AI company listing dilemma: Show muscle era is far away, or there is no new story

Author:Starting line of entrepreneurs Time:2022.08.05

Produced | Bullet Fortune

Author | Yin Tai Bai

Edit | Egg

Since AlphaGo defeated the Go world champion Li Shishi in 2016, 6 years have passed in a blink of an eye. The AI industry has gone through a stage of development from extremely high to rational regression. With the continuous promotion of capital and policies, AI companies are listed. It has also accelerated repeatedly.

Following AI companies such as Shangtang Technology, Hikvision, Guling deep pupils, Eagle Hitomi Technology, and Yuncong Technology, Sib Chi also launched an impact on the capital market.

On July 15th, the official website of the Shanghai Stock Exchange showed that the application of the IPO of Sibich Science and Technology Board has been accepted, and the latter intends to raise 1.033 billion yuan. Siba is a dialogue -type artificial intelligence platform enterprise. Based on the company's independently developed, the new generation of dialog -style man -machine interaction platforms and artificial intelligence voice chips are provided to provide artificial intelligence technology and product services combined with software and hardware.

"In summary, Sibi has a three -purpose purpose: first, augmented cash flow; the other is to increase the research and development investment and upgrade of core technologies; the third is to continue commercialization and landing." Wu Hao, an analyst of AI industry, told "Bullet Fortune".

In fact, not only thinking about impacting the capital market, according to incomplete statistics of the "Bullet Finance", as of now, at least 20 AI and AI related companies have been listed or promoted to the listing process.

AI companies have come, but unfortunately, the capital market seems to be unable to accommodate the "big money burning households", and this industry has not been able to tell more attractive new stories.

1. Investors tend to be rational

Why is AI company attached to the market? Prior to this, a person in the AI industry told the "Bullet Finance" that AI companies have invested high research and development. If they have not been listed, and the pressure of funds brought about by continuous losses, once the investment institution loses confidence, then AI companies will be Facing the risk of global collapse.

However, a number of investors told the view of "bullet wealth" that even if AI companies can be listed smoothly, their prospects are not optimistic. "AI companies are full of scientific and technological content, but they often make money and not make money. Listing does not mean once for all. "Li Lei, an investor in the AI industry for a long time.

(Figure / Photo Network, based on VRF protocol)

"The listing of AI companies is actually only the first step. In the long run, it is still necessary to focus on the scale of revenue, R & D investment, fund reserves, product performance, and commercialization." Investor Wu Kai said.

Wu Kai is still unprepared to this day. "On July 20, 2020, the stock price of the first day of Cambrian listing soared nearly 290%, and the market value once exceeded 110 billion yuan!" A kind of pride of "spring breeze proud horseshoe disease".

However, with the ups and downs of the Cambrian stock price and falling along the way, Wu Kai's pride has not been able to last long. As of now, the total market value of Cambrian has evaporated more than 70 billion yuan than the highest peak.

"The air outlet of the AI industry has passed, and now it is not an era when the concept of hype can allow investors to pay orders. If AI companies still cannot show enough competitiveness in the secondary market, naturally they cannot bring investors to investors More confidence. "After studying many AI industry research reports, Wu Kai gave such a conclusion.

Li Lei also believes that in the secondary market, the pursuit of profits is still the first priority that investors upholds, and investors cannot always pay for AI companies that continue to lose money.

In fact, not just investors in the secondary market tend to be rational for AI companies. In the first -level market, investment institutions have also been cautious and rational to AI companies.

Computer vision (Computer Vision) is a well -developed track in the AI industry, but according to statistics from iResearch, 2018 is a period of financing of computer vision track, with a financing amount of 27.3 billion yuan. In 2019 Since the continuous improvement of market saturation, the financing popularity of the track has decreased, and the financing rounds and amounts have not reached the level of 2018. In the first 11 months of 2021, the financing amount of computer vision tracks has fallen to 7.5 billion yuan.

Taking "AI Four Little Dragons" as an example, Shangtang Technology, established in 2014, completed 9 rounds of financing before 2018, and only received 3 rounds of financing after 2018; The latest round of financing, which was established, stayed in 2019 and 2020, respectively. Only Yitu Technology, established in 2012, completed 4 rounds of financing after 2018, but compared with the number of financing rounds before 2018 Far away.

Li Lei said: "I learned from AI investors in the first -level market that there are fewer and fewer new things in the AI industry, and the homogeneity is very serious. Enterprises are getting more and more difficult to get financing. "

From 2016 to 2018, that is, the most popular period of the AI industry, some investment institutions even invest in several AI projects at the same time, because "it is not sure which project can run out in the end."

