China Securities Association released the list of the latest off -site options dealers: a total of 44 brokers are listed, but these 5 have entered a transition period

Author:Daily Economic News Time:2022.08.06

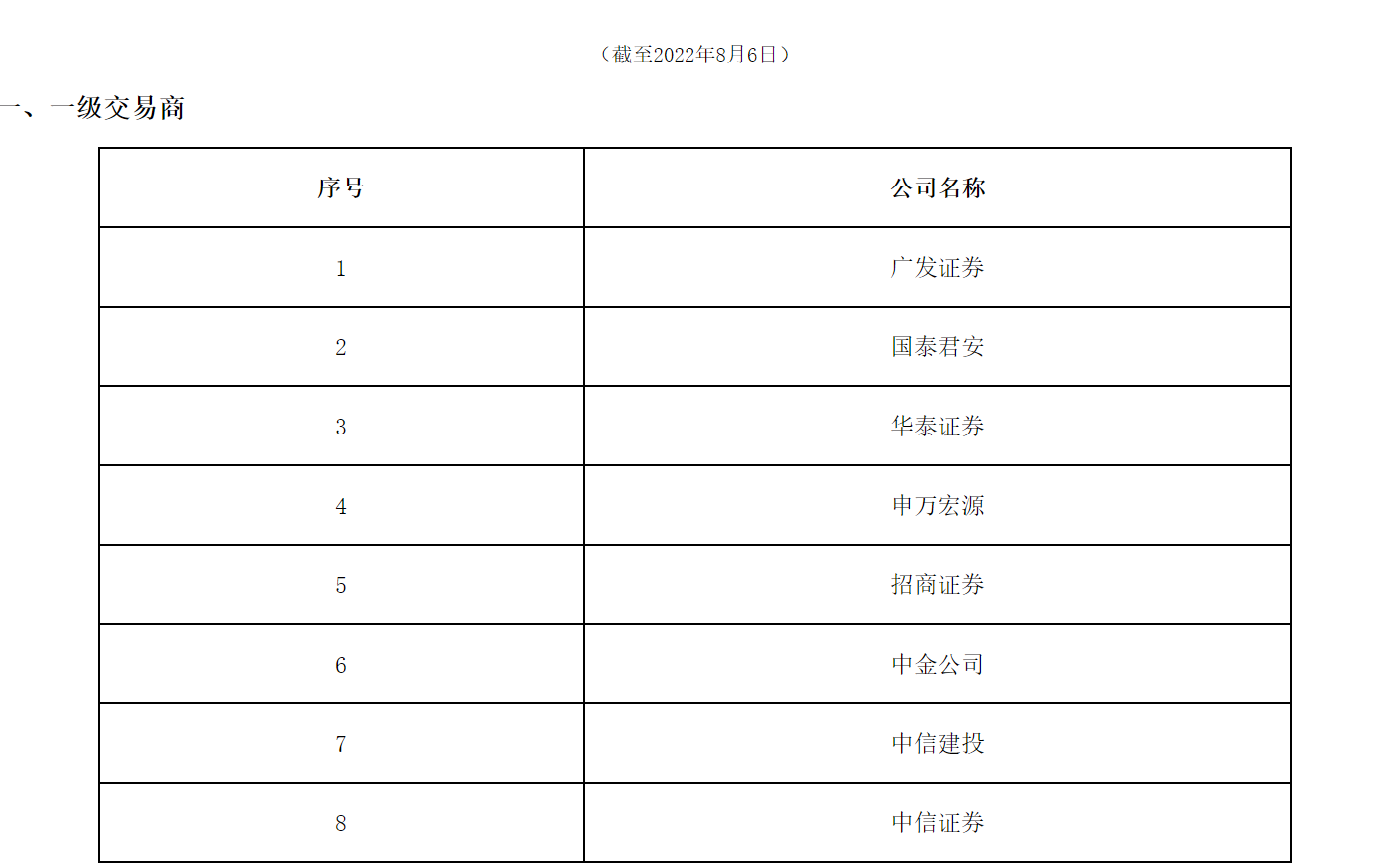

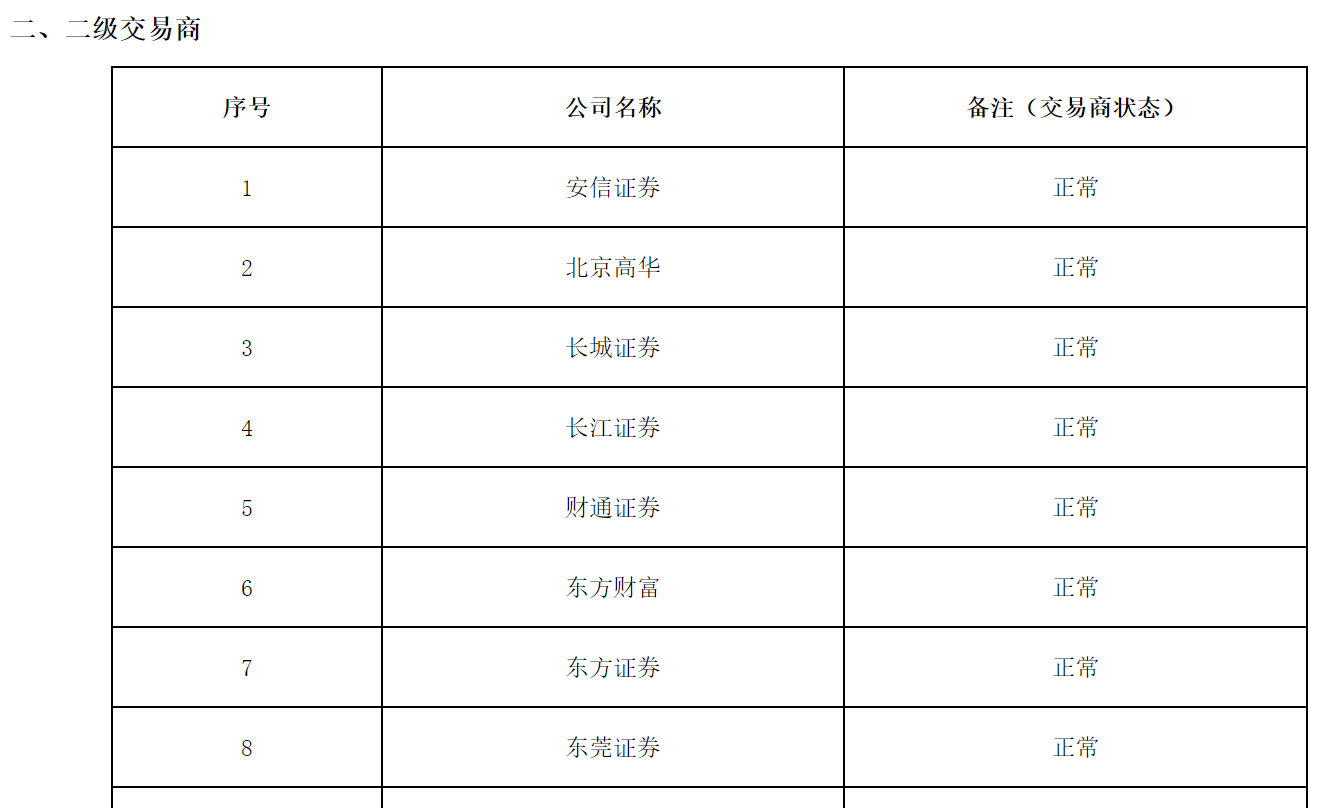

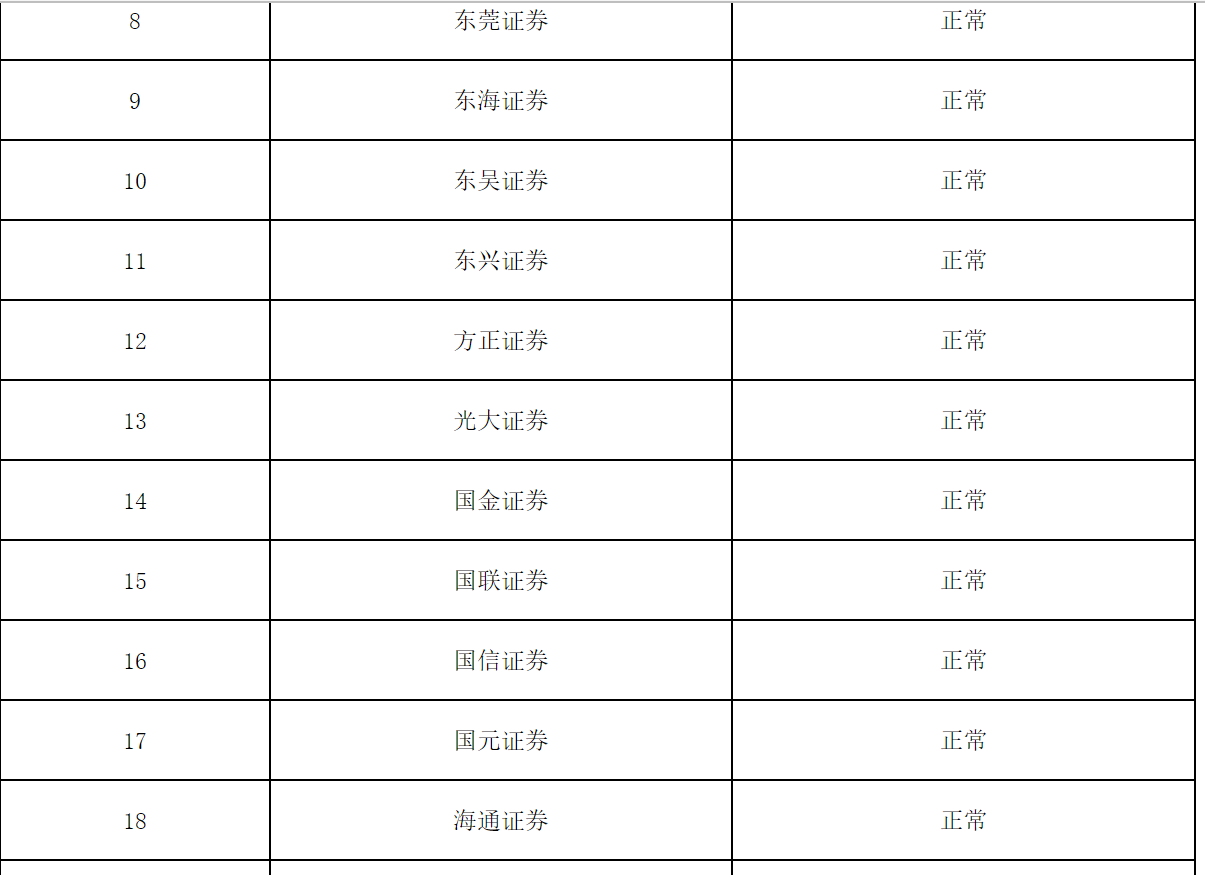

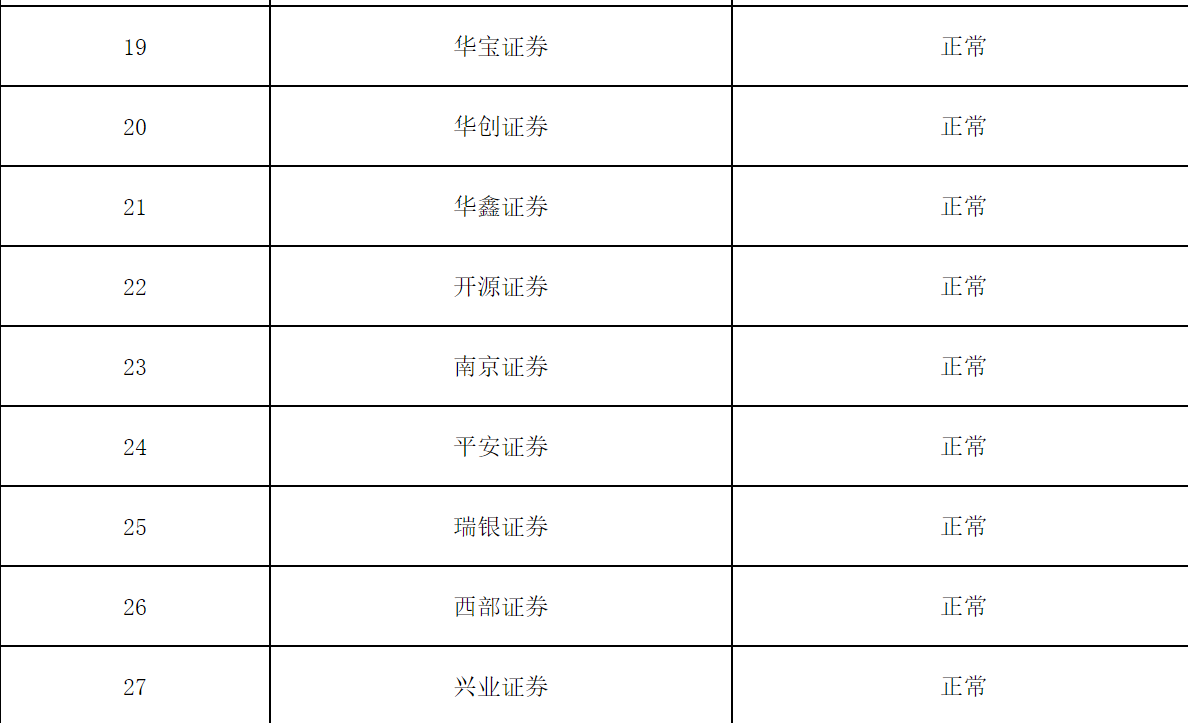

