Noah Holdings Pan Qing: The mission of wealth management company is to provide customers with products and services that can be suitable for different market environments

Author:Federation Time:2022.08.10

China's wealth management and asset management industry is at a inflection point. Market integration will eventually bring stronger growth opportunities to head companies, and the industry will also take a development path with unique Chinese characteristics. In China's wealth management track, all players want to be "China UBS" and are constantly promoting the healthy development of the industry.

As an old -fashioned institution in the wealth management industry, Noah Holdings is injecting elements such as advanced, focused, and professional elements to China's wealth management industry.

In 2010, Noah.us successfully landed on the New York Stock Exchange and became the first independent wealth management agency listed in the United States in Mainland China. In July of this year, Noah Holdings (6686.HK) became the first Chinese independent wealth management agency to realize Hong Kong and the United States, which has always maintained the status of the track pioneer. According to Ferrisanliwen, Noah focuses on providing services to high net worth and ultra -high net worth investors. According to the total income of 2021, Nooya is over 21.5%of China's independent high net worth wealth management service market. , Is China's largest independent wealth management service agency.

Nowadays, the world economy is undeniable to enter the downward cycle. Many investors have begun to be conservative, and they need more professional and dynamic financial services. The wealth management industry is also experiencing the big waves of "sand". In a complex and changeable economic environment, what is the real mission of wealth management companies? Pan Qing, Chief Financial Officer of Blue Whale Finance and Noah Holdings, started a deep dialogue.

"Independence" is the advantage of Noah, which means that there is no thoughts, and it is truly customer -centric.

Blue Whale Finance: Investors of Noah have expressed their views on the investor platform that "independent wealth management" does not exist as an independent segment, so "independent wealth management" and wealth management are the same thing. , There is no difference in toothpaste and Yunnan Baiyao toothpaste. How do you understand "independence"?

Pan Qing:

The so-called independence is actually the definition of the Pure-Play private wealth management institution in the industry. It is used to distinguish the institution of Universal (that is, comprehensive banks). Independent wealth management represents independent existence of not attached or associated with any other financial institutions. It is one of Noah's great advantages to make the market the fastest response to the market according to the needs of customers. Independence can make Noah centered on customers without thoughts. In other words, it can give customers a real -independent service and no other interference professional services. For example, when the AR (asset allocation expert) in the Noah Railway Triangle, when configuring the product to the customer, its core demand is to configure the "correct" product that is suitable for the current market environment and meets the needs of the customer. This is also Noah’s’s’s. One of the professional characteristics -our judgment.

Blue Whale Finance: There have been new companies entering the wealth management track and private equity field. What do you think of this?

Pan Qing: I think there are two types of companies.

The first is "follow the trend". But unfortunately, the grand narrative era of private equity tracks has basically ended. In the era of Volkswagen entrepreneurship and innovation, a large number of invested companies were created. Some companies only innovated in the surface business model, rather than achieving great progress in the fields of technology and core competitiveness. They did not really improve the entity Economically create incremental value. However, because of the high valuation, many PE/VCs have been attracted, and the emergence of many PE/VCs has also been created.

The second is hard -core players, which is the institution that can really enter the track at this stage. I think the professional threshold for entering this industry in the future will become higher and higher. Private equity is an alternative investment, and it has become a unique characteristics of the times.

Blue Whale Finance: Is the non -standard transfer necessary for wealth management companies?

Pan Qing: Non -standard asset allocation is the product of a special historical period. After the introduction of the new rules of self -funding, the overall orientation of supervision is to compress the stock and promote the transformation of such business, and it is inevitable to withdraw from the historical stage. From a compliance perspective, I think it is also necessary.

Transformation must face certain pressure and pain, but for wealth management agencies that seek sustainable development, non -standard transfers are inevitable. Because our professional duties are to protect the wealth of customers in any environment.

