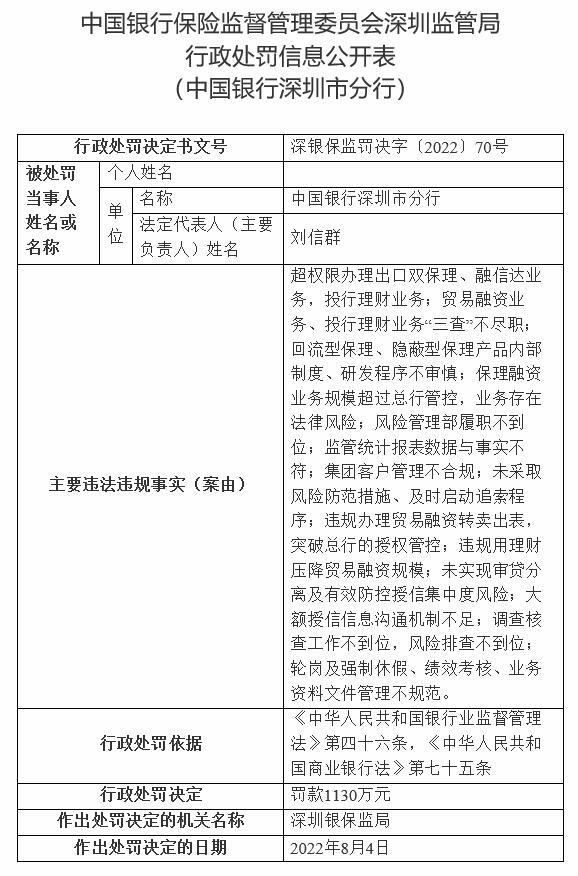

14 illegal rules of the Bank of China Shenzhen Branch were fined 11.3 million people for a lifetime forbidden industry

Author:China Economic Network Time:2022.08.08

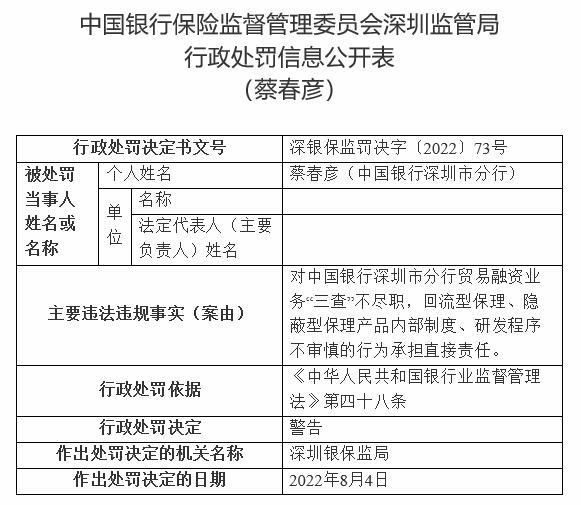

Decisive Decisive Decisions [2022] No. 73, which was announced on the same day, showed that Cai Chunyan (Bank of China Shenzhen Branch) did not serve as a "three investigations" for the trade and financing business of Bank of China Shenzhen Branch. The internal system of the product and the non -prudential behavior of the research and development procedures should be responsible for direct responsibility. The Shenzhen Banking Insurance Bureau warned Cai Chunyan in accordance with Article 48 of the Bank of the People's Republic of China.

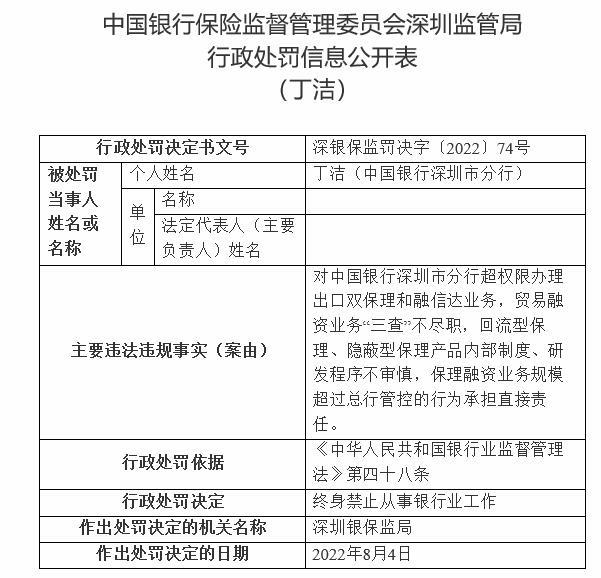

Decision of Shenzhen Banking Supervision [2022] No. 74 shows that Ding Jie handle export dual factoring and Rongxinda business on the overweight of the Bank of China Shenzhen Branch. The internal system and R & D procedures of concealed factoring products are not prudent, and the scale of factoring financing business exceeds the direct responsibility of the head office control. According to Article 48 of the "People's Republic of China" of the People's Republic of China, the Shenzhen Banking Insurance Regulatory Bureau made Ding Jie's decision to prohibit the work of the banking industry for life.