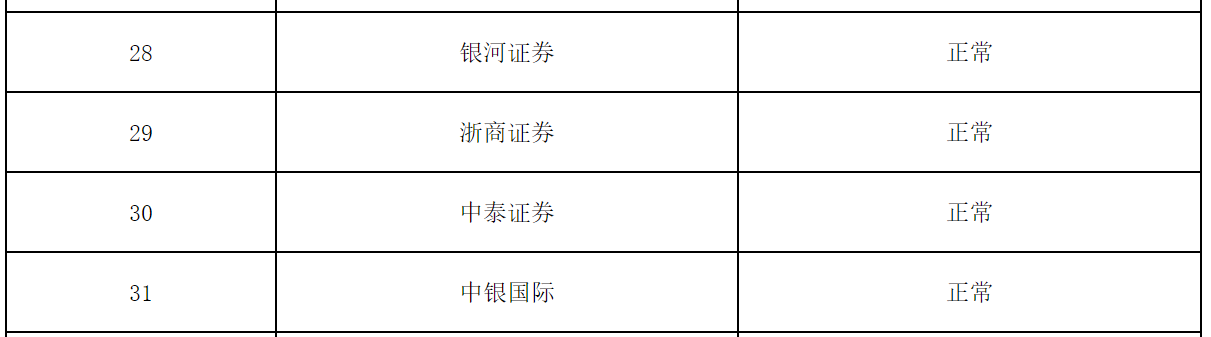

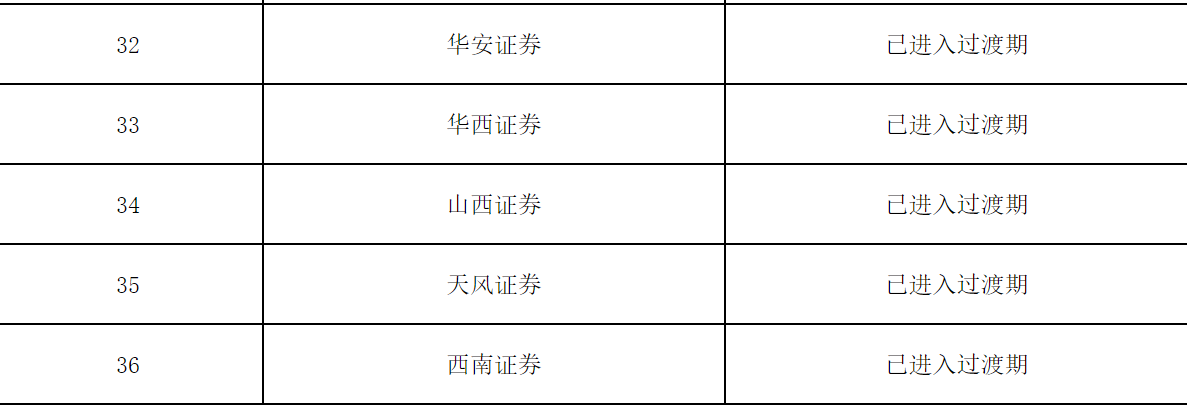

On August 5th, the China Securities Association released the list of the latest out -of -the -market options dealers. A total of 8 brokers were first -level dealers, 36 brokers were second -level dealers, and had 44 -level dealers qualified securities securities securities firms. Family.

