Important Announcement Collection of listed companies: China Unicom's net profit in the first half of the year increased by 18.7% year -on -year.

Author:Securities daily Time:2022.08.09

China Unicom: In the first half of the year, net profit increased by 18.7% year -on -year. It is planned to be 10.663 yuan Huaxia Bank: Shougang Group and Beijing Investment Company intend to subscribe to the company's non -public A -share stock Great Wall Motor: In July, new energy vehicle sales 10994 Yonghui Supermarket:It is intended to repurchase the share coke in Shanxi with 400 million to 700 million yuan: net profit of 5.694 billion yuan in the first half of the year increased by 192.88%

Important Announcement of Shanghai City: New City Holdings: In July, the contract sales amount decreased by 35.52% year -on -year. New City Holdings (601155) Announcement that the company realized the contract sales of about 10.890 billion yuan in July, a decrease of 35.52% over the same period last year; the sales area was about 1.0787 million square meters Mi, a decrease of 30.58%over the same period last year. From January to July, the company's cumulative contract sales amount was about 76.05 billion yuan, a decrease of 43.48%over the same period last year; the cumulative sales area was about 7.6507 million square meters, a decrease of 38.42%over the same period last year. Yaxing Bus: In July, sales increased by 61%year -on -year. The sales volume in July was 106, a year -on -year increase of 61%; the cumulative sales of this year were 898 units, a year -on -year decrease of 20%. Great Wall Motors: In July, the sales of new energy vehicles 10994 Great Wall Motors (601633) announced that the company disclosed the July production and sales express report. In July, the sales volume was 10,1920, a year -on -year increase of 11.32%. In July, new energy vehicles were sold for 10,994 units, and from January to July, a total of 74,584 units were sold. JAC: In July, the sales of pure electric passenger cars increased by 43.35% year -on -year JAC (600418) announced that in July, sales were 43766, a year -on -year increase of 11.55%. Among them, the sales volume of pure electric passenger cars was 17,212, a year -on -year increase of 43.35%. Electronic City: The subsidiary Zhiyu Zhilian will be announced on August 9th to the New Third Board Electronics City (600658). Essence As of the announcement date, the company is the largest shareholder of Zhiyu Zhilian, holding 20 million shares of Zhiyu Zhilian, holding a share of 40.00%. Huanxu Electronics: In July, the consolidated operating income increased by 38.87% year -on -year Huanxu Electronics (601231) Announcement that the company's merging operating income in July 2022 was 5.643 billion yuan, an increase of 38.87% compared to the same period last year, from June 2022 in 2022 Combined operating income decreased by 2.12%month -on -month. The consolidated operating income from January to July was 34.584 billion yuan, an increase of 31.31%over the same period last year. Huaxia Bank: Shougang Group and Beijing Investment Company planned to subscribe to the company's non -public A -share stock Huaxia Bank (600015) announcement that the company's proposed non -public issuance of A -share shares raised not more than 20 billion yuan. Shougang Group and Beijing Investment Co., Ltd. issued the "Subsidity Form" to the company on August 1st. Shougang Group and Beijing Investment Company intended to subscribe to the non -publicly -issued A -share stocks of 5 billion yuan and 3 billion yuan, respectively. Shougang Group and Beijing Investment Company constituted the company's related parties, which constitutes a company -related transaction. At present, the company has not signed a subscription agreement with Shougang Group and Beijing Investment Corporation for the above subscription. Yonghui Supermarket: It is planned to repurchase the shares of the shares of Yonghui Supermarket (601933) for 400 million to 700 million yuan. The number of repurchase does not exceed 150 million shares, and the repurchase price does not exceed 5 yuan. Nanwei Software: The pre -winning bid 150 million yuan Fujian Public Security Big Data Center Quanzhou Branch Platform project Nanwei Software (603636) announced that the company is a winning candidate for the project of the Quanzhou Branch of Fujian Public Security Center, with a pre -bid amount of 154 million yuan Essence The half -annual report of 2022: Ailong Technology: In the first half of the year, net profit increased by 62.32%year -on -year Aelon Technology (688329) Announcement that the operating income in the first half of the year was 166 million yuan, an increase of 27.23%year -on -year; The income per share is 0.39 yuan. Lidaxin: In the first half of the year, net profit increased by 60.97%year -on -year Lidaxin (605365) announced that in the first half of the year, operating income achieved 3.911 billion yuan, an increase of 40.77%year -on -year; net profit was 286 million yuan, a year -on -year increase of 60.97%. Basically 0.57 yuan per share. Snowy Salt Industry: In the first half of the year, net profit increased by 180.77%year -on -year Xue Tian Salt Industry (600929) Announcement. In the first half of the year, operating income was 3.295 billion yuan, an increase of 67.69%year -on -year; net profit was 461 million yuan, an increase of 180.77%year -on -year; basically per share; basically per share; Income is 0.34 yuan. China Unicom: In the first half of the year, net profit increased by 18.7% year -on -year to announce that 10.663 yuan China Unicom (600050) announced that in the first half of the year, the company achieved operating income of 176.26 billion yuan, an increase of 8.3% year -on -year; A year -on -year increase of 18.7%; basic earnings per share was 0.158 yuan. For every 10 shares, a cash dividend is 0.663 yuan (including tax), and a total of about 2.019 billion yuan (including tax) dividends will be issued to the company's shareholders. Zhongheng Design: In the first half of the year, net profit decreased by 8.56%year -on -year. It was an announcement of the 10.5 yuan Zhongheng Design (603017). In the first half of the year, the operating income achieved 663 million yuan, an increase of 4.46%year -on -year; The income per share is 0.26 yuan. The company intends to distribute a cash dividend of 2.5 yuan (tax) per 10 shares.