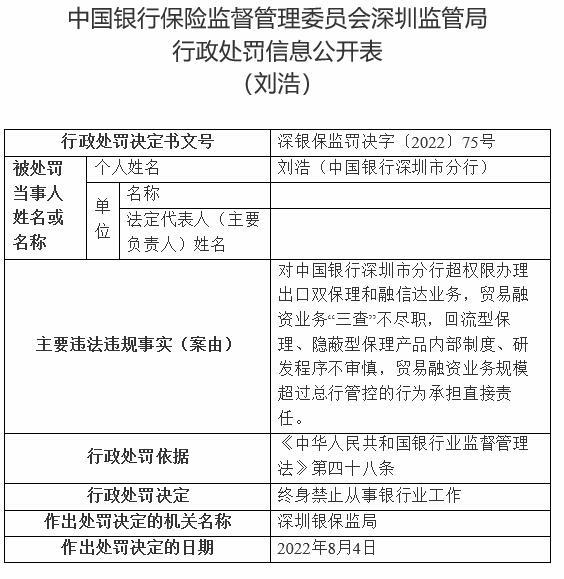

Decision of Shenzhen Banking Supervisory Decision [2022] No. 75 shows that Liu Hao handle export dual factoring and Rongxinda business on the overweight of the Bank of China Shenzhen Branch. The internal system and R & D procedures of concealed factoring products are not prudent, and the scale of trade and financing business exceeds the direct responsibility of the head office's control. According to Article 48 of the "People's Republic of China" of the People's Republic of China, the Shenzhen Banking Insurance Regulatory Bureau made Liu Hao's decision to prohibit the work of the banking industry for life.

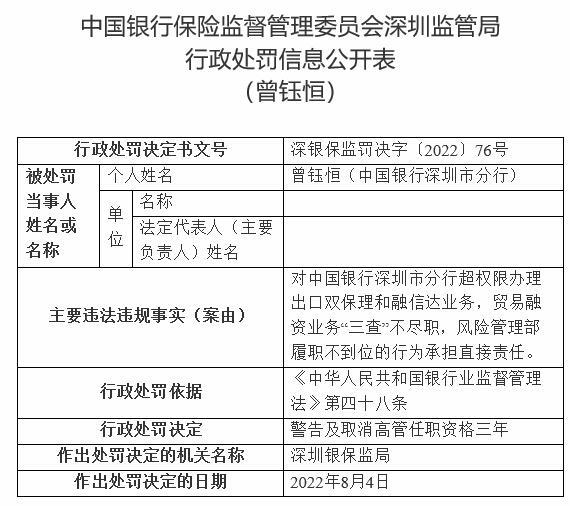

Decision of the Decision of Shenzhen Banking Insurance [2022] No. 76 shows that Zeng Yuheng handles export dual factor and Rongxinda business on the overweight of the Bank of China Shenzhen Branch. The in place is responsible for direct responsibility. According to Article 48 of the "People's Republic of China" of the People's Republic of China, the Shenzhen Banking Insurance Regulatory Bureau warned Zeng Yuheng to warn and eliminate the qualifications of executives for three years.

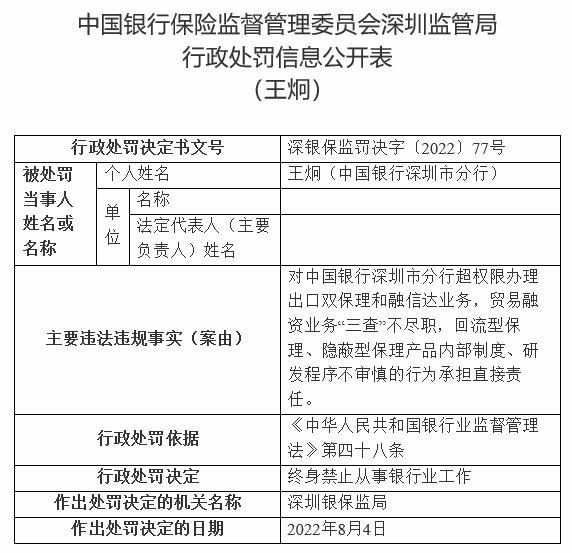

Decision of Shenzhen Banking Supervision [2022] No. 77 shows that Wang Jiong handle export dual factoring and Rongxinda business of the Bank of China Shenzhen Branch. The internal system of concealed factoring products and the behavior of non -prudent research and development procedures shall bear direct responsibility. According to Article 48 of the "People's Republic of China" of the People's Republic of China, the Shenzhen Banking Insurance Regulatory Bureau made a life penalty decision on Wang Jiong to prohibit the work of the banking industry.

