13 listed companies send "red envelopes"!The gross profit margin of Tibet Mining has chased Moutai and exclusively responded to the "Hao Heng" dividend

Author:Huaxia Times Time:2022.08.11

China Times (chinatimes.net.cn) reporter Chen Feng, a reporter Zhang Mei Beijing reported

With the advent of the semi -annual report, the annual dividend of listed companies has become the focus of market attention.

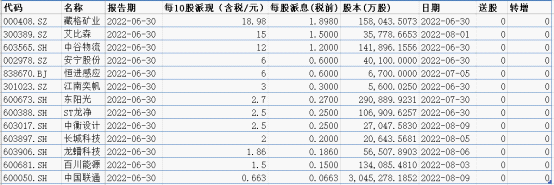

Data from Flush Shun shows that as of August 9, a total of 13 companies in A shares disclosed the midterm dividend plan. From the perspective of the existing amount, the Tibetan mining dividend is the most generous, and it is 18.98 yuan per 10 shares (including tax). In addition, the three companies of Ebison, Zhonggu Logistics, and Anning shares are 15 yuan, 12 yuan, and 6 yuan per 10 shares. China Unicom is at 0.663 yuan per 10 shares (including tax).

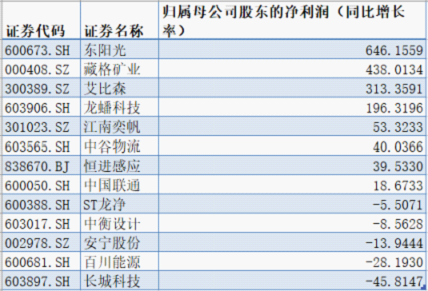

From the perspective of performance, of the 13 companies that announced the mid -term dividend plan, the highest net profit increase was East Sunshine, and the net profit attributable to the mother increased by more than 646%year -on -year. %. Ebison, Longxuan Technology, Jiangnan Yifan, Zhonggu Logistics, Hengjin induction, and China Unicom have achieved net profit growth year -on -year. Among them, the net profit of China Unicom's mother -in -law increased by 18.6733%year -on -year.

Tibetan mining dividend big pen

The medium -term dividend of Tibet Mining "Hao Heng" makes people pay attention to their performance. The Tibet Mining Half -annual report showed that the revenue of lithium carbonate business increased by 449.04%year -on -year; the gross profit margin was 90.52%. You know, according to the Moutai semi -annual report of Guizhou, the gross profit margin of Moutai in Guizhou in the first half of the year was 92.11%.

According to the semi -annual report, Tibet Mining intends to use a total share capital of 1.58 billion shares as the base to distribute 18.98 yuan (including tax) to all shareholders per 10 shares, in order to calculate the total cash dividend of 2.999 billion yuan (including tax).

It is worth noting that the net profit during the reporting period of Tibet Mining was 2.397 billion yuan, and the 3 billion yuan dividend scheme thrown this time was 700 million yuan more than the company's net profit during the reporting period.

Why is it so dividend? The reporter of the Huaxia Times gave a letter to the relevant staff of the Tibet Mining and Secretary Office. The staff said that the company's profit distribution is to ensure the company's normal operation and long -term development, and comprehensively consider the profitability and level of profitability in the first half of 2022 and the level of profit in the first half of 2022 and The overall financial situation has taken into account the immediate and long -term interests of shareholders, and reflects the principle of actively returning the company's operating results of shareholders and sharing the company's growth with all shareholders.

Regarding the plan of Tibet Mining in the second half of the year, the above -mentioned relevant staff responded to the reporter of the Huaxia Times that the company will complete the production of potassium chloride more than 540,000 tons and a lithium carbonate output of more than 5,300 tons in the second half of the year. According to the current potassium lithium sales price, the company will be expected to achieve higher operating income, and net profit will have much room for growth. The company will also actively respond to changes in market prices, adjust strategies in a timely manner, maintain sufficient cash flow, and maintain the company's normal production and operation activities.

