China Private Equity Fund Monthly Observation Report | In July, private equity filing broke out, Hainan rushed into the top ten of the fund managers, and foreign giants accelerated their entry

Author:Daily Economic News Time:2022.08.08

In July, a new round of small outbreaks appeared in private equity funds.

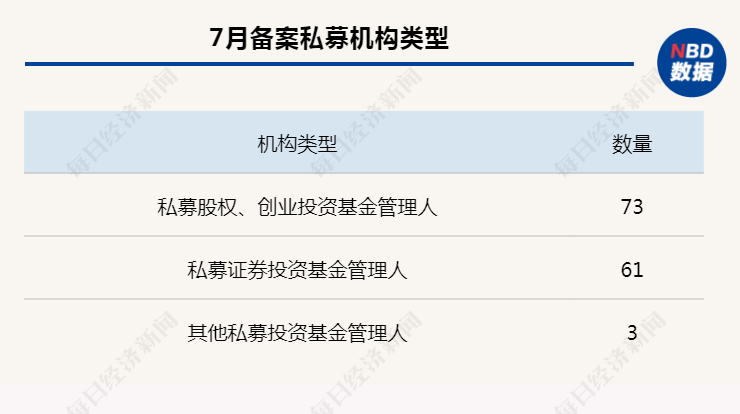

According to the preparation of the private equity fund manager announced by the China Securities Investment Fund Industry Association (hereinafter referred to as the China Foundation Association), "Daily Economic News" reporter statistics found that after the significant recovery of the record in June, it ushered in a further new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new new has ushered. increase. Throughout July, there were 137 private equity funds completed in the China Foundation Association, an increase of nearly 20%compared with 116 in June. Among them, the number of private equity, entrepreneurial investment fund managers and private equity investment fund managers are closer than before. The former has 73, the latter is 61, and 3 are other private equity fund managers.