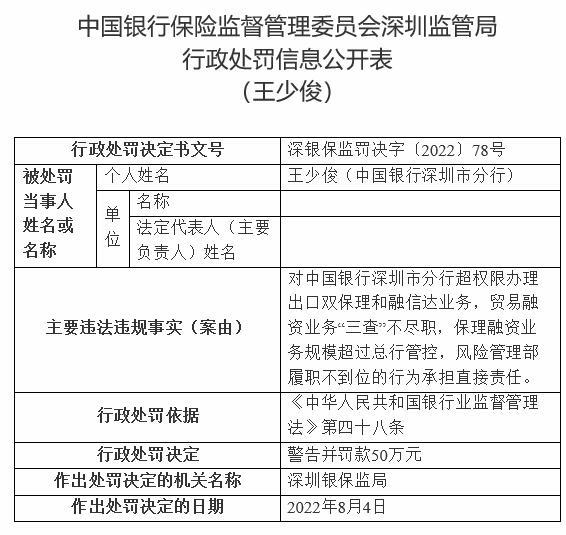

Decision of Shenzhen Banking Supervision [2022] No. 78 shows that Wang Shaojun handle export dual factoring and Rongxinda business on the overweight of the Bank of China Shenzhen Branch. The office of the head bank, and the act of failing to perform their duties in the risk management department shall bear the direct responsibility. The Shenzhen Banking Insurance Regulatory Bureau warned Wang Shaojun and fined Wang Shaojun 500,000 yuan in accordance with Article 48 of the Bank of the People's Republic of China.

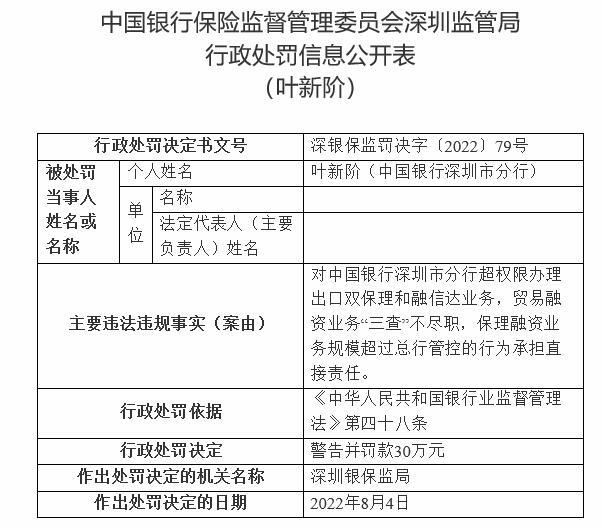

Decision of the Decision of Shenzhen Banking Insurance [2022] No. 79 shows that Ye Xinjie handle export dual factoring and Rongxinda business on the overweight of the Bank of China Shenzhen Branch. The behavior of the head bank's management and control is directly responsible. The Shenzhen Banking Insurance Regulatory Bureau warned Ye Xinli and fined 300,000 yuan in accordance with Article 48 of the Bank of the People's Republic of China.

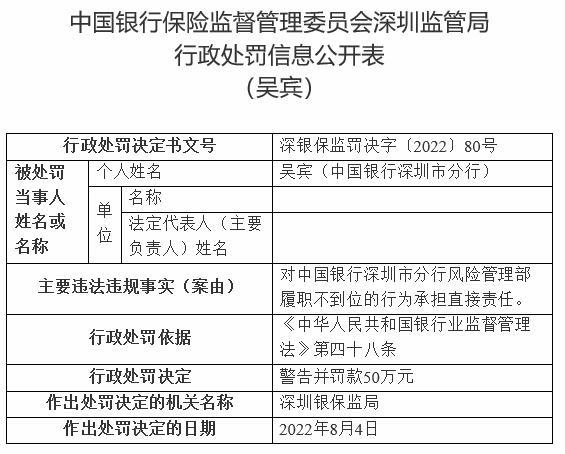

Decision of the Decision of Shenzhen Banking Supervision [2022] No. 80 shows that Wu Bin is directly responsible for the act of failing to perform his duties in the risk management department of Bank of China's Shenzhen Branch. The Shenzhen Banking Insurance Bureau warned Wu Bin and fined Wu Bin 500,000 yuan in accordance with Article 48 of the Bank of the People's Republic of China.

