The performance of the performance is all year round. Can the "receiving" of the Sanyuan shares save the prince's milk in the crisis?

Author:Burning news Time:2022.08.09

Future Network, Beijing, August 9th (Reporter Ling Meng) After experiencing the second auction of the equity, the issue of the ownership of Prince Milk of Lactic acid bacteria of lactic acid bacteria in the past was finally settled.

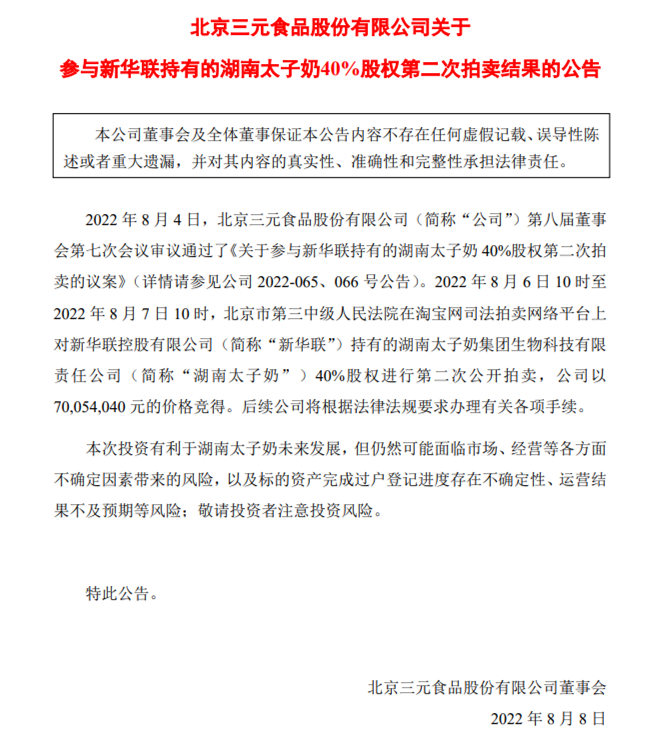

On August 8th, Sanyuan issued an announcement saying that it has recently obtained a 40%equity of the Hunan Prince Milk Group Biotechnology Co., Ltd. (hereinafter referred to as "Prince Milk") by the judicial auction process, and the auction auction is 70.54 million yuan. It is reported that after this round of auction is completed, Prince Milk will become a wholly -owned subsidiary of Sanyuan.

In fact, as early as 2011, the Sanyuan Co., Ltd. acquired Princess Milk on the edge of the bankruptcy and reorganization, holding 60%of the shareholding ratio. However, earlier acquisitions did not allow the two dairy companies to embark on the road of "win -win". After encountering the broken capital chain, the prince's milk after being listed as the executing person was sluggish, and it was in a loss state in terms of performance. Can the three yuan shares save the prince milk in crisis this time?

Three yuan shares acquire 40%equity? Back to the beginning and end of the prince's milk equity auction

Recently, a announcement of the Sanyuan Co., Ltd. returned to the public's vision for the long -awaited prince milk brand.

On August 8th, Sanyuan issued an announcement, saying that from 10:00 on August 6th to 10:00 on August 7, the Beijing Third Intermediate People's Court of Beijing on the Taobao judicial auction network platform (hereinafter referred to as the abbreviation "Xinhua Lian") Hunan Prince Milk Group Biotechnology Co., Ltd. 40%of the equity of 40%of the equity in the second public auction. The company competes for 70.54 million yuan. It will subsequently go through various procedures in accordance with laws and regulations.

Picture source: Sanyuan Shares Announcement

Tianyancha shows that the current three yuan shares and Xinhua Lian are major shareholders of Prince Milk, and the two hold 60%and 40%of the shares. This also means that after this round of auction is completed, Prince Milk will become a wholly -owned subsidiary of Sanyuan.

It is worth noting that a month ago, the above -mentioned equity of Prince Milk had been auctioned for the first time. According to the announcement of Sanyuan on July 2, the Beijing Third Intermediate People's Court will publicize a public auction of 40%of the 40%equity held by Xinhua Union, with a starting price of 87.677 million yuan.

At that time, as a major shareholder of Prince Milk, Sanyuan shares enjoyed the right to purchase. However, in the first auction, Sanyuan shares gave up this right. The Sanyuan Co., Ltd. pointed out in the announcement, "Beijing Third Intermediate People's Court consulted whether the company advocated the right to purchase priority. After comprehensive consideration, the company intends to abandon the right to buy priority and not participate in this auction." In the end Running and flowing.

Judging from the results of the second auction, Sanyuan shares can be described as reversing. Sanyuan shares pointed out in the announcement on August 8 that this investment is conducive to the future development of Hunan Prince Milk, but it may still face the risks brought by the uncertain factors such as the market and operation, as well as Uncertainty, operational results are not as expected.

According to the previously issued equity asset evaluation report released by Sanyuan, the market value of 40%of the 40%equity held by Xinhua Liana on December 31, 2021 was 125 million yuan. Based on this calculation, the final auction price of the second auction of Sanyuan shares is equivalent to 56%of the market value.

Destiny is too much, and once won the "annual bid king" of CCTV food and beverage

Judging from the beginning of the equity auction, whether it was the first round of tragedy or the severe shrinking of the final bidding, it added a touch of dramatic colors to the fate of the old prince's old company.

In fact, as a former lactic acid bacteria company, Prince Milk has also been brilliant. Public information shows that Edward Milk was founded in 1996. With its major shareholder Sanyuan shares, and even today's dairy giants, Mengniu and Yili belonged to companies at the same time.

From the establishment to becoming popular, Prince Milk has only spent one year. The following year, the founder Li Tuchun won the "annual bid king" of CCTV food and beverage at a price of 88.88 million yuan. Since then, Prince Milk has opened a glorious era.