Photo source: Photo Network-5007696

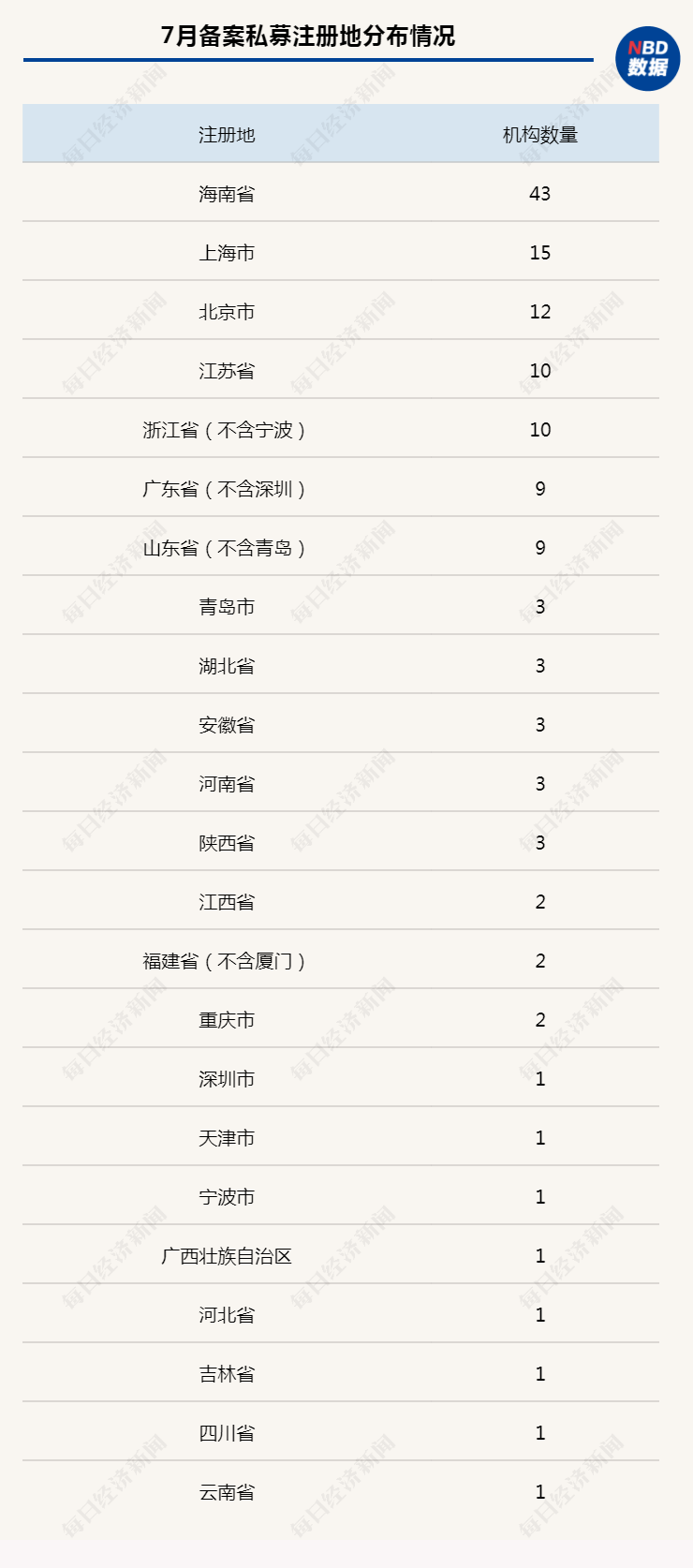

It is worth noting that in the choice of registration, Hainan's leading advantage is still expanding, and the absolute advantage of 43 new private equity has continued to lead. Judging from the latest data released by the China -Foundation Association, the number of private equity fund managers in Hainan has rushed into the top ten of all registered places, ranking eighth. In addition, after the "small universe" broke out in June, the private equity fund manager who filed in Jiangsu in July continued to grow rapidly. With 10 scores, it was located in the fourth place in all registered places with 10 scores. Stunning.

In July, a number of foreign private equity accelerated the Chinese market. Among them, the management scale of more than 1.3 trillion US dollars, the private equity of the asset management giant, the private equity of Wellington Investment Management completed the filing at the beginning of the month, causing heated market debate. The momentum of "public and private" is still unreasonable, and many senior public offers are smuggling or independent portals, and the flow of talents is still high frequency.

In addition, the China -Foundation Association announced the 48th batch of 35 private equity institutions that were suspected of losing contact in July, and at the same time canceled the registration of 55 private equity fund managers in two batches.

Welcome a new round of outbreak, Hainan and Jiangsu's limelight

According to the filing information of the China Foundation Association, a new outbreak of private equity fund managers' filing in July this year. Following the rapid recovery of June, the private placement filing in July maintained a momentum of further growth. A total of 137 institutions successfully completed the filing, and the number increased by 18.1%month -on -month. "Daily Economic News" reporter made a comprehensive statistics on this newly added fund.

First of all, from the perspective of institutional types, 73 of the 137 private equity are private equity and entrepreneurial investment fund managers; new private equity securities investment fund managers are also "unwilling to show weakness", with a total of 61, which has closer to private equity. The gap between equity and entrepreneurial investment fund managers; three other private equity fund managers.

Judging from fund registration, Hainan still maintains a significant lead. Throughout July, a total of 43 private equity funds chose to register in Hainan, accounting for 31.39%of the newly recorded private equity. This proportion has been significantly improved compared to the previous months. So far, the number of new filing funds registered in Hainan has reached an amazing 198.

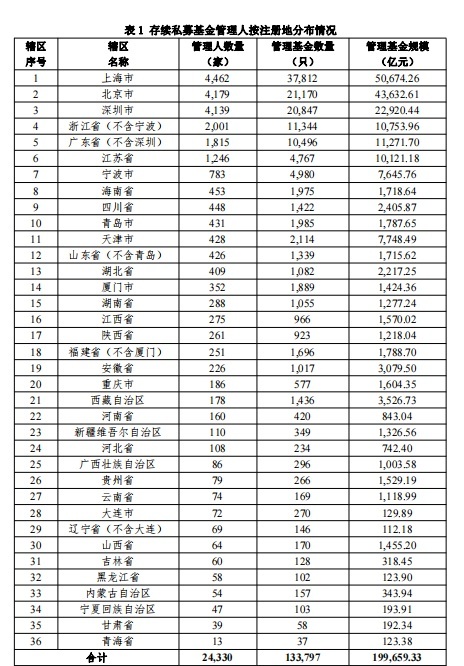

In fact, according to the monthly report and product filing monthly report of the private equity manager announced in mid -July, the number of private equity in Hainan has jumped from the previous ten to the eighth place, and it continues to grow rapidly. The momentum is quite rapid.

Another noticeable registration place is Jiangsu. There were 15 funds filled in Jiangsu Province in June, and 10 were in July, ranking fourth in all registered places. As of the end of June this year, there were 1,246 private equity managers in Jiangsu Province, ranking sixth.

In addition, the top five of the number of filing agencies are Shanghai, Beijing and Zhejiang (excluding Ningbo), including 15, 12 and 10, respectively.

Source: Registration and product filing month report of the China -founded Private Equity Fund Manager (June 2022)

Let's take a look at the registered capital of these new filing funds. The number of 501 to 10 million yuan is still the largest, reaching 93, of which only 91 are 10 million yuan, accounting for 66.42%of the newly recorded private equity in July; followed by 5 million yuan and less than 5 million yuan, there are together, together 23; 17 to 50 million yuan, 100 million yuan and above are 17 and 4. Among them, Guangzhou Yuexiu Capital Private Fund Management Co., Ltd., which has the highest registered capital, has reached 800 million yuan, which is also one of the highest -registered private equity in recent months.

