The Tai'an Finance Bureau builds a high -quality main body of the better business environment service market

Author:Tai'an Daily Time:2022.08.08

Since the beginning of this year, under the strong leadership of the Municipal Party Committee and Municipal Government, the financial department of Tai'an City has seriously implemented a positive fiscal policy, and in accordance with the principles of "strengthening efforts, highlighting key points, and accurate effectiveness" policy. Especially through full support and guarantee of the implementation of the value -added tax refund, etc., with accurate and efficient policy funding, it will effectively help enterprises to relieve the market vitality and create a first -class business environment. The city's economy is stable and healthy.

Improve the accuracy of tax refund to accelerate the progress of tax refund to help enterprises high -quality development with "refund"

Thai Kai Group, located in Tai'an High -tech Zone, is a leading enterprise in the domestic transmission and transformation equipment manufacturing industry. Currently, it has 15 provincial -level scientific and technological innovation platforms, 27 high -tech enterprises, more than 1,000 technology research and development teams, more than 1,200 independent patents It has won honorary titles such as the National Torch Program key high -tech enterprises, the National May Day Labor Awards, and the National Detention Enterprise Credit Enterprise.

"In the first half of 2022, the company's companies achieved sales revenue of 8.6 billion yuan, an increase of 14%year -on -year. This was benefited from this year's combined tax support policy. In the first half of the year, 20 companies in the group obtained a total of 4168 reserved taxes 4168 10,000 yuan, 16 small and medium -sized enterprises delayed 40.81 million yuan in taxes, which timely eased the company's capital pressure. Various tax preferential policies were directly enjoyed, and they were acting from the perspective of the enterprise. To the national warmth policy, "said Zhang Xuefang, the person in charge of the fiscal and taxation of Taikai Group.

Since the implementation of the large -scale value -added tax deduction policy, in order to accelerate the transformation of the policy "dividends" to the development of "power", the city's financial and tax departments at all levels have improved their ideological awareness, refined work measures, and fully supported and guaranteed the development of tax refund. Ensure that policy dividends directly reach market entities at the fastest speed. Our city actively establishes a business mechanism for fiscal and taxation cooperation. The fiscal and taxation departments further strengthen information sharing, work collaboration, and policy linkage, and timely grasp the implementation of the city's fiscal and taxation policies, quickly analyze and accurately solve the difficulties and problems existing in the implementation of policy implementation. At the same time, improve the service methods of benefiting enterprises, strengthen policy publicity and guidance, compile the "Tax reduction policy and compilation of the charging catalog list", and launch the charging list QR code card to help enterprises understand and master policies in a timely manner, pass the "sending policy policy to send policy policies On -site service enterprises "," I do practical work for enterprises "and other activities to understand the business status, tax refund effects and capital flow of funds, provide enterprises with refined, customized, personalized services, and guide enterprises to use tax refund funds more for production and operation more for production and operation In terms of technical transformation and upgrading, improve the effect of funds. In terms of strengthening tax refund funds, the financial department of our city has closely followed the policy trend, comprehensively figured out the number of bottoms, actively strives for superior support, strengthened funding for funds, and made every effort to ensure tax refund funds. From January to June, the city has accumulated a total of 4.67 billion yuan in tax refund, an increase of 4.25 billion yuan over the same period last year. In particular, in April-June, the city's 6257 small and micro enterprises enjoyed tax refund, accounting for 94.5%of the total number of tax refund households; 368 large and medium-sized enterprises enjoyed a discount of 2.22 billion yuan in tax refund, with an average household tax refund of 6.044 million yuan. Shi Heng Special Steel Group Co., Ltd., with the largest tax refund scale in our city, realized a tax refund of 460 million yuan in the first half of the year.

Focus on the enterprise's "urgent and sorrow" active service, precise service, and heart -warming service to promote the construction of new industrialization and strong business environment

The Municipal Finance Bureau is expected by the urgent needs of the enterprise, trying to settle the difficulties of the enterprise, create a better business environment, and allow enterprises to rest assured to invest, ease entrepreneurship, and develop at ease. In the urgent enterprise, the Municipal Finance Bureau combined with various financial institutions to set up a financial service expert team to tailor -made financing plans for enterprises to solve the "urgent" of enterprises. The Municipal Finance and Finance Group helped enterprises financing 12.85 billion yuan through financing guarantee, financing leasing and bridge repayment, effectively alleviating the financing problem of corporate financing. In cooperation with Beijing Hongtai Capital and Qingdao Zhongsheng Capital, it has set up an industrial investment fund of 2 billion yuan and 1 billion yuan, respectively. With the help of fund companies, it has successfully attracted 6 companies to land to help 4 backbone enterprises accept capital assistance. To solve the needs of the enterprise, the "special loan of technical reform" is launched to give discount support for the corporate technology transformation loan. At present, 20 banks have made cooperation intentions, 10 banks have completed the contract, and the first batch of technical reform projects have been completed. Support enterprise listing, support listed enterprises in stages, give up to 10 million yuan in rewards, and now allocate eight companies to reward 24 million yuan in funds. In order to consider enterprises, in response to issues such as energy consumption indicators that restrict the development of the enterprise, the implementation of "one thing, one policy, one enterprise and one policy" accurately help, and ensure the smooth construction of the new project.