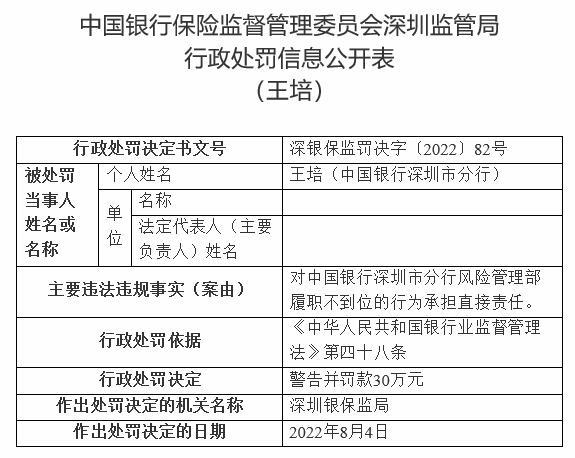

Decision of the Decision of Shenzhen Banking Insurance [2022] No. 82 shows that Wang Pei is directly responsible for the act of failing to perform his duties in the risk management department of Bank of China's Shenzhen Branch. The Shenzhen Banking Insurance Regulatory Bureau warned Wang Pei and fined 300,000 yuan in accordance with Article 48 of the Bank of the People's Republic of China.

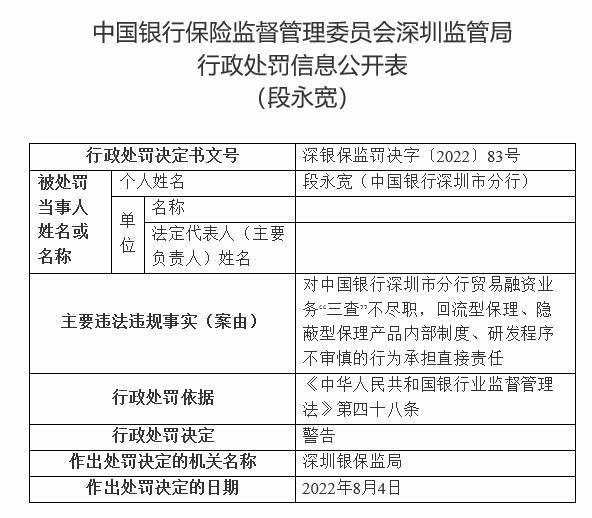

Decision of the Decision of Shenzhen Banking Supervision [2022] No. 83 shows that Duan Yongkuan does not have the duty of "three investigations" for the trade and financing business of Bank of China Shenzhen Branch. Responsibilities. The Shenzhen Banking Insurance Bureau warned Duan Yongkuan in accordance with Article 48 of the Bank of the People's Republic of China.

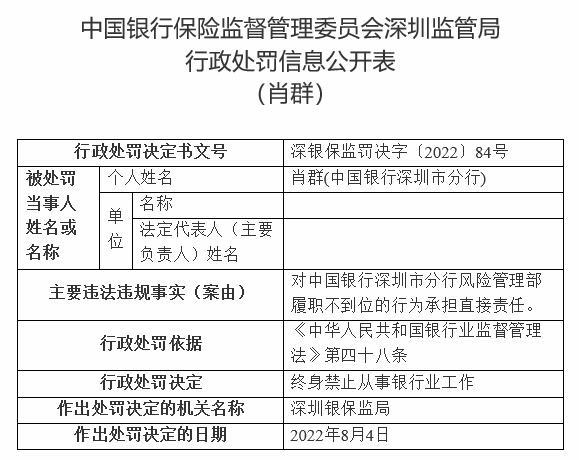

Decision of the Decision of Shenzhen Banking Supervision [2022] No. 84 shows that Xiao Qun assumes a direct responsibility for the act of failing to perform his duties in the risk management department of Bank of China's Shenzhen Branch. According to Article 48 of the "People's Republic of China" of the People's Republic of China, the Shenzhen Banking Insurance Regulatory Bureau made Xiao Qun's administrative penalty decision on the banking industry for life to prohibit the work of the banking industry.

