Zhang Yugui and Zhang Qian: The Federal Reserve "Hardly Integration", using the wrong medicine

Author:Global Times Time:2022.06.17

As market expectations, the Federal Reserve under the leadership of Powell announced the two -day monetary policy meeting, announcing a significant increase of 75 basis points on the target range of the federal fund interest rate. This is already a "hard interest rate hike" model in the policy sense, and it also sets a record for the Federal Reserve since 1994. It can be called the "Walker Moment" in the 21st century.

As we all know, when the economy is normalized, central banks of various countries will not easily start interest rate hikes. In particular, the Federal Reserve has been the world's most influential central bank since the establishment of the Bretton Forest system. Its monetary policy has always been the vane of the global market and has a great impact on other countries. Judging from the logical mechanism of economic policy, the Federal Reserve raised interest rates and even used the drug at all. The first goal was to fight against inflation. The signal, that is, the United States is seriously treating the increasingly severe inflation and never allows the US economy to "derail".

However, as Powell recognized, there are many factors that are not controlled by the Federal Reserve in general inflation, such as the cost -promoting inflation caused by the cost of Russia and Ukraine, Western sanctions on Russia, and supply chain disconnection. The Federal Reserve's monetary policy is really possible to act as an inflation that causes overheated demand by the currency over issuance. Powell's meaning is actually explaining the problem of the Fed's facing "insufficient skills". Rating interest rate hikes is also a last resort. On the other hand, it also implies that the United States has to deal with the increasingly serious inflation with the world's major economies.

Some market participants compare the current inflation situation facing the United States from the "stagnation" from the 1970s to the early 1980s. The inflation momentum. Although history is similar to some extent, today's US and global economic situation is still very different from more than 40 years ago. The "stagnation rising" crux of that year was the two oil crisis and the use of excessive use and insufficient innovation in the United States. The Federal Reserve Chairman, who is considered the most eagle in history, has sacrificed a large -scale austerity policy in the history. The purpose is to reshape the US economy after squeezing the bubble, so there is a famous "Walker Moment".

But today the United States is facing the impact of "Minsky Moment". The world should not forget that more than two years ago, when the new crown pneumonia's epidemic spread globally and caused a break from the supply chain industry chain bureau, the US economy faced large -scale stops, the stock market fusion, and the pace of large depression was getting closer, the Fed opened unlimitedly, and infinitely opened up infinitely The quantitative loose (QE) "helicopter sprinkle money" model and reduces the interest rate of federal funds to 0-0.25%, resulting in sharp expansion of the Fed's balance sheet. And everyone who is familiar with currency finance knows that the problem of easy to play and difficult to collect the unlimited QE can not find the optimal solution in the real world.

Therefore, the current significant interest rate hike of the Fed is essentially "buried" for the infinite water release more than two years ago. On the other hand, the cost of promoting inflation in the United States is largely caused by the "neighbor" policy adopted by the United States. This is why the Fed feels powerless. The report of the UN Secretary -General's Global Crisis response to the food, energy and financial systems released on the 8th states that interaction between food, energy and financial channels has begun to form a vicious circle. And everyone who is concerned about the current international political and economic situation knows that at least part of the United States has the key to solve the above problems. As for structural problems such as the imbalance of supply and demand in the US labor market, the dilemma of the company facing the shortage of labor, and the rising position of the position to the historic high, the inflation is intensified, which is closely related to the long -term financial melting of the US economy, and the government's rescue effects.

In fact, the Federal Reserve's "hard interest rate hike" measures can effectively curb high inflation and avoid the economic recession at the same time, and even Powell himself has no bottom. Today's Federal Reserve is not as good as expected management capabilities. If investors and most American families are unwilling to compress the balance sheet, the actual effect of the Fed's interest rate hike policy will be greatly reduced. In other words, the United States should put the focus of economic policies on stable market expectations, and improve the economic environment, especially the competitiveness of the real economy, because "hard interest rate hikes" do not constitute the driving force for endogenous growth.

