The valuable monster stocks than Ali are hidden a amazing relationship network

Author:City world Time:2022.08.05

In addition to Li Ka -shing, who holds a lot of shares, there are many celebrities endorsement: including PricewaterhouseCoopers, Rong Xianwen and Wang Ruiqiang, and Liang Botao, chairman of Asian region before the business of Citibank Investment Bank. Member of the Consultation Committee. Wu Shuqing, the founder of the Hong Kong Meixin Group, and others, who had been on the event for Shangbo and Cai Zhijian during the event. Xiaomi founder Lei Jun also had a great relationship with Cai Zhijian -Shangbao Group and Xiaomi jointly established a virtual bank Airstar Bank.

This should be one of the few magic events in the capital market.

A company that has only 50 employees, less than 200 million yuan in annual income, and has just been established for more than 3 years. In more than half a month after listing, the market value has soared from US $ 3 billion to US $ 310.7 billion (about RMB 2.1 trillion). At one time on August 2, 2022, it surpassed Alibaba and became the "superstar" of Chinese stocks.

But soon, what welcomed it continued to plummet -August 3 and August 4, its declines reached 34.48%and 27.27%, respectively, and finally closed at a price of $ 800/share to the market value of $ 148 billion. Still ranked second in China Stocks.

Such a very puzzling story is a U.S. -listed company called Shangbuke and headquartered in Hong Kong.

Under the huge contrast of performance and market value, "Li Ka -shing platform" was once regarded as an important reason for its stock price soaring, but soon the Yangtze River Group issued an announcement to clarify the relationship between himself and the "monster stock". The reason for the surge became another one puzzle.

On the evening of August 4, some people of the media learned that from the issue price of $ 7.8 per share to the highest price of $ 2,555 in the market, up to 327 times the increase, which may stem from a large oolong.

01, farce or a big oolong

According to the International Financial Report, the liquidation company of Shangbian Division on the first day of listing did not deliver the company's stock to the underwriters and new investors' stock accounts, but the underwriter put the stock that did not deliver at all in the investor account. Until now, the transactions in the market have become the sale of "empty orders".

The direct consequence is that as the stock price rises, the short -term account margin is insufficient and the positions are continuously burst.

The city community asked the listed company on the above situation. As of press time, the other party had no response.

If the situation is true, this oolong means that it is difficult to blame many parties including liquidation companies, underwriters and listed companies, and this "mistake" has continued for more than half a month since the stock listing. Essence

Another statement is that a "mysterious power" from the United States also played a certain role behind it.

There is a website called Reddit in the United States, similar to the existence of domestic Baidu Tieba, but the specific gameplay is slightly different. It is reported that it is some of the remarks and hype generated in the bar called "WallStreetbets" (Wall Street Gambling), which has led The stock price of the division has soared.

Data providers Quiver Quantitative data shows that on August 2nd, the highest market value, AMTD (Shangbo Group) has become the most popular topic in the chat room "WallStreetbets", but the direction of speech in the past two days has been optimistic about Change to singing decline.

Regardless of the reason, the proportion of circulating shares with a very low number of Division of Division is a prerequisite for the stock price to be strongly increased.

Data show that of its 740.181 million total share capital, only 8.3681 million shares are circulating shares, accounting for 11.31%, and are considered a type of stock that is easily "controlled" by the dealer. This also makes its stock price be beyond imagination, but the transaction volume is limited and has not significantly affected the stock market.

Behind this unsolvable event, what is the sacredness of the multiplication department?

According to the prospectus, in January 2003, Li Ka -shing's Yangtze River Hercho and Australian Federal Bank jointly established the Shangbo Group Co., Ltd. (hereinafter referred to as "Shangba Group") to provide financial services. Take the Group to enter the digital investment business and the so -called spider web ecosystem solution business.

In 2019, the Shangbian Division was established, and the Shangbo Group reorganized some of its business, and was put into the newly established Shangbuki Division. Said to be listed.

