Jiu Gua 丨 End of the transition period, bank financial management "half -year test" results were announced

Author:Jiu Gua Financial Circle Time:2022.08.07

Source | Puyi Standard

Edit | Wu Wen Zhang Yundi

Beauty | Yang Wenhua

The transition period of the new asset management regulations ended at the end of last year, and the transformation of the net value of bank wealth management was completed. In 2022, it was more than half. The development of the wealth management market ushered in the "half -year assessment". Overall, the bank wealth management market has shown the following development points since this year.

From the product level, all institutions have deployed "solidaries+" and FOF products as tentacles to explore the market; at the same time, wealth management institutions actively develop and innovate theme products; from the perspective of marketing, wealth management companies have expanded rapidly on their agency channels for sales channels , Small and medium -sized banks have obvious trends in the sales agency business; from the perspective of service level, wealth management institutions are actively innovating service concepts, improving investor portraits, and comprehensively improving the breadth and depth of services; from the perspective of fintech, institutions are empowering investment through fintech to invest in investment. Research ability, help risk management, broaden customer channels, and improve customer experience to promote the development of wealth management business.

From the perspective of the wealth management market structure, various institutions have shown differentiated development. State -owned banks and shares have basically completed product migration, while urban commercial banks and agricultural and commercial banks are restricted by their own conditions, and the number of new issues and duration products accounts for a high proportion. At the same time, the scale of wealth management business is relatively concentrated, which is mainly concentrated in the wealth management company of state -owned banks and shares, and the head effect is becoming more and more obvious. In general, the advantages of wealth management companies in various institutions have gradually emerged, and they are growing into the main force of the wealth management market.

Through the in -depth exploration of the bank's wealth management business and wealth management market structure, we can see that the bank wealth management market has certain challenges on the capital side, asset side, and operating terminals. In order to cope with market development and promotion of wealth management business more efficient, bank wealth management companies should "take the right medicine", solve existing difficulties from different ports, and provide a good development environment for the development of bank wealth management business.

one

2022 is more than half, the portrait of bank wealth management products is released

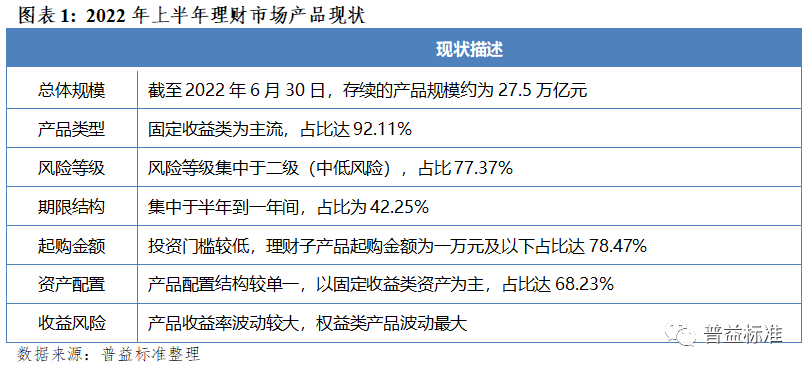

The transition period of the three -year asset management regulations officially ended, and bank wealth management has basically completed the net worth transformation. This article analyzes the current status and characteristics of the bank wealth management market through statistics in the first half of 2022 [1]. Show.

(1) The scale of wealth management and the number of new hair products fell simultaneously

The existence of bank wealth management products fell to a certain existence from the end of 2021, about 27.5 trillion yuan. According to the statistics of the Puyi Standard, the scale of bank wealth management products has shown a significant growth trend since the first quarter of 2021, from about 24 trillion yuan in the first quarter of 2021 to breaking 28 trillion yuan in the fourth quarter of 2021. In 2022, the scale has fallen to a certain extent. As of June 30, 2022, the scale is about 27.5 trillion yuan. This is mainly due to factors such as the international economic environment and the shares and bond market shocks. The bank wealth management market that has just completed the transformation of net worth has just completed. In the first quarter, the large -scale products were "broken". After entering April, the situation began to improve. Especially since mid -April, with the further relaxation of the capital, the bond market recovers, and the return on the yield of solidarity products has been rebounded. The bank wealth management market has stabilized, and the existence of bank wealth management products has increased.

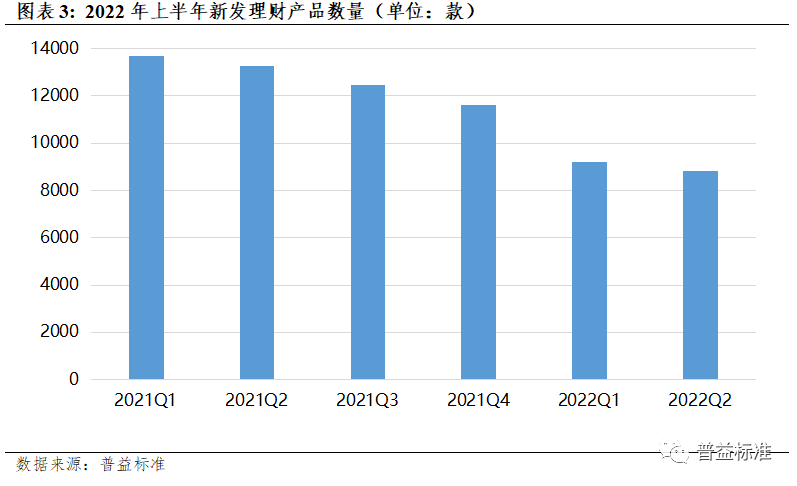

The total number of new products of bank wealth management has declined. In the first half of 2022, the number of new bank wealth management products decreased significantly compared to 2021. According to the statistics of the Puyi Standard, the number of new bank wealth management products has gradually declined since 2021, from more than 13,000 in the first quarter of 2021 to more than 8,000 in the second quarter of 2022, a decrease of nearly 40 %. The reason, first of all, after the assessment ended at the end of last year, the bank's pressure on the funds was relatively small, which led to weakening the power of its release of new products. The outlets make it difficult for offline wealth management business to spread; in the end, the new asset management regulations guide funds for long -term investment, which will compress the short -term and medium -term products with a large number of times, which will lead to a decline in the number of issued products.

(2) Absolute mainstream of solid -income products occupy

The product type is still mainly based on a fixed income category, accounting for over 90%. According to incomplete statistics, as of June 30, 2022, fixed income products accounted for 92.11%of the duration of wealth management products, 7.09%of mixed products, and equity products and products and financial derivatives. The sum of the person is only 0.81%.

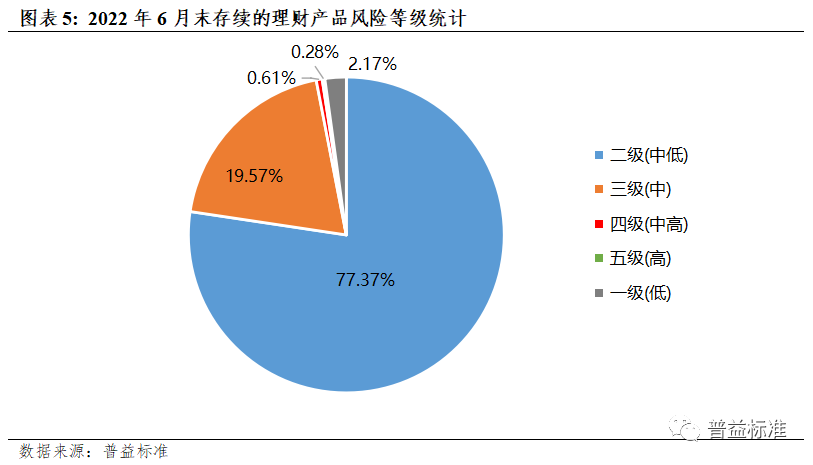

(3) Product risk levels concentrate at second (low) risk

The risk of wealth management products is low, mainly concentrated in the second level (low) risk. As of June 30, 2022, the risk level of the durable wealth management products is generally at a low level. Mid -risk and the following products account for 99.11%. The proportion of first -level (low) risk products is 2.17%, and the proportion of risk products in the third (middle) risk is 19.57%. As of June 30, 2022, the total proportion of risk levels at the fourth (medium high) and level (high) (high) and fifth (high) risk levels were only 0.89%.

