After 18 days and 14 boards *ST will suddenly suspend trading in the future to check and receive supervision inquiry letters

Author:Cover news Time:2022.08.11

Cover Journalist Zhu Ning

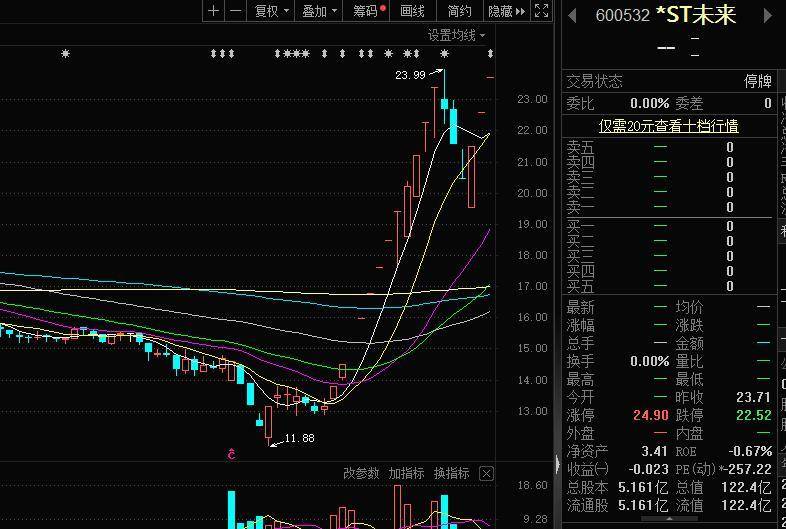

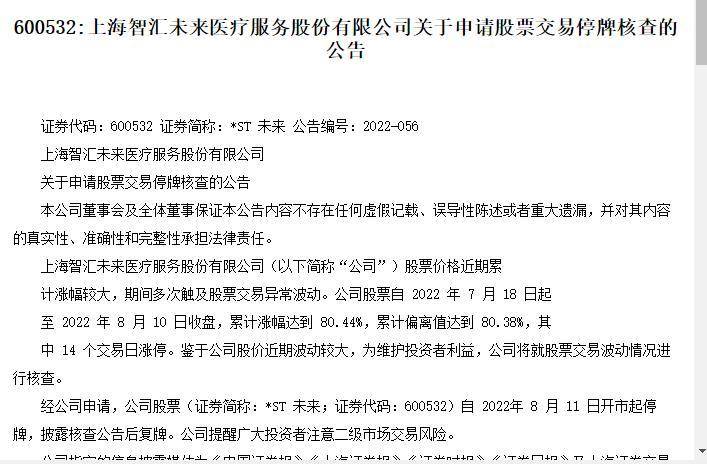

On the evening of August 10,*ST announced in the future that the company's stock price has recently increased a lot, and during the period, it has repeatedly touched the stock transactions abnormally. In view of the recent fluctuations in the company's stock price, in order to protect the interests of investors, the company will check the fluctuations in stock transactions. After the company's application, the company's shares stopped on August 11, 2022.

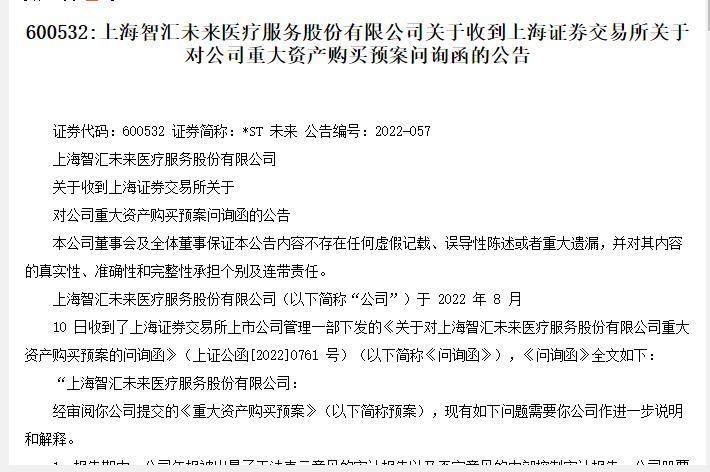

On the evening of the same day, the Shanghai Stock Exchange issued a inquiry letter on*ST in the future on major asset purchase plans, requiring*ST to replenish the basis and rationality of the estimated transaction price of the target asset in the future, and whether the purchase decision is cautious and reasonable, whether there is existing Capture the stock price of hot spots.

On August 11,*ST suspended trading in the future. From July 18th to August 10th, the cumulative increase reached 80.44%, and the cumulative deviation value reached 80.38%, of which the daily limit of 14 trading days.

