Pension wealth management and pension savings gradually spread out the organization's layout of pension finance.

Author:Jining News Network Time:2022.08.05

Photo photo

With the support of relevant policies, financial institutions have deployed pension finance this year to go to the "fast lane." In terms of banking industry, the second batch of pilot institutions for pension financial products ushered in the "first show", and pilot pilot pilots gradually approached; insurance companies actively participated in the third pillar construction and steadily advanced in innovative products. As of the end of June, exclusive commercial business The cumulative number of insurance coverage of endowment insurance is 196,000; the fund company continues to improve the product line to enhance the income of related product.

Insiders said that in terms of pension finance, financial institutions will focus more on the research and development and innovation of equity wealth management products or asset management products, and pay more attention to professional talent reserves, investor education and investment consulting business. At the same time, the market generally believes that more supporting policies related to pension systems will also be accelerated.

Pension wealth management and elderly savings are gradually rolling out again

Since the beginning of this year, the banking industry has expanded its layout in the field of pension finance. After the pilot of pension financial management has landed, the pension savings business will also open.

The CBRC and the Central Bank recently issued the "Notice on the Pilot Work of Specific Pension Savings" stated that since November 20, 2022, ICBC, Agricultural Bank, Bank of China and Construction Bank in Hefei, Guangzhou, Chengdu, Xi'an, Xi'an The pilot pilot pilot with Qingdao City was launched, and the pilot period was tentatively set for one year. From the perspective of the product, specific pension savings products include three types: rectification, zero deposit, and zero deposit. The product period is divided into 5 years, 10 years, 15 years, and 20 years. The listing interest rate of regular deposits in a five -year deposit in large banks.

Dong Ximiao, chief researcher at Zhailian Finance, believes that this pilot city covers East China, South China, North China, and Southwest China. There are many outlets of four large commercial banks, rich online and offline service channels, and huge existing customers. Pension savings pilots will help better meet residents who have the needs of pension savings, and maximize the convenience of more residents to handle the care of pension savings.

Analysts said that the period for specific pension savings products launched this time is long. In 5 to 20 years, interest rates are more moderate, suitable for groups with low risk preferences, low liquidity requirements, pursuing fixed income, long -term elderly care with residents for residents The demand is compatible.

While the pilot pilot pilot is getting closer, the second batch of pilot institutions' pension wealth management products have also ushered in a new trend. China Post Financial's first pension wealth management product was officially launched on August 3, and the product name was "China Post Financial Postal Fortune Tim Yiyi · Hongjin closed series 2022 Phase 1 of Pension Wealth Management Products", the product type is a fixed income Categories, the distribution scope is 10 pilot cities such as Beijing, Shanghai, Shenzhen, and Guangzhou.

Although among the second batch of pilot financial management institutions, the remaining five for sale have not yet been clear, according to the reporter's understanding, the relevant product name has been set. On the whole, most of the products are mostly characterized by long -term, stability, and inclusiveness in the design concept. The risk level is relatively low, the investment threshold is relatively low, starting from 1 yuan, and the period is relatively long.

Dong Ximiao believes that commercial banks should focus on the long -term development of the elderly market, build a more complete pension financial system, seize direct business opportunities such as asset management, deposits, and custody, digging accounts, card issuance, settlement and other indirect business opportunities to promote improvement and improvement of my country. The social security system, while alleviating my country's growing pension needs while achieving its own development.

Each of all kinds of institutions do something

Not only banks, insurance institutions, public funds and other financial institutions are also actively developing the pension blue ocean market.

As the earliest involved in the pension financial market, the insurance industry has unique value. As of now, many insurance companies have participated in the third pillar construction, steadily advanced in innovative products, and continuously moving towards various segments.

According to the latest data from the CBRC, at present, commercial insurance with pension attributes has accumulated over 4 trillion yuan for long -term pension funds, and innovative commercial pension finance pilots have achieved obvious results.