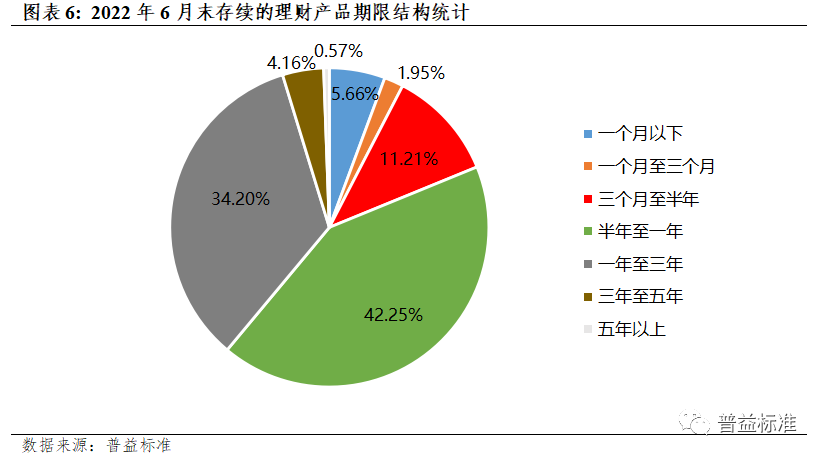

(4) The term interval of wealth management products is concentrated in half a year to one year

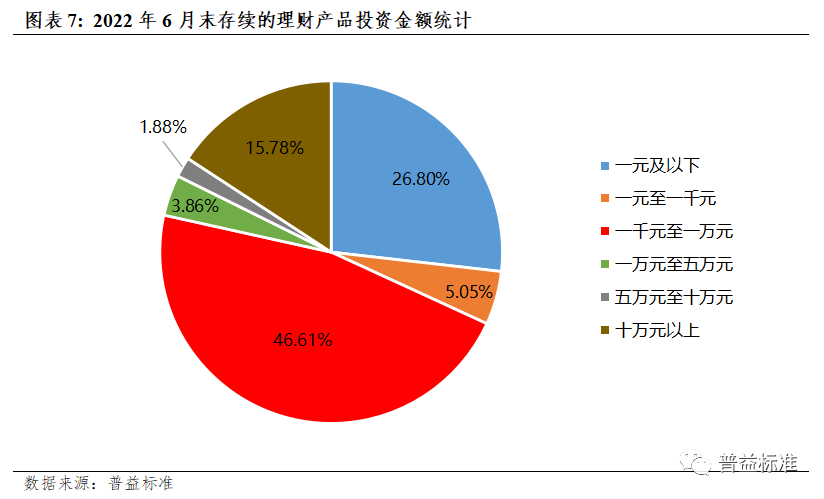

Generally speaking, wealth management products have a high liquidity, and the product period interval is concentrated in half a year to one year, and its proportion is 42.25%. The product period is also high in the one -year to three years, with a higher proportion of products, 34.20%. In addition, the product period is 5.66%of high -liquidity products with a product period of less than one month, and the product period is 11.21%from one month to three months. It is 4.73%. (5) The amount of wealth management of the deposit bank is 10,000 yuan and below, accounting for nearly 80 %

The amount of financial management of the deposit bank is relatively low, and the proportion of purchases from 10,000 yuan and below accounts for nearly 80 %. Generally speaking, as of June 30, 2022, the threshold for the purchase of bank wealth management products was low, and products with a purchase amount of one yuan and below accounted for 26.80%. The product with a purchase amount of 1,000 to 10,000 yuan accounts for 46.61%, and products of less than 10,000 yuan account for nearly 80%. On the whole, the starting threshold for the start of bank wealth management is significantly lower than the wealth management products before the transformation of net worth.

(6) The underlying asset allocation of bank wealth management products is mainly based on solid -income assets

The underlying asset allocation of bank wealth management is relatively single, with fixed income assets. Generally speaking, as of the end of the first quarter of 2022 [2], the deposited bank wealth management asset allocation was mainly based on solidarity assets, accounting for 68.23%. The main reason for this phenomenon is that the risk preferences of the target group of bank wealth management products are low, so they focus more on low -risk solid -income assets. In addition, the proportion of currency market asset allocation is also high, with 22.46%, and the total asset allocation of the remaining types accounts for 9.31%. Among them, the proportion of equity assets is only 2.02%. Due to the incomplete construction and research system construction system of banking institutions, insufficient talent reserves, limited customer risk tolerance, and the concept of customer "capital protection financial management" have not been completely broken. In the short term, in the short term Internal increasing the number of equity assets and the proportion of allocation of equity still faces a certain degree of challenges.

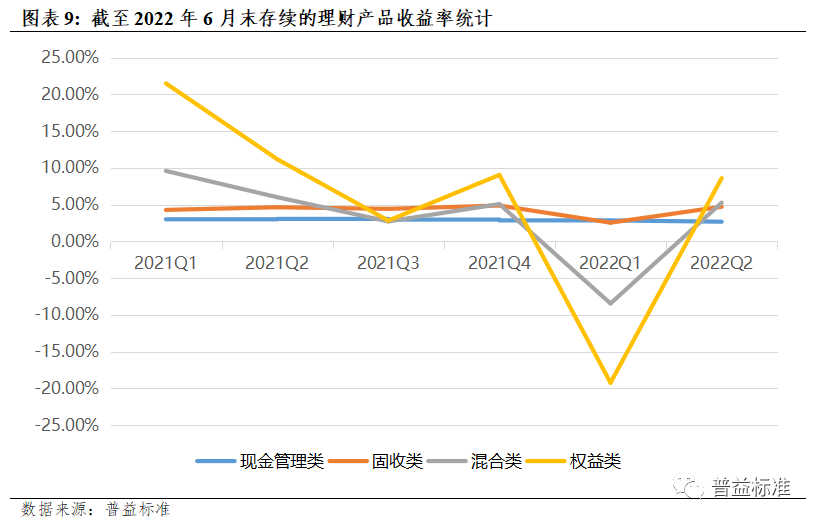

(7) Affected by the fluctuation of the capital market, the product yield fluctuates a lot

In addition to cash management, wealth management products fluctuate largely, and the yields of equity products fluctuate the greatest. Specifically, during the statistical period, the income curve of the solid-income product is relatively smooth, the product yield fluctuates between 2.55%-4.88%, and the yield of the product's product yield is fluctuated by -19.24%-21.51%. The product yield fluctuates in range -8.45%-9.59%. The main reason was that the international situation in the first quarter of 2022, the rise in geopolitical risks, and the outbreak of local war conflicts, which led to the decline in the global bond market and the rights market of equity, bonds, stocks and other revenue, which then affected the benefits of wealth management products. Since the stock market and the bond market have stopped falling back since April, the net value of bank wealth management products has risen, and the Shanghai Stock Exchange Index has been greatly repaired. The yields have been significantly improved. The cash management products have high liquidity and stability, and are less affected by the fluctuations in the stock and bond market, so their product yields have no significant fluctuations.

two

The business line shows a new development trend, and innovation and development

(1) Product level -rich product shelves, innovative product theme

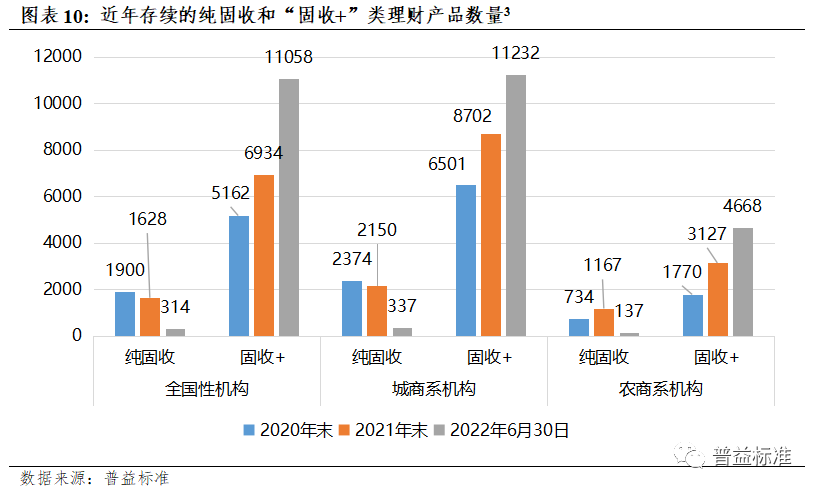

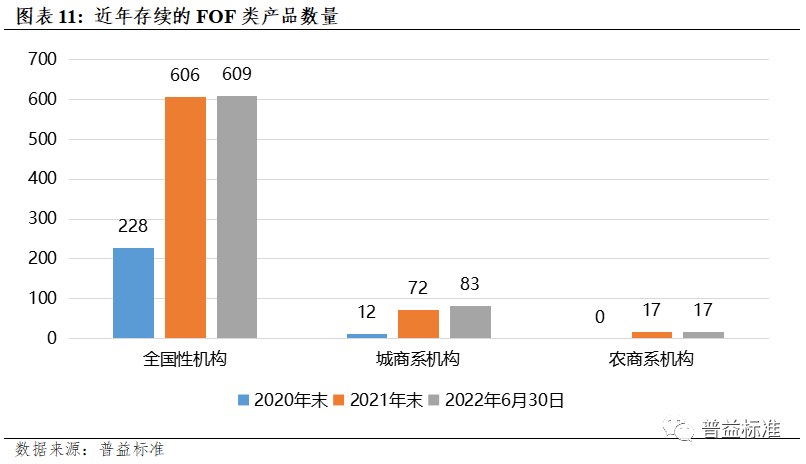

1. Product structures are convergence, "solid income+" and FOF products have become the starting point of exploring rights and interests

In recent years, the product structure of national institutions, urban and commercial institutions, and agricultural and commercial institutions is mainly based on solid -income products. It has maintained more than 80%of the product structure. There are fewer types of products in categories, and the product homogeneity is serious. In this context, the institution is vigorously deploying "solidaries+" and FOF products. The reason is that in the context of breaking the new redemption, the level of revenue has decreased significantly, and there is a certain limitations of market expansion. Therefore, under business -driven, the organization vigorously deploys "solidaries+" and FOF products, and through the traditional advantages of banks -fixed income products as the basic market to explore the rights market; Large investment and research pressure to improve the level of product income and its own competitiveness. According to statistics, the number of "solidaries+" products and FOF products that are continuted from 2020 to the end of June 2022 can see that the layout of the two types of products has become the consensus of various institutions, and the number of "solidaries+" products and FOF products all present out the number of products and FOF products. A significant growth trend year by year. In the future, institutions may continue to use "solidaries+" products and FOF products as the starting point of exploring rights and interests, adjust product structure, enrich product shelves, and thicken product returns.