"In the next step, the Municipal Finance Bureau will continue to work around the municipal party committee and municipal government center, put the optimized business environment in a more prominent position, focus on the construction of new industrialized cities and the cultivation of high -quality and efficient tax sources, coordinate financial resources, increase investment in capital investment , Fully promote the implementation of the combined tax support policy, actively help enterprises to relieve difficulties, develop rapidly, and contribute fiscal forces for the establishment of a new situation in the new era of socialist modernization in the new era. " Essence

[Tai'an Daily · Most Thai Security Media Reporter Su Ting Correspondent Hu Feifei Wang Huiting]

- END -

deal!These drugs are reduced!

On July 12, the seventh batch of national organizational drugs were purchased in N...

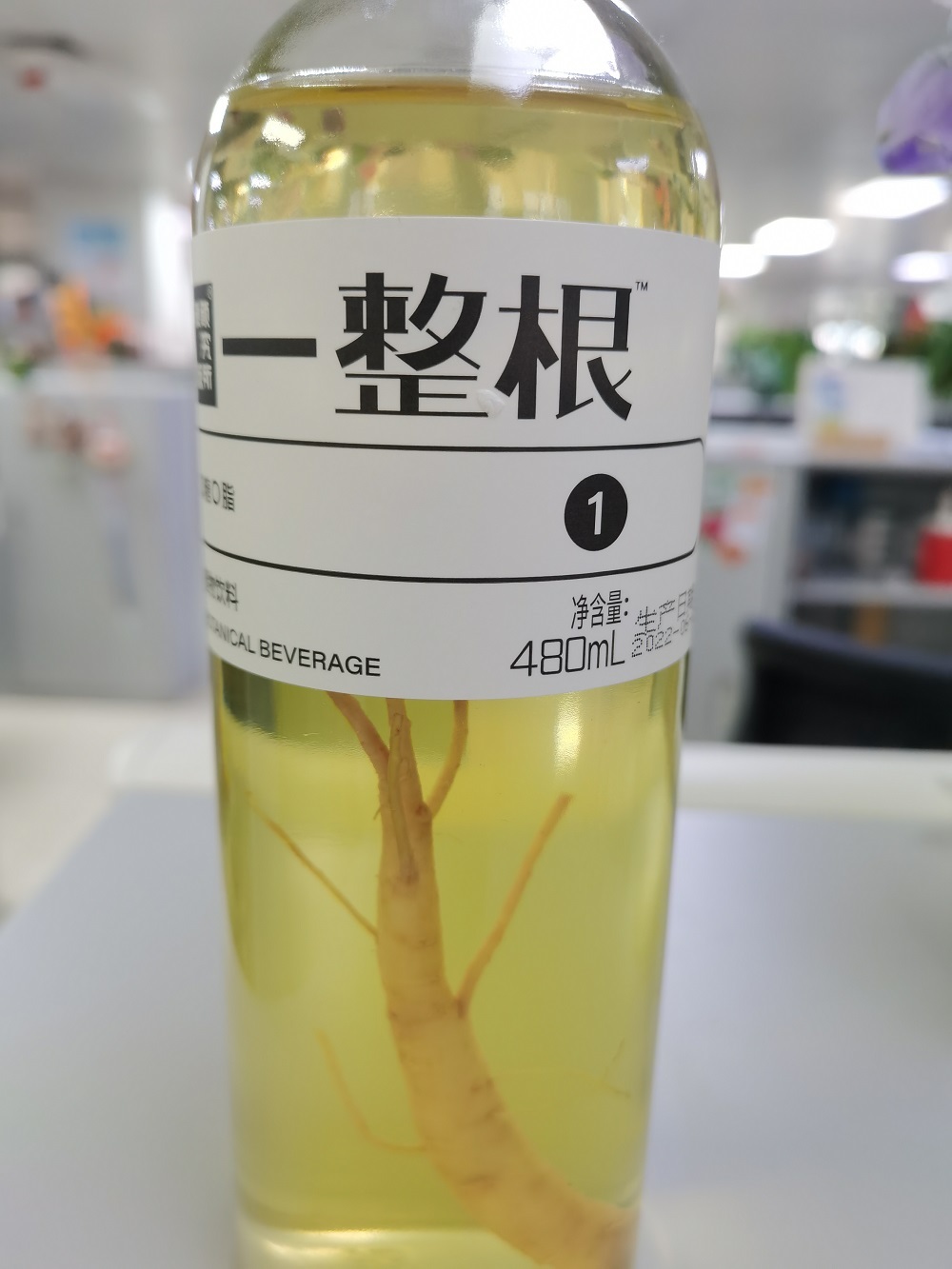

Net red drinks are sold out, some people add money to find scalpel!The cost of ingredients is only 2 yuan

Recently, a staying up late water in the convenience store is out of fire. It is u...