The Federal Reserve policy turns to the hopes?The new non -agricultural employment population in the United States has doubled from expected, and the unemployment rate has reached a new low in more than 2 years. The 75 -basis point in September is expected to rise again

Author:Daily Economic News Time:2022.08.05

On the evening of August 5th, Beijing time, data released by the U.S. Labor Statistics show that the non -agricultural employment population in the United States increased by 528,000 in July, the largest increase since February this year, with an expected 250,000 person and a previous value of 372,000. At the same time, the U.S. unemployment rate in July recorded 3.5%, hitting a new low since February 2020, with expected 3.6%, with a previous value of 3.6%.

After the release of the data, the market expects the Federal Reserve to raise interest rates again. The US dollar index has a short line of more than 50 points, which is now reported at 106.48; the spot gold short -term diving fell by more than 1%; The Nasdaq 100 index futures fell by 1%, Date Futures fell by 0.45%; the inverted challenge of 2 -year US bonds and 10 -year US bonds expanded to 45 basis points, the largest since August 2000.

The data released at the same time also show that non -agricultural employment data in May and June 2022 were repaired at the same time. In May, the number of non -agricultural employment was revised from 384,000 to 386,000, and the number of non -agricultural employment in June was revised from 372,000 to 398,000. After the amendment, the total number of new employment in May and June is 28,000 higher than the previous report.

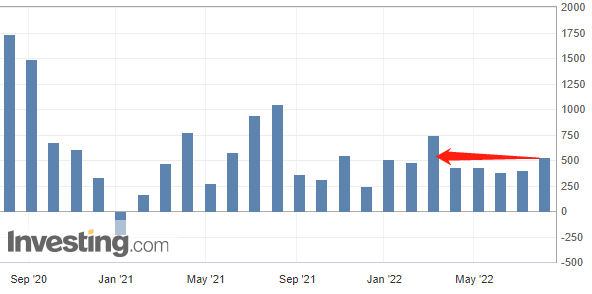

Added a change of the number of non -agricultural employment every month. Photo Source: British Caiqing

Data show that in July, non -agricultural wages in the United States also rose sharply, and the average monthly salary of the United States rose 0.5%month -on -month, and expected to rise by 0.3%; a year -on -year increase of 5.2%, and expected to rise by 34.9%.

The level of unemployment rate of 3.5%, the average hourly salary of overlapping increases, has further exacerbated the market's concerns about inflation.

However, the US labor participation rate fell slightly in that month, and the data fell slightly to 62.1%in July, which was less than 62.2%of the market expectations; the average weekly working hours remained unchanged, 34.6 hours, slightly higher than the expected 34.5 hours.

Specifically, in July, the number of employment positions in the American leisure and hotel industry increased the most, with 96,000, followed by professional and commercial services, and recorded 89,000 increases. The medical and health care industries have increased 70,000 jobs, while the government has increased 57,000 jobs.

Although the market is not optimistic about future expectations, new non -agricultural jobs in July are much higher than the average growth level of 388,000 in the past four months. The press release of the US Labor Statistics pointed out that since most of the US economy in April 2020 due to the blockade of new crown pneumonia, non -agricultural jobs have increased by 22 million.

The number of non -agricultural employment in July exceeded the number of employment in the United States for the 19th consecutive month, although GDP has shrunk for several consecutive quarters. Some analysts believe that the employment report may force the Federal Reserve to raise 75 basis points at the third time at the September meeting, but this depends to a large extent depending on the July inflation data released later this month.

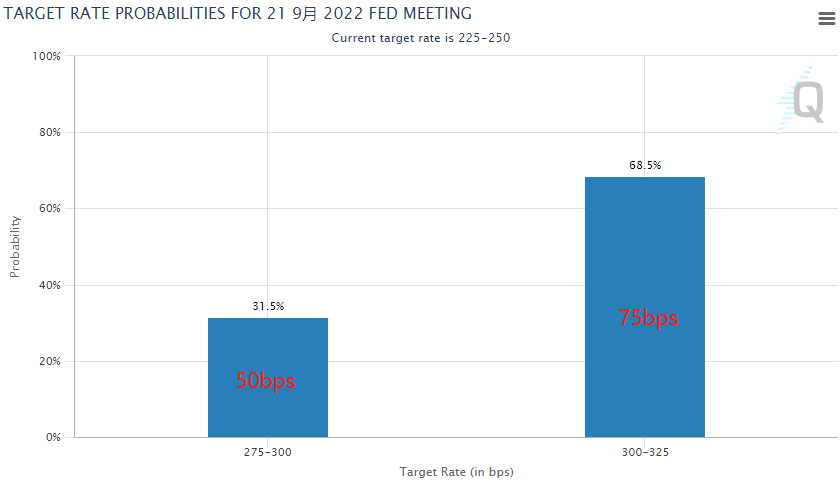

After the announcement of non -agricultural data, as of press time, the US interest rate futures price showed that the probability of the Fed ’s interest rate hike at the end of September was 68.5%, which was a significant increase from the probability of 40.5%before the data release. %. In addition, the US interest rate futures price also shows that the Federal Reserve Federal Fund interest rate will reach 3.5%before the end of the year, and the data is 3.4%before the announcement.

Image source: Federal Reserve Observation Tools

Fitch rating chief economist Brian Coulton said in a comment email sent to the reporter of "Daily Economic News" that "the United States is creating new employment opportunities at a rate of 6 million per year. This is three times the number of we see in our historically good economic development. At this speed, the U.S. unemployment rate will drop to 3%, which will hit a new low since the 1950s. Slowing, but a strong labor market is an important buffer of consumer demand. This also means that it may take some time and rate hikes to slow the core inflation. "

Daily Economic News

- END -

[To achieve two overall plans to seize the double victory] Weifang Qingzhou: Fighting in the second quarter to seize the "double victory"

The Twelfth Party Congress report of the Provincial Provincial Congress proposed that the conversion of old and new kinetic energy was promoted in depth, comprehensively enhanced traditional industrie

"Famous Factory" Google Tension Recruitment?Large -scale retracting, Google's Silicon Valley myth is gone?

On the world's Internet market, a large Internet factory represented by Google is ...