75 basis points!The Federal Reserve has a maximum interest rate hike in 28 years.

Author:Securities daily Time:2022.06.17

Reporter Liu Qi

At 2 am on June 16, Beijing time, the Fed announced the statement of the Federal Public Marketing Committee (FOMC) meeting in June. According to the statement, the Federal Reserve raised 75 basis points between the target range of the federal fund to 1.5%-1.75%. This is the largest interest rate hike since the Federal Reserve since 1994, and even the Fed Chairman Powell has evaluated "the interest rate hikes of 75 basis" ‘extraordinary’.

The statement also shows that the committee will continue to reduce its national debt and institutional debt, and mortgage loan support securities (MBS), as described in the "Plan for Reducing the Federal Reserve's balance sheet" released in May. The committee is firmly committed to restoring the inflation rate to 2%of the target.

Regarding the Fed's radical interest rate hike in June, Luo Zhiheng, chief economist of Guangdong Securities, told the Securities Daily reporter that the United States "inflation is theory" is falsified, and currency tightening will inevitably increase. Previously, the benchmark hypothesis of 50 basis points in interest rate hikes was that inflation decreased, but the United States in May in May of the United States exceeded the expected innovation high year -on -year. Therefore, the Fed tightened the currency further, and the range and rhythm of interest rate hikes would increase.

75 basis points to raise interest rates to curb inflation

The interest rate hike at 75 basis points is undoubtedly the most direct response to the Fed in May. According to data recently released by the US Department of Labor, the US CPI in May increased by 8.6%year -on -year, and continued to refer to a new high since December 1981, which announced that the hope of U.S. inflation before the June interest conference was shattered.

"Because of this, the Fed needs to take a more" eagle faction "measure at this meeting to restore the serious consequences of underestimating inflation." Zou Ziang, a researcher at the Bank of China Research Institute, told the Securities Daily reporter that in this context, the Fed broke through this background, the Fed broke through The interest rate hike path with 50 basis points is taken as a pace, and a larger interest rate hike measure is taken.

Will the radical interest rate hike rhythm continue? Powell did not give a clear answer. He said at a press conference after the meeting that the interest rate hike at 75 basis points was "extraordinary", and it is expected that this amplitude rate rate hike is not common. From the current point of view, the next meeting (July) to raise interest rates 50 basis points or 75 basis points is possible.

From the perspective of many analysts, Powell's policy position is more compared to market expectations.

According to the medium value of the Federal Reserve in June, the federal fund interest rates in 2022, 2023, and 2024 are 3.4%, 3.8%, and 3.4%, respectively. The expectations given in March are 1.9%, 2.8 2.8 %, 2.8%. Of the 18 members, 13 are expected to reach or higher than 3.25%-3.5%higher than the end of 2022; 16 are expected to reach or higher than 3.50%-3.75%higher than the end of 2023.

If the Fed raised interest rates to 3.25%at the end of the year, it means that there will be 175 basis points in the year. CITIC Securities Chief Economist said in an interview with the Securities Daily reporter that considering that the inflation may still be at a high level in the near future, the 75 -basis point of interest rate hikes will continue to raise interest rates in July. Inflation.

Li Chao, the chief economist of Zhejiang Business Securities, believes that although Powell is slightly obvious, the interest rate hike in July is still a high probability of 75 basis points. Essence

Global financial risk upward

What impact does the Fed's interest rate hike affect the financial market? Wu Chaoming, deputy dean of the Caixin Research Institute, told the Securities Daily that the Fed's tough interest rate hike is expected to drive the global liquidity to further shrink, bringing new challenges and uncertainty to the current severe global economy and financial situation. Inside will face the situation of high interest rates, high inflation, high debt and low growth. In this context, the global stocks, bonds, and exchange market fluctuations may increase significantly, cross -border capital flow may be more unstable, and global financial risks tend to rise.

From the perspective of the US market, after the 75 -basis point rate hikes, US stocks have more positive feedback. As of the close of June 15 local time, the Dow Jones Index closed at 30668.53 points, an increase of 1.00%; the Nasdaq Index closed at 11099.16 points, an increase of 2.50%; the S & P 500 index closed at 3789.99 points, up 1.46%.

