China Merchants Securities: The net inflow of funds in the north was 25.34 billion yuan last week, a

Author:Zhongxin Jingwei Time:2022.06.08

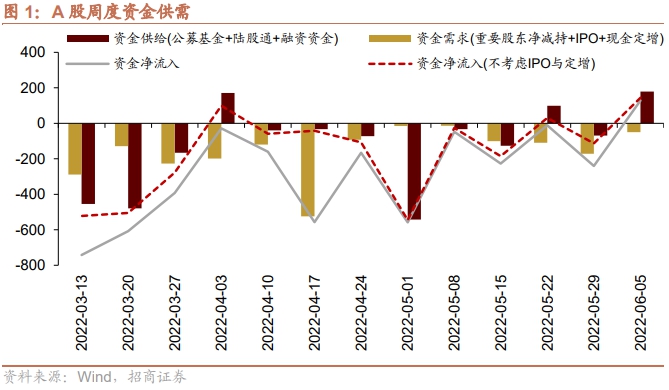

Zhongxin Jingwei, June 8th. On the evening of June 7, China Merchants Securities released a research report stating that last week (May 30th to June 2nd) improved the liquidity of the A -share market, and the fund issuance was steadily rebounded. The net inflow of funds in the north is 25.34 billion yuan. The three industries of food, beverage, chemical, and electrical equipment have a high net purchase scale, and the purchase amount is 5.87 billion yuan, 4.56 billion yuan, and 3.10 billion yuan. Real estate, building decoration, building materials and other industries.

Source: Investment Promotion Strategy Study

Source: Investment Promotion Strategy Study

Research report shows that the share of public funds in April is reduced, but the recent issuance of fund issuance has slowly issued slowly Back. According to the latest data, as of the end of April 2022, the size of the open partial stock public offering fund was 7.06 trillion yuan, of which 2.18 trillion yuan of stocks and 4.88 trillion yuan were mixed. decline. From the perspective of fund share, the share of open partial stock public funds totaling 5.83 trillion copies, of which 1.77 trillion copies of the stock type and 4.06 trillion copies of mixed types increased by 54.4 billion yuan and decreased by 85.5 billion copies, respectively. Overall shrinking.

Considering that the issuance scale of stock -type+hybrid funds in April was 16.9 billion copies, according to this, the net redemption of old funds in partial stock funds in April It is -0.82%. With the obvious decline of the public offering fund's heavy position in April, the fund's participation in the purchase of Xinfang Fund was not enthusiastic, and the scale of the fund issuance declined; at the same time, the old fund was redeemed by investors. Although the issuance of public funds has fallen to a high level of history, public offering funds have risen slowly for three consecutive weeks since mid -May, showing that market sentiment has been repaired.

From the perspective of private equity positions, as of the end of May, the average position of the subjective multi -headed strategy -type private equity fund was 69.60%, which was slightly decreased by 0.4%compared to the end of April, or some funds selected with the market rebounded to the end of the market. The bag is related to peace. However, from the perspective of the future position adjustment plan, survey data in early June shows that the private equity fund plans to increase the proportion of 6.71%, an increase of 2%compared to the early stage; the proportion of positions increased by 36%, an increase of 8.6%compared to the early stage. The research report believes that the position of private equity funds has been slightly decreasing, and the proportion of planning to increase its proportion will increase in the future.

In terms of funds, there were 3.47 billion partial public offering funds set up last week, an increase of 450 million yuan from the previous period. Stock ETFs have net outflow compared with the early stage, corresponding to 7.18 billion yuan in net outflows. The net market financing of the entire week sold 3.09 billion yuan, which changed from the early net inflow to net outflow. As of June 2, the A -share financing balance was 1440.70 billion yuan. The net inflow of the land stocks this week, the net inflow of the week was 25.34 billion yuan, from the early net outflow to net inflow.

In terms of capital demand, last week's IPO financing amount fell to 1.24 billion yuan, a total of 3 companies enteredIPO issuance, as of June 6 announced that two companies will be issued in the next week, and the planned fundraising scale will be 1.40 billion yuan. The scale reduction of important shareholders has reduced its holdings, and its net reduction was 3.47 billion yuan; the planned reduction scale of the announcement was 6.87 billion yuan, a decrease from the previous stage.

The market value of restrictions on the ban is 30.07 billion yuan (the original original shareholder restricted sales of the shares of the shares of the shares of which were lifted 14.30 billion yuan, the first average shares of the first issued shares of the shares of the shares were 15.09 billion yuan, the other 490 million yuan), compared with the previous period, compared to the early stage decline. In the next week, the scale of lifting the ban will rise to 63.95 billion yuan (the original shareholders' limited -sale sales of 36.89 billion yuan, the first general shares of the first shares of the shares of 620 million yuan, a fixed increase of the shares of the shares of 24.70 billion yuan, and the other 1.74 billion yuan).

The research report shows that the financing purchase amount last week was 239.55 billion yuan; as of June 2, the proportion of A shares was 7.2%, which was increased from the previous stage. The premium drops. The net inflow of funds last week was 25.34 billion yuan, and the three industries of food, beverage, chemical, and electrical equipment were high, and the purchase amount was 5.87 billion yuan, 4.56 billion yuan, and 3.1 billion yuan, respectively. The high -scale industries are real estate, building decoration, building materials and other industries.

In addition, ETF's net redemption last week was 4.48 billion copies, and the wide refers to ETF was mainly net redemption. Real estate (excluding brokers) ETFs are purchased more, and information technology ETF has more redemption. Specifically, the CSI 300ETF net redemption was 950 million copies; the GEM ETF net redemption was 1.19 billion copies; the CSI 500ETF net purchases were purchased by 100 million copies; and 920 million copies of the Shanghai Stock Exchange 50ETF. Double innovation 50ETF net redemption of 640 million copies. In terms of industry, information technology ETF net redemption is 1.27 billion copies; 960 million copies of ETF net redemption; 520 million net red redemptions; 130 million copies of ETFs for securities firms; 6 billion yuan for financial real estate ETF; military industry ETF 470 million copies of net purchase; raw materials ETF net purchase of 40 million copies; 80 million copies of new energy intelligent vehicle ETF ETF. (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, investment is risky, and you need to be cautious to enter the market.)

Pay attention to the official WeChat public account of JwVIEW (JWVIEW) Get more elite financial information.

- END -

Dazhou: Send "Timely Rain" and "Charcoal in Snow" to the enterprise

Feng Weihua: Promote the transformation of industries to high -end transformation to urban urban

In the report of the Party Congress, it was once again mentioned in depth to promote the coordinated development of Beijing -Tianjin -Hebei. Feng Weihua, the representative of the 12th Party Congres