In the era of standardization, the scarcity of high -quality products is getting lower and lower, especially financial products are different from other goods. The standardization degree is high and can be replicated. There may be no unique products. Therefore, we will spare no effort to find high -quality resources, but the essence is to provide customers with value through allocation and services, and use the correct way to meet the essential needs of customers.

Blue Whale Finance: After the non -standard transfer is successful, what is Noah's next plan?

Pan Qing: An important strategy of our transformation is to turn to customers. The increase in the amount of raising, income, and profit is the result of the continuous growth of customers.

The essence of wealth management is management risk. First of all, we must understand customers. It is important to guide customers, but this is not an easy task. Wealth management is a very localized business. Even the old foreign -funded institutions, they also face many challenges in China. The reason is that wealth management needs to know local customers very well.

Noah's pursuit is to become a wealth management company of "Baili Pick One", and we hope to obtain 1%of the market share. Although this number does not sound big, it is actually very considerable. In China, high -net -worth individuals with assets of more than 10 million accounts account for only two thousandths of the population, but account for 33%of the amount of investment assets. This is a market where wealth is very focused, but it has only developed a small part, and a large number of high net worth is not served by mainstream financial institutions. We think that 1%is a very good thing. Wealth management and asset management industries have been uniformly transformed. Industrial changes, operating ecology and characteristics are different from the past. The industry has ushered in the inflection point of the evolution of business models. Because of the past and current competitive position of Noah Focusing on "customer -centric", using more advanced and professional service models, from strategic to execution, can achieve competition breakouts.

The mission of wealth management companies is to provide customers with products and services that can suitable for different market environments.

Blue Whale Finance: What development is Noah now?

Pan Qing:

I think Noah's recent listing in Hong Kong is of great significance, marking that we have opened a very critical new stage. In the nearly 20 years of Noah's previous entrepreneurship, it mainly relies on the rapid development of China. Today, the economy has entered a slow development cycle. In this cycle, finding the most suitable products and services for customers and helping customers manage wealth is our mission.

We have made a lot of changes to deal with this new stage.

First of all, at the product side, we began standardized transformation in 2019, and the standardized transformation was successfully completed in only 8 quarters. The supply and differentiation quality services of standardized products are the main tasks. After the transformation is successful, continue to consolidate Noah's research ability. Since this year, under the influence of complex factors such as global epidemic and international situation, many investors have shown anxiety and even pessimistic emotions in asset allocation. As a professional wealth management and asset management agency, in order to provide customers with a more forward -looking professional decision -making basis, Noah has established the Noah's CIO office to systematically output our global macro insights and thinking about global configuration.

Secondly, on the client, Noah broke the "sales" model of a single financial planner in the past, turning the concept of "Push Sale" into today's 3R iron triangle service, which is very different from the past model. It requires a higher level of understanding of customer needs. In the past, it was called "non -standard product standard service" because non -standard products were simple, but after being transferred to standardized products, the service would become more complicated and personalized. In the future, the biggest opportunity will be hidden in asset allocation and investment consultants. This is also precisely the important competition barriers of the wealth management industry in the future. We will make long -term investment and persistence.

Blue Whale Finance: Why does Noah must insist on making 3R iron triangles, what is the meaning of customers?

Pan Qing:

Iron Triangle is a term from Huawei. The top of the pyramid is a single interface for serving customers, called AR (account representative), creates and maintain customer relationships, and provides asset allocation consulting services. The other corner is FR (Fulfill Responsibility), which is responsible for investing in execution, making many renewal reports for customers, and regularly sharing background functions for customers. The reason for creating this role is that we want to release the workload of various tasks in the past, so that AR can spend more time in contact with customers.

The last corner is not a fixed corner, it is a product expert SR (Solution Responsibility). For example, if a customer gets a configuration plan, we will discuss multiple strategies for customers to choose from.

In the past, it was based on a single product, and it is now a solution based on the whole picture. This product may be good, but it is not necessarily suitable for all customers.

This model has not been implemented in the past, especially independent wealth management agencies because it costs very high. But Noah must do.

