US media: strong dollar is hurting all other countries around the world

Author:Global Times Time:2022.08.11

The US CNN article on August 7th, the original title: Strong dollar is hurting all other countries around the world this year. This is good news for American tourists who travel in Europe, but it is a bad news for almost all other countries in the world.

Data map source Visual China

Compared with other major currencies, the US dollar rose more than 10%in 2022, close to the highest level in the past 20 years. As investors are worried about the global economic recession, they have snapped up the US dollar, and the US dollar is considered a shelter during the turbulent period. In order to respond to the high rate of interest rate hikes in response to decades, the Federal Reserve has also increased the appeal of the US dollar. This makes investment in the United States more attractive, because these investment now provides higher returns.

Has been hurting some fragile economies

American tourists may be strenuous. The $ 100 Roman nightlife every night now only costs $ 80, but for multinational companies and foreign governments, the situation is much more complicated. About half of the international trade is settled in the US dollar, which brings a lot of bills to manufacturers and small companies relying on imported goods. The government that needs to repay debts in the US dollar may also be in trouble, especially in the case of insufficient foreign exchange reserves.

The appreciation of the dollar has hurt some vulnerable economies. Because of the shortage of dollars, the most serious economic crisis in the country's history broke out in Sri Lanka. In late July, the exchange rate of the Pakistani Rude against the US dollar fell to a historical low and was pushed to the edge of breach of contract. Because of the rise in food prices, Egypt is dealing with the exhaustion of the US dollar reserves and foreign investment outflows. None of these three countries have to seek help from the International Monetary Fund. "This is a challenging environment." Said William Jackson, the chief emerging market economist of Kaitou.

The reality behind "USD Smile"

The US dollar often appreciates when the US economy is very strong, or appreciate when the US economy is weak and the global economy is facing decline. In these two cases, investors regard the US dollar as an opportunity to ensure growth, or to spend the storm during the storm and configure the relatively safe place for cash. This phenomenon is usually called "US dollar smile" because the United States has stronger strength in both extremes.

However, there are not so many things in other countries in the world that can make them smile. Nara, a cross -asset strategy director of UBS, pointed out that the strengthening of the US dollar may damage the countries with smaller economic scale. There are three main reasons. First, strengthening the dollar will increase fiscal pressure. Not every country is capable of borrowing funds with its national currency, because foreign investors may have no confidence in their systems, or their financial markets are not developed enough. This means that some countries have no choice, and can only issue bonds denominated in the US dollar. However, if the US dollar appreciates, the cost of repaying debts will increase, thereby exhausting government funds. Second, the US dollar helped the long capital to flee. When a country's currency depreciates sharply, wealthy individuals, companies, and foreign investors will start to withdraw their money, hoping to deposit the money to a safer place. This further lowered the exchange rate of a country and exacerbated financial issues. Third, a strong dollar drags economic growth. If the company cannot afford the imports required by the business, there will be no inventory. This means that even if the demand remains strong, the company cannot sell so much, which will drag economic output. When the US dollar stronger because the United States is on the verge of decline, it may bring more pain to the market.

Or produce a Domino card effect

The US dollar has fallen 0.6%in the past week, but it is expected that there will be no meaningful reversal in the short term. Scott Renne, a senior global market strategist in the Institute of Investment, Wells Fargo, said, "We expect the US dollar to be basically strong in the near future." domino. Another risk is that the turmoil of emerging markets may spread to the entire financial ecosystem, which has caused a wide range of overflowing effects.

The US Foreign Relations Commission's Brad Sett recently wrote that he is closely paying close attention to Tunisia, which is currently trying to meet the budget needs, and Ghana and Kenya, which have heavy debt burdens. Salvador will pay a bond at the beginning of next year, and Argentina is still struggling after the last currency crisis in 2018. The International Monetary Fund estimates that 60%of low -income countries are in the high risk of government debt crisis, and this proportion 10 years ago was about 20%.

The two largest economies in the world -the fate of the United States and China may determine many things. If these two growth engines really start to stop, emerging markets may have painful investment outflows. Brooks, chief economist of the Institute of International Finance, said: "Whether the United States will fall into a decline will be vital. This makes everyone more avoid risks."

- END -

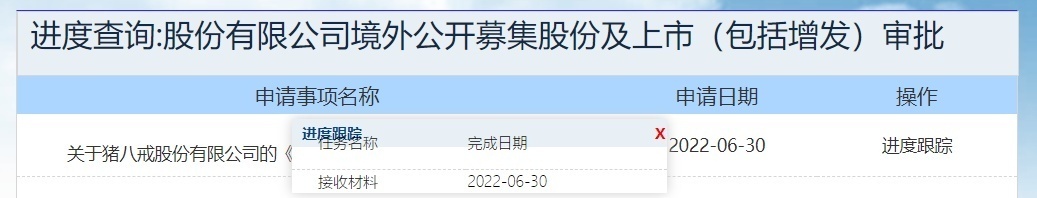

Zhu Bajie.com ’s first public issuance of shares for the first public issuance of the application for receiving materials for the China Securities Regulatory Commission

On July 1st, Capital State learned that Zhu Bajie Co., Ltd. submitted the approval...

Yongxin Chengcheng IPO: The prospect of the online shooting range business is unknown customer concentrated account receivable inventory dual high

Yongxin Chengcheng mainly focuses on the network shooting range of the emerging se...