Establish the concept of rational investment and financial management.

Author:Ecological Ya'an Time:2022.08.10

In recent years, some criminals have used the lack of investment risk awareness, the form of new criminal forms and the lack of understanding of the defrauding means, etc., and promote them to induce them to make the so -called investment with high returns and deceive the money for the elderly. With the diversification of the way of pension, "the old -age care of the house" has also become a hot topic. Some criminals have begun to perform fraud against the elderly under the guise of "pension with houses". To bait, the elderly who are unknown to the truth step by step are brought into a carefully designed scam.

Bank staff popularized financial knowledge to elderly groups

It is understood that "housing pension", also known as the reverse mortgage pension insurance of housing, refers to the elderly who own the entire property rights of the house mortgaged to insurance companies or commercial banks, but continue to have house occupation, use, income and mortgage mortgage The right to dispose of the power person will receive pensions in accordance with the agreed conditions until the death; after the elderly died, the insurance company or commercial banks obtained the right to dispose of mortgage real estate, and the disposal of the disposal will be used to pay for the relevant expenses of pension insurance.

"The basic routine of the household financial management scam is that the old man mortgaged the house to exchange money, and invested in the so -called house -pension project, claiming that he could get tens of thousands of pensions per month. It can receive high returns, but it is often not long before the company lost contact, the boss runs, and the old man 'money house is empty. "The relevant person in charge of an insurance company in our city introduced.

The regulatory authorities remind consumers that the criminals claim that the "pension with houses" has nothing to do with the retrofit pension insurance of the housing trial of the country, but it is just a means of publicity and promotion of national policies and promoting illegal fund -raising activities. Elderly people must establish a rational investment and financial management concept. Do not easily believe in the so -called "stable earnings" and "risk -free, high yields" publicity. Do not invest in projects with unclear business and unknown risks.

Reporter Jiang Yangyang

- END -

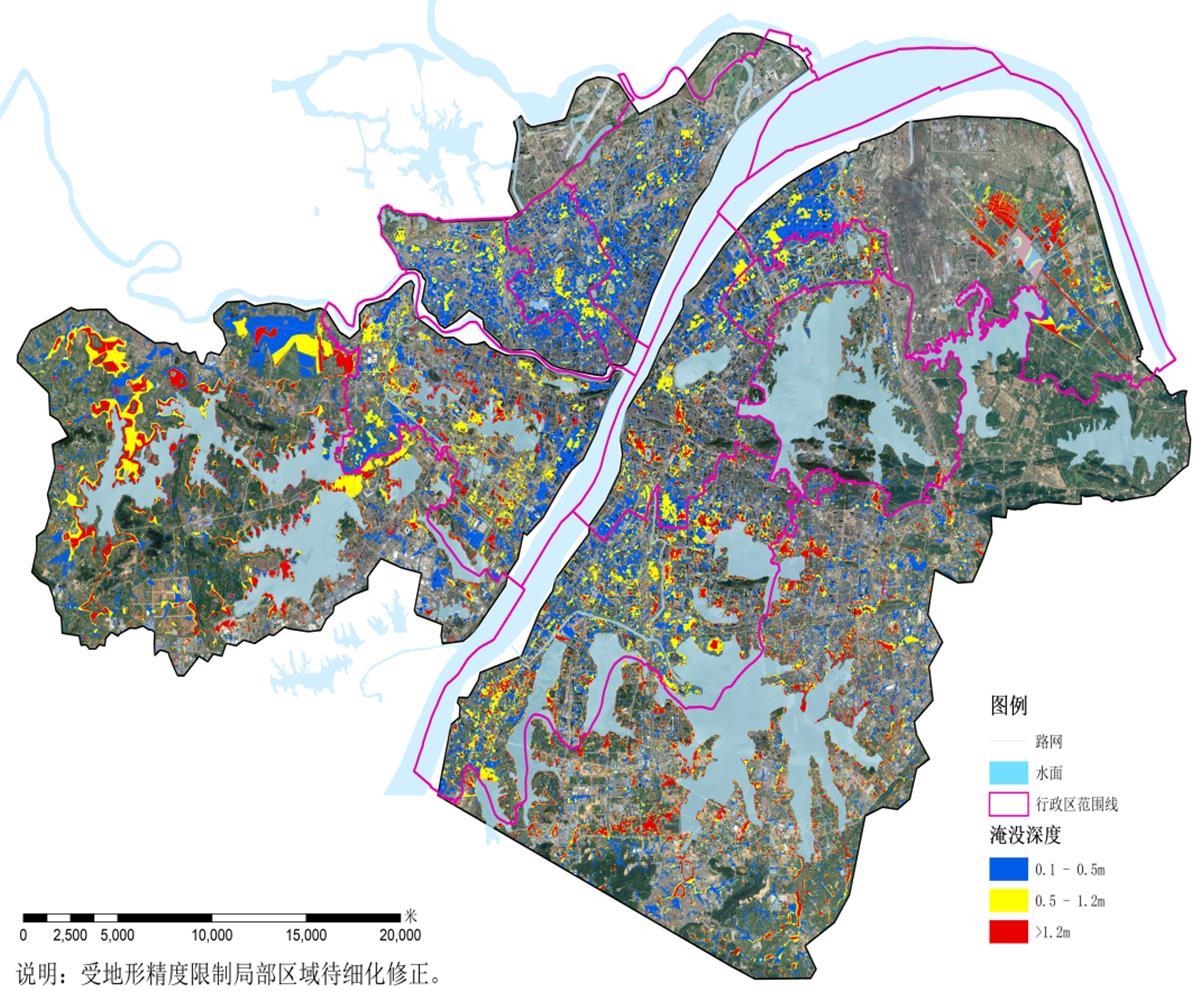

Where is the rainy rainfall, where is it easy to cause waterlogging?Wuhan delineates 21 risk areas

Jimu Journalist Pan XizhengIntern Xiang YuchenOn July 6, the Wuhan Municipal Gover...

New Peasant New Models grow new hope

UAV is taking medicine for high standard Miantian (taken on July 2). Reporter Han ...