2. The development of development is increasingly differentiated, and innovative theme products are endless

Many institutions actively deploy innovative wealth management products markets. Judging from the number of new theme products, the theme product market is active. The number of innovative theme products, such as ESG, pension and carbon theme products, increasing. As of June 30, 2022, 42, 21, and 13 models were issued from the end of last year. 175, 25 and 84. From the perspective of the issuance agencies of innovative theme products, financial institutions are actively participating in the issuance. In terms of pension financial management, with the expansion of the pilot scope, institutions represented by China Post Financial Management are actively preparing related elderly financial management products to enter the track. In addition, ICBC Financial Management, Traffic Bank Financial, and Qingdao Bank have issued "anti -epidemic theme" wealth management products; Traffic Bank Finance and BOC Financial have issued two "specialized new" theme wealth management products and completed their recruitment. The theme of innovation products is endless, mainly the effects of macro policies, product's own performance, and the development of wealth management institutions themselves. On the one hand, due to the influence of policy orientation, the tilt of funds in the new areas of ESG, pension, carbon neutralization, and specialized specialty in specialty can help improve the efficiency of the financial service real economy; on the other hand, innovative theme products reflect in the market in the market It is better. Under the influence of the bond market at the beginning of the year, the large area of wealth management products is "breaking", but the yield of innovative wealth management products such as pensions is stable at a certain level and is favored by investors. In addition, the layout of innovative theme products can make an active attempt to explore asset allocation, expand investment and research ideas, and form a differentiated investment strategy to provide experience in building a compatible risk control model within the institution. Based on the above factors, the following analysis is based on ESG and pension as an example.

(1) ESG theme

ESG is the abbreviation of three English first letters: Environmental, Social, and Governance, which is used to measure the sustainability of corporate development. ESG Investment is a responsible investment concept of focusing on corporate environment, society, and governance performance. Under the background of the "14th Five -Year Plan" emphasizing green transformation and the gradual landing of my country's "double carbon" policy, ESG investment prospects in China It was further affirmed that market funds have gradually flowed to high -quality enterprises with good performance, and ESG wealth management products have also ushered in rapid development.

From the perspective of the number of products, the number of ESG theme products that survived at the end of June 2022 increased rapidly. At the end of 2021, there were 134 ESG bank wealth management products that were survived by the market. As of June 30, 2022, the ESG bank wealth management products with market survival were 175, with a growth rate of 30.60%. Among them, the number of ESGs of Huaxia Bank and Bank of China still leads the market. As of June 30, 2022, the number of ESG theme products for the two institutions was 41 and 27, respectively, accounting for 23.43% of the market share of the ESG theme survival product. And 15.43%; the main institutions that promote the number of ESG theme products are Xingyin Finance, Agricultural Bank of China Finance and CITIC Finance. In the first half of 2022, the three institutions issued 9, 9, and 15 ESG theme products. It can be seen that various institutions are actively deploying the ESG field.

From the perspective of the type of distribution, the type of ESG theme product has changed significantly compared with the end of 2021. As of the end of 2021, the existence ESG theme wealth management products are mainly pure solid -income products, and the number of various products categories is small. As of June 30, 2022, the existence ESG theme products are mainly "solidaries+". Compared with the end of 2021, the proportion of "solidaries+" products increased from 23.31%to 61.14%, an increase of more than 158.96%; the proportion of mixed products decreased from 34.59%to 6.86%; the proportion of pure solid -collection products decreased from 41.35%to to 41.35%to 31.43%, equity products change less.

(2) Pension theme

At present, the process of aging in my country is increasingly accelerated, and the structure of the pension system is unbalanced. The proportion of basic pension insurance led by the government is too large. The second -pillar enterprise has insufficient annuity development. The third pillar of personal pension is still in its infancy. In the face of the above issues, the regulatory layer in order to supplement and improve the multi -level pension system, promote the development of the third pillar of individual pensions, and introduce relevant policies many times, and encourage financial institutions to actively develop long -term stable returns to provide long -term stable returns for the pension guarantee needs of different aged groups. Differential financial products that meet the needs of pension cross -life cycle.

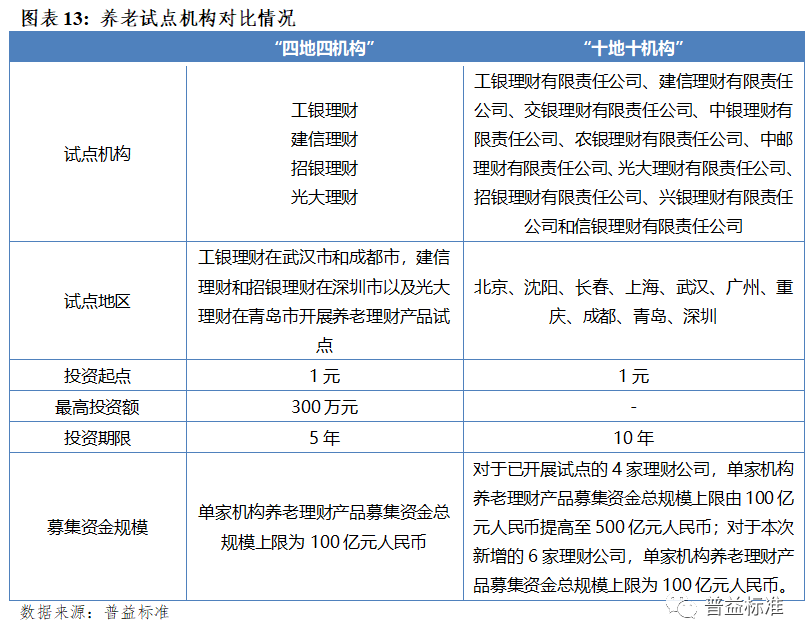

Among them, in August 2021, the General Office of the China Banking and Insurance Regulatory Commission issued the "Notice on the Pilot on Pension Financial Management Products", allowing ICBC Financial Management in Wuhan and Chengdu, CCB Financial and China Recruitment Finance in Shenzhen and Everbright Financial Management Qingdao carried out pilot pilot financial management products. Since the launch of the pilot of pension wealth management products, the overall operation is stable and the market response is positive.

In the first quarter of 2022, on the basis of the preliminary pilot work, the CBRC formulated and issued the "Notice on Expanding the Scope of Piloting the Pension Wealth Management Products". The "Notice" stipulates that starting from March 1, 2022, the pilot scope of pension wealth management products has been expanded from "four places, four institutions" to "ten places and ten institutions". The pilot wealth management company shall choose one or more pilot areas to sell pension wealth management products within the pilot area, but it shall not exceed the pilot area for sales.

From the perspective of issuance, the second batch of pilot pilots is still for personal retail, and the recruitment method is still public offering. At present, the planning scale of the wealth management company's planning for pension wealth management products ranges from 1 billion to 10 billion yuan, which is relatively concentrated at 10 billion yuan; the average planned scale increased by 4.5 billion yuan from the first batch of pension wealth management to 5.468 billion yuan; the average of the averages; average The actual raising scale has continued from 2.206 billion yuan to 2.2071 billion yuan; the agency's confidence in the issuance of pension products continues. From the perspective of the product period, the investment period of the 25 pension wealth management products issued in the second batch of the second batch of pension wealth management products is except for the investment period of a product issued by Berlaide CCB's wealth management. The change of pension products has not changed much.

From the perspective of liquidity, the second batch of 25 pension wealth management products issued by the second batch can be redeemed in advance, providing protection for investors' liquidity, similar to the first batch of retirement mechanisms for old -age products.

From the perspective of the starting point of subscription and wealth management costs, the starting point of the subscription is 1 yuan starting to purchase, showing the inclusive attributes; and most of the products do not charge the sales rate, the custody rate and fixed management rate are concentrated at 0.02%and 0.10%, respectively. , Almost the bottom.

From the perspective of income and risk level, the performance comparison of the performance of pension wealth management products issued in the first half of 2022 is concentrated between 5.8%-8.0%, with a high level of income, which is consistent with the first batch of pension wealth management products as a whole. At the same time, the performance of individual product performance is 4.8%-7.0%and 5.0%-10.0%. Correspondingly, the product risk is also concentrated in level 2 (low risk) and level 3 (medium risk), and 96%of the products are concentrated in low -risk, and the risk level is low.

In general, the pension theme wealth management products rely on policies, the number of products has increased rapidly from 4 to 25, and the scope of the pilot is expanded. Relevant institutions are preparing to issue pension -themed wealth management products. Essence Since the beginning of this year, the pilot piloting of my country's pension financial business innovation has steadily advanced, and the development of pension financial business has entered the "fast track". After the pilot of the "ten places and ten institutions" of the pension and wealth management products landed steadily, the pilot savings pilot was started.

Recently, the person in charge of the relevant departments of the China Banking Regulatory Commission said that in order to further enrich the supply of third -pillar pension financial products, the China Banking Regulatory Commission was launching a pilot pilot of specific pension savings with the People's Bank of China. This will further promote the development of multiple types of commercial pension financial business from insurance, public asset management products to bank deposits.

(2) Marketing level -the rapid expansion of channels, the trend of agency sales has been displayed

In recent years, the bank wealth management market has vigorously strengthened the construction of agency sales channels. The reason is that agency sales can achieve the expansion of product sales at a relatively low cost, optimize the process and cost of the layout of the outlets, supplement their own product shelves, and enrich the product line. The following is the statistics of the banking sales data of the banking market in the first half of 2022, and the full picture of the banking sales market has been portrayed and analyzed.

