Daoda Investment Notes: Science and Technology Board is activated again that this round of market has not ended

Author:Daily Economic News Time:2022.06.16

On June 16th (Thursday), the biggest highlight of the A -share market is that the science and technology board is active again.

When this round of market starts, it is the leading sector.

At present, the science and technology board continues to be active, which is also a confirmation of active market. When it comes to the end of the science and creation board, this round of the market may really end.

What needs to be explained here is that Dago must have confidence in the mid -term of the A -share market, and in the short term, it needs an emotional release.

If the Shanghai Stock Exchange Index can be adjusted near the lower edge of the sideways last week, it is an opportunity for most investors.

In the operation, try to choose a greater opportunity to reduce the frequency of transaction. As long as it is not chased at this position, the problem is not big.

10 times the stock with fire a plate

Only three days after talking about New Oriental on Monday, only three days later, Hong Kong Stocks New Oriental Online (HK01797, the stock price of HK $ 28.600, and a market value of HK $ 28.621 billion) rose more than doubled. For more than a month, New Oriental's stock price has risen 10 times from the bottom.

Could it be said that the increase in the stock price is directly proportional to the increase in fans in the live broadcast room? Dago is really stunned. Even if it is foresee that New Oriental will rise online, who can think of it is such a rising method!

It is said that the cargo data of New Oriental live broadcast on Wednesday was more than 50 million. No wonder it can rose 100%directly on Thursday's stock price on Thursday. But having said that, the current situation is more hype, the market can give the valuation, it depends on the follow -up performance data.

Of course, this data is highly probable that the institution is calculated every day in the live broadcast room, and there should be corresponding data flowing in the future. Interested friends can make an estimate compared to the data of other head live broadcast rooms. At present, the market value of New Oriental Online is 28.621 billion Hong Kong dollars. If the valuation of 60 times the price -earnings ratio is calculated, the company's performance requirements are about HK $ 480 million a year.

This performance requirement is not particularly difficult. If it is much cost -effective after rising, then you don't know. New Oriental's online stock price rose sharply, not only driving Chinese stocks for teaching and training, but also for A -share teaching and training stocks. Not only did the continuous "20cm" daily limit stocks, but also educating ETFs also rose daily limit.

New Oriental opened its mind for the transformation of the education industry, and also allowed capital to start re -evaluating the pricing model of the industry. To be honest, the current education sector is more short -term ideas. Could it be that everyone intends to do live broadcasts? The threshold for live broadcasts has not improved, but New Oriental has raised the ceiling, and it may not be easy for other companies in the teaching and training industry to copy.

For the short -term ideas of the A -share education sector, Dago has said enough before. Although it is only a short -term trading model, as long as the risk -based income ratio is controlled and the model is done well, the income should be considerable.

Everbright Securities is weakened and causes concerns

Come back to talk about the market. The latest interest rate hike action of the Federal Reserve has not exceeded expectations. Powell also expressed a pigeon view, and overnight U.S. stocks rose a response. And Da Ge went to see US stock index futures on Thursday, and it also meant to decline. I don't know what kind of means to control inflation in the Federal Reserve. It is estimated that the traders of U.S. stocks understand this way, otherwise I won't go to the stock index futures. Fortunately, the decline in this US stock index futures has little impact on A shares.

On Thursday, the Shanghai Stock Exchange Index was adjusted by the drive of the securities company. The most typical is the weakening of the leading Everbright Securities (SH601788, the stock price of 18.49 yuan, and the market value of 85.253 billion yuan), which triggered market concerns.

Everbright Securities rose by 9%in the early morning, and the closing of the market fell 7%, and a single -day transaction was 12.4 billion yuan. Da Ge looked at the Dragon and Tiger List after the market, and there was a north -direction fund operation, and he still bought it.

Whether the market's market market will end, and the next few trading days may have to look at Grand Securities. If Everbright Securities has continued to fall and even shrinkage and fall, the brokerage stocks may be such a wave of markets.

New news came on Thursday. Everbright Securities (Hong Kong) was fined 3.8 million Hong Kong dollars for violating the regulations on cracking down on money laundering. If the stock price of Everbright Securities can stabilize under such a sharp air, it means that there is still a chance to have a chance to have a brokerage stock.

Differential differences are the test gold stones for inspection. For example, this round of car stocks rose sharply. During this period, there were several differences. Big tickets such as Changan Automobile and Great Wall Motors often used a horizontal vibration to digest the difference. Marvel market.

As Everbright Securities drives the decline in financial stocks and the overturning of the car stock, the market has once again entered a more chaotic situation. Many themes are rising, but there is no clear main line. Holding group. Investors should still be alert to such a disk without obvious main line.

The defense sector is active, and the industries related to consumption -related industries such as charm and salt sauce vinegar tea, pork, medicine, tourism, clothing, shoes and hats are the focus. This defense sector can do some low -suction operations. (Zhang Daoda)

According to the latest regulations of relevant national departments, this note does not involve any operating suggestions, and the risk of entering the market should be borne.

Daily Economic News

- END -

2022 "Qilu Grain and Oil" Fuzhou Promotion Conference was successfully held

Qilu.com · Lightning News, June 18, Shanhai Tongyun, Lu Minrong. On the morning o...

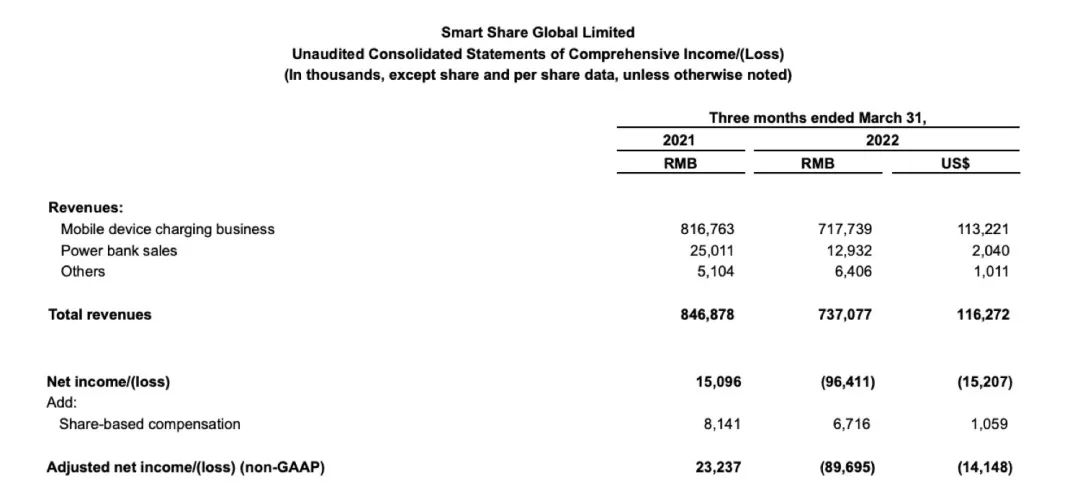

Shanghai revenue dropped by 93%, and the monster charging monsters under the epidemic losses for three consecutive quarters

On the evening of June 15, the Share Charging First Share Monster Charging (EM.US)...