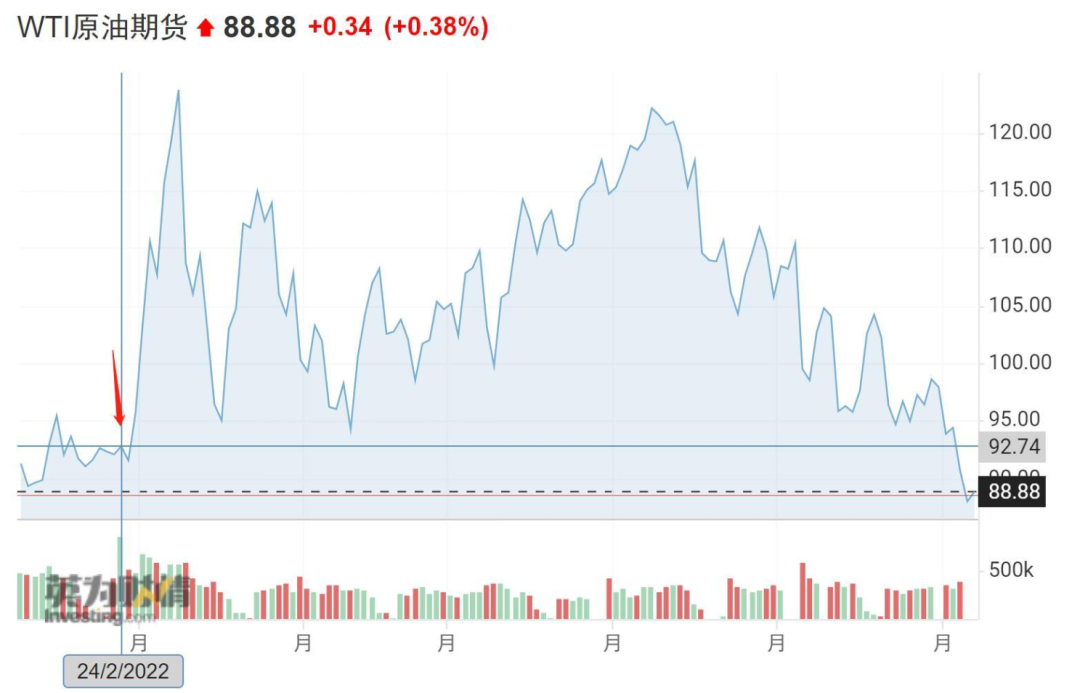

$ 120 → $ 90, international oil prices have fallen back to the level before the Russian and Ukraine conflict!

Author:Daily Economic News Time:2022.08.05

For two consecutive days of international oil prices, WTI crude oil futures (US oil) and Brent crude oil futures fell below $ 90/barrel and $ 100/barrel, respectively. In the case of no significant changes in the supply side, the decline in oil prices showed that the market's concerns about the weakness of oil demand for economic recessions intensified.

Photo source: Photo Network 501522339

It is "very noteworthy, because the crude oil market is still very tight, and the space for ease is very small." Craig Erlam, the market analyst of foreign exchange trading company OANDA. "The discussion on economic recession is getting hotter, and once the decline becomes a reality, it may partially solve the imbalance of supply and demand."

The two crude oil futures began to fall on the evening of August 3 and fell for two days. WTI crude oil futures fell to a low of $ 87.76/barrel on August 5th, which fell 8.8%from the recent high point set on August 3; Brent crude oil futures fell to $ 93.32/barrel on August 5th The low position fell from 8.7%from the recent high point that set on August 3.

As of press time, the price of two oils rebounded slightly, which were reported to $ 88.88/barrel and $ 94.26/barrel, but both had fallen to the price level before the outbreak of the Russian -Ukraine conflict. Since the outbreak of the conflict on February 24, due to the impact of Western countries' sanctions on Russia in major oil -producing countries, the energy demand has rebounded since the new crown epidemic.

Image source: Yingwei Caiqing

On the news, data released by the US Energy Information Administration on the 3rd of the local time showed that the U.S. crude oil inventory was recorded by 4.467 million barrels of growth that week, and the market expectations would fall by about 630,000 barrels.

According to the agency, as the best indicator of the demand for gasoline in the United States, the average consumption of the surrounding gasoline has fallen by more than 1 million barrels per day compared with the normal level before the epidemic. At the same time, the average US gasoline price has fallen from a historical high of over 5 US dollars/gallon to $ 4.14/gallon on August 4th. However Consumption demand in the summer of driving rebound.

At the macro level, the Federal Reserve, the British Bank and the European Bank of the European Bank are raising interest rates. The market is concerned that rising interest rates will lead to slowing economic activities, which will exacerbate the weakening of energy demand. On August 4, the Bank of England raised its interest rates sharply, and warned that the British economy would fall into a decline in the last 3 months of this year and will last until the end of 2023. This will be the longest decline since the financial crisis in 2008. Fed officials have also intensively delivered eagle remarks this week, trying to calm the market's guess of the Fed's upcoming monetary policy tightening.

As the price of oil falls, the supply of international crude oil has not changed significantly. Although the US President visited Saudi Arabia last month, he hopes that OPEC+can increase production, but on August 3, local time, OPEC+only agreed to increase production in September by 100,000 barrels per day, which is about 0.1%of global demand, which is the institution. One of the minimum production increases since the establishment of the output quota system in 1982. As soon as the news came out, the price of the two oils even rose briefly.

OPEC+said that the idle capacity is very limited. Before deciding to increase production, it takes more time to evaluate whether global energy demand will decline.

After OPEC+only increased production slightly, the focus of market attention turned to the Iranian nuclear agreement negotiation. According to CCTV news reports, Iran, the United States, and the European Union said on August 3 that senior representatives will be sent to the Austrian capital Vienna to continue the Iranian nuclear issue to restore performance negotiations. Iranian Petroleum Minister Javad Ogi said that Iran has prepared for production to increase production to restore oil exports to the pre -sanctions level as soon as possible. Market analysis believes that if the United States lift sanctions, Iran can supply at least 1 million barrels of oil to the global market daily.

Reporter | Li Menglin

Edit | Wang Yuelong Lan Su Ying Du Hengfeng

School pair | He Xiaotao

| Daily Economic News nbdnews original article |

Reprinting, excerpts, replication, and mirroring are prohibited without permission

Daily Economic News

- END -

The first single business of "Jiashan Individual Insurance" landed, solving the "urgent need of eyebrows"!

Recently, the first loan business of Jiashan Rural Commercial Bank's Jiashan Individual Insurance successfully landed, which solved the urgent urgent of the 200,000 yuan capital turnover to operat...

Beauty Giant Merboline defeats the Chinese market?What happened to all offline stores?

Recently, the beauty market can be described as changing. We just saw the defeat o...