The reason is that it can make the company better understand customers. In this model, customers will have very complete channels to feedback his feelings. If the customer has the only financial management representative, he may face the predicament of the financial management representative without channels. However, in the iron triangle mode, customers will have the opportunity to come into contact with a variety of feedback channels.

Blue Whale Finance: What will be the core competitiveness of wealth management agencies after non -standard transfer?

Pan Qing:

I think the core competitiveness of wealth management agencies has always been customers. And how to win customers, I think there are three aspects.

For example, for example, first, Noah wins with "product power", which is also based on our understanding of customers.

The second is the ecology of the product partner. Noah has established a strong cooperation ecology with the global leading managers. In addition, we have given these managers very good platforms, because the work of sales and duration is our responsibility. Fund managers only need to focus on investment and give professional matters to professional people.

The third is that the ecological barriers of our asset management sector are very high. The nature of the funds we introduce is very good, because our average households in high net worth people are the highest in the industry. Most of our investment funds come from relatively mature qualified investors. They can accept long -term products and can bear risk fluctuations. Whether it is Morgan Stanley, Jiaxin, or Belle, we find that the business logic behind the successful wealth management and asset management institutions includes business thinking from channel thinking to platform thinking, to ecological thinking to ecological thinking Change.

Noah defines herself as a technology financial service agency, that is, to empower financial products through technology.

Blue Whale Finance: What is the overall layout of Noah in the field of fintech?

Pan Qing:

We mainly deploy financial services. The main channel customer interface is two -wheel drive of wealth management and asset management.

Noah has always defined herself as a financial service institution for science and technology. Digital transformation has always been one of our core strategies. Noah develops digitalization, first to enhance the customer experience. The second is the exhibition industry that empowers the wealthy wealth wealth management. Digitalization allows financial management to perceive the needs of customers. Finally, I hope to maximize the matching products to the greatest extent, and let our business operate automatically, and improve operating efficiency.

Blue Whale Finance: How to think of the difference between technology finance and fintech?

Pan Qing:

The wealth management industry is a traditional industry. After more than 200 years of history, there is no essential change. Supervision has published some views on fintech or large retail finance. I think it is very good.

First of all, financial products are actually monopoers, not who can buy it. This is a qualified investor system.

Secondly, financial products are not who can sell it, but the customer -centric and how to understand the needs of customers. Whether wealth management institutions and asset management institutions understand the risk of customers. If we cannot accurately understand and identify customers, there will still be risks.

Therefore, Noah emphasizes technology finance and empower financial products through technology. Our gene is a "private bank". This difference is important.

Listing in Hong Kong is the second battlefield in the capital market for Noah.

Blue Whale Finance: What is the impact of listed in Hong Kong?

Pan Qing:

It is more a strategic layout. First of all, from the perspective of Noah's listed company, we open the second battlefield in the capital market. In fact, the stock price of many Chinese stocks is affected by the so -called "pre -delisting risk" to a certain extent, and there is no way to resolve it in a short time.

Second, our customers are mainly Chinese in the world, especially customers in mainland China. We have operating experience in Hong Kong, China and operating a Hong Kong company in about 10 years, so it is equivalent to listing in the local market, which will help Noah to develop the local market.

Third, this can further optimize the structure of the investor and make our shareholder structure more diversified.

In the last point, we hope to take this opportunity to go public in Hong Kong, and Nona's international brand will make a communication and promotion, and let more customers understand our comprehensive service strength overseas.

The brand renewed is not just a logo, but the overall upgrade of the entire brand strategy and brand play.

Blue Whale Finance: What is the profound significance of this year's brand renewal?

Pan Qing:

First, the tone, grade, and personality behind the brand are important. In the new brand renewal, Noah wants to convey professional, real and warmth. During the renewal process, Noah began to have her own "person". Share an interesting thing. In the process of renewing the brand, the survey results show that many customers describe Noah's image, like the intellectual sisters next door, or a 40 -year -old successful man, etc. This makes Noah and other institutions. differentiate.

