Round the "first mallet"!The financial sharing court is here

Author:Luqiao release Time:2022.08.08

Golden card

● One of the birthplaces of China's private economy

● China's pioneering area and gathering area of small and micro finance

● The only county -level district with four local legal person banks in the country

Small and micro finance

Inject vitality into the development of the private economy

It also breeds a lot of financial disputes

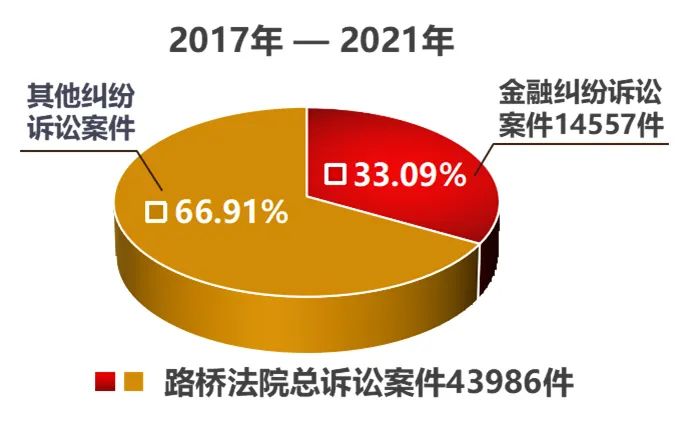

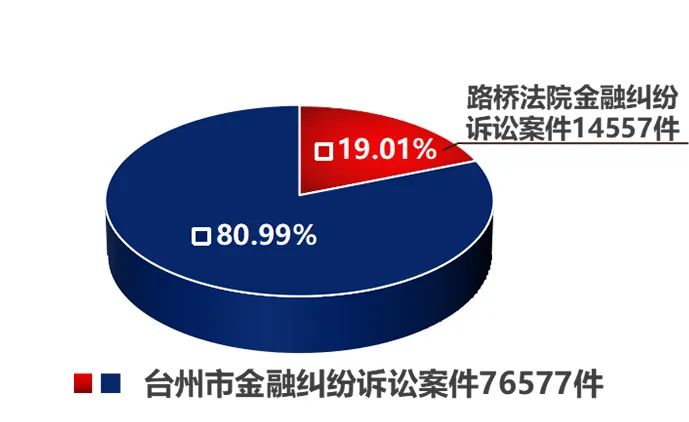

In the past five years, the People's Court of Luqiao District has accepted a total of 1,4557 financial disputes, accounting for one -third of the case in the hospital, and also accounting for nearly 1/5 of the city's financial cases.

How to effectively resolve financial disputes?

In November 2021, Luqiao took the lead in setting up a financial sharing court in the city, covering five major functions including mediation guidance, online filing, online lawsuits, law propaganda, and grassroots governance.

01

Construction and sharing together with points and faces

"Now please confirm the signing in the mediation agreement." Recently, a financial borrowing dispute case was conducted on -site mediation through Taizhou Bank Financial Sharing Court. In just half an hour, the two parties reached the final mediation plan.

Financial sharing court mediation site

In order to meet the diversified judicial needs of the masses, the "last mile" of convenient services for convenience services, the Luqiao Court finally selected the Bank of Taizhou Bank as the financial sharing court station and radiated to other financial institutions in the area. Sub -stations and service stations.

At present, there have been 26 financial shared courts and service stations in the area under the jurisdiction, and all financial institutions in the area have covered the full coverage of all financial institutions in the jurisdiction. The parties to the other party can apply for litigation services such as the financial sharing of the financial institutions to apply for cases and mediation through the financial sharing court of the people's outlets to enhance the effectiveness of the source of financial disputes.

02

Eliminate the space and combine the resolution

The borrower Ye Moumou is engaged in the mold processing industry, and the main target customers are concentrated in Changzhou, Jiangsu. Affected by the epidemic in the first half of this year, Ye Moumou's fine molds could not be released, and he could not go to Changzhou to repair the molds. As a result, the tail payment could not be settled, and the capital turnover was very difficult.