In the process, the Yangtze River Hutchison of Li Ka -shing has sold most of the equity of Shangba Group since about 2012. According to the latest announcement released on August 4th in the Yangtze River, as of currently only holding less than 4%of the equity of Shangbo Group, and "now discussing the sale of these shares", it also said that "has not participated in the operation of Shangcheng Group, And know nothing about any business and plan of the group. "

(Screenshot of the Yangtze River Heji Announcement)

The reason why the Yangtze River Harmony was so avoided, perhaps, Li Jiacheng also smelled a dangerous atmosphere from this company's oversupply market value soaring market value and unable to provide support.

02. Who is behind?

A question that is generally concerned by the outside world is that in the context of the soaring stock price, who is the beneficiaries standing behind the subject?

Because it was founded by the Yangtze River and Ji under Li Ka -shing in the early days, Li Ka -shing has also become an important speculation "label" before and after the listing of the stills. The group's less than 4%of the equity, that is, the indirectly holding the equity of about 3.5%of the stills, but because it is not directly held, it is impossible to directly realize the cash out by stimulating the latter's stock price. In contrast, the actual controller Cai Zhijian seems to be a greater profitable party.

Public information shows that Cai Zhijian was born in Hong Kong and graduated from the University of Waterloo University in Canada. After that, he served as the chairman of Shangrama Group in PwC, Citi Group, and UBS Group. Send two listed companies under the Shangbo Group to the capital market.

On the day of August 2, 2022, the market value of the stills reached the pinnacle of US $ 310.7 billion, and Cai Zhijian, who held 28.83%of the shares behind, once reached 85.967 billion US dollars (about RMB 580 billion), becoming the richest man in the new Chinese richest man Essence

Such a pace is simply a perfect counterattack of the "audit migrant worker", but in the above -mentioned public experience, only a hidden relationship between Cai Zhijian and China Civil Investment has omitted.

In 2016, China Civil Investment and Lauri Capital jointly established Laorui Financial Holdings Co., Ltd., which bought 71.03%of the controlling equity of Shangbao Group, of which China Minchan indirectly held 24.79%of Shangbo Group, and Lai Rui was 46.24 46.24 %Of equity has become the largest shareholder.

In 2017, China Civil Investment Joint Communication and many institutions shareholders jointly launched a "Belt and Road" overseas investment fund project with a scale of more than 10 billion US dollars. Zhongmin Investment claims to invest billions of yuan among them, but after that There is no sound, no following.

According to Caixin reports, Cai Zhijian joined Shangbo Group after leaving UBS in 2016, and also started working in Zhongmin Investment. Civil Investment once entrusted Cai Zhijian to manage billions of yuan.

However, after the debt crisis in 2019, after a group of executives, including Dong Wenbiao, the blood was replaced, and Zhongmin Investment began to collect debts. The debt collection object included Cai Zhijian.

In August 2020, there was a huge poster on the railings on the streets of Central, Hong Kong. It was Cai Zhijian's black and white portrait. On the left, the four characters of "financial fraud" and its name Cai Zhijian were written on the left. Including "father and son joined forces to steal huge funds for shareholders", "uh, my hard -earned money", "deceive shareholders, bloody fraud" and so on.

After that, the public investment details of the Civil Investment Civil Investment in Shangcheng Group were no longer displayed. In 2019, the prospectus disclosed by the IDEA Group shows that the shareholders of the Holding joint venture of Shangcheng Group are 61.6%of the shareholders of 61.6%of the shareholders holding 61.6%. The subsidiaries of the Rui Group, Cai Zhijian held 32.5%through the offshore registered company. According to reports, Cai Zhijian's parents held shares and interests in the company of the Ciri Department.

In the prospectus of Shangbuke, its description of the founder Cai Zhijian is "entrepreneurs who start from scratch, and have a good record in establishing, cultivating and developing the leading financial services business."

But in fact, Cai Zhijian's financial industry record is not so perfect -the Hong Kong Securities Regulatory Commission issued the "Notice of Proposal Disciplinary Action Action" in 2020, and believes that Cai Zhijian's part of the time during the director of the UBS group was transcended. The scope of the responsibilities of general bankers may cause conflicts between them with UBS or customers.