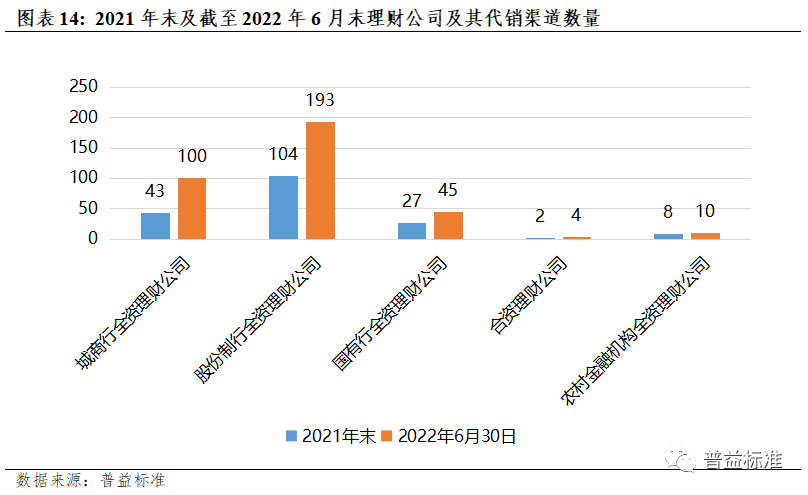

1. Fast expansion of wealth management company sales channels

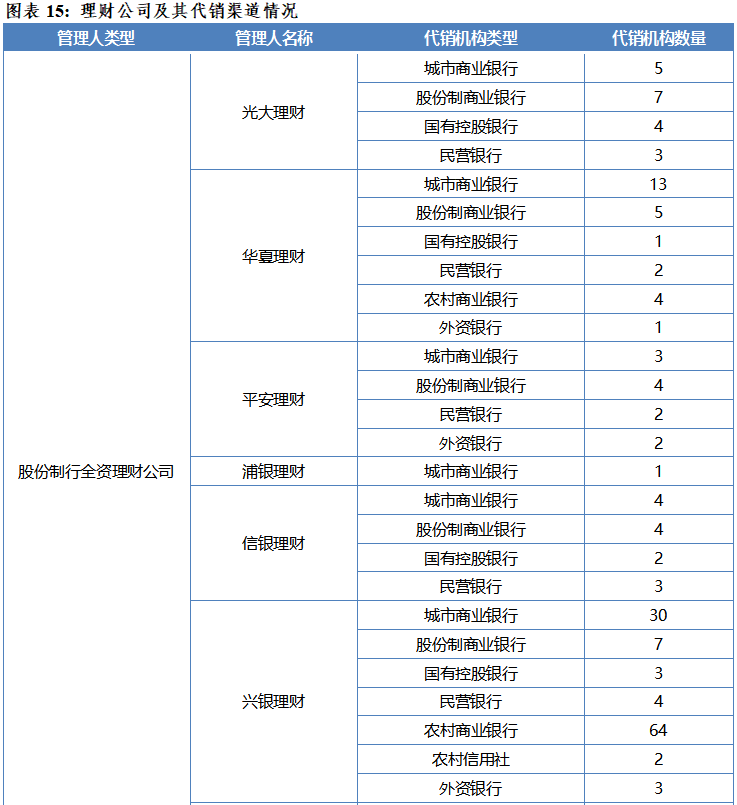

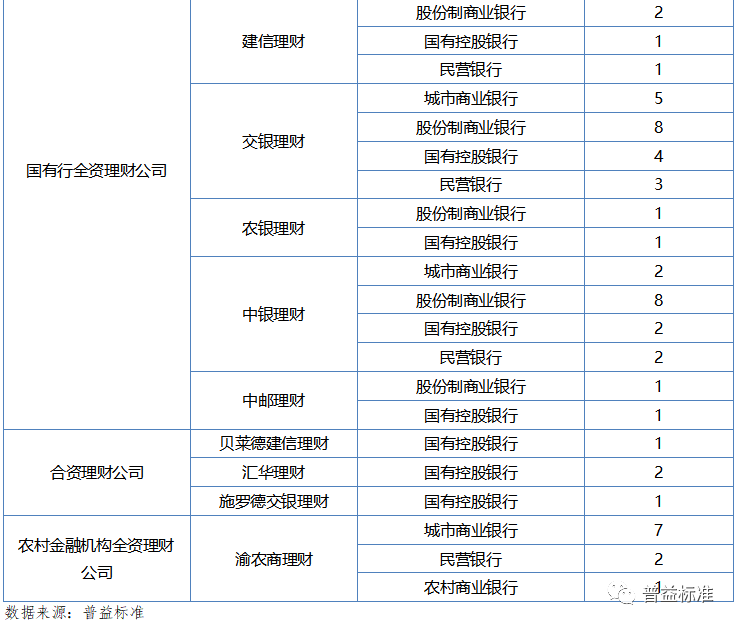

The sales channels for wealth management companies have been fully rolled out, which is significantly increased from the end of 2021. As of June 30, 2022, there were a total of 352 agencies of each wealth management company. Compared with 184 at the end of 2021, the number of agencies increased by 91.30%. Among them, the number of wholly -owned wealth management companies in the joint -stock system accounts for the leading position, and the number of agencies in the agency is growing rapidly, accounting for 55.46%. It can be seen that the wealth management company has expanded the channels for sales on a large area. Each wealth management company is breaking its own restrictions. It is not limited to its mother bank sales channels.

The wholly -owned wealth management company of state -owned banks has the largest number of banking financial management and BOC financial management agencies. The number of agencies is 20 and 14 respectively. State -owned holding bank.

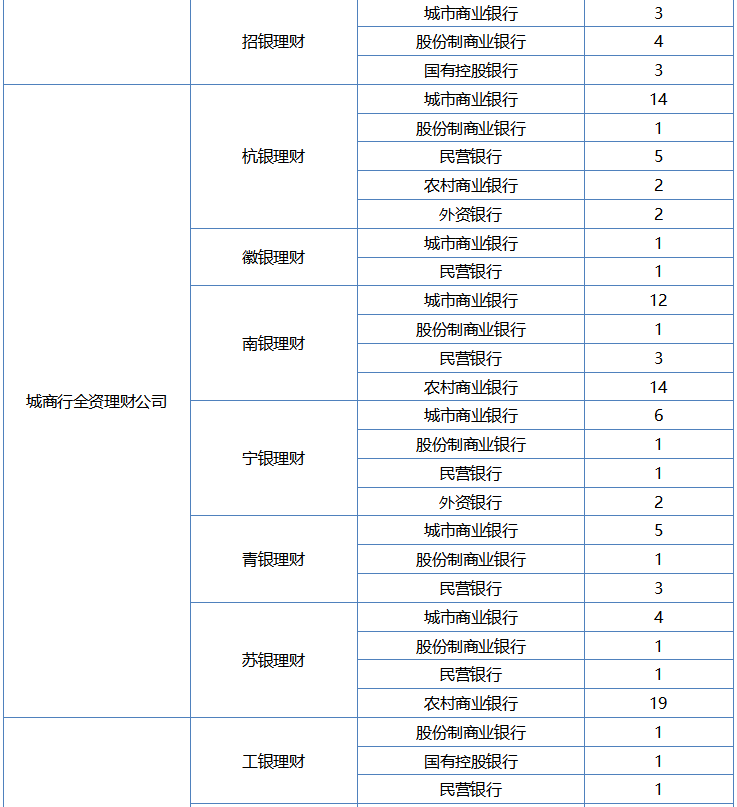

A wholly -owned wealth management company of the joint -stock bank, the largest number of sales channels for Xingyin Bank, 113; second, the number of substitutes for Huaxia Finance and Everbright Financial Sales Channel is also considerable, with 26 and 19 respectively. Follow -up financial management is richer than other types of wealth management companies. The types of sales agencies of Xingyin Financial Management are the most abundant. Compared with 2021, two types of private banks and rural credit cooperatives are added. Currently, it covers urban commercial banks, joint -stock commercial banks, and state -owned holding banks. Seven types of private banks, rural commercial banks, rural credit cooperatives, and foreign banks.

The wholly -owned wealth management company of the city commercial bank, the number of Southern Bank Financial Management, Su Yin Finance and Hangyin Financial Sales Sales, with a large number of substitutes, with 30, 25 and 24 respectively. Among them, Hangyin Financial Management has increased more than 14 new agencies in the first half of 2022, adding 14, and adding two types of private banks and foreign banks.

The Rural Commercial Bank Wealth Management Company currently has only a wealth management company of the Yu and Commercial Management of the Chongqing Rural Commercial Management, with a total of 10 agency sales channels. The types of sales are three types: urban commercial banks, private banks, and rural commercial banks. Among them, the number of urban commercial banks has the largest number of agencies, reaching 7.

2. Differential situation is gradually showing, and small and medium banks move to fight for sales

Under the background of the transformation of net worth, many small and medium -sized banks are facing serious investment and research capabilities and the lack of system construction capabilities. It is difficult for them to establish a sound net worth management operation system. The natural advantages of scale, business foundation, technical support, etc. Therefore, small and medium banks are more inclined to carry out the sales agency business, and the differentiation situation of the wealth management market has begun to appear. Small and medium -sized banks have obvious trends in the sales agency business. As of June 30, 2022, 115 of the 276 commercial banks that launched a substitution business were urban commercial banks and 104 were rural commercial banks. The trend of small and medium banks' vigorous deployment of agency sales business has been further prominent. Judging from the number of banking institutions introduced by agency channels, Bank of Jiangsu maintained a leading position in 2021 and introduced 12 wealth management companies; Suzhou Bank increased the introduction of 2 wealth management companies. As of June 30, 2022, 8 wealth management companies were introduced. The Bank of Hangzhou, Bank of Ningbo and Bank of Xiamen have introduced 7 wealth management companies. From the ranking of the number of introduction of financial management, the top ten banks Zhongcheng Commercial Bank number is more than half. In summary, small and medium -sized banks are actively introducing wealth management companies to vigorously deploy the sales agency business.