According to the Beijing Business Daily, in 2005, Prince Milk won the top ten influential brands in China and was rated by the Chinese Food Science and Technology Society as the first in the production, sales, and market share of China's fermented milk industry. More than 70%of the market share.

Picture source: Prince Milk Official WeChat public account

By 2006, Prince Milk began to seek listing. In order to get private equity funds such as British Federation, Goldman Sachs, and Morgan Stanley, Prince Milk signed a gambling agreement with the three major investment banks, and immediately embarked on a diversified expansion path.

However, everything was abruptly ended in 2008. With the outbreak of the financial crisis, Prince Milk was forced by Citi Bank's debt, and the capital chain began to break, which also led to the failure of the prince milk to the gambling agreement. Then, Prince Milk was exposed to huge debt, and Li Tuchun also lost his control over prince's milk.

In 2011, Prince Milk faced bankruptcy and reorganization. It was also this year that Sanyuan and Xinhua jointly contributed 375 million yuan to receive prince milk, holding 60%, 40%of equity and corresponding available assets, respectively.

However, the acquisition of the prince is still unable to get rid of the shadow brought by huge liabilities. Tianyancha shows that since 2011, Prince Milk has been listed as the executed person seven times, and the total amount of execution has reached 356 million yuan.

At the same time, Prince Milk is also frequently warned by sanitary control. In July 2018, the Food and Drug Administration of Hunan Province issued a warning letter on the flight inspection of Prince Milk. According to a police letter, Prince Milk has 10 safety risks in terms of production environmental conditions and production process control, including freely storing cleaning ingredients in the workshop feeding area, unsatisfactory ventilation facilities in the temporary stored in the material, and drinking workshop atrvial clothes. Wait seriously. Tianyancha shows that since 2016, Prince Milk has also been punished by administrative penalties due to violations of water pollution to prevent the management system and the excessive discharge of smoke and dust in the boiler exhaust gas, with a total penalty amount of 220,000 yuan.

In addition, according to the asset evaluation report released by Hunan Public Assets Assessment Co., Ltd. in April this year, as of the end of 2021, Prince Milk Group had a total of 88 employees, with a total of 11,615 square meters of houses. "Due to the aging equipment, the production line is severe and leak, which leads to the failure to organize production. The Prince Milk Group has no production in the production area since August 2020, and the equipment is in a state of disable." The plan to restore production in the production area will gradually dispose of production equipment. "

Performance loses all year round. Can the three yuan shares save the prince milk in the crisis?

In addition to being listed as the executed person and administrative penalties, since being reorganized, the performance of Prince Milk is also difficult to speak optimistic.

Public data shows that from 2001 to 2007, the sales of prince milk jumped from 50 million yuan to 3 billion yuan, and the results of the six consecutive years doubled. In the financial reports of Sanyuan in recent years, what presents the opposite is the opposite.

In the future, the reporter of the network sorted out the financial report of the three yuan shares after the years and found that from 2012 to 2021, the revenue of Prince Milk was 85 million yuan, 163 million yuan, 180 million yuan, 182 million yuan, 79 million yuan, 96 million yuan, and 96 million yuan. 552 million yuan, 127 million yuan, and 190 million yuan. Even if the revenue lasted for 9 years, since 2016, the revenue growth rate of Prince's milk has shown a negative growth trend all year round. In 2021, the revenue of Prince Milk was only 18.52 million yuan, a shrinkage of more than 150 times compared with the peak of 3 billion yuan.

In addition, the net profit of Prince Milk is also in a state of losing money all year round. Except for 2015 and 2019, which were profitable 50,000 yuan and 50.58 million yuan, the remaining 7 years were losses. In 2016, 2020 and 2021, they faced huge losses. Yuan, -61.4 million yuan.

As for the unsatisfactory performance of Prince's milk, Sanyuan shares have been explained many times in the financial report. There are no new asset impairment in the period, and profits have been reduced year -on -year. "

But even so, the former prince's milk was difficult to hide the momentum. Many people in the industry have an optimistic attitude towards the Sanyuan shares to buy prince milk again.

"Prince Milk is the main attack of the Central South Market. The Sanyuan Co., Ltd. acquired again this time, mainly to see the brand status of Prince Milk in Central South." Song Liang, a senior dairy analyst, said in an interview with Future Network reporters. He said that in the future, Sanyuan may increase its investment and layout in the central and southern region, and then open up the central and southern markets such as Hubei and Hunan, and even the Southwest markets such as Sichuan to make Prince Milks into a professional brand.

For the prince milk that has lost their performances all year round, can Sanyuan shares save it in "water and fire"? In this regard, Song Liang pointed out that as an old dairy company, the brand image of the prince milk in the market is too old, the product types It is also relatively single. "In addition, Prince Milk is also facing problems such as marketing and weak channel capabilities. Whether it can restore the loss of performance, mainly depends on the positioning and shaping of the prince milk brand next."

Chinese food industry analyst Zhu Danpeng also told Future Network reporters that for Sanyuan's shares, Prince Milk may be an important starting point for it to the country, and it is also an important way and means for its channel sinking. "At present, how to revitalize Edward Milk is the problem that Sanyuan is the first to be solved. Generally speaking, the equity acquisition is a better choice for both Sanyuan and Prince Milk."

- END -

Whether the IPO of Yihong shares will be available

Cover reporter Ma MengfeiOn August 2nd, the 47th review meeting of the GEM Listed ...

ZARA's "Three Sisters" defeated the Chinese market. Why did the European and American fast fashion brands disappear?

Recently, the fast fashion industry exposed a heavy news: Zara three sisters brand...