50 employees, the market value once exceeded Goldman Sachs, ranked fifth in the world!How to make the "2022 first demon stocks"?Who is the beneficiary?

Author:Daily Economic News Time:2022.08.04

Following the "wonders" that created "more than 200 times the issue price of 13 trading days on the market", the "Monster Stocks" with the highest attention in the United States still attracted the most attention (HKD, the stock price was $ 1100, and the market value was 203.5 billion U.S. dollars. ) August 3 (Wednesday) in the East Time rose by 20%, and the market value even pressed Alibaba, but then fell rapidly, with a maximum decline of 41%, triggering melting.

As of the close of the day, the number of divisions of the number of divisions fell by 34.48%to $ 1100, and the market value evaporated by US $ 107.1 billion (about 722.9 billion yuan) within a transaction.

Even so, the market value of the stills still exceeds Goldman Sachs (GS, the stock price is 333.17 US dollars, and the market value is 114.4 billion US dollars), such as Wall Street, ranking the fifth largest financial company in the world, second only to Berkshire Hathaway, Morgan, JP Morgan Chase, Bank of America, Industrial and Commercial Bank of China.

How can a small company with a total of only 50 employees throwing Wall Street Travel behind in a short period of time? Who is the biggest beneficiary in this "capital carnival"?

Why "crazy"?

The Shangbian Digital Section submitted the prospectus on May 20, 2022, and was officially listed on the NYSE on July 14. As of the closing of the U.S. stock market on August 2, the 13th trading day since listing, the stock price of Shangbuki has risen to $ 1679/share, which is 215 times higher than the issue price of $ 7.8/share. 1.38 trillion yuan), the price -earnings ratio reached 13560 times. On the day, its stock price even rushed to $ 2555.3/share, an increase of 327.6 times from the issuance price. It can be described as the largest "monster stock" in 2022. The market value even exceeded Alibaba (BABA, the stock price was $ 95.72, and the market value was 253.48 billion US dollars).

What does this soaring mean?

For example, if an investor buys a minimum price of $ 12.05 per share on July 15th, it is worth the $ 10,000 of Shangbuke stocks at a price of $ 10,000, and on August 2, Eastern Time The maximum price is 2555.3 US dollars per share, and its account profit will exceed $ 2.1 million.

However, the trend of soaring showed signs of braking on August 3, Eastern Time. In the session, the number of stills continued to rise, the increase of over 20%, but then the felling down in the market fell, the highest drop of 41%, triggering the fusion. As of the closing, the number of divisions fell 34.48%to $ 1100.00, compared The issue price of $ 7.8 still rose more than 120 times.

Image source: Wind Financial terminal

Earlier, some people in the industry believed that the stock price of the stills of the number of families may be related to the concept of Li Ka -shing. According to the prospectus, the Shangbo Digital Section is the Asian Digital Financial subsidiary of the Shangbo Group, and it is split out of the International Service Company of the New York Stock Exchange. Shangcheng Group was founded by Li Ka -shing's Changjiang Industrial Group and Hutchison Whampoa in 2003. It is the largest private independent investment bank in Asia. One of the brokerage companies.

In response, Li Jiacheng's Yangtze River Group clarified on August 4 that the company's company did not directly hold the equity of the stills, and did not have any business exchanges with the company.

The Yangtze River Group said that the parent company of Shangbuki Section is Shangbo Group. The Yangtze River Group had sold most of the rights and interests of the Shangbo Group nearly 10 years ago. Now there are only less than 4%of the minimum of minimal interests that were not sold at that time. These shares are now negotiating. After the group sells most of the rights and interests held by the Group, it has classified the only small amount of still multiplication group's rights and interests to one of the small projects of many financial investment. There is no representative of the Yangtze River Group's board of directors at the current Fashion Passenger Group; the Yangtze River Group has not participated in the operation of the Shangbo Group and knew nothing about any business and plan of the group.

Picture source: screenshot of the official website of Changjiang Group

Regarding the previous surge in the Shangbo Division, Cen Zhiyong, a strategist in Hong Kong Baihui Securities in Hong Kong, told the reporter of "Daily Economic News" through WeChat, " Look, although the supply is very small, it is easy to fry the stock price if the investor is interested in this company. "

According to the company's prospectus, the number of IPO issuances of the number of times is 16 million shares, and the issuance price is $ 7.8/share. "Daily Economic News" reporter estimated that if all the stock issued by the IPO issued by the IPO issued by the IPO is only $ 124.8 million at the issue price, and its actual fundraising amount is $ 116 million.

However, the reporter noticed that there were only about 8.37 million shares of the stills, accounting for about 11.3%. Although the number of times has risen for many days before, the turnover rate is not high. Oriental wealth data shows that within the nearly five trading days as of August 3, the turnover rates of the number of sections of the number of times were 1.31%, 0.79%, 0.24%, 0.19%, and 0.06%, respectively, and the turnover was 300 million US dollars, respectively. , $ 432 million, $ 196 million, $ 486 million and $ 152 million. It can be seen from the sales of the sale and sale that most of the stock prices are traded in one hand and one hand. As a reference, Apple's one -day turnover is about $ 13.6 billion.