8家一级交易商分别是广发、国泰君安(SH601211,收盘价:14.27元,总市值:1271亿)、华泰、申万宏源(SZ000166,收盘价:4.02元,总市值:1007亿)、招商、中Jin, CITIC Jianjian (SH601066, closing price: 25.60 yuan, total market value: 198.6 billion), CITIC.

8 first -level dealers mean that they have received AA -level evaluation this year

The following is a list of first -level dealers and secondary dealers:

"Daily Economic News" reporter noticed that on September 25, 2021, China Securities Coordinated and released the "Administrative Measures for Overseas Observatory Business of Securities Company".

In the management chapter of the dealer, the CSI Association pointed out that the securities company participated in the implementation of the OTC OCCO transactions. According to the company's capital strength, classification results, comprehensive risk management levels, professionals and technical systems, it was divided into first -level traders and and technical systems. Secondary dealer.

Among them, those who have classified rating above AA in the last year are recognized by the China Securities Regulatory Commission and can become a first -level dealer. In the past year, the classification rating is above A level A or a Class BBB level or above. It continues to standardize the business company that operates and professional, technical systems, and risk management meets the corresponding conditions. Those who have a good situation and have no major risk events in one year can apply to the CSRC as a first -level dealer.

Considering that the classification evaluation of the securities company in 2022 has just notified the broker, this means that the above -mentioned 8 securities firms who have been rated as the first -level dealers this year are all AA -level AA.

But it is worth mentioning that there are five brokers entering the transition period, namely Tianfeng, Hua'an, Huaxi, Shanxi, and Southwest.

According to the regulations of the China Securities Association, for the securities company that does not meet the conditions of the dealer, the setting period shall not be added during the transition period. Call out the list of corresponding levels.

However, the reporter of "Daily Economic News" learned that the five of the five brokerage companies (Huajin, First Entrepreneurship, and Sichuan Cai) who did not receive the BBB rating, that is to say, these five brokers were temporarily listed to observe the list. The evaluation results are for another reason.

In June, the Securities and Futures Commission took regulatory measures for the illegal acts of the three head securities malls outside options business

So, what is the difference between first -level dealers and secondary dealers?

According to the regulations of the China Securities Association, the first -level dealers should open a special account of hedging transactions in the Shanghai -Shenzhen Stock Exchange and directly carry out hedging transactions.

The second -level dealers can only conduct hedging transactions on the venue with the first -level dealers, and shall not be able to carry out the opponent of the opponent of the opponent other than the first -level dealers to conduct a hedging transaction; and it should ensure that it is a party with the opponent and the first -level dealer. The transaction elements such as the options of individual stock option contracts, contract period, contract nominal principal, and income structure have been basically consistent.

First -level dealers should perform their duties due to their duties, monitor and evaluate the trading purpose, transaction targets, trading behavior, etc. of secondary dealers and their opponents, and determine whether they accept the concentration of the target whether to accept the second -level dealer's individual stock option hedging transactions If the discovery does not meet the regulations, relevant transactions shall not be carried out. The first -level dealers refuse to accept hedging transactions, and secondary dealers shall not reach a transaction contract with customers.

It can be seen that the first -level dealers have more authority and market position than secondary dealers. However, the China Securities Association also protects the second -level dealers, stipulating that "first -level dealers should establish a fair and fair individual stock option quotation mechanism, and shall not use the transaction advantage status to perform unfair competition."

It is worth mentioning that due to the high degree of complexity of off -site options, regulators attach great importance to the risks of the business to carry out the business. When securities firms have also experienced illegal acts when conducting off -site options.

