -owned Bank of China, establish a special construction fund.After the large-scale launch of 2015-2017, the scale of special construction funds reached about 2 trillion yuan, but because the transaction structure is bound to government credit and has new hidden debt, the special construction fund has faded out of the market since 2018.(Coordinating: Ma Chunyuan)

- END -

Is there any difficulty in corporate funds?Agricultural distribution Henan Branch "President into Wan Enterprise" on -site investigation

Top News · Henan Business Daily reporter Ding Lianying Correspondent Luo Pengwei ...

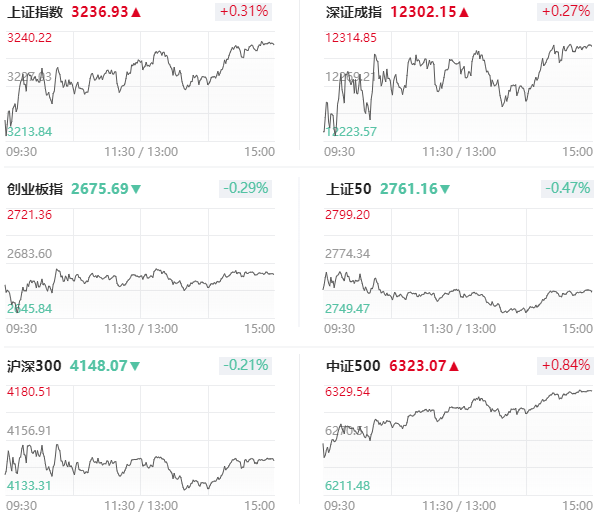

A -share evaluation: The Shanghai Index opened at a low high and rose 0.31%, and the two cities reproduced the daily limit of hundreds of shares

On August 8th, the broader market rebounded after opening the day, and the three m...