Latest version released!It is related to staged social insurance premiums

Author:Wujin TV Station Time:2022.08.04

Operation guide for tax refund and tax reduction policy

——Serial social insurance premium policies in stages

one

Suitable

1. Enterprises affiliated with difficult industries. Catering, retail, tourism, civil aviation, highway waterway railway transport 5 special trapped industries; agricultural and sideline food processing industries, textiles, textiles and clothing industries, papermaking and paper products, printing and recording media replication industries, pharmaceutical manufacturing, chemistry, chemistry, chemistry, chemistry, chemistry, chemistry, chemistry, chemistry, chemistry, chemistry Fiber manufacturing, rubber and plastic products, general equipment manufacturing, automobile manufacturing, railway, ships, aerospace and other transportation equipment manufacturing, instrument manufacturing, social work, radio, television, film and recording operations, Cultural and art industry, sports, and entertainment industry 17 difficult industries.

2. All small and medium -sized enterprises who have a temporary difficulty in production and operation in areas affected by the epidemic situation, and individual industrial and commercial households who are insured by units. Public institutions and social groups, foundations, social service agencies, law firms, accounting firms and other social organizations such as the basic pension insurance for enterprise employees are implemented.

3. Individual industrial and commercial households and various flexible employees who participate in the basic endowment insurance of enterprise employees.

two

Policy content

1. Enterprises that are affiliated with difficult industries may apply for the payment part of the basic endowment insurance premiums, unemployment insurance premiums, and work injury insurance premiums (hereinafter referred to as three social insurance premiums) units. The period of retracting the insurance premium and unemployment insurance premium of work injury does not exceed 1 year. During the slow payment period, it is exempted from late fees.

2. All small and medium -sized enterprises who have a temporary difficulty in production and operation in areas affected by the epidemic situation, and individual industrial and commercial households who are insured by units can apply for the payment part of the three social security premium units, and the implementation period of the slow payment will be reduced to the end of 2022, during the period, and the period, during the period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, and the period. Exempted stretches.

3. Individual industrial and commercial households and various flexible employees who participate in the basic endowment insurance of the enterprise employee are difficult to pay for the payment in 2022, and the payment of the payment will be applied voluntarily. The payment base is self -selected within the upper and lower limits of the local personal payment base in 2023, and the accumulated calculation of the payment period.

Specific regulations are subject to local implementation measures.

three

Operating procedures

(1) Enjoy the way

Eligible companies can apply for a certain period of social insurance premiums according to their own situation.

(2) Related regulations

Enterprises applying for social insurance premiums shall fulfill their obligations to withdraw their personal payment obligations in accordance with the law. During the slow payment period, if employees apply for pension insurance benefits and transfer of relationship transfer, enterprises shall make up for their ectopic insurance premiums for their relief.

Specific regulations are subject to local implementation measures.

Four

Related documents

(1) "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Human Resources and Social Security on doing a good job in doing skills to prevent unemployment and preventing unemployment work" (Ministry of Human Resources and Social Security [2022] No. 23)

(2) "Notice of the General Office of the General Office of the General Taxation of the Ministry of Human Resources and Social Security on the implementation of the staged implementation of the staged industry's social insurance premium policy" (Human Resources Department [2022] No. 16)

(3) "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Development and Reform Commission of the Ministry of Human Resources and Social Security on the Scope of Implementation of Periodic Substaying Social Insurance Policy Policy" (Ministry of Human Resources and Social Security [2022] No. 31)

five

related question

(1) After expanding the scope of the implementation of social insurance premiums, which industries can slow social insurance premiums?

