There are also national -owned banks to receive a tens of millions of yuan!During the year, the six major banks had a fine of over 172 million, and 60 % of the loan business violated regulations.

Author:Broker China Time:2022.08.07

Recently, many state -owned banks have settled 10 million yuan in fines!

On August 5th, according to the official website of the China Banking Regulatory Commission, the Shenzhen Banking and Insurance Regulatory Bureau issued 13 tickets to the Bank of China Shenzhen Branch and relevant responsible persons. 12 illegal acts including export dual factoring, Rongxinda business, investment bank wealth management business.

Coincidentally, on July 28, the Shanghai Branch of Industrial and Commercial Bank of China also landed a 13.1 million yuan ticket, including 10 illegal acts such as "wealth management funds illegal for the payment of land funds, and the use management seriously violated the rules of prudential business". In addition, a responsible person was warned.

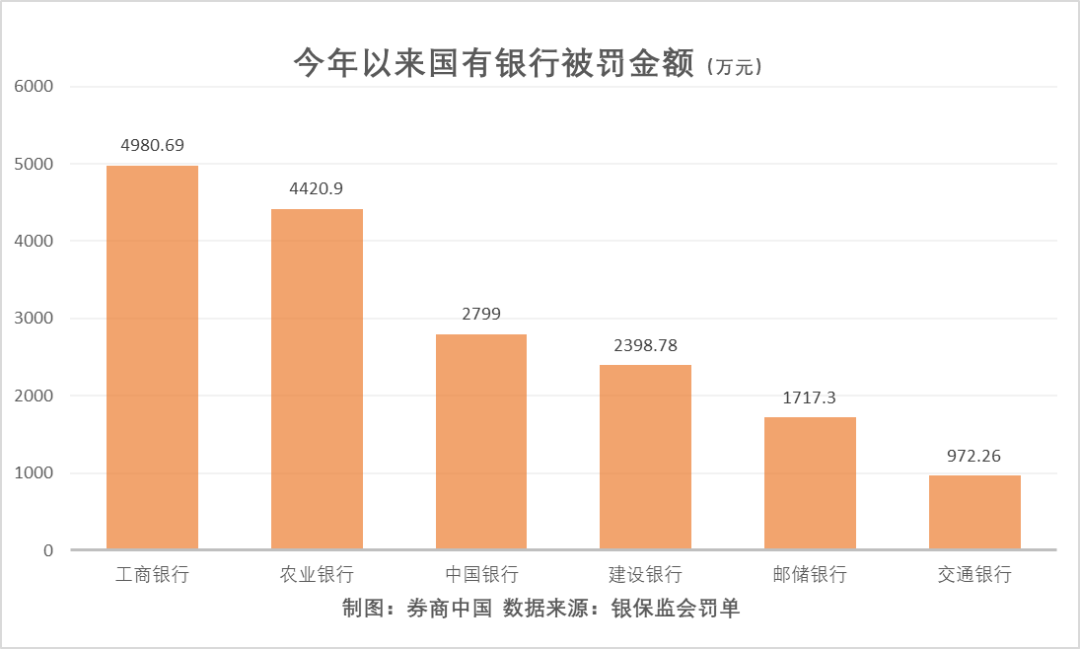

As of August 5th, according to the incomplete statistics of Chinese reporters of securities firms, the cumulative amount of penalties for the six major state -owned banks had exceeded 172 million yuan. Since the beginning of this year, the highest penalty of state -owned banks was ICBC, with about 49.807 million; the minimum fines were Bank of Communications, 9.723 million.

ICBC and Bank

On August 5, the official website of the Banking Insurance Regulatory Commission disclosed 13 tickets for Bank of China Shenzhen Branch and relevant responsible persons. In addition to the bank's fines of 11.3 million yuan, 12 other responsible persons were warned or fined, and four were prohibited from working in the banking industry for life. The amount of fines was the highest penalty for the Bank of China during the year.