After understanding the situation, in order to reduce customer doubts, the branch contacted the mediation officer and shared the court through the financial sharing of the court, and the judge remotely mediation guidance and successfully reached a mediation agreement. "The bank will gradually repay the loan through the distribution of loan products, alleviate the short -term repayment pressure of the household, ensure that the current operating conditions of the customer are not affected, and help the enterprise to relieve difficulties." Introduction to Director.

Financial sharing court online mediation

The Court of Financial Sharing of the Luqiao Court has moved forward to the bank by moving the litigation service window forward, achieving the court, banking, financial regulatory authorities, mediation committees and other institutions. The parties can go to the nearest financial sharing court sub -site for professional mediation services in the nearby financial sharing court when they encounter financial disputes.

At the same time, the Financial Sharing Court also gives grass -roots financial institutions a greater mediation decision right. During the mediation and litigation process before the lawsuit, the elasticity of the extension of repayment periods, reduction of interest rates and handling fees, etc. The debtors who have lack of repayment ability have reached mediation to achieve a win -win situation.

In terms of the selection of full -time people's mediators of financial disputes, financial institutions recommend those who have excellent morality, outstanding ability, and financial career experience to the Taizhou Banking Insurance Regulatory Commission. The people's court is equipped with a "1+1" pairing judge for mediationers to carry out the source of financial disputes with a combination of "industry+professional" and "people's mediation+judicial confirmation".

03

Mechanism advances to cure

"You have always said that the capital turnover is difficult, don't you consider the loan reorganization?" In the Financial Sharing Court of China Bank, the customer manager Xiao Zhang and the passenger service repeatedly communicated and negotiated, and finally reached an agreement. The mediation method relieves the pressure of funds and extend the time of the customer's repayment.

"The bank re -issues a loan to the borrower, the new loan is used to return the old loan, and the repayment time is re -agreed. If the bank can not be repaid on time, the bank can apply directly to the court after passing the judicial confirmation." A measure not only effectively alleviates the phenomenon of unable to repay on time on time, but also greatly shortens the case litigation process of the case, which is really convenient.

In April of this year, the Luqiao Court issued the "Guidelines for the Management of the Source Governance of the Financial Dispute Source of the People's Court of Taizhou City", which followed the "risk signs", "urging", "diversified resolution", "urging", "enforcement" in accordance with the "risk signs". The "five -step" work mechanism carried out daily work and efficiently resolved financial disputes.

Different situations of financial disputes are resolved according to risks

Certificate of syndrome differentiation to develop ABC three types of resolution mode

Class A: The borrower's debt has reached the repayment mediation agreement when the debt has been overdue

Category B: The borrower has a risk signs (not overdue) to reach the repayment mediation agreement

Category C: Financial institutions can be replaced by the borrower with the repayment protocol reached by the borrower with "re -loan" or "loan repayment" method

Financial institutions provide accurate identification and classification of non -performing loans. "If the people's mediation is successful, the judicial confirmation application is signed according to the need. Set the extension confirmation clause in the application, and extend the start time of the judicial confirmation procedure from 30 days from the date of signing to 30 days from the date of the debtor's overdue. "The approval of confirmation can not only solve financial disputes efficiently and conveniently, but also greatly save judicial resources. So far, 62 A mediation agreements have been reached, 18 types of mediation agreements, 27 Class C (first repayment), and 34 categories C (loan repayment).

04

Digital empowerment efficient resolution

On May 19, Tyrone Bank received the first repayment from the parties Yin Mou from Guangzhou. This is the performance result of the first customer of the "Sharing Court" of the Road and Bridge Court this year to help Tyrone's mediation.

The borrower Yin Mou borrowed 45,000 to help his son's business glasses. Later, due to operating problems, there was still 12,000 yuan in principal. After fully communicating, the mediator learned that the parties Yin Mou and the Bank of Tyron have the willingness to mediate.

Considering that Yin Mouyuan was in Guangzhou and his travel was inconvenient, the mediation officer guided Yin to conduct online mediation online through the "shared court" financial resolving code. "It's really convenient. No need to run back and forth. Now that the big things are on the ground, I want to rejuvenate, make more money, and repay it at an early date." The mediators finally proposed a plan for loan restructuring and installment return. Both parties were very satisfied with this plan.