Finally, take a look at the situation of the new private equity fund in July. The "Mengxin" without funds is still the vast majority, with a total of 131; in addition, there are 6 private placements that are currently in charge of funds, and the largest number has 4 funds. Established Hainan Hengli Private Equity Fund Management Co., Ltd. (hereinafter referred to as Hainan Hengli Private Equity).

"Daily Economic News" reporter noticed that Hainan Hengli Private Equity is also a private equity fund manager established by senior asset management people. Its legal representative, general manager, and executive director Pan Huan had previously served as executives in many brokers. Before the establishment of Hainan Hengli Private Equity, he served as the Securities Investment Headquarters of Guoxin Securities as general manager of the department. Zhang Xingchen, another executive of this institution, and the head of compliance control, was previously the supervisor of the Red Earth Innovation Fund and had many years of work experience in the company. Now he also chose to go away from "Ben Private".

Foreign -funded giants accelerate the entry, "public galloping and private" still sings high in advance

Since the beginning of this year, a number of foreign giants have accelerated the layout of the Chinese market and setting up and filing private equity is an important action.

On July 1, a private placement named Wellington Huanyu Private Equity Fund Management (Shanghai) Co., Ltd. (hereinafter referred to as Wellington Huanyu) was completed. This institution is one of the world's largest independent investment management companies- Wellington Investment Management of private equity fund managers.

The filing information shows that Wellington Huanyu was established in January this year, with a registered capital of 2 million yuan. The business type belongs to pilot agencies such as QDLP (qualified domestic limited partners). Established, the actual controller is Wellington Management Hong Kong Co., Ltd.

Wellington Investment was founded in 1928 by Walton Morgan. He is headquartered in Boston, England. He is an investment consultant for more than 2,400 customers in more than 60 markets worldwide. Asset management giant.

In addition, Zhang Guest, the legal representative and general manager of Wellington Huanyu, is also a very senior asset management veteran. The industry has many years of deep accumulation.

In addition to Wellington Investment, on July 15, a private equity manager named Shangbo Private Equity Fund Management (Shanghai) Co., Ltd. (hereinafter referred to as Shangbo Private Equity) also successfully completed the record.

Shang Bo Private Equity was founded by Thornburg Investment. It was established in June 2020 and registered $ 2 million. The business type is also pilot agencies such as QDLP. Shang Bo Investment is a boutique asset management institution in the United States. It is headquartered in New Mexico, USA. As of March 31 this year, it has a management scale of approximately $ 46 billion.

According to statistics, since this year, many foreign private equity giants have completed the record in the form of pilot agencies such as QDLP, and many international asset management institutions have approved QDLP to be approved. At present, there are more than 40 foreign private equity in regulatory filing.

In addition to the acceleration of foreign giants, the tide of "public and private" is still enthusiastic. Not only the institutions set up by the Star Fund Manager "Independence Portal" completed the record, but also a number of public offering veterans and fund managers joined forces to start a business and set up their own private equity funds.

On July 11, Shanghai Yunzhou Private Equity Fund Management Co., Ltd. (hereinafter referred to as Shanghai Yunzhou Private Equity) completed the filing. Its legal representative, executive director, and actual controller were Zhou Yingbo, the top -flow fund manager who had previously announced the resignation.

Shanghai Yunzhou Private Equity was established in March this year, with a registered capital of 20 million yuan and 17 full -time employees. According to public information, Zhou Yingbo worked in Ping An Securities and Huaxia Fund. He joined the China -Europe Fund in 2014. He has served as a researcher, assistant investment manager, and fund manager. The highest management scale is close to 60 billion yuan. In addition, Wen Jun, the former director of the China -EU Fund and the former deputy general chief of the Yinhua Fund, also served as the general manager of Shanghai Yunzhou Private Equity; he worked at the Castrol Fund, the Yinhua Fund, and the China -EU Fund. He is the person in charge of compliance risk control.

Shanghai Novelty Legend Private Equity Fund Management Co., Ltd. (hereinafter referred to as Shanghai New Legend Private Equity), which has completed the filed with Yunzhou private equity, has attracted much attention because its senior management teams are senior public offers.

The filing information shows that the Shanghai New Legend Private Equity was established in July 2016, with a registered capital of 20 million yuan and 5 full -time employees. General manager Wang Yansheng has worked for many years of work in the public fund. He entered China Merchants Fund as researcher in 2013, and joined Boshi Fund at the end of 2015. The fund manager who served as too many funds was 31.17%during his tenure. In May of this year, he served as the general manager of Shanghai New Legend Private Equity.