Since then, the Hong Kong Securities Regulatory Commission has ruled that Cai Zhijian was not "appropriate candidates for the licensee" and ordered it for two years for the ban. After that, Cai Zhijian filed a review application. The formal hearing will be held in December this year.

In addition to Li Ka -shing and Cai Zhijian, who had been punished, there were many "celebrities" endorsements. Including Cai Zhijian's parent school, Feridun Hamdullahpur, the principal of the University of Waterloo, Canada, Rong Xianwen, a former partner of PwC, and Wang Ruiqiang, and Liang Botao, chairman of the Asian region before the business of Citibank Investment Bank, are members of the Global Advisory Committee. Wu Shuqing, the founder of the Hong Kong Meixin Group, and others, who had been on the event for Shangbo and Cai Zhijian during the event.

The more well -known Xiaomi founder Lei Jun, also has a great relationship with Cai Zhijian -AIRSTAR Bank (Tianxing Bank), jointly established by Shangcheng Group and Xiaomi, has won one of the 8 virtual bank licenses issued by the Hong Kong Financial Administration, and and of. Operations began in June 2020. Lei Jun was originally chairman of the board of directors. Later, he was busy building by Lin Shiwei, vice president of Xiaomi Group.

Although the stills of the stills do not hold the equity of Tianxing Bank, Tianxing Bank obviously one of its important customers -not only repeatedly appeared in the prospectus, but the 12.8 million Hong Kong dollar service fee paid each year is about 6.53%of the revenue in 2021, and if the follow -up group obtains any income from Tianxing Bank, the number of families can also enjoy 15%of them.

One of the details worth noting is that the IPO issued 16 million shares of the IPO, of which the underwriter and bookkeeper manager amtd Global Markets Limited The "Oolong Incident" is true, so the Shangcheng Group, who is also an underwriter and behind the listed company, will obviously have a lot of responsibilities. 03. The background color of the stills

Since the market value is unexpectedly standing under the spotlight during the soaring market value, let's take a closer look. This market value once exceeded Ali's Shangbuki Division. What is the "background color"?

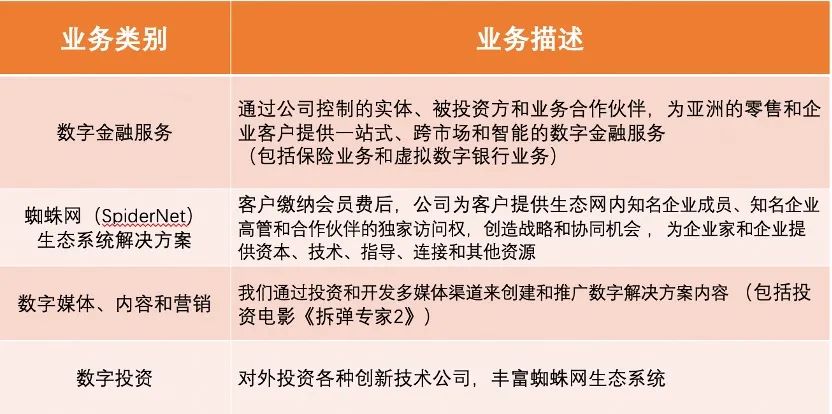

After the reorganization of 2019, the main business of the Multiplying Division is divided into four sectors, namely digital financial services, spider web ecosystem solutions, digital media, content and marketing, and digital investment business. Among them Spider web ecosystem solution (hereinafter referred to as "spider web ecological business").

In terms of core competitiveness, the Digital Division emphasizes that it has some of the scarce digital financial licenses in Asia, but as of now, only one Hong Kong insurance license, a Singapore insurance technology platform, and the Hong Kong digital bank license obtained by the holding group Essence