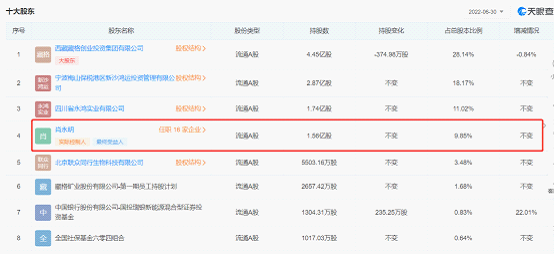

The actual controller of Tibet Mining, who was arrested for suspected illegal mining, or the biggest winner of the dividend. According to the information of Tianyan, Xiao Yongming owns 156 million shares (9.85%) of Tibet Mining, and the company he controls Sichuan Yonghong (61.33%holding the shares) and Tibet Ge startup (90%holding the shareholding), holding them respectively, holding them respectively. Tibet Mining 174 million shares (11.02%) and 445 million shares (28.14%) shares, which means that Xiao Yongming may be able to get more than 1.2 billion yuan from the dividend plan.

So this time the dividend dividend is the most income, is there any suspicion of big shareholders? The above -mentioned relevant staff told the "Huaxia Times" reporter that the distribution of this profit is in line with the "Company Law", "Corporate Accounting Guidelines", "Shenzhen Stock Exchange Stock Listing Rules", "Shenzhen Stock Exchange Self -Regulatory Guidelines No. 1 -Main Board No. 1 -Main Board The regulation of listed companies and the company's articles of association stipulates that it is in line with the company's determined profit distribution policy, profit distribution plan, long -term return planning planning plan, and relevant commitments made.

Tibet Mining Co., Ltd. was established on June 25, 1996. In July 2016, the assets of the purchase of Golmud Ge Ge Ge Fertilizer Co., Ltd. were completed to achieve backdoor listing. The company's main business is the production and sales of potassium fertilizers (potassium chloride), and the main products of potassium fertilizer (potassium chloride).

The semi -annual report shows that the main products of Tibet Mining are potassium chloride and lithium carbonate. On the one hand, global grain prices continued to rise in 2022, continued to increase the demand for food, promote the expansion of planting area, and increase the demand for fertilizers. The rigid needs of grain and the continuous transmission of raw material prices have helped the continuous rise in the market price of potassium fertilizers. On the other hand, the rapid growth of the number of new energy vehicles has spawned the strong demand for lithium raw materials.

A new energy industry fund manager analyzed the "Huaxia Times" reporter that lithium carbonate is a raw material for new energy vehicles to prepare power batteries, and it is a positive electrode material for lithium batteries. The price has risen for nearly two years. The price of lithium carbonate is now as high as nearly 500,000 tons, but the cost of mining is different. If the price is very high, if the cost is low, the gross profit margin can be very high.

Listed company that makes money

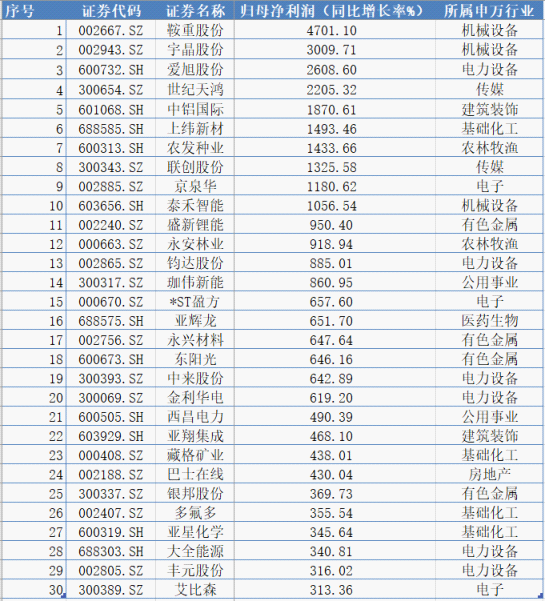

As of the noon on August 10, a total of 314 listed companies in A shares disclosed the semi -annual report of 2022. 193 listed companies achieved a net profit increase year -on -year, accounting for 61.4%.

鞍重股份以高达4701.10%净利润增长率位居榜首;其次是宇晶股份,净利润增长率达3009.71%;爱旭股份、世纪天鸿净利润增长率也超过2000%;中铝国际、上Wei Xincai, Nongfa Seed Industry, Lianchuang Co., Ltd., Jingquanhua, Taihe's intelligent net profit growth rates exceeded 1000%; 10 companies such as Shengxin Lithium and Yongan Forestry have a net profit growth rate of more than 500%, which There is also a star with a star with a hat. According to statistics, the industry has increased more than the industry and other industries. The half -annual report of Saders' Shares shows that based on the profit contribution of the lithium resource business sector, the company's performance in the first half of the year has increased significantly. During the reporting period, the company realized operating income of 289 million yuan, an increase of 148.21%year -on -year, and the net profit attributable to shareholders of listed companies was 48.7749 million yuan, an increase of 4701.1%year -on -year. This is also the best semi -annual report data from the Sadership Shares since its listing.