On July 15th, Hainan Shangshan Riman, the former star manager of the Baoying Fund, was a private equity fund management partnership (limited partnership, hereinafter referred to as Hainan Shangshan Ru) to complete the record in the China -foundation Association, which also caused heated discussions.

The filing information shows that Hainan Shangshan Ru was established in May this year and recorded on July 15th. The registered capital was 10 million yuan. 4 full -time employees. His executive partners (appointment representatives) and actual controller were all Xiao Xiao.

Xiao Xiao is one of the representatives of the Mesozoic Fund Manager. From July 2008 to February 2015, he served as a researcher in United Securities, Minsheng Securities, and Founder Securities. Deputy General Manager and General Manager of Equity Investment Department. His masterpiece Baoying advantageous industry fund once became the third place in active equity funds with a 100.52%return in 2021.

In addition to foreign giants and "Ben Private" army, industrial capital also shot one after another in July.

On July 22, Hainan Kingdee Chaser Private Equity Investment Fund Management Co., Ltd. (hereinafter referred to as Hainan Kingdee) completed the record. The agency was established in November last year with a registered capital of 10 million yuan and 5 full -time employees.

It is worth noting that the actual controller of Hainan Kingdee is Kingdee International Software Group, and the investor Kingdee Cloud Ecological Technology Co., Ltd. is a wholly -owned subsidiary of Kingdee Software (China). His legal representative and general manager Zhang Yuan is the general manager of the Investment Department of Kingdee Software (China). Before joining Kingdee, he served as companies such as Guangdong Mobile, Tencent Technology, Shenzhen Qianhai Holy Lechuko Fund, and Fosun Hi -Tech.

It is not only Kingdee Group. Since this year, large companies and listed companies have set up private equity fund managers. The integration of industries and capital has become the norm. Judging from the situation in recent months, the enthusiasm of industrial capital from LP to GP is high, and investment layouts along the industrial chain to the upstream and downstream have become the choice of many industrial giants. Regulatory announcement has another list of suspected loss of private equity institutions, cancel 55 fund manager registration

On July 6, the China -Foundation Association announced the list of 48 batch of suspected loss of private equity institutions. A total of 35 private equity "on the list" including Shenzhen Xinyin Investment Management Co., Ltd. and Zhonghan Yaxin Asset Management Co., Ltd. Essence According to the statistics of "Daily Economic News", this is the seventh batch of suspected loss of private equity lists released by the China Foundation Association this year, with a total of more than 300 institutions "lost contact".

In addition, on July 22, the China Foundation Association continuously announced two batches of listing of the registration of private equity fund managers, involving a total of 55 institutions. Among them, nine private equity including Weinuo Asset Management (Shenzhen) Co., Ltd. was registered with the administrator's registration because the announcement of the private equity manager registered by the administrator's registration requirements could not meet the registration requirements of the manager's registration; and 46, Beijing Zhongcai Jiaying Fund Management Co., Ltd. The home agency was canceled and registered because it reached the three months of the publicity period and did not take the initiative to contact the China -Gen Association and provided the cancellation of effective proof materials.

The China -foundation Association also disclosed in the monthly report of the private equity fund manager's registration and product filing that in June 2022, the private equity fund manager registration application for 18 related institutions was suspended, and 304 private equity fund managers were canceled.

On July 13, the China -Foundation Association also released a disciplinary decision decision, showing that Liu Ming, the person in charge of the gold kapona regulations, made a "public condemnation, adding a blacklist, and the deadline for three years". Prior to this, the golden kapok and the controller He Hanhong had been punished by the regulatory agency, and the latter was also "pulling black" for three years.

The latest discipline decision decision also shows that four illegal facts have promised investors to protect their capital and guarantee income, unreasonable and cautiously fulfilling the obligations of qualified investors. At present, Golden Kapok has been disqualified by the China -Foundation Association, and the main executives have also been regulated to "pull black".

According to the statistics of the "Daily Economic News" reporter, since this year, the Central Foundation has announced the disciplinary decision of 14 private equity institutions and 22 employees, showing the continued efforts and determinations of the relevant departments for the strong supervision of the industry.

Daily Economic News

- END -

Shandong Rizhao 9 companies on the list of provincial manufacturing singles champion list

Luwang August 18th. Recently, the sixth batch of manufacturing champion companies (products) and the third batch of review companies in Shandong Province have been announced. House selected for the pr

"Snow Lotus Ice Cubes" by hundreds of millions of netizens: five days of fans soaring 670,000, but dealers said they could not earn money

Jimu Journalist Li XianchengRecently, the person in charge of Xuelian ice cubes re...