(3) Service level -innovative service concept, improve customer portrait

In recent years, with the rapid growth of my country's wealth accumulation, the scale of corporate and family wealth has continued to expand, residents 'asset allocation structure has been adjusted, and residents' financial needs have also developed diversified development, and the requirements for bank financial services have also been improved simultaneously. However, the service concept at this stage is more traditional, and its support for investor services and customer management is limited. In the future, wealth management institutions can improve their service capabilities through innovative service concepts and establishment of service evaluation feedback mechanisms to improve customer stickiness and help business market expansion.

1. Innovate service concepts and enrich service dimensions

my country's wealth management customer management market has developed a short period of development, and the market maturity and complexity are low. The main business model is direct sales products. The understanding of customer needs is relatively single, and there is a lot of room for improvement in investor services. At present, wealth management institutions usually carry out the form of questionnaires on a regular basis. The content of questionnaires usually involves relatively simple content such as customer financial preferences and risk preferences. It does not conduct multi -dimensional exploration of potential wealth management needs of investors.

In the future, bank wealth management institutions should innovate service concepts, be guided by customer needs, sort out the service concept of "customer -centric" service concepts, provide customers with comprehensive financial planning, and smooth investors' life wealth needs; Links customer needs and actively enrich the service dimension, so as to break the traditional single product sales business method and explore innovative business models. On the one hand, institutions can continue to extend financial services to services such as pension, real estate, etc., and different institutions use their own advantages as the starting point to provide customers with a multi -layer and multi -directional service experience; on the other hand At the level, the requirements of the requirements for funding demand and innovative product preferences are added to strengthen the management of innovative wealth management customers and further expand business width.

2. Improve the portrait of the customer and the depth of the excavation service

In the process of fierce competition in the wealth management market and the continuous deepening of investor education, bank wealth management institutions have not formed a sound customer evaluation system for the time being, which is relatively limited to factors such as product repurchase rates and preferences. The comprehensive customer evaluation system has limited help to further expand the market and increase investors' viscosity.

In the future, when bank wealth management institutions build a wealth management product system, they should consider from the needs of customers and the profitability of the wealth management company at the same time, establish a customer database, and the investment preferences, financial conditions, family conditions, consumer behavior, retirement planning of customers The legacy arrangement and other situations have been made comprehensive and in -depth analysis to improve customer portraits. Financial institutions should be based on a clear cognition and profound understanding of customer needs, customize service solutions, continue to tap the depth of services, and provide customers with customized products and services in conjunction with the operation of the wealth management institutions.

(4) Fintech level -comprehensive empowerment, help business take off

Fintech is an important tool for improving and improving the market adaptability of the wealth management market. It is also the core driving force for the rapid transformation of bank wealth management business. Financial technology advantages will become one of the core competitiveness of the asset management industry. At present, a number of banks and wealth management companies make full use of new technologies such as artificial intelligence, blockchain, and big data to empower the investment, risk control, and operation of financial management business. Business innovation development.

1. Fintech empowering bank wealth management and research capabilities

Compared with the investment and research systems that integrate research, transactions, risk control, and compliance, the investment and research system of bank wealth management is relatively weak. Therefore, bank wealth management institutions actively establish a systematic investment and research system, covering strategies and large -scale asset research frameworks in the industry, obtaining data through big data and artificial intelligence, timely grasping market information and industry trends, and providing viewpoints for product design and investment directions. Support support with investment research, deepen insights and integration of underlying assets, improve the ability of asset management and large -scale asset allocation, and promote the diversified development of bank wealth management investment directions. For example, Everbright Finance has independently developed the first -level issuance model of credit bonds, which provides strong support for the first -level bid yield. Credit bond pricing platforms provide digital analysis basis for credit bond investment research by building model -driven scenario -driven and collaborative investment research service system. 2. Fintech help risk management

Compared with the passive risk management model that used to meet regulatory compliance in the past, the active management model of monitoring and early warning is obvious by relying on new technologies to monitor and early warning. It can achieve comprehensive and effective risk prevention and control through systematic operations. Technologies such as artificial intelligence and big data can build customer portraits and business panoramic views through models. The system automatically captures external information in real time. Operation, strengthen risk prevention and control and prediction capabilities, thereby improving the accuracy of risk and early warning, and continuously optimizing the risk assessment model.

3. Financial technology broaden customer channels and enhance customer experience

Fintech plays an important role in obtaining customers, living customers and customers in banking and wealth management companies. In terms of customer acquisition, banks and wealth management companies use various living scenarios to guide a large number of customers through cooperation with third -party platforms, and carry out customer dynamic portraits to provide customers' subdivision and carry out personalized financial services to provide guarantee. Drawing on the "Scene+Financial" model for product sales, embedding sales in other customers' transaction processes, using the advantages of scenario to enhance customer acquisition capacity and expand product sales radius; , Perform customers with precise marketing and potential mining, create differentiated products or services, and then mix the products or services that are matched into ecological scenarios, docking customer needs, and realize the customer's "thousands of people and thousands of faces and thousands of people. "Quick response and comprehensive services. For example, BOC Financial Management fully improves the business processing pillar, focuses on business process processing, emphasizes efficiency, compliance, and safe, and improves the application of financial technology around the core capabilities of products and investment. New features, thereby improving the ability to serve customers and enhancing customer experience.

three

The wealth management market structure has changed, and the rise of wealth management companies

(1) The development of wealth management companies has made rapid progress and has become a dazzling star

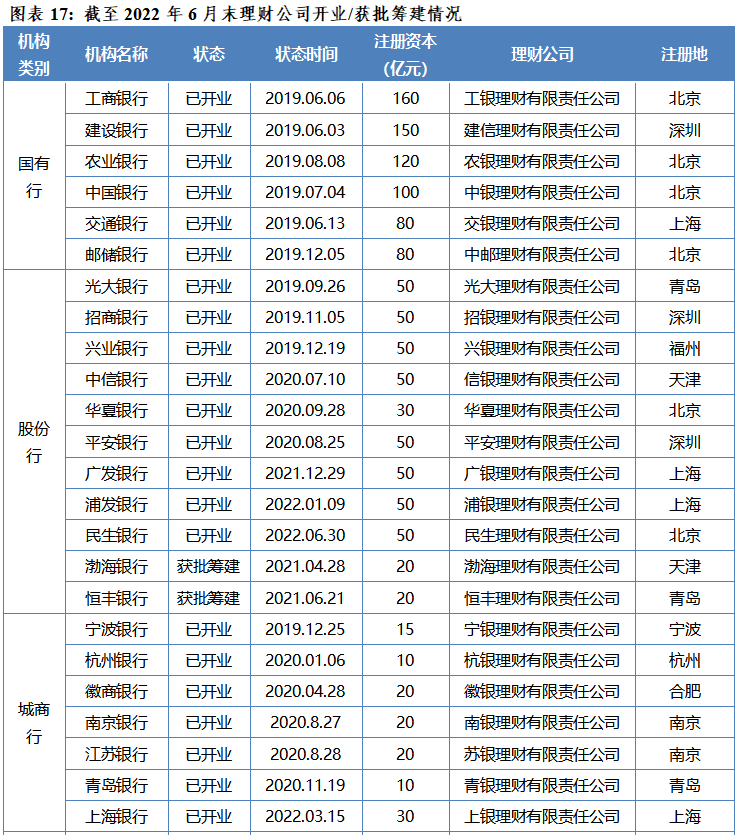

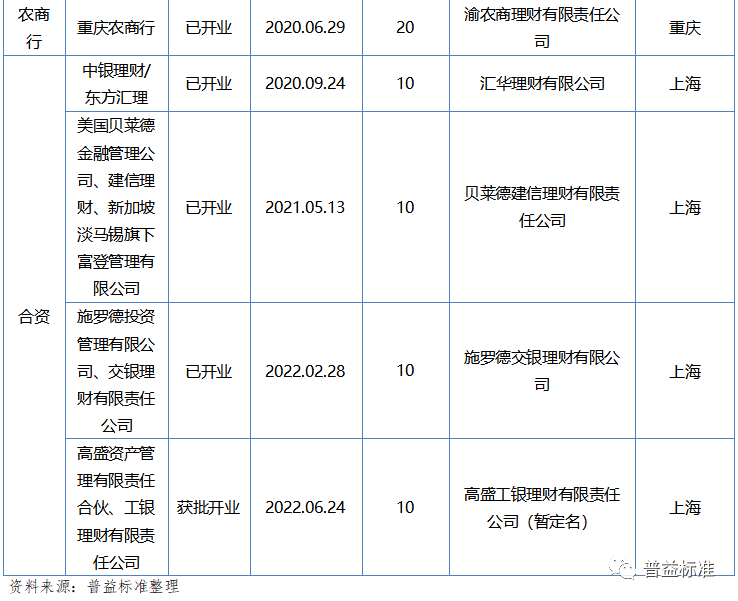

Since the "Administrative Measures for Commercial Bank Wealth Management Subsidies" in December 2018, commercial banks have successively established wealth management companies to carry out wealth management business to promote the reform of the wealth management business system. After more than three years of transformation and development, the number of wealth management companies has expanded rapidly and has achieved remarkable results. As of June 30, 2022, 29 bank wealth management companies in my country have been approved for construction. Among them, 26 were completed, and one was approved. Only Bo Yin Financial Management and Hengfeng Financial Management were still waiting for the opening of the business.

