Important announcement of listed companies: Bai Yunshan plans to purchase 18.18%of Guangzhou Pharmaceuticals at 10.03 billion yuan

Author:Securities daily Time:2022.08.09

Greenland Holdings: All -as -the -dollar subsidiary intends to borrow 3 billion yuan from the company's two shareholders of Dongfeng Automobile: receives a national new energy vehicle promotion subsidy of 300 million yuan Baiyun Mountain: Integrate to buy 1.8.18%of Guangzhou Pharmaceuticals, BydiDonate some company shares: 70.54 million yuan to win 40%equity of Hunan Prince Milk

Important Announcement of Shanghai City: Greenland Holdings: All -funded subsidiaries intend to announce a total of 3 billion yuan in borrowing from the company's two shareholders (600606). Shanghai City Investment (Group) Co., Ltd. borrowed 1.5 billion yuan, the borrowing period was two years, and the annual interest rate of the loan was 6%. This transaction is a powerful measure for state -owned shareholders to support the development of the company, which helps the company to maintain a reasonable liquidity. Poly Development: In July, the signing amount of 33 billion yuan decreased by 21.72% year -on -year Poly Development (600048) Announcement. In July 2022, the company achieved a contract area of 2.068 million square meters, a decrease of 33.86% year -on -year; %. From January to July 2022, the company's signing area was 15.1419 million square meters, a year-on-year decrease of 23.68%; the amount of signing was 243.221 billion yuan, a year-on-year decrease of 25.7%. Baiyunshan: It is intended to purchase 18.18%of Guangzhou Pharmaceutical Baiyunshan (600332) announcement. Medicine ") 18.1847%of the shares. After the transaction is completed, the company will hold 90.9237%of Guangzhou Medicine. The transaction is conducive to stabilizing the pharmaceutical equity structure of Guangzhou and continuously promoting the development of the company's pharmaceutical circulation business. Sanyuan shares: 70.54 million yuan to win 40%equity of Hunan Prince Milk 3 yuan shares (600429) Announcement, 10:00 on August 6th to 10:00 on August, Beijing Third Intermediate Court on Taobao's judicial auction network platform against Xinhua The Hunan Prince Milk Group Biotechnology Co., Ltd. held a second public auction of 40%of the Hunan Prince Milk Group Biotechnology Co., Ltd., and the company won at a price of 70.54 million yuan. Shengmei Shanghai: It is proposed to invest in high -end semiconductor equipment to expand the R & D project Shengmei Shanghai (688082) announcement. The total investment of the project is about 748 million yuan, of which 16.8591 million yuan was invested in the use of its own funds, and the remaining 731 million yuan was planned to use the company's first listing of super -raising funds. The project's proposed research and development of products including the expansion of the dry method equipment and the supercritical CO2 cleaning and drying equipment have a high level. It is expected that certain performance indicators can reach the international leading level. Tibet Mount Everest: 4.39%of the company held by Ge Shixiang Jin will be announced by judicial auction of Tibet Mount Everest (600338). Thousands of shares will publicly conduct stock judicial disposal auctions on August 26 on August 26. This part of the share accounts for 4.39%of the company's total share capital, and Goeta Shi Xiangjin holds 84.46%of the company's shares. Dongfeng Automobile: Received the National New Energy Vehicle Promotional Subsidies 300 million yuan Dongfeng Automobile (60006) Announcement. On August 4, the company received the third batch of new energy promotion and application subsidies for the SME Economic and Information Technology Bureau of 300 million Yuan. The subsidy payment will directly reduce the company's receivables, which will not affect the company's current profit and loss, and will have a positive impact on the company's cash flow. Jin Hongshun: Jinhe Group plans to transfer the company 11.98%of the company's shares Jin Hongshun (603922) announcement, the company's shareholder Jinhe Group August 5th with Changfeng Yunfan Selected Private Equity Investment Fund, Tuoba Xingfeng No. 7 Private Securities Investment The fund signed a share transfer agreement, and intends to select the No. 1 private equity investment fund to Chang Fengyunfan, the private equity securities investment fund transfer of 7.6672 million shares (5.99%of the company's total share capital), and the transfer price of the company is transferred. 19.59 yuan/share, the total transfer price was 150.2 billion yuan. The half -annual report of 2022: Shengmei Shanghai: In the first half of the year, the net profit of 237 million yuan increased by 163.83% year -on -year Shengmei Shanghai (688082) Announcement that the company achieved operating income of 1.096 billion yuan in the semi -annual 2022 year, a year -on -year increase of 75.21%; net profit of 237 million yuan , Year -on -year increased by 163.83%; basic earnings per share were 0.55 yuan. Xinyuan shares: In the first half of the year, net profit of 14.8224 million yuan turned losing losses in Naxinyuan (688521) in the first half of the year. In the first half of 2022, the company realized operating income of 1.212 billion yuan, an increase of 38.87%year -on -year; net profit was 14.8224 million yuan, a year -on -year losses to profit. The company lost 45.645 million yuan in the same period last year. Puyuan Electric Power: In the first half of the year, net profit of 28.5529 million yuan turned losing losses of Puyuan Electric (688337) announced that in the first half of 2022, the company realized operating income of 261 million yuan, an increase of 23.25%year -on -year; net profit was 28.5529 million yuan, a year -on -year losses to profit to profit. ; Deducting non -net profit is 7.7055 million yuan, a year -on -year losses.