Important Announcement in Shenzhen City: Minhe Shares: In July, the income of commercial chicken seedlings in July was nearly 36.32 million yuan decreased by 30% year-on-year Minwa shares (002234) Announcement. The change was -4.89%; the sales revenue was 36.316 million yuan, a year-on-year change of -30.02%, and a month-on-month change -13.36%. Satellite Chemistry: It is intended to invest with SKGC Company to build an EAA installation project with a total investment of 1.64 billion yuan of satellite chemistry (002648) announcement. Contract, SKGC holds 100%equity of China and South Korea. SKGC and Shantelai agreed to combine their respective advantages to increase capital to China and South Korea Correte Company to jointly build and operate the EAA installation project. The production scale of EAA devices is 40,000 tons/year, and the total investment is about 1.64 billion yuan. Tianbang Food: In July, the sales revenue of commercial pigs increased by 23.79% month -on -month. Tianbang Food (002124) announced that in July, 326,900 commercial pigs were sold, with sales revenue of 816 million yuan and average sales price of 22.16 yuan/kg. %, 23.79%, 29.33%. From January to July, there were 2.4059 million commercial pigs, with sales revenue of 4.309 billion yuan, and the average sales price was 14.89 yuan/kg. Tongguang Cable: The subsidiary's pre -winning bid 281 million yuan Southern Power Grid project Tong Light Cable (300265) Announcement, all -funded subsidiary Jiangsu Tongguangqiangqi Power Transmission Technology Co., Ltd. Pre -China Southern Power Grid Company 2022 Main Network Materials No. 1 A number of framework bidding projects, the amount of winning bid was about 281 million yuan, accounting for 14.6%of the total operating income of the audited operating income in 2021. *ST Star: The company's control of the right to change *ST Star (300256) Announcement. On August 3, the Pingxiang Intermediate People's Court ruled that the company's reorganization plan was approved, and the company entered the implementation stage of the reorganization plan. After the implementation of the reorganization plan, the company's controlling shareholder will be changed to immediately, and the actual controller of the company will be changed to Ying Guangjie and Luo Xueqin couples. Wen's Shares: In July, the sales of meat pigs increased by 35.75% month -on -month. %, 13.72%, 11.96%, the year-on-year changes were -3.91%, 47.96%, and 51.81%, respectively; 1.3243 million meat pigs were sold in July, with revenue of 3.421 billion yuan, and the average sales price of hair pigs were 22.06 yuan/kg, with a month-on-month change of 7.49, respectively. %, 35.75%, 29.01%, and the year -on -year changes were 3.58%, 50.97%, and 46.29%of Sinochem. The construction section of the road renovation project (Phase I) of Hou Avenue (Second Ring Road to Jiang'an River), with a total bid price of 362 million yuan, accounting for 6.99%of the company's audited operating income in 2021. Beidou Star Tong: Draw up the announcement of not over 1.135 billion yuan (002151) announcement. The total amount of funds raised by non -public offering of shares will not exceed 1.135 billion yuan. And industrialization projects, vehicle functions, high -precision Beidou/GNSSSOC chip development and industrialization projects, research and development conditions construction projects, and supplementary funds. Zhengbang Technology: In July, the sales revenue of commercial pigs was 742 million yuan increased by 12.18% from the previous month. Fall 49.60%; sales revenue was 742 million yuan, an increase of 12.18%month -on -month, a year -on -year decrease of 77.51%. The average sales price of commercial pigs (after deducting piglets) was 21.08 yuan/kg, an increase of 33.62%over the previous month; averaged 71.01 kg/head, a decrease of 5.93%from the previous month. Kangda New Materials: Integrate 500 million yuan to build Chengdu Kangda Intelligent Manufacturing Base Project Project Kangda New Materials (002669) announced that the company plans to invest 500 million yuan to invest in the construction of Chengdu Kangda Smart Manufacturing Base Project in the future of Chengdu, and with Chengdu High -tech Industry The Development Zone Management Committee signed the "Investment Cooperation Agreement". The half -annual report of 2022: Lyl Chemistry: In the first half of the year, net profit of 1.048 billion yuan increased by 107.46% year -on -year Lill Chemical (002258) announcement that the company's operating income in the semi -annual 2022 year was 5.078 billion yuan, an increase of 60.72% year -on -year; 1.048 billion yuan, a year -on -year increase of 107.46%; basic earnings per share was 1.42 yuan.