"There is room for restoration in the short term of US stocks, but the mid -term triple pressure, especially the growth style has been impacted." Luo Zhiheng believes that on the one hand, liquidity tighten valuation pressure. US debt yields have risen sharply, mainly driven by actual interest rates, and the tightening of monetary policy is expected to lead to downward market risk appetite, and growth stocks with high valuations have been further under pressure. On the other hand, the macro demand has weakened after interest rate hikes. Previously, high growth and high prosperity may be faked. In addition, after risk -free interest rates, the difficulty of financing for corporate financing will increase, and the efforts of supporting stock prices will weaken through repurchase stocks.

In terms of U.S. debt, after the Fed announced a rate hike 75 basis points, the 10 -year US debt yields have briefly upward. After Powell's relatively pigeon speech, the 10 -year US debt yield shook down. According to data from the US Treasury Department, the local time closed on June 15th, and the 10 -year US debt was reported 3.33%, down 16 basis points from the previous transaction 3.49%.

- END -

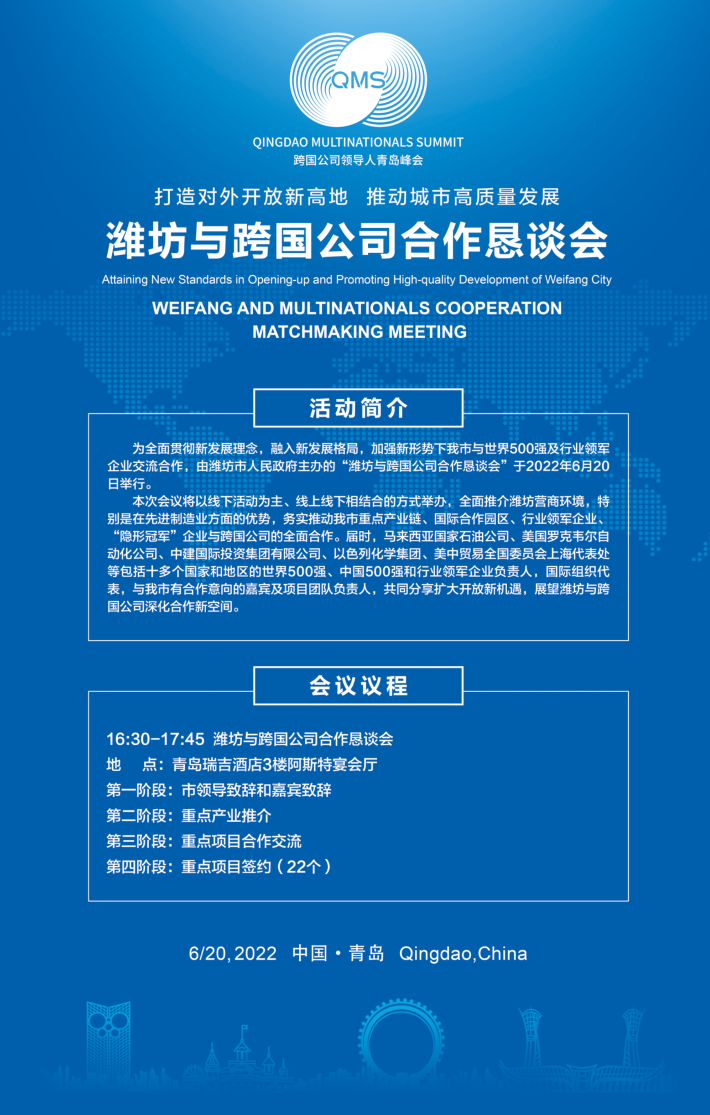

By the summit Dongfeng to promote the development of Weifang -the cooperation between Weifang and the multinational company will be held on June 20

Weifang Daily Weifang Rong Media News in 2022 will be held in Qingdao from June 19...

Agricultural issuance of Jiangyan District Sub -branch and Jiangyan Rural Commercial Bank signed a comprehensive business cooperation agreement

Agricultural issuance of Jiangyan District Sub -branch and Jiangyan Rural Commercial Bank signed a comprehensive business cooperation agreementOn the afternoon of June 15, the Jiangyan District Sub -b