Answer: According to the "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Finance and Reform of the Ministry of Human Resources and Social Security on the Scope of Implementing the Scope of Implementation of Social Insurance Policy Policy," The scope of implementation of social insurance premiums policies is based on the implementation of the basic pension insurance premiums, unemployment insurance premiums, and work -related injury insurance premiums on the implementation of 5 special trapped industries in the catering, retail, tourism, civil aviation, and highway waterway railway transportation. Focusing on manufacturing companies with a greater affected outbreak and difficulty in production and operation, the industrial chain supply chain further expands the industry scope of applicable to the applicable policy. Specific: agricultural and sideline food processing industry, textile industry, textile and clothing, clothing industry, papermaking and paper products, printing and recording media replication, pharmaceutical manufacturing, chemical fiber manufacturing, rubber and plastic products, general equipment manufacturing industry , Auto Manufacturing, Railway, Ship, Aerospace and other transportation equipment manufacturing, instrument manufacturing, social work, radio and television movies and recording operations, cultural and art industry, sports, entertainment, a total of 17 industries, plus plus in total, plus In the early period of 5 special trapped industries, there are currently 22 industries that can enjoy three social insurance premium policies.

(2) We are a catering company. Due to the impact of the epidemic, we have previously applied for the pension insurance premiums that have been paid slowly in May to June. Can the pension insurance premiums in the second half of the year still apply for a slowdown?

Answer: According to the "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Finance and Reform of the Ministry of Human Resources and Social Security on the Scope of Implementation of Periodic Substaying Social Insurance Policy," , Tourism, Civil Aviation, Highway Waterway Railway Transport 5 specialty industries for enterprises to slowly pay the end of pension insurance premiums to the end of 2022. Therefore, your unit's pension insurance premiums that should be paid by the end of 2022 can apply for a slow payment.

(3) We are a textile enterprise. Can we enjoy the social insurance premiums to slowly pay the policy and can pay up to a few months? Answer: According to the "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Finance and Reform of the Ministry of Human Resources and Social Security on the Scope of Implementing the Scope of Implementation of Performing Social Insurance Policy," In the expansion industry, you can enjoy the social insurance premiums to slowly pay the policy. Among them, the implementation period of the retarded payment of pension insurance premiums of enterprises to the end of 2022, and the periodic period of resurgence and unemployment insurance premiums should not exceed 1 year. According to the requirements, the provinces will formulate specific implementation measures to clarify the implementation procedures, slow payment periods, etc. Therefore, the specific implementation period should be based on the implementation measures issued by your company's province.

(4) We are a small guest house. The registered industry type is the accommodation industry. Can we enjoy the slow payment policy of social insurance premiums?

Answer: According to the "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Finance and Reform of the Ministry of Human Resources and Social Security on the Scope of Implementing the Scope of Implementation of Performing Social Insurance Policy," All small and medium -sized enterprises with temporary difficulties in regional production and operation can apply for the payment part of the basic pension insurance premiums, unemployment insurance premiums, and work -related injury insurance premiums for the employee employee. Therefore, if your unit belongs to small and medium -sized enterprises that have a temporary difficulty in production and operation in areas affected by the epidemic, you can apply for a social insurance premiums to slowly pay the policy. Specific difficult enterprise standards and the conditions for identification of small and medium -sized enterprises shall prevail in this province.

(5) We are a law firm. Can we enjoy the policy of slowing social insurance premiums?

Answer: According to the "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Finance and Reform of the Ministry of Human Resources and Social Security on the Scope of Implementing the Scope of Implementation of Performing Social Insurance Policy," All small and medium -sized enterprises with temporary difficulties in regional production and operation can apply for the payment part of the basic pension insurance premiums, unemployment insurance premiums, and work -related injury insurance premiums for the employee employee. Public institutions and social groups, foundations, social service agencies, law firms, and accounting firms such as social organizations, foundation, social service agencies, law firms, law firms, and accounting firms are implemented. Therefore, law firms can apply for a social insurance premiums to slowly pay the policy, but whether it is identified as a difficult enterprise must subject to the specific implementation measures where your firm is located.

(6) I am an employee of a car manufacturing company. Can I apply for a slow payment of social insurance premiums?

Answer: According to the "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Human Resources and Social Security of the Ministry of Development and Reform Commission of the Ministry of Development and Reform of the Ministry of Development and Reform of the Ministry of Development and Reform of the Ministry of Finance, the Scope of Implementation of the Periodic Substitute of Social Insurance Policy" (the Ministry of Human Resources and Social Affairs [2022] No. 31), slowly pay social insurance The fee policy is only aimed at the payment part of the basic endowment insurance premiums, unemployment insurance premiums, and work injury insurance premiums for enterprise employees. For employees' individuals, enterprises shall fulfill their withdrawal obligations for withdrawal and payment in accordance with the law.