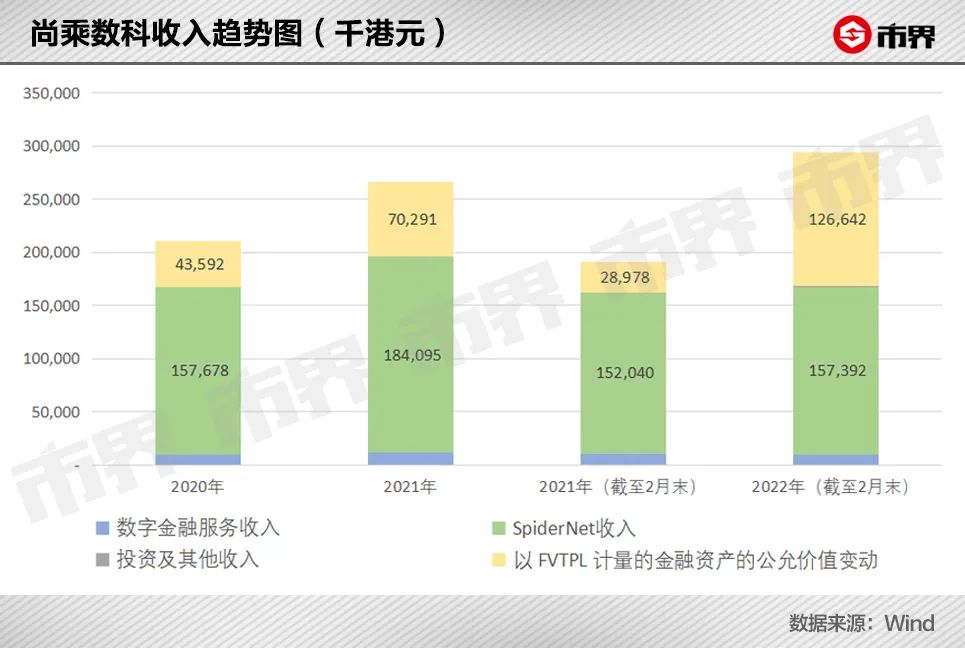

2020 -10 months as of February 2022 (hereinafter referred to as the "2022 Reporting Period"), the total income of the number of multiplications was HK $ 168 million, HK $ 196 million, and HK $ 168 million, of which the income of the spider web ecological business accounted for accounted for The ratio reached 94.1%, 94.0%, and 93.7%, respectively.

In addition, the gains and losses of fair value changes caused by foreign investment have also brought income ranging from HK $ 28.78 million to HK $ 127 million during the same period.

(Note: The fiscal year of the US stocks is from May to April of the previous year, and the "2019" revenue refers to the fiscal revenue from May 2018 to April 2019).)

One problem shows that during the reporting period in 2021 and 2022, its revenue increased year -on -year by 16.87%and 3.45%, respectively, and there were significant slowing trends.

In the risk reminder of the prospectus, the company stated that "from a historical point of view, we have obtained a large number of customers through the recommendation of the controlling shareholder or through the spider web ecosystem. Develop customers. At present, this issue is indeed gradually emerging.

At the same time, because its main business is the consultant business with a high gross profit margin, and the changes in the profit or loss of the fair value changes in each year, the net profit of each year is not much different from the income. In 2022, in 2022 During the reporting period, net profit even exceeded income.

Although the contrast between performance and market value is large enough, it is also surprising that at the end of February 2022, there were only 50 people in the entire company, including 4 senior managers, 35 front -line employees and supporters.

Among the 77 stocks listed on the NYSE, the number of employees who take the number of families is the second less. Coincidentally, the company with the least employees belongs to the Shangbo Group. Take the IDEA Group (originally known as Shangcheng International).

50 people support the market value of two trillion people. The per capita income, profit creation and salary naturally belong to the absolute top flow in China stocks. The disclosed employee benefits of 63.127 million yuan in the disclosed 2022 report period is calculated. 1515,000 Hong Kong dollars, placed in the first three levels of A shares.

However, this amazing efficiency appears in the Shangbian Section, which is inevitable that a question mark must be made. The reason is that in the case of frequent affiliated transactions, there are many rooms that can be "modified" in revenue and net profit.

Because the Shangbuki Digital Division is part of the business split from the Shangbo Group, and this part of the business is highly supported by the holding group, it is unable to operate and operate independently. Related transactions.