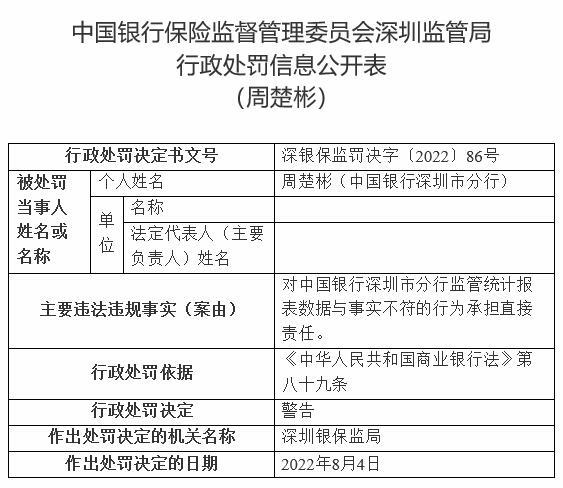

Decision of the Decision of Shenzhen Banking Supervision [2022] No. 86 shows that Zhou Chubin bears direct responsibility for the statistical statement data of the Bank of China's Shenzhen Branch. The Shenzhen Banking Insurance Regulatory Bureau warned Zhou Chubin in accordance with Article 89 of the Bank of the People's Republic of China.

Related legislation:

Article 46 of the "People's Republic of China Banking Supervision and Management Law": The banking financial institutions have one of the following situations. If the circumstances are particularly serious or do not corrected overdue, they may be ordered to suspend business or revoke their business licenses; if a crime constitutes a crime, criminal liability is investigated according to law:

(1) Those who are appointed directors and senior managers who are appointed without qualifications;

(2) Reject or hinder non -on -site supervision or on -site inspection;

(3) Reports, reports, and materials that provide false or concealing important facts; (4) If the information is not disclosed in accordance with the regulations;

(5) Those who seriously violate the rules of prudent business;

(6) The measures stipulated in Article 37 of this Law are rejected.

Article 48 of the "People's Republic of China Banking Supervision and Management Law": If the banking financial institution violates laws, administrative regulations, and state regulations on the supervision and management of the state, in accordance with Article 44 of the Law in accordance with Article 44 of this Law to Article 47 In addition to the punishment, different circumstances may be distinguished, and the following measures may be taken:

(1) Disciplinary sanctions on directors, senior managers, and other direct responsible persons are ordered to order financial institutions;

(2) If the behavior of banking financial institutions does not constitute a crime, a warning of directors, senior managers, and other direct responsible persons who are directly responsible will be punished for fines of 50,000 yuan and 500,000 yuan;

(3) Cancellation Directors and senior management personnel who are directly responsible and senior managers will be qualified for a certain period of time until life. Directors, senior managers, and other direct responsible persons who are directly responsible will be prohibited from being engaged in banking work at a certain period of time.

Article 75 of the "Commercial Bank Law of the People's Republic of China": Commercial banks have one of the following circumstances. If you do not make corrections within the time limit, you may be ordered to suspend or revoke its business license; if a crime constitutes a crime, criminal responsibility is investigated in accordance with the law:

(1) If you refuse or hinder the inspection and supervision of the banking supervision and management agency of the State Council;

(2) Provide false or concealing important facts financial accounting reports, reports and statistical statements;

(3) Failure to comply with other regulations of capital adequacy ratio, asset liquidity ratio, the proportion of loans of the same borrower, and other provisions of the asset -liability ratio of the State Council's banking supervision and management agency.

Article 89 of the "Commercial Bank Law of the People's Republic of China": If commercial banks violate the provisions of this Law, the State Council's banking supervision and management institution can distinguish different situations and cancel its direct responsible directors and senior management personnel. Directors, senior managers, and other direct responsible persons who are prohibited directly responsible for a certain period of time until they are engaged in the banking industry for a certain period of time.

If the actions of commercial banks do not constitute a crime, they will warn directors, senior managers and other direct responsible persons who are responsible for directly responsible and impose a fine of 50,000 yuan or less.

The following is the original text:

- END -

Zheng's eyes look at the market: multi -short difference nodes appear to pay attention to the risk of interim reports

The Federal Reserve raised 75 basis points overnight. On June 16th (Thursday), A -share rose and decline. As of the closing, the Shanghai Composite Index fell 0.61%to 3285.38 points, the deep comprehe

The total outbreak of chip stocks has increased by more than 50 shares of more than 9 %. The institution claims that the follow -up trend needs to pay attention to the implementation of the US "Chip Act"

Economic Observation Network reporter on Monday Fan On August 5th, the A -share in...