Among them, the exclusive commercial pension insurance pilot has gone through more than one year. During the period, the China Banking Regulatory Commission continued to expand participation in the main body of insurance companies and expanded the scope of the pilot to the whole country. The latest data show that as of the end of June, the cumulative number of insured parts was 196,000, of which the new economy, new business staff and flexible employees insured 29,600 pieces.

Public funds are also important forces in the capital market and pension financial fields. Earlier, the CSRC asked the society for public opinion on the "Interim Provisions on the Management of Business Management of Public Pension Investment Public Investment Fund Business Management (Draft for Soliciting Opinions)", and to the fund product standard requirements for personal pensions, and the entry threshold of fund sales institutions Clear and provide a clearer operation path for the development of related businesses.

As the first batch of pension target fund managers, China -EU Fund has laid out three products. According to the China -EU Fund, the company has established the pension business department to specialize in the person in charge of personal pension -related investment research. Shang Morgan Fund stated that it will fully integrate global vision and local insights. In terms of product design, investment research, customer service, etc., it will introduce the strategy of mature overseas pension overseas to actively develop product innovation to provide investors with diversified and professionalization. Internationalized pension solution.

The chief analyst of open source securities non -silver financial chief analysts are superb expectation that after the subsequent personal pension system is fully launched, it will be included in funds with good long -term performance and long -term investment in personal pensions. Essence More supporting policies will come out

"After the official implementation of the personal pension system, it will become an important asset of family financial management. At present, there are as many as 700 million people who have the qualifications of personal pension accounts in my country, and the number is expected." Wuhan University of Science and Technology Chang Dong Dengxin believes that in terms of pension finance, financial institutions will focus more on the research and development and innovation of equity wealth management products or asset management products, and pay more attention to professional talent reserves, investor education and investment consulting business.

The market generally believes that more supporting policies will also be accelerated. The spokesman for the China Banking Regulatory Commission and director of the Regulations Department said that at present, the relevant supporting policies have solicited opinions within a certain scope. The specific time to introduce should also be determined depending on the overall work progress of the personal pension system.

The Ministry of Human Resources and Social Security also stated that it will introduce opinions to promote the development of personal pensions and study and formulate relevant supporting policies. The next step will be formulated with relevant departments to make supporting policies to determine the cities of the personal pension system.

According to Zhang Yinghua, an executive researcher of the World Social Security Research Center of the Chinese Academy of Social Sciences, the pilot cities of the personal pension system should have the following conditions: local governments actively promote, strong workers participate in their willingness, good tax collection foundation, complete financial infrastructure, and construction of information platform construction Jia, the pilot city of personal tax deferred commercial pension insurance has been launched.

Zhang Yinghua suggested that it can speed up the establishment and launch of a qualified pension product catalog. For special circumstances, there should be exceptions to "early collection", such as emergency, serious illness, child education and other needs. Return, etc., make specific provisions to enhance the elasticity of account management and increase the attraction of personal pensions. (Reporter Xiang Jiaying)

- END -

Chongzhou Taxation Development "First -handed Process" activity out of the service "heart" experience

In order to better serve the taxpayer's payment, the implementation of I do practi...

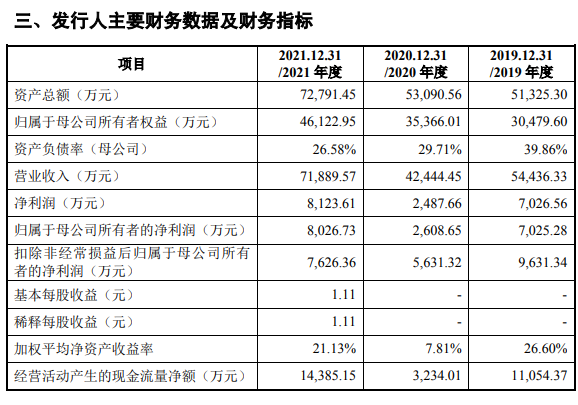

Rui Xing and Starbucks "Common Friends" Hengxin Life Sprint IPO: It is intended to raise funds to expand capacity, but there are difficulty digestion risks

Hengxin Life Technology Co., Ltd. (hereinafter referred to as Hengxin Life) is an ...