The income drops sharply by 35%!Well -known brand CEO of the world: made mistakes in China

Author:China Fund News Time:2022.08.11

China Fund reporter Wen Jing

According to reports, Adidas CEO Kasba Rost said in an interview with the media recently, "Adidas failed to fully understand Chinese consumers, this is a mistake." Previously, Adidas had sold in Greater China for 5 consecutive quarters. " Found "."

On the other hand, Chinese domestic products brands have risen in an all -round way, and domestic brands such as Li Ning, Anta, Tubu, Hongxingrk are competing for the title of "Light of Chinese Stocks".

Adidas CEO:

Make mistakes in China

On August 9, local time, Adidas CEO Kasper Rorsheng was interviewed in an exclusive interview with the German Business Daily (HandelsBlatt) believes that the revenue of Adidas in the first quarter of Greater China fell 35%, which was "made mistakes" by Adidas itself. Essence "We don't know enough about consumers, so we have left space for those Chinese competitors who have done better ... Today's Chinese consumers like (product) have a" Chinese feeling '. "

He believes that the main reason for Adidas's income in Greater China is the new crown epidemic and the impact of the Xinjiang cotton incident, but he does not think that China will eventually abandon Western brands. "Then all world brands will encounter trouble. I think this is unrealistic. The Chinese market will return, and there is still a lot of room for growth."

However, Luo Side did not deny another severe possibility. If the Chinese market reaction is not as good as expected, it may destroy Adidas' revenue goals by 2025. "If the initial assumptions change permanently, we will have to adjust our goals," he mentioned.

The picture comes: Reuters

Sales fifty consecutive declines!

In the first quarter, income dropped by 35%

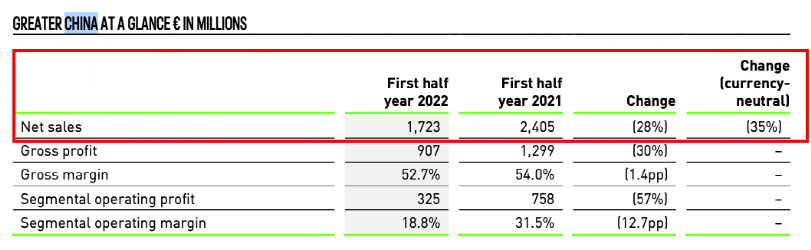

Adidas Greater China revenue has declined for five consecutive quarters, and this year has fallen 35%for two consecutive quarters.

Greater China was once the "pillar" of Adidas' revenue. By the end of fiscal year 2019, Adidas once achieved sales in the Greater China market for 23 consecutive quarters. But since fiscal 2020, Adidas has continued to weaken in Greater China.

Specifically, from the second quarter to the fourth quarter of fiscal year, the sales of Adidas Greater China were 1.03 billion euros, 1.155 billion euros, and 1.037 billion euros, respectively, a year -on -year decrease of 15.9%, 14.6%, and 24.3%. In the first quarter of 2022, while sales increased by 0.6%to 5.302 billion euros, sales of Greater China fell 34.6%year -on -year to 1.04 billion euros; in the second quarter, the company's sales increased by 4%at an unchanged exchange rate, reaching 5.6 billion yuan The euro, the revenue of Greater China decreased by 35%.

Affected by the performance of Greater China lower than expected, Adidas expects the company's operating profit margin this year is about 9.4%, and the previous expectations are between 10.5%and 11.0%.

According to the financial report, although the supply chain limited the growth of about 400 million euros in the first quarter, which led to a decrease of currency neutral income by 3%, the currency income of currency in North America, EMEA, and Latin America achieved 13%, 9%and 9%and respectively. 38%increase. The revenue of Greater China fell by 35%, while the Asia -Pacific region decreased by 16%. In the first quarter, the company's revenue increased from 5.2068 billion euros in the same period last year to 5.302 billion euros.

The financial report also shows that the company's operating profit in the first quarter was 437 million euros, with 704 million euros in the same period last year; the operating profit margin was 8.2%, and the same period last year was 13.4%. Affected by the significant increase in procurement and freight costs and e -commerce, the company's gross profit margin in the first quarter decreased from 51.8%of the previous year to 1.9 percentage points to 49.9%.

Adidas said that the company is expected to grow at a rate of 11%to 13%in 2022, but considering the impact of the epidemic, it is expected that the net profit from the continuous operation business will also reach the lower limit of the scope of 1.8 billion to 1.9 billion euros that previously communicated. Essence At the same time, as the income of Greater China is lower than expected, it is expected that the company's gross profit margin in 2022 will be close to 50.7%(previously expected to be between 51.5%and 52.0%); Between 11.0%).

Adidas predicts that despite the continuous decline in sales of Greater China and the negative impact of supply chain restrictions on about 200 million euros, the growth will continue to grow in the second quarter. In the second half of this year, net sales are expected to increase by more than 20%.

Chinese goods have risen in full!

Anta China's market share surpassed Adidas

On the one hand, Adidas sold in Greater China for five consecutive quarters for five consecutive quarters. On the other side, Chinese domestic products brands have risen in an all -round way. Domestic Li Ning, Anta, Tobe, Hongxing Erk and other brands compete for the title of "Light of Chinese Stocks".

In March of this year, the 2021 annual performance announcement released by Anta Group showed that in 2021, Anta Group achieved revenue of 49.330 billion yuan, an increase of 38.9%year -on -year. Anta Group's revenue exceeded Adidas' revenue, approaching Nike's Chinese revenue. In 2021, Anta Group achieved net profit of 7.72 billion yuan, an increase of 49.55%year -on -year.

In addition, Li Ning and Tubu lived fourth and fifth, Li Ning revenue reached 22.57 billion yuan, and Tubu was 10.01 billion yuan.

Statistics also show that Anta Group's market share (market share) in domestic sports shoes and clothing in 2021 rose by 1 percentage point to 16.2%year -on -year, ranking from third in 2020 to second, surpassing 14.8%of 14.8% Adidas China has further narrowed the gap with Nike China. In recent years, the "national tide" has been hot, and under the trend, the thermal value of the local brand has continued to increase. The Li Ning brand has also shot again, with 830 million British giant shoes companies. According to public information, the Clarks brand was founded in 1825. It has a history of nearly two hundred years. The products are sold to more than 100 countries and regions around the world. The peak period can sell 54 million pairs of shoes each year, which is equivalent to 103 per minute. Double shoes were sold.

Another domestic brand Hongxing Erk has also become famous in the past two years. According to reports, in July last year, on the entire platform of Tmall and Taobao, the sales of Hongxingrke's brand were 553 million yuan, sales increased by 1543.71%year -on -year, and sales increased by 745.27%month -on -month. In the following year, the annual sales data of the Hongxing Erk brand still doubled year -on -year.

Readers of fund newspapers are watching:

Heavy emergencies! A big news of Apple: More than 10 A shares immediately raised the daily limit!

Deng Xiaofeng shot! Litter

Hot search! Parents spent 2 million to buy Ultramanca, and have not collected! Netizen: Poverty limits my imagination

Edit: Captain

- END -

Zou Fushun, deputy general manager of Poly Property and chairman of Poly Business: Create a 4T service model in the new development pattern

On August 4th, the 12th China Value Real Estate Annual Conference, hosted by the D...

Suzhou: Industry prosperity helps modern agriculture to accelerate

In 2022, Suzhou District focused on achieving the goal of modern agricultural mode...