"The madness of the first -level market is an important reason for the excessive fire in the AI industry. The ripe AI companies have been riding a tiger and have to seek listing to continue their lives. "Li Lei revealed to the" Bullet Fortune ". In Wu Kai's opinion, the root cause of the fact that AI companies are not optimistic are that the AI industry is fiercely competitive. In the later period, it is necessary to continue to invest in research and development. It is neither profitable nor the risk of continuous losses in a short time. "For investors, AI companies It is not a high -quality investment target. "

For AI companies that "high valuations, high research and development, and high loss", as the industry's outlets have gradually gone, listing is almost the last fight, but after listing, it is The key to breaking AI companies.

2. Siby's profit has no solution

In contrast to the pessimism of the first and secondary markets, the AI industry has huge development prospects.

According to the latest report released by IDC, the size of China's artificial intelligence software and application market in 2021 reached US $ 5.28 billion (approximately RMB 33.03 billion), an increase of 43.1%year -on -year.

Among them, the computer vision market achieves a market size of 2.34 billion US dollars; the voice semantic market achieves a market size of US $ 2.17 billion; the market size of the machine learning platform market has achieved a market size of $ 570 million.

If it is simply from the perspective of the market size, the AI industry is indeed a super track, but if it is specific to the operating performance of AI companies, the AI industry seems to be difficult to dawn.

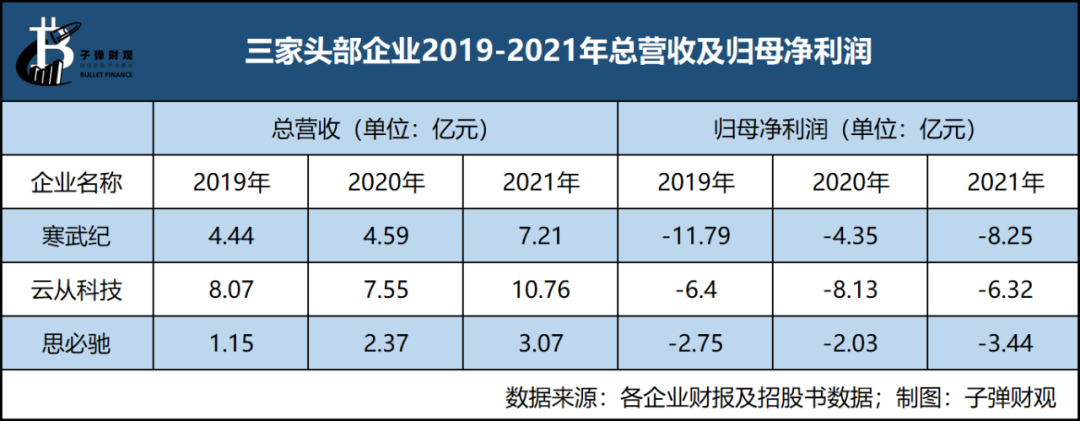

In the prospectus, Sib Chi listed a lot of competitors, including Cambrian, Yuncong Technology and other industries, and the comparison of the total revenue of the three and the net profit of the mother was shown in the chart.

In the past three years, although Siby's overall revenue has increased year by year, it still fails to achieve profitability as most AI companies, and R & D investment is an important reason for its failure to make profits.

The prospectus shows that from 2019 to 2021, Siby's R & D investment reached 199 million yuan, 204 million yuan, and 287 million yuan, respectively, accounting for 173.35%, 86.26%, and 93.25%of the total revenue. There is a trend of "catch up" total revenue.

In fact, the phenomenon of R & D investment is not uncommon in the AI industry. From 2019 to 2021, the proportion of R & D investment in Shangtang Technology accounted for 63.30%, 71.21%, and 65.11%of the total revenue; the proportion of Yuncong Technology's R & D investment accounted for 56.25%, 76.59%, and 49.67, respectively. %.

"For a technology company, the current losses are not the most terrible. The key is whether its pillar business or core products can drive overall performance growth, and whether its comprehensive gross profit margin is stable." "Explanation.

However, for Sibi, the situation is not optimistic.

Specifically, according to the distinction of products, Sibchi ’s business is mainly divided into smart human -machine interactive software products, software and hard -hard integrated artificial intelligence products, technical authorization services and custom development services. The main source of revenue, in 2021, the business revenue was 101 million yuan, accounting for 33.00%of the total revenue.

However, it is very embarrassing that despite the flag of the revenue of the shoulder -to -shoulder revenue of the integrated artificial intelligence products, the gross profit margin has been declining.

From 2019 to 2021, its gross profit margin is 28.75%, 24.74%, and 19.12%, respectively, at a very low level, so that Sib Chi has always been difficult The gross profit margin instead is as high as 95.71%. Without the optimization of the business composition, Sib Chi achieves profitability or far away.