From the perspective of establishment, national banks have basically achieved the layout of wealth management companies, with a total of 17; regional urban agricultural and commercial banks are affected by factors such as business scale and human resources. At present, there are fewer layouts, only 8; foreign capital; Banks have deployed my country's bank wealth management market and established joint venture wealth management companies with my country's commercial banks and wealth management companies. There are currently four.

From the perspective of regional distribution, 29 wealth management companies are mainly distributed in Beijing, Qingdao and the Yangtze River Delta. The registered place of local banks' wealth management companies is consistent with the location of its mother bank. Taking the wealth management companies of 17 national banks as an example: there are 6 in Beijing, namely ICBC Financial Management, Agricultural Bank of China Finance, BOC Financial Management, China Post Financial Management, Huaxia Financial Management and Livelihood Wealth Management; Silver Finance, Silver Financial Management, and Guangyin Finance; 3 Shenzhen, namely CCB Finance, Micro -Silver Financial Management and Ping An Wealth Management; 2 Qingdao, namely Guangda Finance and Hengfeng Financial Management; Fuzhou and Tianjin each, improvisation silver wealth management and and Xingyin Finance and Tianjin Boyin Finance.

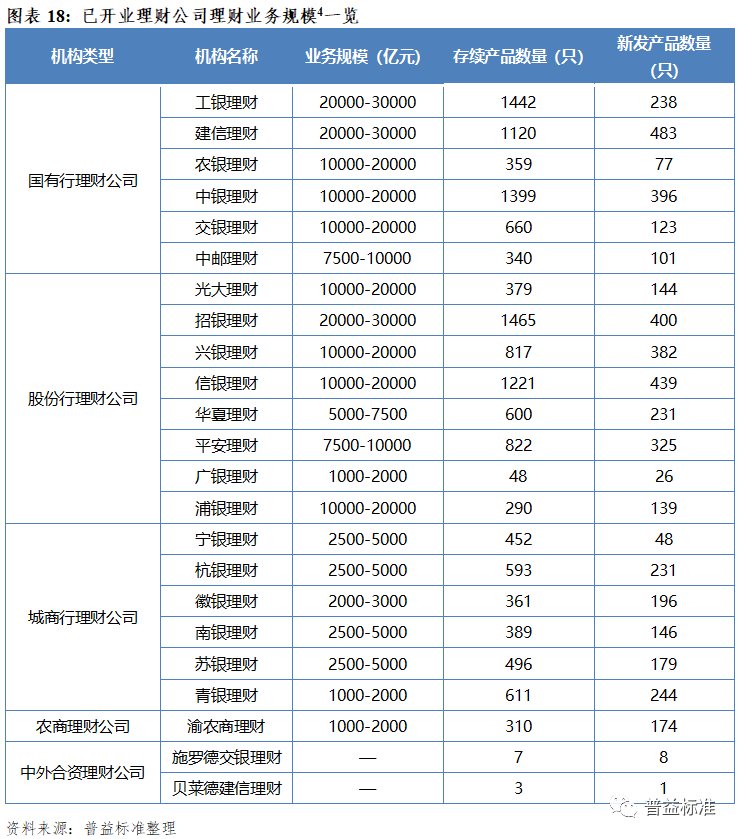

From the perspective of product distribution, in the first half of 2022, wealth management companies issued a total of 4,878 wealth management products. Among them, CCB Financial Management, Silver Financial Management, and Micro -Silver Finance ranked in the top three, with 483, 439, and 400.

From the perspective of market concentration, as of June 30, 2022, the total amount of wealth management companies has a total of 1,4184 duration products. Among them Later. The top ten wealth management companies in the deposit products total 10,157, accounting for 71.61%. In general, the number of newly issued and durable products of wealth management companies concentrates, and the total ten -in -ten proportion has exceeded 70%, and the head effect is obvious.

From the perspective of business scale, as of June 30, 2022, 10 wealth management companies' business scale exceeded trillion. The business scale of silver wealth management and CCB financial management is more than 2 trillion, far exceeding other financial management companies. Among the state -owned wealth management companies, the business scale of China Post Financial alone is still below trillion; among the shareholders' wealth management companies, the business scale of Guangyan Finance is small, and it has not exceeded some of the open city agricultural and commercial bank wealth management companies; The company's business scale gap is small, and the scale is below 500 billion. On the whole, the current business scale of wealth management companies has shown a more obvious head effect. From the perspective of revenue, in 2021, the profitability of wealth management companies has increased significantly, and a number of wealth management companies have a net profit of more than 2 billion yuan in 2021. Among them, the net profit of China Merchants Financial Management was 3.203 billion yuan, an increase of 30.57%year -on -year, ranking first; the net profit of "Dark Horse" Xingyin's financial management was 2.8 billion yuan, an increase of 108.62%year -on -year, and temporarily ranked second. At the same time, the state -owned holding bank wealth management company is also catching up. Last year, BOC Financial Management and CCB Finance achieved net profit of 2.609 billion yuan and 2.062 billion yuan, respectively, an increase of 473.41%and 515.52%year -on -year, and the growth rate was rapid. In addition, wealth management companies such as Xinyin, Agricultural Bank of China, Ping An, Everbright, China Post, and Communications Bank of China exceeded 1 billion yuan in 2021, respectively, 1.806 billion yuan, 1.721 billion yuan, 1.616 billion yuan, 1.586 billion yuan, 1.225 billion yuan Yuan and 1.155 billion yuan.

(2) Fortune of the wealth management market institution, the characteristics of differentiation are prominent

1. National banks have basically completed product migration.

With the continuous transfer of the wealth management business of commercial banks to wealth management companies, the development pattern of various institutions of the bank wealth management market has changed significantly. From the perspective of the six state -owned holding banks, its existence products and new products are the least in each institution, with 801 and 603, respectively, accounting for only 2.13%and 3.63%. It can be seen that because the state -owned holding banks have wealth management companies, most of the wealth management business has been transferred. At the same time, among the 12 shares, only Zhejiang Commercial Bank has not been approved to build a wealth management company. In the first half of 2022, the number of new issues in the shareholding bank was only 649, accounting for 3.91%of all new hair products, and the contraction effect was obvious.

2. Most urban commercial banks and agricultural and commercial banks have not been qualified for wealth management companies, and the proportion of new and deposit products is high

Compared with state -owned holding banks and joint -stock commercial banks, urban commercial banks and rural commercial banks have limited conditions due to their own capital strength, customer resources and other conditions, and the scale of wealth management business is relatively small. The main body conducts wealth management business. In the first half of 2022, the number of new products from urban commercial banks and agricultural and commercial banks was 4,865 and 5746, and the total proportion of the two reached 63.95%. At present, in terms of the number Commercial banks follow. However, with the development of the bank's wealth management market, some urban commercial banks and agricultural banks with strong strengths are expected to be approved to build wealth management companies. For example, Guiyang Bank, Suzhou Bank, Guangzhou Rural Commercial Bank, Changsha Bank, Chengdu Bank, etc. with a wealth management scale between 500-100 billion yuan?

3. National banks and their wealth management companies prefer to issue medium and high -risk products

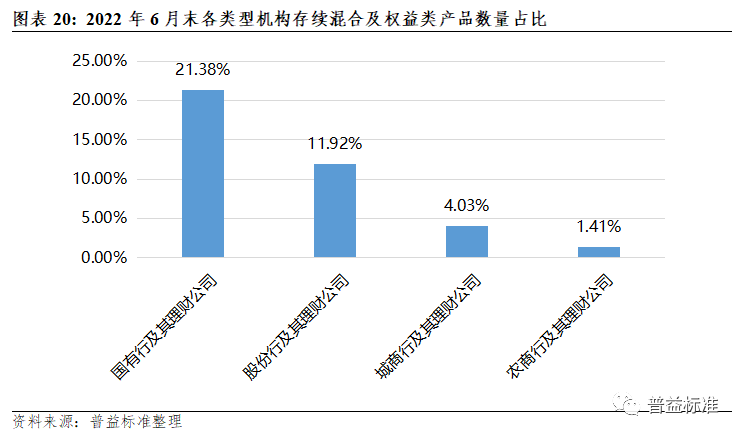

From the perspective of the investment nature of various types of institutions, as of June 30, 2022, among the existence products of state -owned holding banks and their wealth management companies, the number of mixed and equity products accounted for 21.38%, among various institutions, in various institutions The highest proportion; followed by joint -stock banks and its wealth management companies, accounting for 11.92%. In contrast, urban commercial banks, its wealth management companies, rural commercial banks and their wealth management companies are more conservative, and the number of mixed and equity products accounts for 4.03%and 1.41%, respectively, and does not exceed 5%. It can be seen that national banks and their wealth management companies prefer mixed -mixed and equity products (mixed categories), showing certain asset allocation capabilities for medium and high risk targets.