具体来看,中行深圳分行涉及12项违法违规事实:超权限办理出口双保理、融信达业务,投行理财业务;贸易融资业务、投行理财业务“三查”不尽职;回流型保理、 The internal system and R & D procedures of concealed factoring products are not prudent; the scale of factoring financing business exceeds the control of the head bank, and the business exists in legal risks; the risk management department does not perform the duties; No risk prevention measures and timely launching pursuit procedures; deal with trade financing transfer forms in violation of regulations, break through the authority of the head office; use the scale of wealth management to surrender trade financing; the risk of unrealized loan review and effective prevention and control credit concentration; Large credit information communication mechanisms are insufficient; investigation and verification are not in place, and risk investigation is not in place; rotation and mandatory leave, performance assessment, and business data documents are not standardized.

Coincidentally, just a few days ago, ICBC also ushered in the bank's largest number of fines this year. On July 28, the official website of the Shanghai Banking Regulatory Bureau showed that there were 10 illegal acts in the Shanghai Branch and its branches, ordered to correct them, and fined a total of 13.1 million yuan. A responsible person was warned by direct management responsibilities for some violations.

According to the ticket, the illegal and illegal acts of ICBC Shanghai Branch mainly occurred between 2016 and 2020. Most of the cases were illegal of loan business. Specifically, the ICBC Shanghai Branch exists: issuing credit loans to the affiliates; some services have inconsistent quality and prices; some loans have loan fees; some businesses have passed the cost; some charging service content records are incomplete; Land funds, the use management seriously violates the rules of prudential business; provides government financing in violation of regulations; some personal loans are used to restrict the areas; some mergers and acquisitions of loans seriously violate the rules of prudent business; illegal agency sales.

Since the beginning of this year, the six major countries have been fined more than 170 million

As of August 5, a reporter from the brokerage company sorted out the ticket information disclosed by the CBRC's official website to remove the penalty of the punishment as a personal penalty. According to statistics, the number of penalties for the six major state -owned banks during the year was 319.

Among them, the largest number of large behavioral agricultural banks reached 92; the minimum number was the Bank of Communications, 20. ICBC, CCB, China Bank, and Postal Savings Bank received 56, 52, 40 and 59, respectively.

From the perspective of the amount of fines, the six major banks have been fined 172.89 million yuan since this year.

Among them, the highest fined amount was ICBC, with a total of 49.8069 million yuan; followed by the Agricultural Bank of China, it was fined 44.209 million yuan. In addition, the Bank of China was fined 27.99 million yuan, the CCB was fined 23.9878 million yuan, the postal savings bank was fined 17.173 million yuan, and the amount of payment was the least, only 9.7226 million yuan.

According to a reporter from the securities firm, in the above -mentioned tickets, the illegal and illegal regulations of the vast majority of institutions are related to the credit business. There are 189 related tickets, accounting for nearly 60 %. Specifically, the illegal regulations for credit business include: credit management is seriously negligent, pre -loan investigation does not do its due diligence, and loans or loan funds are misappropriated in violation of regulations, especially the illegal flow of loan funds to the real estate or stock market.

In addition to the illegal regulations of credit business, Chinese reporters from securities firms learned based on the relevant ticket analysis that the common violations of state -owned banks also include: collecting various fees from customers, such as handling fees, management consulting fees, pledged evaluation fees, etc.

In addition, the phenomenon of illegal management of employee behavior is generally common. For example, some state -owned employees, illegally help customers to handle credit cards, use credit cards for illegal cash cash, and apply for the important situation of false statement products for sales, exaggerate income, conceal insurance contracts, and inadequate risks. Essence

It is worth mentioning that many state -owned bank branches have been punished for loss, damage, and forgery for financial license.

- END -

Da Mei Bianjiang 丨 Jilin Yanbian: Sanghuang Industry helps rural revitalization

In the midsummer season, in the Yanbian Korean Autonomous Prefecture and Eight Tow...

Taking reform as the driving force, building the foundation foundation for making a strong country

As the heavy weapon of the country, manufacturing is an important force of a stron...