In addition, due to the large proportion of hardcover artificial intelligence products and low gross profit margin, it has dragged down Sibch's comprehensive gross profit margin.

The prospectus shows that from 2019 to 2021, Siby's comprehensive gross profit margin was 72.17%, 69.74%, and 58.15%, respectively, showing a trend of decline year by year. In contrast, the comprehensive gross profit margin of the Cambrian was 68.19%, 65.38%, and 62.39%, respectively, while Yuncong Technology's comprehensive gross profit margin was 40.9%, 43.5%, and 42.2%, respectively. Obviously, the latter two have basically stabilized.

"While the total revenue of AI companies has increased, net profit has never achieved synchronous growth. On the one hand, commercialization is not as good as expected, and on the other hand, it is also the outside world's expectations for AI. The situation of increasing profit will continue, and the operating performance of AI companies is still difficult to boost. "Li Lei analyzed.

This is true. Regarding profit -making time, Sib Chi only said in the prospectus that "realize project income as soon as possible and improve operating efficiency and profitability." The risks of "gross profit margin may continue to decline" and "may not achieve profitability for a period of time and trigger the delisting conditions for a period of time".

In other words, even if Siby can be successfully listed, "burning money" will still be the main theme in the next few years.

3. Commercialization of the Great Examination

Whether it is before listing or after the listing, no investor institution is willing to invest in AI companies that are difficult to land for commercialization. Although AI is the general trend of science and technology development, huge R & D investment and a huge contrast for the formation of profits cannot be achieved. Many investors and investment institutions are in their throat.

AI algorithm engineer Yang Kuo tried to explain the reason why AI companies are difficult to commercialize from the perspective of daily work. Only the combination of scenes can reflect value, and the significance of its own existence is not great. That is to say, the commercialization of AI is inseparable from custom services. "

(Figure / Photo Network, based on VRF protocol)

The development logic of AI companies is to first have technology, and then enter a certain vertical field to make breakthroughs, and then spread to other fields. Its advantage is that they can connect all walks of life. It is high, and it is difficult to achieve large -scale development.

"Each segment has different rules, and the time cycle required for developing a new segment is basically calculated in annual. For example Selling to Customer B, even if Customer A and Customer B are in the same field, the demand cannot be completely consistent. Therefore, it is necessary to re -train the model for specific scenarios or needs to continue to invest in manpower and time. The difficulty of commercialization has become the normal state that is difficult for AI companies to avoid at this stage. "Yang Kuo further explained.

Customized opening up the imagination of the commercialization of AI enterprises, but at the same time, it also limits the process of commercialization.

At present, because computer vision technology is universal, it has been effectively combined with many application scenarios, and has gradually expanded from the two major fields of finance and security to transportation, medical, robotics, the Internet of Things, autonomous driving and risk control.

According to the "Bullet Fortune", compared with the computer vision track, the voice semantic track where Siba is located is very different from it.

On the one hand, the phonetic semantic track is difficult to be standardized due to the high difficulty of sound recognition, and the scale development is unable to talk about it; on the other hand, voice semantic technology needs long -term training and data accumulation, and also requires different applications with different applications. The scene is deeply integrated, resulting in the slow expansion of the voice dataset.

However, Sibchi is not limited to the software level, and its hardware business is also in force, such as AI voice chips, smart voice language interactive equipment, etc., which will start from smart appliances, vehicle voice interaction, wisdom, wisdom Medical care has further expanded to consumer electronics, office hardware and other fields.

"At present, the homogeneity competition between AI companies is actually very serious. Sibi and many AI companies have the phenomenon of business interweaving or overlap. Therefore Ying and the foundation of building a moat. "Li Lei said to the" Bullet Fortune ".

Yang Kuo also tends to cultivate some fields in some areas. "Although customized in the industry is a common phenomenon, as long as five customers are done in a certain field, there will be more and more products of the product overlap, which means that it means More and more parts of the modular part are achieved, and the cost of diluting is achieved. "

For more than 90%of AI companies, commercialization is still an ultimate test. In the past, AI companies needed "storytelling", but now they need to come up with a real commercial landing plan and data. After all, the era of "muscles" has gone away.

In the future, the competition between AI companies is no longer a simple dazzling skill, but a confrontation based on comprehensive capabilities of computing power, data, algorithms, and application scenarios. It is a hand -to -hand combat that is about life and death.

*Note: The names in the text are all pseudonyms. The title of the article comes from: visual China, based on the RF protocol.

- END -

From tomorrow, nine staged benefit enterprises measures will be implemented in Nansha Port District, Guangzhou Port

Recently, Guangzhou Port Co., Ltd. issued an announcement of the measures for the ...

Landzhou Observation 丨 Green Finance adds new kinetic energy to green development

Reporter Wei YongguiOur power station adopts new technology and technology, and th...