Back to Tianxin Material: In the first half of the year, the net profit of 182 million yuan increased by 22.32%year -on -year to return to Tianxin New Materials (300041) Announcement. The company's operating income in the semi -annual 2022 year was 1.9 billion yuan, a year -on -year increase of 34.83%; the net profit of the mother was 182 million yuan. , Year -on -year increased by 22.32%; basic earnings per share were 0.44 yuan. Ivek: In the first half of the year, net profit of 52.34 million yuan decreased by 51.05% year -on -year. Fall 51.05%; basic earnings per share is 0.12 yuan. Shandong Haihua: In the first half of the year, net profit of 661 million yuan increased by 147.62% year -on -year Shandong Haichu (000822) announced that the company's operating income in the semi -annual 2022 year was 50.034 billion yuan, an increase of 74.83% year -on -year; Increasing 147.62%; basic earnings per share is 0.74 yuan. Super map software: In the first half of the year, the loss of 49,662,600 yuan Super Map Software (300036) announced that the operating income in the first half of the year was 447 million yuan, a year -on -year decrease of 28.41%; the net profit was 49.626 million yuan, and the net profit of 55.481 million yuan in the same period last year. Triangular Defense: In the first half of the year, net profit of 301 million yuan increased by 82.35% year -on -year triangular defense (300775) Announcement that the company's operating income in the semi -annual 2022 year was 912 million yuan, an increase of 95.35% year -on -year; net profit of mother -in -law was 301 million yuan, an increase of 82.35 year -on -year %; Basic yield per share is 0.61 yuan. Yongxing Materials: In the first half of the year, net profit of 2.263 billion yuan increased by 647.64% year -on -year. Increased by 647.64%; basic earnings per share were 5.63 yuan. Shanxi Coking Coal: In the first half of the year, net profit of 5.694 billion yuan increased by 192.88% year -on -year Shanxi Coking Coal (000983) Announcement that the company achieved operating income of 27.713 billion yuan in the semi -annual 2022 year, an increase of 44.14% year -on -year; %; Basic earnings per share 1.39 yuan. I know you are "watching"

- END -

8 departments jointly issued: Promoting staged and exempting market main house rent work

8 departments such as the Ministry of Housing and Urban -Rural DevelopmentNotice on promoting phased and exemption of market main house rent workJianfang [2022] No. 50All provinces, autonomous regions

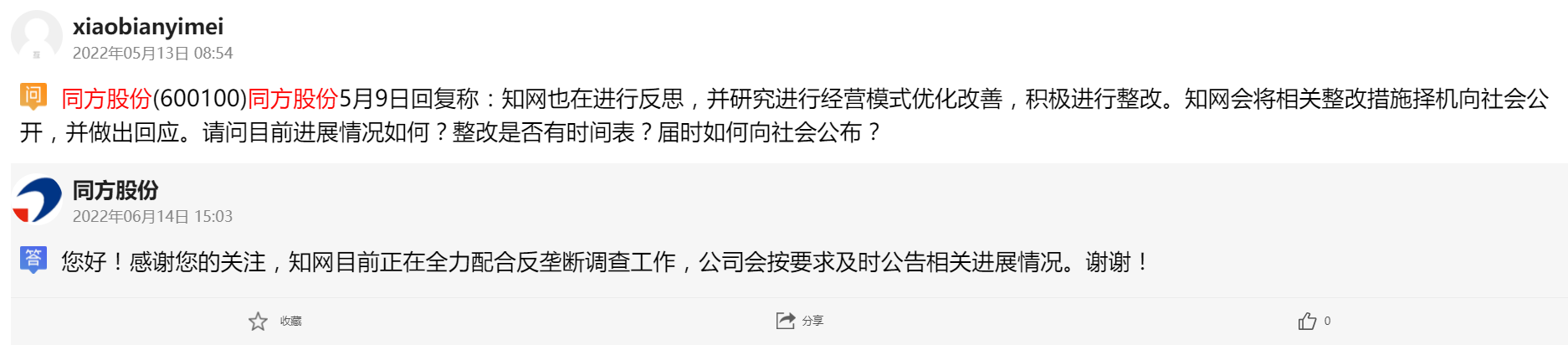

The latest response of Zhiwang: Zheng Jiao is fully cooperating with antitrust investigations, and will announce progress in a timely manner

The Yangtze River Daily Da Wuhan Client June 18 (Reporter Li Yuying) Tongfang rece...