The second is the importance of recognizing the strategic of the brand. The meaning behind the standardized product is the homogeneity of the product. After the vast majority of the products are homogeneized, only the brand is more recognizable in front of customers.

Third, it is to be more clear about the support and empowerment of business from the past. The brand renewed is not just a logo, but the overall upgrade of the entire brand strategy and brand play. For the wealth management industry, talents, assets, and core technology are all competing resources, and we will further improve in these aspects.

We recommend that investors continue to "improve protection and layout growth" in the second half of the year.

Blue Whale Finance: What is Noah's investment outlook for the second half of the year?

Pan Qing:

In the first half of the year, we suggested that Noah's global high -net worth customers actively actively actively inspects the protection, protection, and isolation of their families and families. In the second half of the year, our main views continue to adjust.

First of all, in the epidemic, we have some optimistic judgments. However, after repeated consideration, internal discussions, and collision with many overseas asset management institutions, the basic judgment obtained is still an overall shock. So our suggestions to customers are to protect them first, and then seek growth. In the investment outlook released by the Noah's CIO office in the second half of this year, we also emphasized that whether it is a high -net -worth family or the asset allocation strategy of Chinese private enterprises, we should adhere to "protection first and then grow." I think consumption will be restored, but it will not be so fast. Therefore, it is very important for domestic and foreign dual -cycle and adherence to internationalization. Second, for enterprises, I think there are still many challenges. In a particularly good environment or a particularly bad environment, companies actually have a strategy of response. The only difficulty is an uncertain environment.

It is more certain that under the complex environment, enterprises and family cash flows may be under pressure, and liquidity management needs to be paid more attention to liquidity management. We recommend that Chinese private enterprises and high -net -worth families actively consider the "liquidity solutions" around capital liquidity management and value -added needs. This is why we have launched the "Smile Treasury" platform facing SME users.

In 2022, we also deeply feel that we have a serious responsibility for customers. The more macroexiac is increasing, the more we need to think calmly and mature judgment.

- END -

Love online shopping and save money!Hefei people in the first half of the year's consumption "list" released

According to the analysis of Hefei consumer market recently released by Hefei City...

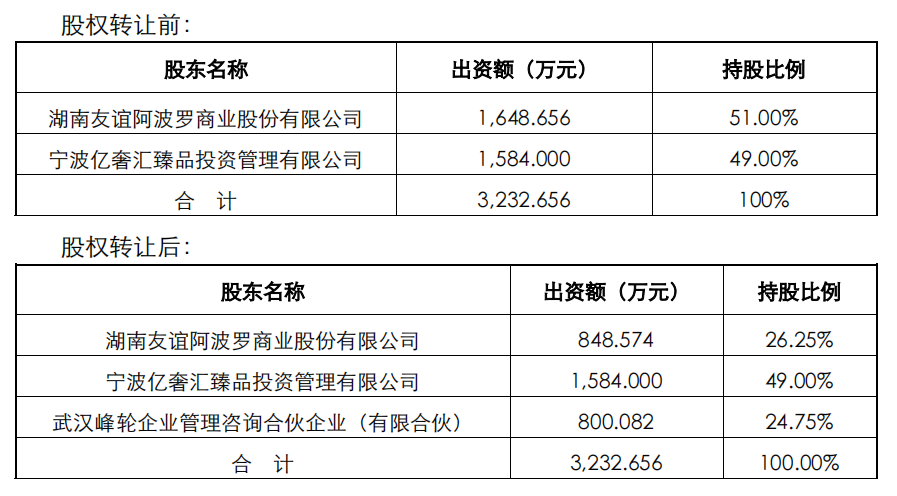

You'a shares: It is planned to transfer 24.75%equity of Ou Paiyi luxury exchange to Wuhan Peak Wheel

On July 8th, A -share company You A shares (002277.SZ) announced that the company ...