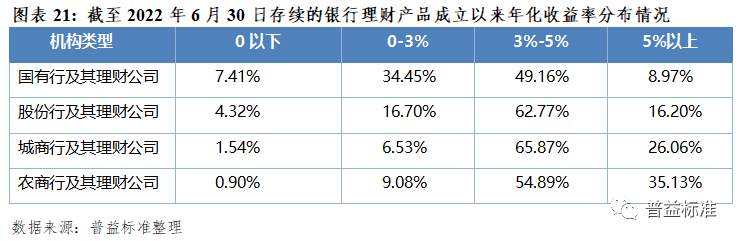

4. Rural Commercial Bank and its wealth management companies, urban commercial banks and their wealth management companies have a higher product yield

From the perspective of the yield distribution of durable products in various types of institutions, as of June 30, 2022, the overall product yield of urban commercial banks and their wealth management companies, rural commercial banks and their wealth management companies is higher, and more than 90%of the product yields are on More than 3%. Among them, 35.13%of Rural Commercial Bank and its wealth management companies exceed 5%, ranking first; followed by the city commercial bank and its wealth management companies, accounting for 26.06%, and the yield The lowest proportion is only 8.97%. At the same time, due to factors such as the adjustment of the capital market, some products have suffered losses. Among them, state -owned banks and their wealth management companies have the highest proportion of losses, 7.41%; followed by shares and their wealth management companies, losing products account for 4.32%.

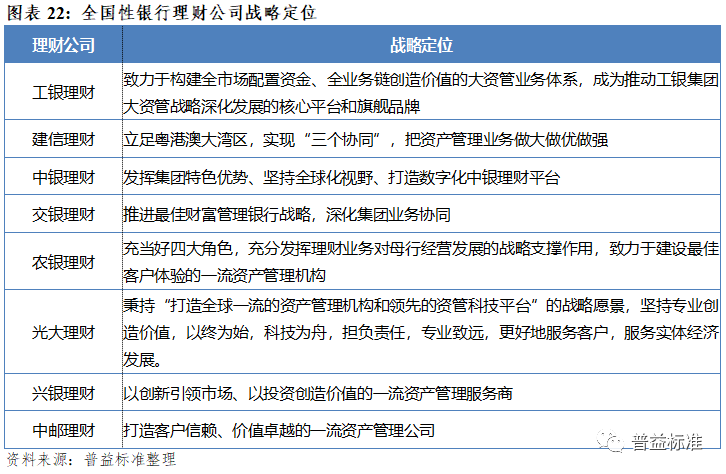

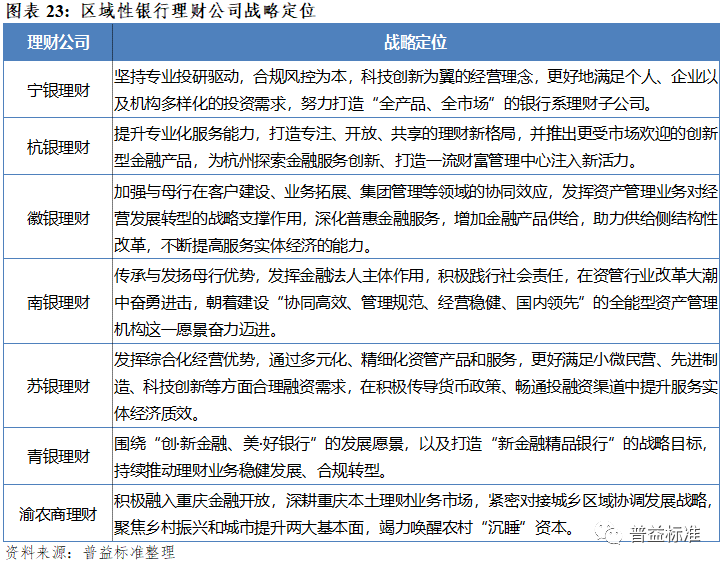

5. Diverse strategic positioning of wealth management companies, deeply cultivate their respective advantages areas

For state -owned holding banks and joint -stock banks, its strategic positioning of wealth management companies focuses on the comprehensive service provider model. State -owned banks and shares have obvious advantages in customers, channels, and talents. The product line layout is relatively complete, and it has resources and strength to form a comprehensive service provider model. At the same time, some state -owned banks or shares through the method of participating in shares or holdings, and its own asset management institutions such as public fundraising funds and trust companies, through the collaboration with other asset management institutions under the group, will provide customers with a comprehensive and integrated one -way and integrated one. The comprehensive service of Hua. From the perspective of the strategic positioning of the Dakang Financial Company, which has been approved, its main characteristics are: First, on the basis of comprehensive and comprehensive development, the entire market allocation funds and the layout of the entire industrial chain are realized, and according to their own own of their own own, and according to their own own of their own own, they are based on their own own. Comparative advantages are looking for specialized business directions; the second is to serve the strategic goal of serving the parent group business, achieve business collaboration with the group, and give full play to the advantages of parent resources. For regional banks, its wealth management companies are more inclined to core service provider models or professional service provider models. Regional city commercial banks and rural banks are relatively limited in customer resources and comprehensive capabilities, and the development and differentiation are serious. They are relatively disadvantaged in the competition in the national market. The business model or professional service provider model will be a better choice. The wealth management company of regional banks mainly develop special products and services, consolidate the regional market, and seek gradually opening the national market in the future.

Four

Where is the bank wealth management road?

(1) After the transformation of net worth, bank financial management is facing new challenges

With the end of the transition period of the new regulations of asset management, the transformation of the comprehensive net worth of banks' wealth management has been completed, and the wealth management market has faced a new change. Wealth management companies have some development difficulties in the capital end, asset side, and operating terminals. Specifically, the capital side, it is difficult for investor investment concepts to change from "guaranteeing capital and guarantee income" to "sellers responsibilities, buyers are responsible", resident investment concept still has a lot of room for optimization, investor education is far away; wealth management company marketing channels Relying on the parent channels, the ability to independently expand business channels is limited, and the development of marketing channels is still in the exploration stage. The transition period of the new regulations for asset management is over, and the layout of equity products is developed in an orderly manner. However, compared with securities firms and public funds, there is still a gap in equity investment capacity. The operation side, system construction urgently needs to be optimized, the talent gap is obvious, and the independent risk control system needs to be improved.

1. Fund side -investor education is far away, and the marketing channels of wealth management companies are still exploring

Investor education has less investment, and investor education is far away. At present, there are still uncertain factors in the economic environment at home and abroad. The financial market disturbances are constantly disturbing, and the fluctuation of net worth of bank wealth management products has increased. In addition, investors are still more sensitive to net value fluctuations, and the correct investment concept has not been fully established. Banking institutions still need to continue to work in investor education. In addition, according to the statistics of the banking wealth management registered custody center, the number of bank wealth management investors in 2021 increased from 22 million in December 2019 to more than 80 million, of which individual investors accounted for more than 99%. It is expected that investors will exceed 1 in 2022 100 million people. This shows that the decline in bank wealth management investment threshold has attracted a large number of long -tailed groups. As the scale of investors increases rapidly, and the complexity of the investment environment, marketing pressure has increased significantly. The growth rate of bank wealth management in investor education needs to further increase the scale of investors with high -speed growth and complex investment environment changes. The road of investor education is still long -term.

The marketing channels of wealth management companies are still exploring, relying on the parent channels. Wealth management companies have a short period of establishment, large business scale and rapid growth. The sales channels are mainly based on the three methods of mother bank, direct sales and interbank agencies. As the construction of marketing channels for wealth management companies has just begun, the increasingly fierce market competition environment is usually used directly to use the parent channel resources. The marketing channels of wealth management companies depend on the parent channels, which has limited capabilities to independently expand business channels. At the same time, due to excessive dependence on the parent channel, wealth management companies also have hidden dangers in risk isolation. Mother bank and bank wealth management companies are mostly vertical relationships in business and personnel management. They fail to meet the requirements of independence and risk isolation, and it is easy to breed moral risks. In addition, there are many challenges in the construction of direct sales and agency channels for wealth management companies. Direct sales have high requirements for customer base scale and corporate information systems. The construction of direct sales channels for wealth management companies must conduct comprehensive consideration of cost benefits. Although the agency sales have gradually become a trend, it is usually only manifested as product shelves and display related products. It fails to provide comprehensive services and a single marketing model.

2. Asset side -the ability of equity asset investment research to be strengthened to be strengthened

Equity asset investment research capabilities are not yet mature. Compared with experienced public equity, private equity funds, securities asset management and other financial management institutions, bank wealth management companies are relatively weak in terms of investment strategy, asset allocation, risk control management, investment research capabilities and investment consulting experience. The traditional advantage of bank wealth management is that credit bonds and non -standard investment, and there are certain shortcomings in the construction of equity investment capacity. In terms of allocation ratio, the proportion of bank wealth management equity assets is usually less than 3%, and some small and medium -sized banks or wealth management companies have unsatisfactory equity assets. In addition, bank wealth management currently relies on the way to seek third -party professional investment management to lay out equity assets. It is not deep enough to understand the rights and interest markets. In the case of huge fluctuations in the market in the short term, it is impossible to quickly adjust the strategy based on changes. With the advancement of bank wealth management, if the situation has not improved accordingly, it will affect the operation of wealth management products. 3. Operations -technology fails to deeply integrate with finance, and comprehensive risk control management needs to be improved

The construction of the system is to be improved, and technology has failed to integrate in depth with finance. With the digital transformation of the banking industry, the importance of digitalization and system construction of wealth management business is even more prominent, but the system construction of bank wealth management is limited by the complexity characteristics of the wealth management business itself and the greater early input cost, which has not yet improved. Technology The fusion depth with finance needs to be strengthened. For banking institutions, the relevant system -related system of wealth management business is still in the early stages of construction and basically meets business operation requirements, but failed to give full play to technology in product innovation, customer acquisition channel exploration, risk intelligent early warning, lightweight midfield, improvement of investment and research capabilities, improvement of investment and research capabilities, improvement, and improvement of investment and research capabilities. The empowerment effect on resource allocation efficiency. From the perspective of business, the customer acquisition channels of wealth management business are more dependent on their own or parent channels. The construction of online channels needs to be improved, and wealth management products have not been able to match customers through the information system. Essence

Insufficient risk management capabilities, weak product stability, comprehensive risk control management needs to be improved. With the transformation and development of the wealth management business, the scope of bank wealth management is widened, and the types of investment targets are richer. In the context of the transaction model and rigorous supervision, the difficulty of banking management risk management has continued to increase, which further affects the stability of wealth management products. The current institutions are in the initial construction and exploration stage of risk rating and risk early warning capabilities in wealth management products. They have not formed a perfect system. The risk control capabilities in the process of promoting the wealth management business are limited. At the same time, in order to adapt to the completion of the transformation of the net value of the product, the bank wealth management institution has implemented a variety of combined products, but the proportion of high volatile assets and stable income assets needs to be optimized, and the product stability is insufficient.