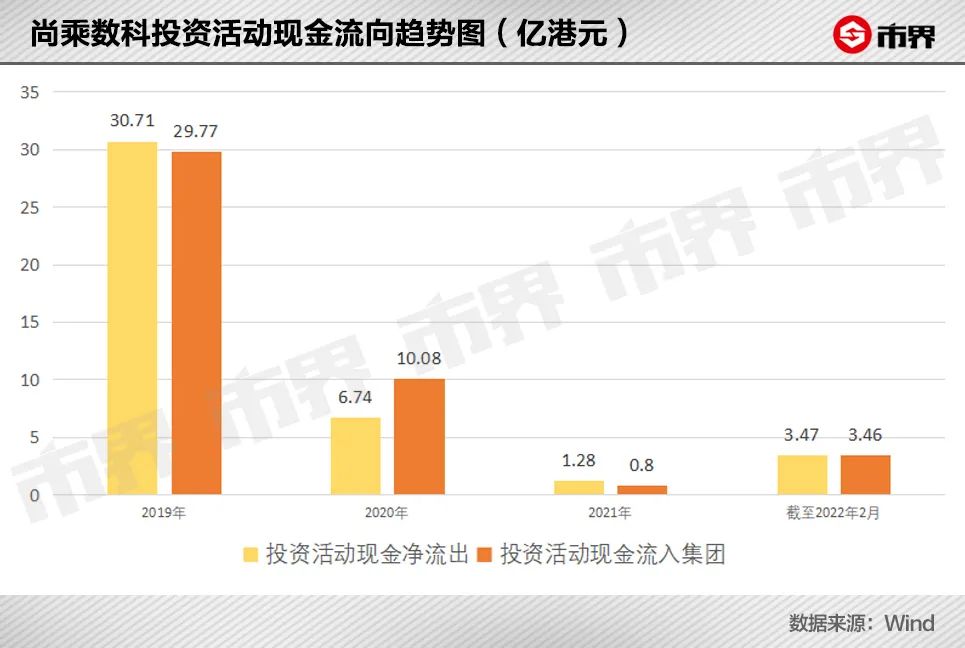

Data show that from 2019 to 2021, there are a large amount of cash outflows from the number of divisions, ranging from HK $ 128 million to HK $ 3.071 billion, and most of them have flowed into the holding Fang Shangbian Group.

At the end of the reporting period in 2020 and 2021, the total assets of the Shangbian Division were HK $ 3.595 billion and HK $ 3.067 billion, but of which the receivables for the holding company were HK $ 2.352 billion and 2.139 billion Hong Kong dollars, accounting for the corresponding final company's total company total company Assets of 65.42%and 69.74%. Such affiliated parties are far greater than the income scale of HK $ 10 million.

In addition, from the total proportion of the top five customers in income contribution, the proportion of the current multiplication period from 2019 to 2022 is 56.6%, 78.0%, 41.5%, and 42.6%, respectively. Big customer concentration.

It is confusing that the prospectus shows that "the average member contract amount of the spider web business increased from HK $ 15.7 million in 2020 to 19.8 million Hong Kong dollars in 2021, and the number of customers increased by 72.2%." The number of customers calculated from the amount is not only less and less, but there are only 10 and 9 customers in 2020 and 2021, respectively. There are problems of conflicting data before and after.

In general, the background color of the "flat" and the market value of 2 trillion yuan of "flat without strangeness" is indeed a staggering contrast. Behind the short market value of 2 trillion yuan, I am afraid that there is still still there is still there is still there still.Unknown "magic".(Except for the sources alone, the above pictures are from Visual China)

(Author 丨 Lin Xiazhang, editor 丨 Liu Xiaoying)

- END -

Joint force to fight poverty alleviation together to seek rural revitalization together

In the designated ten years of assistance in universities directly under the Ministry of Education: joint poverty alleviation and fighting together to seek rural rejuvenationIn Dingxi, Gansu, ecologic

Disposal

In order to further promote the pairing cooperation of Suzhou and Fuyang, on the morning of June 14, the Sufu Famous Products Exhibition Center was unveiled in Fu. The platform will provide more oppor