Important Announcement in Shenzhen City: Northern Copper Industry: 811.688 million shares of non -public issuance shares will be lifted to the Northern Copper Industry (000737) announcement that the company's non -public issuance shares will be released on August 11th. It accounts for 4.58%of the company's total share capital. There are 9 issuers who have applied for the issuance of limited sales, and the number of securities accounts involves 47 households. The limited sales period promised at the time of issuance is 6 months. Yuandao Communication: Realistor and other relevant shareholders extended the limited -sale stock lock -up date of Yuandao Communications (301139) announced that the company's shares were listed on July 8th. From July 8th to August 4th, the company's shares were 20 consecutive transactions in a row consecutive transactions. The daily closing price is lower than the issuance price of 38.46 yuan/share, triggering the performance conditions of the relevant shares lock -up period. The company's controlling shareholder, actual controller, directors, supervisors, executives and relevant shareholders extend the lock -up period for extended sales stocks. BYD: The company's executives donated some company's shares BYD (002594) announcement to receive a notice from Li Ke, executive vice president of the company, and learned that its proposed 500,000 A -share unlimited sales conditions they held for free donation were to BYD The Charity Foundation is used in the Shenzhen Hospital of Peking University to carry out public welfare projects related to blood diseases. The donation will be carried out in a non -transaction transfer. The half -annual report of 2022: Xiangfenghua: In the first half of the year, net profit of 92.8766 million yuan increased by 117.52% year -on -year Xiangfenghua (300890) Announcement that the company achieved operating income of 942 million yuan in the semi -annual 2022 year, an increase of 146.72% year -on -year; net profit was 92.866 million yuan , Year -on -year increased by 117.52%; basic earnings per share were 0.93 yuan. Zhongjing Food: In the first half of the year, net profit of 63.1359 million yuan decreased by 8.61% year -on -year Zhongjing Food (300908) Announcement that the company achieved operating income of 417 million yuan in the semi -annual 2022 year, a year -on -year increase of 6.12%; net profit of 63.1359 million yuan, a year -on -year decrease of 8.61% year -on -year decrease ; Basic yield per share is 0.63 yuan. I know you are "watching"

- END -

Central Plains Consumer Finance: Practice social responsibility interpretation of financial responsibilities

Central Plains Bank and Central Plains Consumer Finance formed the Central Plains ...

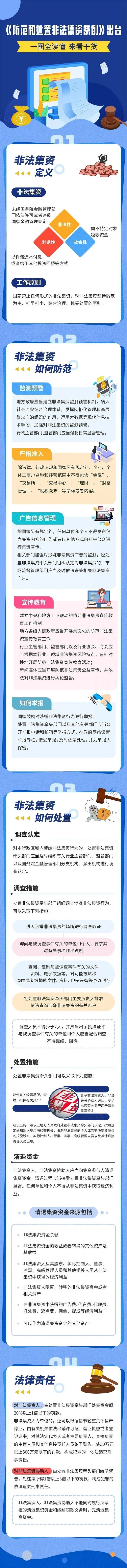

The Regulations on Prevention and Disposal illegal Funding will be officially implemented on May 1st!One picture understands

The Regulations on Prevention and Disposal illegal Funding will be officially impl...