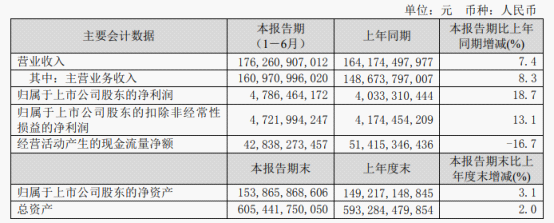

The reporter found that the semi -annual report is also the China Unicom. In the first half of this year, China Unicom achieved operating income of 176.26 billion yuan, an increase of 7.4%year -on -year; the net profit attributable to the parent company was 4.786 billion yuan, an increase of 18.7%year -on -year. In the first half of the year, it was calculated in 181 days. In the first half of this year, China Unicom made 26.442 million yuan.

China Unicom's semi -annual report said that the company attaches great importance to the return of shareholders. After fully considering the company's good operation and development, based on the decision to continue to distribute mid -term dividends based on the holding subsidiary Unicom of Unicom, the board of directors proposed that the medium -term dividend dividend was RMB 0.0663 per share, which is expected to increase by 35.9%year -on -year.

The reporter of the Huaxia Times called the China Unicom Directors' Office inquiring about how to develop the business in the second half of the year, and the relevant personnel did not give a specific reply.

The co -director, researcher Pan and Lin, a reporter of the Digital Economy and Financial Innovation Research Center of Zhejiang University, told reporters of the Huaxia Times that China Unicom has achieved ideal performance and mainly benefits from the popularity of 5G applications. 5G is a communication operator. Provides business increment. At the same time, in the 5G era, Unicom's expansion in the telecommunications field will get more stock markets from competitors.

Panhe Lin believes that the current valuation of Unicom is still not high, and positive dividends help boost Unicom's valuation. In addition, dividends should be the amount that Unicom itself can withstand. China Unicom actively participates in the East and Western Calculation and Double Gigabit Construction. The amount of funds invested in the future is still high.

Editor: Editor Yan Hui: Xia Shencha

- END -

CICC and Haitong Securities Receiving Supervision Alert Letter!Involved Bonds incident

[Dahecai Cube News] On August 11, the Liaoning Securities Regulatory Bureau adopted a warning letter supervision measure on China International Financial Co., Ltd. and Haitong Securities Co., Ltd..Aft

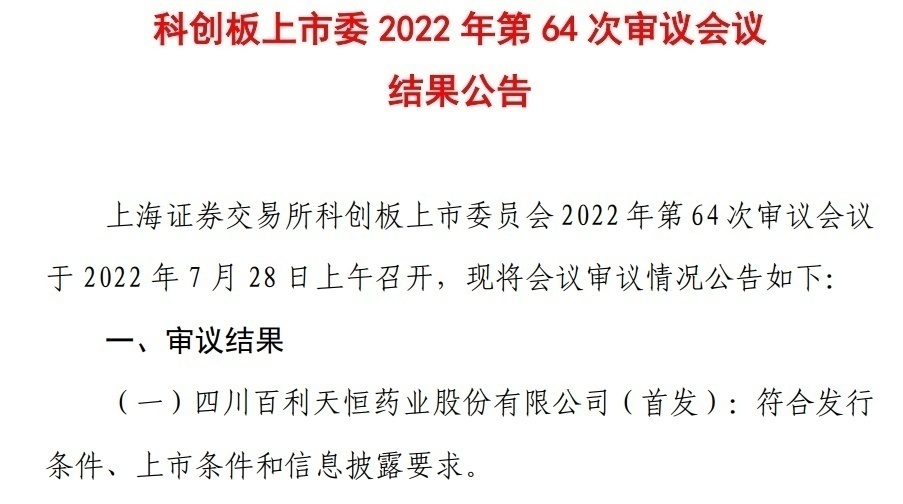

Baili Tianheng Creative Board IPO passed the review, and these questions were asked

On July 28, 2022, the results of the 64th review meeting of the 64th review meetin...