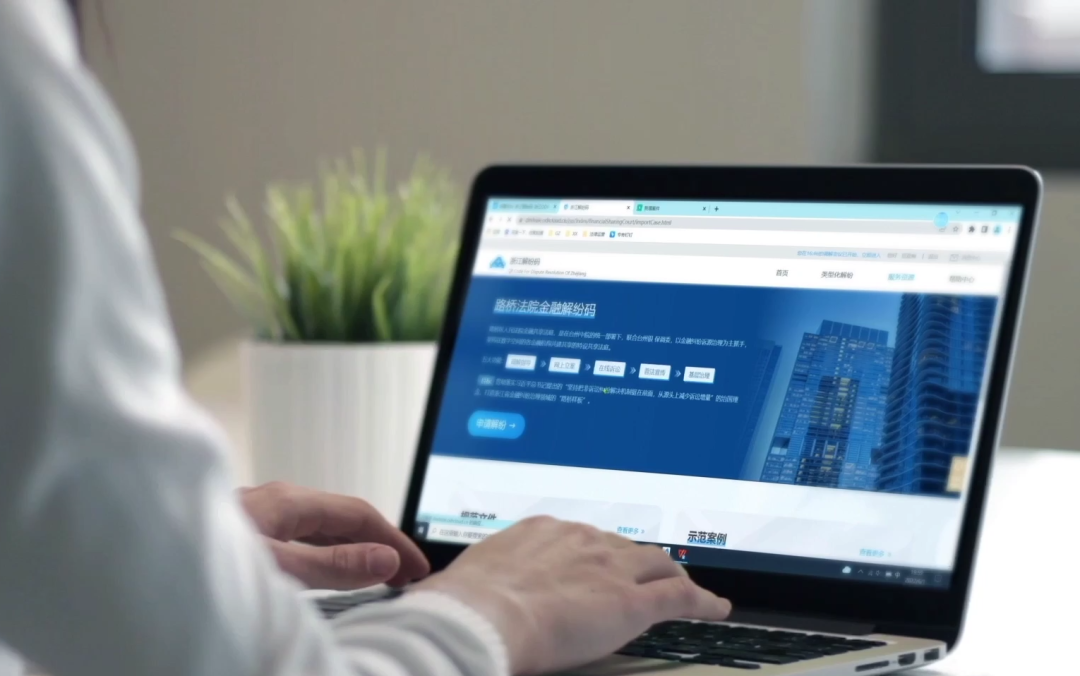

In order to promote the effective operation of the financial sharing court, the Luqiao Court launched an online application "Financial Resolving Code" version 1.0. As an online platform for the financial sharing court, it will continuously improve the digitalization of the "financial sharing court".

"Financial resolution code" is supported by the deep coupling of science and technology and financial resolution, and gives full play to the empowerment of financial technology core technologies such as big data, cloud computing, blockchain, and artificial intelligence, and integrates "online mediation", "lost contact" Fix the functions of "intelligent supervision", "demonstration mediation", "big data analysis and application", etc., break the space -time barriers of dispute resolution, and reshape the offline "fragmentation" resolution process into a complete system of resolution process. Financial participation subject provides new channels for providing professional, online, and uninterrupted financial resolution services.

January to July this year

Luqiao Court Financial Sharing Court

Resolve 426 financial disputes

Among them, 285 items were resolved before the adjustment

After the adjustment protocol, resolve 141 pieces

Luqiao Court's financial disputes in the first instance of the first instance of civil and commercial collection cases, a year -on -year decrease of 49.2%. The proportion of financial disputes accounted for the number of cases of civil and business in the hospital, which has fallen from nearly 1/3 to 1/6, and the management of financial disputes and sources has achieved staged results.

Create for the road and bridge

Common and wealthy pioneers

Private economy innovation zone

Modern livable new business capital

Provide strong judicial support

Source: District People's Court

Edit: Zhou Luqi

- END -

Wulian County, Rizhao City: Growing up for talents to let innovation vitality release

Not long ago, Shandong Wantong Hydraulic Co., Ltd. declared the provincial high -performance hydraulic basic parts technology innovation center successfully entered the expert demonstration and answer

The credit evaluation mechanism should be "expanded"

● ShiyanA few days ago, the Corps announced the results of the credit evaluation of 297 real estate development companies and 269 property service companies, and implemented differentiated management...