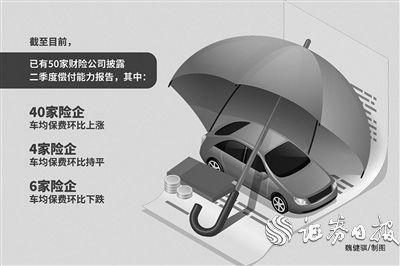

80% of the insurance companies in the second quarter increased the average car premiums in the second quarter, rose by 17 increases from the previous month.

Author:Securities daily Time:2022.08.05

Reporter Leng Cuihua

The average car premiums rose as a whole. "Securities Daily" reporter's solvency report on insurance companies found that of 50 of the 50 -quarters of the car insurance business that had been disclosed in the second quarter solvency report, 40 insurance premiums of the insurance companies rose from the previous month, and 4 of them were The average premium of insurance companies was flat, and only 6 insurance companies fell on the previous month.

In this regard, industry insiders believe that the changes in the average premium of a insurance company are related to the structure of their insured vehicles, and it is also related to changes in the premium of the same type of vehicle. Most insurance companies have risen premiums, reflecting the presence of car insurance prices. Since the implementation of the comprehensive reform of the auto insurance, while many insurance companies have been under pressure on the business operations of the auto insurance business, they have also continuously accumulated relevant data to improve their pricing capabilities. On the whole, the competition in the auto insurance market is still relatively rational.

The average car premium rose overall

According to the requirements of the second -generation project construction plan of the insurance industry, since the first quarter of this year, insurance companies should disclose more detailed information in the solvency report. Judging from the average premiums in the first two quarters of this year, the average premiums in the second quarter increased significantly from the previous quarter.

Among the 50 insurance companies with the current disclosure solvency report, 40 insurance companies have risen in the second quarter of the second quarter. Among them, 17 insurance companies in the second quarter increased by more than 10%from the previous quarter, and the average premium of the average increase in vehicles increased by more than doubled; and the average premiums in the second quarter of insurance companies increased by more than 5%in the second quarter.

The relevant person in charge of Changan Insurance told the "Securities Daily" reporter that the average car premium was increased, mainly due to the increase in the increase of consumer preservation and preservation, and the rising amount of liability insurance rising in the third party. In the early days of the comprehensive reform of auto insurance (official implementation of September 19, 2020), due to factors such as insufficient data accumulation and insufficient pricing accuracy, the sufficient sufficient premiums of auto insurance premiums were relatively low. After more than a year of data accumulation, the judgment of insurance companies' compensation costs for different models is becoming more and more accurate, pricing is becoming more and more accurate, and the independent coefficient is improved, and the average premium of the vehicle has been rebounded.

Another industry insider analyzed reporters that the price of auto insurance rose, indicating that the auto insurance business operations were under pressure, and there was a driving force for price increases. Earlier, some insurance companies relying on their fees or price wars to compete for the market. Now this competition is no longer feasible, and competition between insurance companies is more rational.

Shi Hui, the general manager of everyone's property insurance, previously said that after the comprehensive reform of the auto insurance, in 2021, the insurance company faced the pressure of the negative growth of auto insurance premiums, and in 2022 faced the pressure of operating losses. This year's auto insurance business is a policy after comprehensive reform, and the pressure on the end of the cost is relatively large, especially small and medium -sized insurance companies with high operating costs.

Judging from the average premiums in the first two quarters of this year, the differences between different insurance companies. For example, the average premiums in the second quarter of JD.com's property insurance, Japan's property insurance, and modern property insurance were more than 5,000 yuan; the average premium of the car premiums of Xin'an Insurance and Tokyo Maritime Daily Fire Insurance (China) Co., Ltd. In addition, the average premiums of 13 insurance companies are more than 2,000 yuan, the average premiums of 29 insurance companies are more than 1,000 yuan, and the average premiums of Huaonong Insurance, China Coal Insurance, and Fude Property Insurance are below 900 yuan.