On the evening of June 2nd, the CSRC disclosed three announcements of administrative supervision measures, all involved an extra -off -option business. The three brokers who were punished are CICC, CITIC Construction Investment and Huatai.

The Securities Regulatory Commission pointed out that CICC has adopted supervision measures with a warning letter for non -professional institution investors for non -professional institution investors. CITIC Construction Investment has also adopted regulatory measures with alert letters due to the excessive scope of the target of the off -site option contract index. Huatai Securities has exceeded the current period of financing and securities and securities and securities and securities and securities and securities and securities and securities. It was ordered by the CSRC.

Daily Economic News

- END -

Auto subscription: a sickle, only cut leeks

The car company is trying to accept the hot water hot frog method to accept the ca...

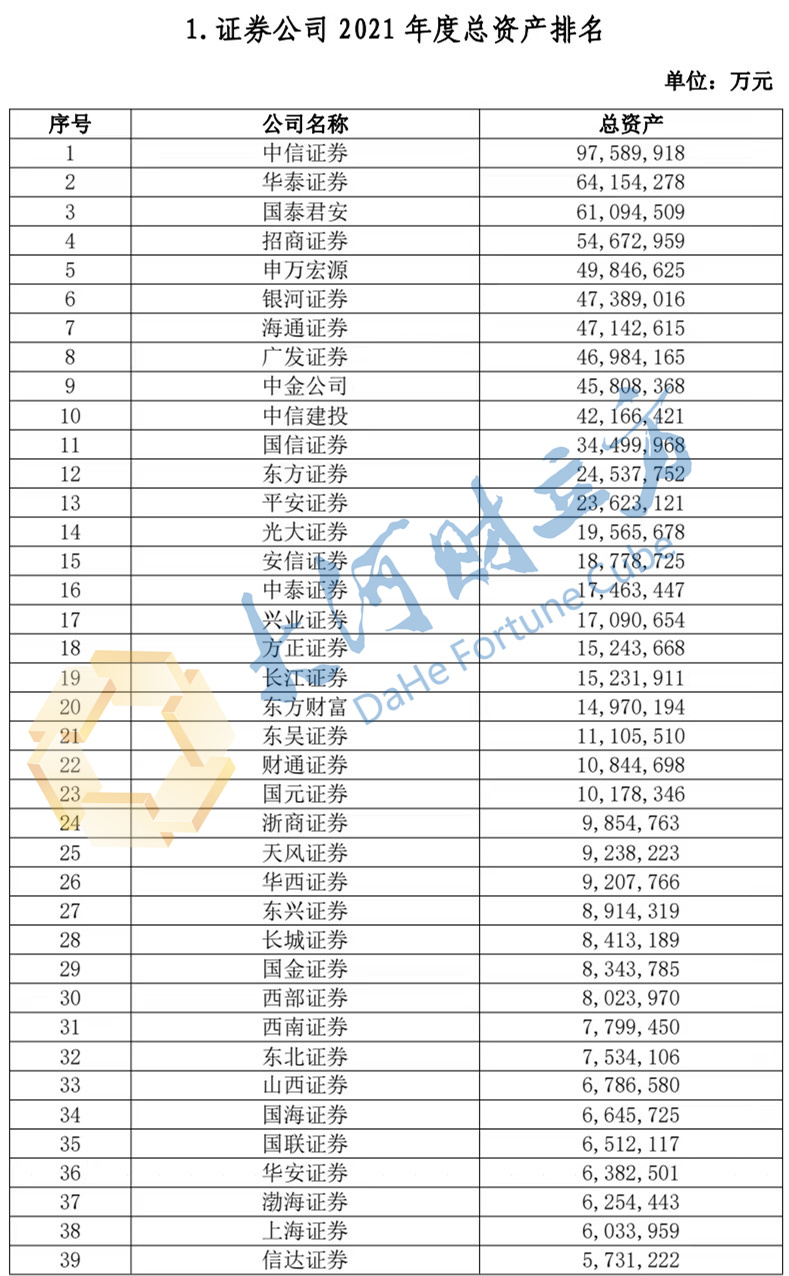

up to date!In 2021, the company's operating performance ranked, and 38 indicators were available

[Dahecai Cube News] June 17 news, a few days ago, the China Securities Industry As...