However, for subsequent investment risks, the Futu Investment Research team pointed out to the reporter of "Daily Economic News" through WeChat that "the new overseas IPO new shares have no historical chips, and the attention is easy to cause concentrated catalysis of the market sentiment in the process of low. In the context of the current market lack of hot spots, short -stir -fry funds are concentrated in hype, but for investors, in the short -term increase of valuation, risk factors should be given priority. " It is believed that the Shangbian Section is not a delegation of a delegation, and does not obtain the attention of retail investors like the game station, and does not stand in the company's stock price trend.

The total number of employees is only 50

The main underwriter and bookkeeper manager of the Multi -Multiple Science Section in the United States is AMTD Global Markets Limited. It should be pointed out that the English name of the stills of the Multiple Department is AMTD DIGITAL Inc.

In addition, it is worth noting that the main underwriter is still parallel relationship with the stills, but it is not a broker registered at the US Securities and Exchange Commission (SEC).

Shangbuki Section clearly wrote in the prospectus, "AMTD Global Markets Limited Monk Monaste is controlled by the same controlling shareholder, and AMTD Global Markets Limited will participate in the distribution of ADS in this distribution."

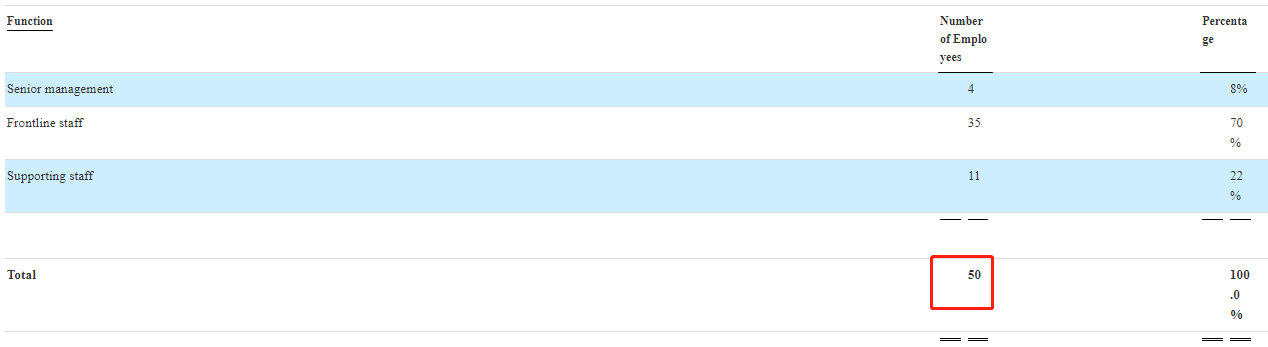

At the same time, the reporter of "Daily Economic News" noticed that the prospectus showed that as of February 28, 2022, there were only 50 employees, including 4 senior managers and 35 front -line employees. 11 employees. However, it is this company with 50 employees, but a year earned about 196 million Hong Kong dollars, and the average employee revenue was HK $ 3.92 million. Although the size of the employee is not large, the company's salary is not small. In 2021, the salary expenditure of the Shangbuki Division was 48 million Hong Kong dollars, and the average annual salary of each employee was HK $ 960,000, equivalent to about 820,000 yuan.

Photo source: Shangbuki Division Prospectus

In addition, the high dependence on the "cobweb" ecosystem solutions in the revenue of the Numerous Division also cannot be ignored.

According to the prospectus of the Multiplying Digital Section, the company mainly divides the business into four parts -digital financial services, "SpiderNet" ecosystem solutions, digital media, content and marketing, and digital investment business. In fiscal year 2019 to 2021 (as of April 30), the revenue of the number of Hong Kong dollars, HK $ 167.5 billion, and 195 million Hong Kong dollars were taken by the number of Hong Kong dollars, and the profits were HK $ 21.544 million, HK $ 158 million, and HK $ 172 million. Both receipts and profits have grown rapidly.

The prospectus shows that in the above three fiscal years, the income of the Digital Division mainly comes from the charges and commissions of the digital financial service business and the "cobweb" ecosystem solution business. Specifically, in the 2019 ~ 2021 fiscal year and the first ten months of fiscal year, the "cobweb" ecosystem solutions accounted for 40.4%, 94.1%, 94%, and 93.7%of the total revenue of the stills.

According to the company, the "cobweb" ecosystem mainly plays a multi -party resource connection and re -empowerment. According to the company, partners from different fields such as the digital and traditional finance industries, the science and technology industry, and academic institutions can all be connected in the cobweb ecosystem. Digital transformation of business.

However, in digital media, content and marketing business, there are still good cases. The film "Bomb Demolition Expert 2" released in 2020 is the first film that is officially involved in the digital film and television cultural industry and participated in production. The investment of this film has made Shangbuki Hiroshima a return of over 1.3 billion yuan.