The relevant person in charge of the insurance company who rose sharply from the previous quarter of the second quarter of the car premiums told the "Securities Daily" reporter that the company included motor vehicle data such as motorcycles and tractors during statistics. However, there are fewer in the second quarter; in addition, the number of business trucks and businesses underwrites in the second quarter, and the average single premiums of these vehicles are higher. The structure of underwriting vehicle structures is relatively large, resulting in a large amount of premiums fluctuating. The person in charge also said that because the regulatory agency did not clearly clear the scope of "auto insurance premiums", the statistical caliber of various insurance companies may be slightly different. If there are more than a large amount of premiums such as motorcycles such as motorcycles, the average premium of the overall vehicle will be affected.

Auto insurance operations will still be under pressure

In the second quarter of this year, the average car premiums rose from the previous quarter, the total revenue of auto insurance premiums also rose, and the operating operation of the auto insurance business of insurance companies also improved. However, industry analysts generally believe that after the normalization of vehicle travel, the auto insurance business of insurance companies will still face large operating pressure.

From the perspective of car insurance premium income in the industry, in the first half of this year, insurance companies realized a total of 397.6 billion yuan in auto insurance premiums, an increase of 6.2%year -on -year. Among them, 196.5 billion yuan was achieved in the first quarter; and 20100 million yuan was achieved in the second quarter, an increase of 2.3%month -on -month.

From the perspective of auto insurance business operations, in the second quarter of this year, due to the repeated impact of the epidemic, the frequency of vehicle travel nationwide decreased significantly, and the auto insurance compensation rate of related insurance companies decreased significantly. Information disclosed by Samsung Property and Casualty Insurance shows that the company's auto insurance premium income and compensation rate in the second quarter of this year were significantly lower than expected. In the second quarter, it plans to achieve 68 million yuan in auto insurance premiums, but only 64 million yuan is actually harvested; the expected compensation rate in the second quarter is 65.29%, and the actual compensation rate is only 38.29%; Essence Benefiting from the low comprehensive cost of auto insurance in the second quarter, the company's auto insurance achieved an underwriting profit of 22 million yuan in the first half of the year.

Samsung Property & Casualty Insurance stated that in the first half of the year, the epidemic was affected by the epidemic, especially from March to May, Shanghai implemented a global closed management, and the offline new car sales stores that cooperated with them were closed, which caused the company's offline car insurance business to be greatly affected. Two The growth rate of quarterly premium income declined sharply. The epidemic in the second half of the year has been effectively controlled, the sales of domestic new vehicles have gradually recovered, and the proportion of sales of new energy vehicles has increased. In addition to the promotion of the company's digital intellectual innovation marketing plan, it is expected that the company's auto insurance premium income will improve. Libao Insurance also mentioned that in the second quarter of this year, the comprehensive cost rate of its car insurance business has improved significantly. The shipping special insurance and health insurance business have declined in the past 12 months, and the company's overall operations have continued to improve.

Huahai Property & Casualty Insurance stated that due to the influence of the epidemic in the first half of the year, the profit and comprehensive cost rate of the company's auto insurance business continued to decline, and the comprehensive cost rate in the past six months has been less than 95%.

"Although the car insurance compensation rate was low in the second quarter and improved operating performance, the pressure of auto insurance operations this year is still large. Although the premium of auto insurance has increased, it has not increased greatly. As the situation of the epidemic prevention and control gradually improves, it is expected that three three are expected to be three. The quarterly car insurance payment rate will be higher. "The person in charge of the auto insurance business of a property insurance company told reporters.

For property insurance companies, auto insurance is the highest type of insurance in the current single business. Auto insurance operations will largely affect the overall operation results of insurance companies. Therefore, improving the quality of auto insurance operations is the heavy work. The aforementioned person in charge of Changan Insurance stated that the company has adopted a variety of measures to improve the quality of auto insurance operations. The first is to improve the accuracy and application capabilities of pricing, adhere to the cost of folding and linked the price lock -up, to ensure the sufficient premium of the car insurance; Resources tilted towards high -quality business; the third is to strengthen the application of insurance technology, and it has achieved good benefits through scientific and technological means; the fourth is to adhere to the optimization of online, automation, and business processes to reduce the operating costs of the entire process of auto insurance.

- END -

Agricultural issuance of 1 billion yuan loan of Guangxi Branch to support the preliminary construction of Yulin's largest water conservancy project

Agricultural issuance of 1 billion yuan loan of Guangxi Branch to support the prel...

Where is the new future of the big health?2022 World Big Health Industry Summit Forum to reveal the secret

The Yangtze River Daily Big Wuhan Client August 5th News On the morning of August ...