(2) Looking at the future, how can bank financial management break through the dilemma?

In order to be more efficient in the wealth management business, at the capital side, wealth management companies need to thoroughly implement investor education and increase investors' recognition of net worth products; on the asset side, accelerate the layout of the pension and green financial fields, continuously improve the product system, enrich Service types; on the operation management side, adhere to stable operations, improve risk management and control capabilities, and continue to improve the investment and research system, and improve scientific and technological empowerment.

1. Fund side -explore effective investor education methods, and establish their own sales channels

In the long -term "rigid" environment, Chinese investors lack channels for understanding the relationship between risks and income, and different investors have different acceptance of "breaking the rigid". Bank wealth management companies should explore effective investor education methods and guide investors to establish the financial concept of "the seller's responsibility and the buyer should be responsible". At the same time, the establishment of its own sales channels to reduce dependence on mother.

Explore effective investor education methods. First of all, wealth management companies can deepen investor education from three aspects: decision -making education, asset allocation education, and equity protection education. In terms of decision -making education, we will popularize financial knowledge, risk income and financial information to investors; in terms of asset allocation, we will create a sense of diversified allocation for investors, and pay attention to the sustainability and integrity of asset allocation; Persons establish a sense of self -protection and set up a consumer complaint processing mechanism within the institution.

Secondly, wealth management companies should improve the professional level of wealth management managers to build an investor "guardian barrier". On the basis of traditional training, the professional training of financial management managers can be strengthened through the internal training of sales staff and organizing competitions to avoid the situation where investor education is not in place during the marketing stage of wealth management products, so as to build investor education first first The "guardian barrier".

Finally, investor education of wealth management companies should explore different investor education methods for different customer types in combination with the development trend of the Internet. Relying on the existing platforms, do a good job in the operation and maintenance of online platforms such as the company's portal, WeChat public account, and embedded investor education in online propaganda, and deepen investor education. At the same time, combined with live broadcast methods, build a interactive communication platform with customers, continuously optimize the display function of electronic sales channels, improve customer experience, and match different types of investors to match personalized investor education.

Establish own sales channels. For a long time, relying on the wide customer foundation of commercial banks, wealth management companies must rely on the channels of mother banks to carry out marketing in the early days. Double -wheel drive. In the short term, wealth management companies can conduct targeted construction according to their mother bank and their own resource endowment. For example, the section of the neighborhood with large traffic is "intelligent, networked, interactive, and comprehensive". "Practical Principles" and "Effect Principles" conduct operation services. On the online side, improve the qualification registration certification such as the official website, WeChat public account, video header number and other subject qualifications, focus on distinguishing from the positioning of the mother, focus on the "financial management business" to improve the content and function construction of the module The remaining business scenarios are selected; at the same time, the company's brand image and reputation can be carried out with the help of mother banks and agency channels to enhance the level of customer cognition and recognition, and to stimulate customers to reach the number of direct sales channels for wealth management companies through scene settings.中长期来看,在已有直销渠道的基础上,理财公司需要建设具有特色并且完善的产品线,做好客户服务和维护,提升自身投研实力,稳定理财产品收益水平,提升客户转化率和Dependence. 2. Asset side -improve the product system and make efforts to innovate products

Clarifying business positioning, based on "solidarity+", improves the product system. With the expansion of the scale of Chinese residents, the increasing competition in the wealth management market, the diversified development of investors' demand, and the demand for bank wealth management companies in innovative products has become more and more obvious. Therefore, bank wealth management institutions must continue to explore the "solid income+" model, and on the basis of making full use of the advantages of the fixed income field, by increasing the allocation of multiple types of assets, adopting multiple types of strategies, grasping the development opportunities of the capital market, taking into account low volatility and realization compared High elastic income. At the same time, the investment and research system is an important support for product innovation, and it is also an important foundation for improving the ability of bank wealth management assets. Bank financial management should be more emphasized more emphasis on the construction of investment systems mainly based on large -scale asset allocation, and in terms of asset operation methods, it is equal to the maturity of holdings and transactions; the second is to emphasize the matching of assets and long -term liabilities. Strengthen the control of interest rate risks and investment risks; the third is that product pricing pays more attention to interest rate changes, emphasizing the analysis of full macro market and interest rate trend, and based on product characteristics and the types of investment in the production, finally determine the long -term period and price.

Focusing on national strategy, focusing on product innovation, and focusing on key areas such as pension financial management and ESG industry. As far as pension and financial management is concerned, active response to the aging of the population is one of the national key strategies during the "Fourteenth Five -Year Plan" period. On September 10, 2021, the China Banking Regulatory Commission issued the "Notice on the Pilot on Pension Wealth Management Products" and launched the pilot of pension wealth management products of "four places, four institutions" on September 15, 2021, which promoted the third pillar pillar pension financial product For rich development, all bank wealth management institutions should actively seize the development opportunities of pension wealth management products, promote the establishment of the diversified development pattern of pension finance, and steadily promote the development of commercial pension finance. As far as the ESG industry is concerned, with the establishment of long -term strategic goals such as "common prosperity", "carbon peak, carbon neutralization", the development prospects of the ESG industry are worth looking forward to. Has stronger risk resistance. Bank wealth management integrate ESG investment concepts into the operation management of wealth management products. It can strengthen product stability while ensuring relative benefits, better serve the green economy, and help the country's sustainable development strategy.

3. Operations -accelerate technology empowering finance and enhance comprehensive risk management capabilities

Adhere to the concept of steady business, prevent financial risks, and improve comprehensive risk management capabilities. With the transformation and upgrading of the wealth management business, the difficulty of banking management risk management has been improved accordingly, and risk management, as an important fulcrum to support the long -term stable development of wealth management business, runs through the entire process of business development. Risk control.

In terms of the construction of risk mechanisms, bank wealth management companies should establish and improve product risk management mechanisms and structures, establish independent risk management and control departments and positions, and equipped with corresponding risk control management personnel. , Continue to improve the company's risk control management system. In terms of risk management responsibilities, the board of directors, the board of supervisors, the supervisory committee, the supervisory level, the manager, the departments, the branches and the subsidiaries fully fulfill the policies and mechanisms of the risk management, and clarify the responsibilities and risk responsibilities of the investment operation management and risk of the principals of wealth management products. In terms of risk and early warning capabilities, bank wealth management companies can improve the timeliness and effectiveness of information acquisition through active cooperation with third -party cooperation to strengthen the liquidity risk management of wealth management products. At the same time, wealth management companies need to further enrich risk management tools. The implementation of risk management including system, risk type, and business is implemented.

Accelerate technology empowering finance and embed the digital platform in front, middle and background. At present, the financial technology of banking company is in a preliminary construction stage. The investment in the construction of information system construction is large. In the future, the demand for technology investment must be continuously increased to improve the efficiency of enterprise. Specifically, on the one hand, bank wealth management institutions should infiltrate intelligence and automation into the application scenarios to promote the efficient transformation and development of the business and effectively solve the pain points of the management level and business level. On the other hand, optimize the internal information system according to the new financial instrument standards to meet the regulatory requirements. At the same time, wealth management companies can embed digital platforms in front, middle and background. In the front desk, the development of online business is more accurate to match the positioning customers and potential customers. In terms of intelligent operations, we can empower the wealth management company, explore its own channel construction, and establish online direct sales channels in the form of APP. In the middle and platforms, the full process integration system is introduced to improve the cooperative efficiency, operating efficiency of the mid -to -back team, and run through the risk management system between various departments and processes. [1] The duration of bank wealth management products as of June 30, 2022.

[2] This data is the latest data disclosed by the Puyi Standard.

[3] Only samples of subdivided products have been disclosed in the survival of solidaries wealth management products. Among them, pure solid -collection products refer to the financial management funds to bond assets, and those who invest in non -standard debt assets are included in the "solid income+" product category.

[4] The business scale data of the wealth management company has both its own caliber and the group's caliber.

Author 丨 Puyi Standard Researcher Yu Yaqin Lei Wenjie Jiang Ling Luoqian

- END -

The first batch of business completion testing of the "New International Trade Service Platform" of the Beijing Free Trade Zone

On June 15th, with the official start -up function test with the New International Trade Service Platform (offshore trade background verification information service platform) with the Beijing Free

International oil prices returned to the level half a year ago, and experts said that it was conducive to the steady development of China's economy

Since the beginning of this year, international oil prices can be described as twists and turns. After the previous two waves, the international oil prices were now returning to the $ 90/barrel near M