Supervision continues to pay attention to*ST's future "lithium"

As for the lithium -related future, as early as July 1, the Shanghai Stock Exchange had issued preliminary inquiries. By the evening of July 29, the company disclosed the relevant plan. The company intends to acquire 70%of the equity of Ruifu Lithium in cash and acquire 70%of the 70%stake in Xinjiang Dongli. With the consent of all parties, the total transfer price of the underlying assets does not exceed 3.85 billion yuan. Data show that both target companies are "lithium -related".

The progress of the acquisition and stock price continued to attract the attention of the regulatory authorities. The company received a major asset purchase plan inquiry letter on August 10 showed that the Shanghai Stock Exchange required the company to further explain and explain related issues.

The inquiry letter pointed out that during the reporting period, the company's annual report was issued an audit report that could not express their opinions and internal control audit reports that denied opinions. The company's shares have been shared by the implementation of other risk warnings after the annual report was disclosed, and the CSRC had been shared by the Securities Regulatory Commission because it did not disclose the annual report within the statutory period.

The company disclosed the absence of the fraud in monetary funds. The amount of funds occupied by 3.81 billion yuan, and the amount of illegal guarantee reached 1.2 billion yuan. The company's controlling shareholder Shanghai Jingzzi stock pledge ratio was 79.89%, accounting for 20.92%of the company's total share capital.

In this regard, the company is required to supplement disclosure: whether the company still exists at the current controlling shareholder and other related party non -operating funds occupation and illegal guarantee; whether there is a situation of caters to the stock price of hot spots May face risks.

The underlying assets are at the middle and lower reaches of the industry

It is worth noting that the capitalization of the domestic lithium salt industry is very high. In addition to the planned IPO Jiangxi Nanshi lithium battery, mainstream lithium salt companies have almost all realized A shares listing.

The Ruifu Lithium Plan is also the third attempt to be acquired in the capital market. Since 2016, it has been seeking securitization twice, but eventually ended in failure. As the price of lithium carbonate rose, it rose from tens of thousands of yuan to 400,000 yuan per ton, and Ruifu Lithium Industry ushered in the capital market's attention.

From the perspective of the quality of the target, the main products of Ruifu in Shandong are lithium carbonate and lithium hydroxide. At present, it has been completed and operated at an annual output of 25,000 tons of battery -grade lithium carbonate and an annual output of 10,000 tons of battery -level lithium hydroxide production lines. It is not low to look at the company's production capacity. It is probably in the midstream of the industry. However, the company's operating data is placed in listed companies in the same industry and can only be ranked at the tail.

- END -

Up to 1 million yuan!Wuhan these service industry companies intend to receive rewards

On August 8th, the Yangtze River Daily's Wuhan client learned from the website of ...

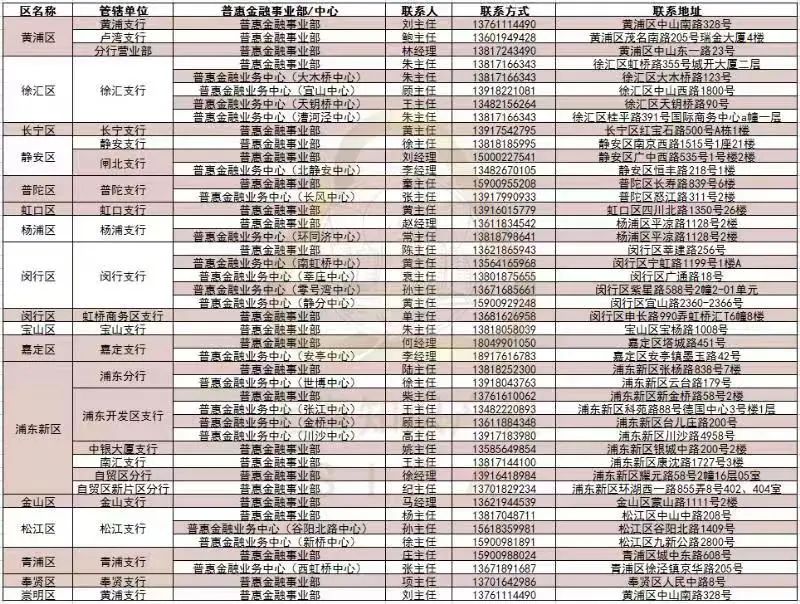

Shanghai starts the trademark pledge to help the city's restaurants such as catering, cultural tourism, and other key industries for bailout "Zhihui Bank" special activities

The Municipal Intellectual Property Office and the Bank of China Shanghai Branch c...