The Federal Reserve ’s interest rate hike will definitely have an impact on the global financial market and forced other countries to passively adjust their economic policies. Especially for those small and medium -sized economies with weaker anti -fighting capabilities itself, the Fed's large -scale discharge or pumping water is often more painful than easy. (The author is the dean of the School of International Finance and Trade, Shanghai University of Foreign Languages and PhD students of the School of International Relations and Public Affairs)

- END -

Jilin Nongan Power Supply: Digital Intelligent Supervision and Escort Digital Power Supply Center Construction

The quality and efficiency of power supply services directly affect the user's sense of happiness and security. The Discipline Inspection Commission of the State Grid Nong'an County Power Supply Compa...

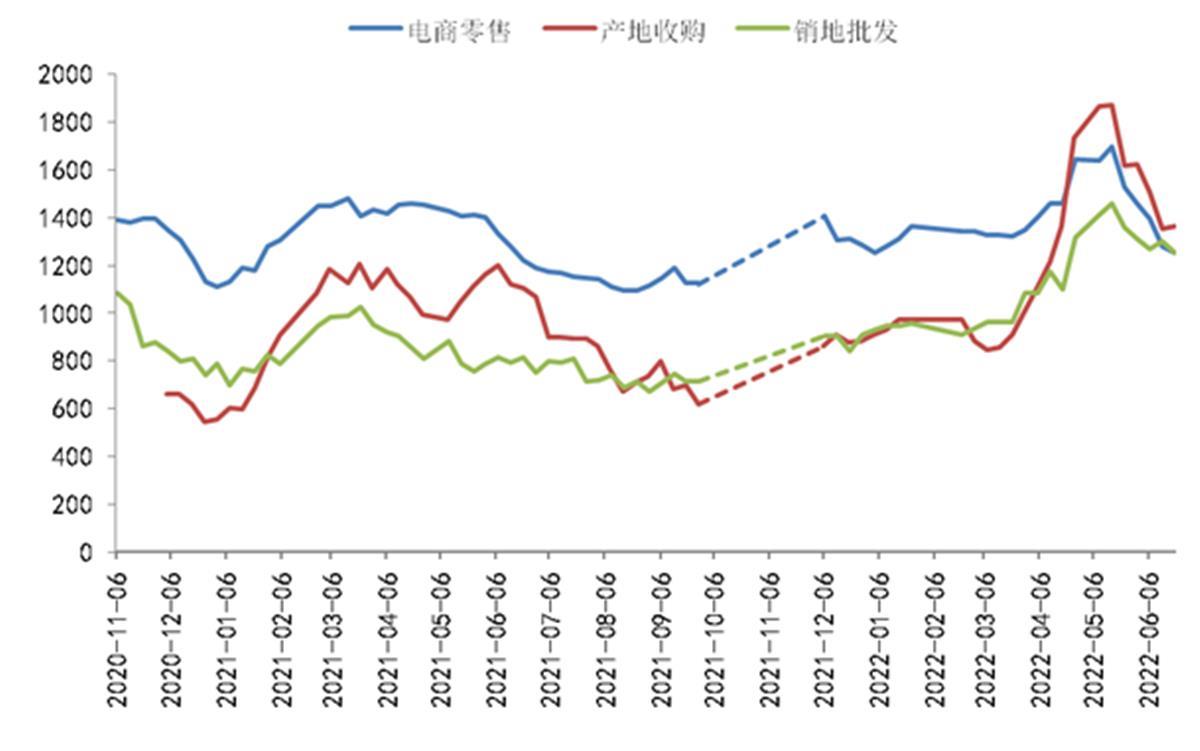

Just after the late citrus, I just got off the market, and returned to Xia Orange on stage

Jimu Journalist Pan XizhengCorrespondent Li Boyi Li ShuiyanIntern Yang RuoxiAt pre...