Fund illegal flow into the housing market!This bank was fined 2.9 million

Author:China Fund News Time:2022.08.09

China Fund reporter Wang Jianqiang

Aiming at the illegal of credit funds into the property market, regulatory punch again. A few days ago, the Dalian Banking Regulatory Bureau issued 9 penalties for Pudong Development Bank. The six penalties were Pudong Development Bank Dalian Branch. The total fine was 2.9 million yuan. Three relevant responsible persons were fined at the same time.

Flowing into the housing market due to illegal funds, etc.

Pudong Development Bank was fined 2.9 million yuan

On August 9th, the official website of the Dalian Regulatory Bureau of the China Banking Regulatory Commission showed that the Dalian Branch of Shanghai Pudong Development Bank was recently issued a number of fines and a total of 2.9 million yuan was fined.

Administrative penalties show that the main violations of laws and regulations of the Dalian Branch of Shanghai Pudong Development Bank, including the inadequate management of employee behavior, the original customer manager misappropriated customer funds, forming case loss and leakage of case information; , Employee behavior is not in place, forming case loss and missing case information.

In addition, there are still problems in the bank: the group's customers are not effectively identified and included in the unified credit management management; the "three investigations" of the loan business are not in place, resulting in the loan funds return borrower; Strictly use it in accordance with the contract; the loan management is not in place, and the loan of mobile funds flows into the real estate field.

In addition, the relevant three responsible persons were ordered to correct and warned. The administrative penalty decision was the Dalian Supervision Bureau of the Bank of China Insurance Supervision and Administration.

In fact, the Dalian Branch of Shanghai Pudong Development Bank had previously fined multiple times for the unattractive related corporate relationships in the financing guarantee business and inadequate post -loan management, with a total fine of 3.4 million yuan.

As of now, Pudong Development Bank has been punished by regulatory authorities such as the CBRC, the central bank and other regulatory authorities, and a total of not 350.45 million yuan. Among them, six tickets involved the case of illegal housing loans or inflows in the housing market in violations of loans. The total penalty was not 11.45 million yuan, accounting for 32.67%of the total penalty during the year, more than 30%.

Regulatory heavy boxing "encirclement" credit funds illegal entering the property market

Since August, the banking industry's tens of millions of fines have appeared. Behind a number of heavy penalties, the chaos in the real estate field has become the focus of regulatory attention.

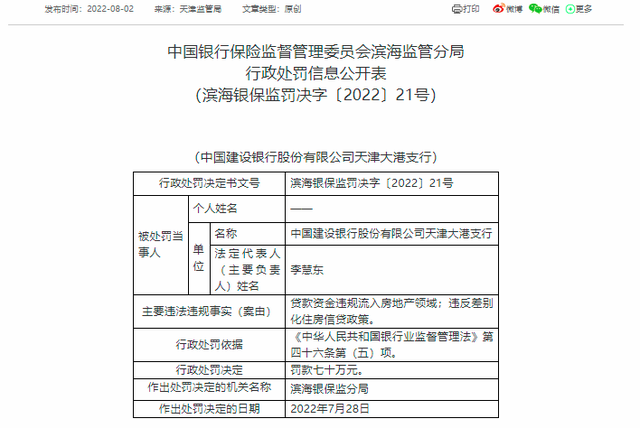

On August 2nd, an administrative penalty information disclosed by the China Banking Regulatory Commission's official website showed that the construction bank Tianjin Dagang Branch was fined by the Binhai Banking Insurance Regulatory Bureau due to the existence of loan funds and violations of differentiated housing credit policies. 700,000 yuan.

Because Song Moumou had direct responsibility for the problem of violations of the loan funds of the Construction Bank Dagang Sub -branch into the real estate sector, Dou Moumou was responsible for management responsibilities for the violation of differentiated housing credit policies of the Construction Bank Dagang Branch. The branch warning punishment.

Although supervision has repeatedly reiterated that bank loans must ensure the real use, and it is strictly forbidden to misappropriation of regulations, why are there always banks who know that they are committed? A relevant person in a state -owned bank said that as the domestic epidemic situation has turned better, the real estate transactions of individual hot -spotted cities have heated up. Among various assets, real estate is naturally attractive to bank funds. Pindedness has led to repeatedly banned violations.

Since 2021, due to the rigorous management of real estate in various places, the regulatory authorities have continuously strengthened the crackdown on "blood transfusion" real estate in operating loans and consumer loans. Recently, due to the continuous relaxation of the property market policies, the situation of illegal housing loans and the inflow of funds in the property market have also increased. Relevant departments have continued the situation of strict supervision, adhered to the wind of "housing housing does not speculate", and promoted the steady development of the real estate industry in the real estate industry , Prevent financial risks.

Edit: Xiao Mo

- END -

Keep in mind the original mission to carry out theme party day series activities

Keep in mind the original mission to carry out theme party day series activitiesLi...

Innovation applications of "blockchain+medical insurance" in our district have achieved results that has been benefited from 13,100 companies this year

Pomegranate/Xinjiang Daily News (Reporter Mi Ri Guli Naser reported) The reporter ...