In terms of digital investment, Shangbian Digital Division has previously invested in artificial intelligence companies Pei Xing Interactive Technology (Appier Inc.), Asia's largest food network information multimedia multimedia service platform, and Internet medical platform micro -medicine group (Wedoctor) Wait.

In terms of digital financial services business, the multiplication is mainly through its control entities, investment objects and business partners to provide one -stop cross -market smart digital financial services for retail and corporate customers in Asia. In addition, multiplier can be acquired or applied for some of the scarce digital financial licenses in Asia.

Who made it?

According to the prospectus of Shangbian Division, before the IPO, the Shangbo Group holds 97.1%of the number of shares issued by the stills, and has 99.9%of the voting rights. After the IPO, Shangbo Group held 88.7%of the stills and 99.4%of voting rights. Infinity Power Investments Limited, the company's wholly -owned company, holds 32.5%of Shangbo Group, is the largest shareholder of the Shangbo Group.

From this point of view, Cai Zhijian may be the biggest beneficiaries of the stock price soaring at this time.

Photo source: Shangcheng Group's official website

According to Dongfang.com, Cai Zhijian was born in Hong Kong, China in 1978. In 1990, 12 -year -old Cai Zhijian moved to Canada with his family and went to Toronto to study. Before leaving Hong Kong, he was the all -around student scholarship winner of Lasha Academy. After going to Canada, he was admitted to the Crescent School and the University of Waterloo University. After entering the workplace, Cai Zhijian first worked as an internship at the audit company Anda Xin Beijing Branch, and then moved to audit companies for auditing or investment banks for many years. According to Zhongxin Jingwei, Cai Zhijian said that during his work, he met many family entrepreneurs in Hong Kong and Southeast Asia, and accumulated rich experience in serving these family enterprise groups. The Changhe Group of the Li Jiacheng family was one of them.

According to information on the official website of Shangchang Group, at present, Cai Zhijian is also the chairman and president of the board of directors of Shangba Group. At the same time, the ASEAN Financial Innovation Network Network Network Network, which was jointly established by the Singapore Financial Administration, the World Bank, and the ASEAN Banking Association. , Afin) as a director.

It is reported that Cai Zhijian led the equity reorganization of Shangbo Group and introduced strategic shareholders including Morgan Stanley and Tongrui Capital Group. Before joining the Shangbo Group, Cai Zhijian was the managing director of the investment banking department and a member of the Asia -Pacific Committee of the Global Family Office in the UBS Group. Earlier, he had served as the chief strategic cooperative officer of the Citi Group Investment Bank sector and led the China Strategic Alliance Department.

In addition, Cai Zhijian has a deeper relationship with mainland companies. In 2018, Shangchang Group obtained the underwriting qualification of Xiaomi Group in Hong Kong. In the same year, Shangbao Group and Xiaomi Financial jointly established Tianxing Bank, which obtained one of the eight virtual bank licenses issued by the Hong Kong Monetary Administration of China at that time. Since then, Xiaomi Group has become a strategic investor, and the Fund has changed its name to "Shangmi Fund". The official website information shows that at present, he is still a non -executive director in Qingdao Bank. At the same time, he is also the founder and chairman of the "Regional Bank+Strategic Cooperation Alliance". The alliance is composed of the leading regional banks and Tianxing Bank, including the Bank of Qingdao Bank, Central Plains, Bank of China, Jiangxi Bank, and Guangzhou Rural Commercial Bank.

But now, Cai Zhijian himself is also facing a lot of trouble.

Public information shows that from 2014 to 2015, two projects participating in Cai Zhijian during work during UBS were investigated by the Hong Kong Securities Regulatory Commission of China due to conflict between interests and information disclosure. One of the cases was that he served as the main representative of the new special energy (1799.HK) IPO at the time, but he did not declare that his parents raided HK $ 700 million before the company's listing, which was equivalent to insider trading.

In 2019, Cai Zhijian was accused of financial fraud, and then his whereabouts began to be low -key.

In January 2022, the Hong Kong Securities Regulatory Commission of China issued the "Decision Notice" to Cai Zhijian, which ruled that Cai Zhijian had two illegal acts: disclosure and fair treatment, and conflict of interests, and made a penalty decision for two years of banned business. Cai Zhijian subsequently submitted the application for review and submitted a close -door hearing application. However, Cai Zhijian's closed -door hearing application was not approved. At present, the case is yet to be tried, and the ban has not been taken into effect. The official hearing will be publicly held from December 12th to 16th, 2022.

(Disclaimer: The content and data of this article are for reference only, do not constitute investment suggestions, verified before use. According to this, the risk is self -affordable.)

Daily Economic News

- END -

Ten years of rejuvenation in the old district of Gannan

In the south of the Gan, the People's Republic of China came from here, and the great Long March set off from here. In the past ten years, the old districts have changed greatly, the transportation is...

Rights and interests are solid, 18 Huaxia Fund products are the top ten list of morning stars

On July 1st, Morning Star China, a domestic authoritative fund rating agency, announced the latest fund performance list. The list is based on different types of funds and the annualized return rate o