Tianli Lithium Energy: The GEM IPO will be purchased on August 17th. It is expected that the net profit in the first nine months will increase by 3 times

Author:Dahe Cai Cube Time:2022.08.07

[Dahecai Cube News] On August 7, Tianli Lithium released the first public offering of stocks and listed the prospectus on the GEM. This plan to issue 30.5 million shares through the Shenzhen Stock Exchange's GEM IPO It is 25%and is expected to be released on August 17.

The prospectus states that this public offering is adopted to use the targeted distribution of strategic investors, the online undercover investor inquiry and sale, and the online market to hold the Shenzhen market non -restricted A -share shares and non -limited deposit vouchers market value The combination of public investors' pricing and distribution. The preliminary inquiry time is planned to be planned on August 11, 2022 (T-4) 9:30-15: 00, and the subscription date is scheduled to be on August 17.

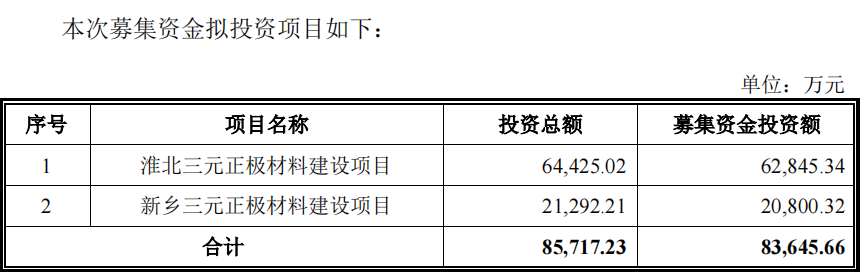

The prospectus shows that the fundraising funds will be invested in two projects. Among them, Huaibei Sanyuan APerarchical Material Construction Project uses raised funds of 628.4534 million yuan, and the investment amount of the raised funds for the use of Xinxiang Sanyuan Polaris Material Construction Project is 20.8032 million yuan. The total amount of funds is 836,456,600 yuan.

In the prospectus, Tianli Lithium can disclose the expected performance of the results from January to September 2022. It is expected that operating income from January to September is 2 billion yuan to 2.3 billion yuan, an increase of 81.42%to 108.63%over the same period last year; the net profit attributable to shareholders of the parent company is 150 million to 180 million yuan, a year-on-year increase of 271.56% To 345.87%; the net profit attributable to shareholders of the parent company after deductions is 144.5 million yuan to 174.5 million yuan, a year -on -year increase of 105.78%to 148.50%.

Tianli Lithium is one of the earliest companies in China that engaged in the research and development and production of ternary materials in China. It has the integrated R & D and production capacity of the three -yuan material and its pre -drive body. Tianli Lithium has been focusing on the field of small power lithium batteries for many years. The downstream customers include Xingheng Power, Tianneng, Changhong New Energy, Hai Sida, Hengdian East Magnetic, Sunshine Power, Penghui Energy and other well -known domestic lithium batteries. According to statistics from High Industry Research (GGII), in the field of electric bicycles and electric tool lithium batteries, the company's related products in 2019 and 2020 ranks first in the industry.

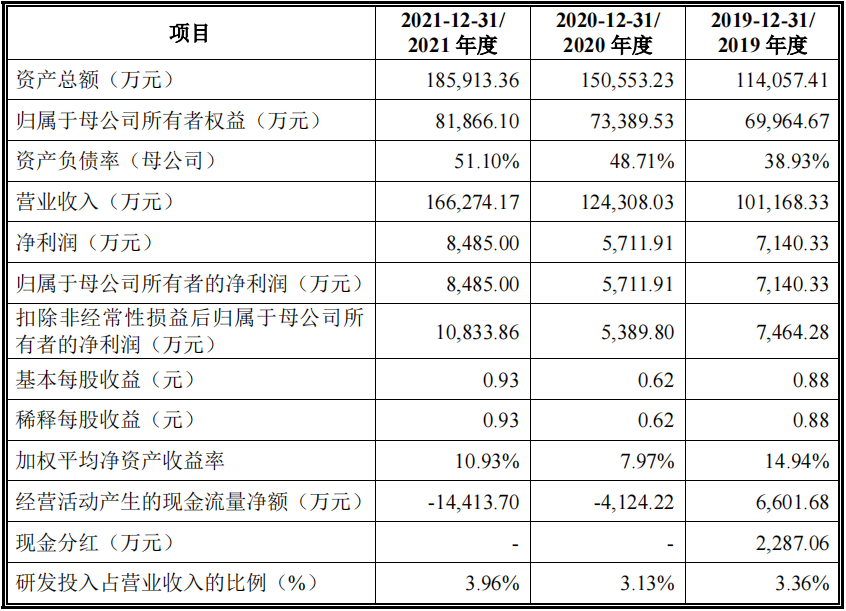

The following table is the main financial data of Tianli Lithium in the past three years:

Responsible editor: Wang Shidan | Audit: Li Zhen | Director: Wan Junwei

- END -

Shanxi government financing guarantee institution, city and county integrated operation reform entering the sprint stage

Shanxi Economic Daily reporter Ma YongliangThe city and county integrated operatio...

The city's industrial enterprises sprint "Double Half Half" for their best

The scorching sun is struggling.The second quarter is the golden period of industrial production and operation. As the backbone of the city's economy, the majority of industrial enterprises in our c...