(7) Our enterprise has applied for and approved to slowly pay social insurance premiums. Is the social insurance premiums be paid within the policy period?

Answer: According to the "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Finance and Reform of the Ministry of Human Resources and Social Security on the Scope of Implementation of Periodic Subsidant Payment Payment Payment Policy," Enterprises paying social insurance premiums are exempt from hid fees during the retracting period.

(8) We are a bar. The registered industry type is entertainment. Do we have to apply for social insurance premiums?

Answer: According to the "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Human Resources and Social Security of the Ministry of Development and Reform Commission of the Ministry of Development and Reform of the Ministry of Development and Reform of the Ministry of Development and Reform of the Ministry of Finance, the Scope of Implementation of the Periodic Substitute of Social Insurance Policy" (the Ministry of Human Resources and Social Affairs [2022] No. 31), slowly pay social insurance Fei adhere to the principle of voluntary voluntary, and qualified difficulties can apply for a certain period of social insurance premiums according to their own situation. Therefore, you can choose to pay slowly or not to pay social insurance premiums according to your own situation.

(9) Our enterprise has applied for slow payment of social insurance premiums in accordance with regulations, but several employees want to retire this year. Do you need to pay for their social insurance premiums?

Answer: According to the "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Finance and Reform of the Ministry of Human Resources and Social Security on the Scope of Implementing the Scope of Implementation of Periodic Substitute Social Insurance Policy," Social insurance premiums affect the personal rights and interests of employees. During the slow payment period, if employees apply for pension insurance benefits and transfer of relationship transfer, enterprises shall make up for their ectopic insurance premiums for their relief. Therefore, if the employee's retirement application for pension insurance treatment, the enterprise shall promptly pay for employees to pay for the pension insurance premiums.

(10) Our enterprise has applied for and approved the social insurance premiums that should be paid this year, but it is still difficult to produce and operate. It is ready to cancel it. When will the slow payment fee be paid?

Answer: According to the "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Development and Reform Commission of the Ministry of Human Resources and Social Security on the Scope of Implementing the Scope of Implementation of Performing Social Insurance Policy" (Ministry of Human Resources and Social Security [2022] No. 31) The case of insurance premiums should be canceled before cancellation.

Specific regulations are subject to local implementation measures.

Source: State Taxation Administration

- END -

A 26 -story "Pig Building" on a 26 -story "raising pig building" in Hubei was put into production at the end of August.

Jimu Journalist Cao LeiIntern Zou LingyiPhotography reporter Li HuiLooking at the ...

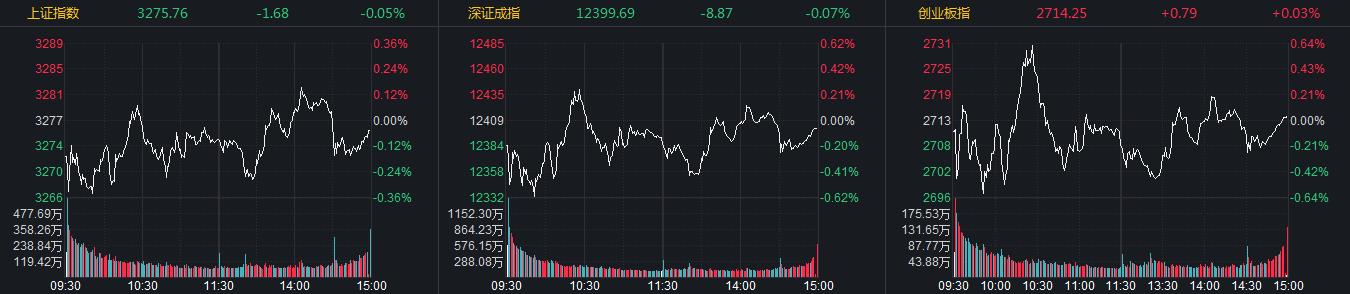

Innovation refers to the reddish daily limit, TOPCON batteries, energy storage and other concepts have risen sharply.

Zhongxin Jingwei, July 27th. On the 27th, the three major A -share stock indexes o...