Jingwei Zhang Ying: Why do so many investment institutions lose confidence in the new consumption field to stop investing?

Author:Rongzhong Finance Time:2022.08.04

Jingwei Zhang Ying shouted and firmly optimistic about consumer investment.

A few days ago, Zhang Ying, the founding partner of the investment big brothers Jingwei China, issued a question on her Weibo: "I didn't understand, why so many investment institutions suddenly lost confidence in the new consumption field and stopped investing."

Regarding Zhang Ying’s doubts, maybe its comment area can answer one or two, a comment with the highest popularity mentioned, "now the disposable income in the hands of the people is getting less and less." This is from the perspective of consumers. Answer, on the other hand, "the economy sinks and the epidemic is unstable. In the short term, the consumer confidence is insufficient, and the consumer market is indeed very large. How long is it? Waiting for the consumer market to restore, no matter how stable the bullets are, this is the answer from the perspective of investor.

Both answers explain the impact of the macro environment on consumption. In the first half of the year, the frequent epidemic in various places had a greater impact on the macro economy, especially for consumption.

Investment in the field of large consumption has always been the blue ocean invested by institutions, especially under the catalysis of the 2020 epidemic, consumer investment is hot, and various "Mao" rising in the secondary market, "soy sauce" Haitianye industry, "mustard" Fuling in Fuling Consumer stocks such as "Mai Mao" Yili, "Yu Wan Mao" Anjing Food, "Ham Mao" Shuanghui Development and other consumer stocks have become heavy stocks of major funds. In the IPO market, it is even more hot. Golden arowana listed in October 2020 has a issuance price of 25.70 yuan. By January of the following year, the stock price has climbed to a high of 145.42 yuan. In just three months, the stock price rose from the issuance price to the issue price. It has been nearly 6 times. Dongpeng drinks listed in May 2021 have a daily limit of 15 consecutive trading days. The issue price is 46.27 yuan. By July, the stock price has risen to 280.44 yuan.

There is also a first -class market. According to the data of IT Orange, the e -commerce retail industry invested 1,219 projects in 2015, reaching its peak, and the number of investment continued to decline in the next few years. In one trend, the number of investment in 2021 was 787. Although the number of investment has declined since 2015, the amount of investment has actually risen in fluctuations, and the investment amount in 2021 reached 128.922 billion yuan.

Since the second half of last year, consumer investment has suddenly cools down, and many investors and LP have gradually lost confidence in consumer investment, and instead turned to hard technology and new energy. "Can new consumer investment continue?" Articles such as "New Consumption Investment are dead" frequently see the public account platforms, plus the "ice cream assassin" represented by Zhong Xuegao some time ago by the "ice cream assassin", the stimulus of the daily freshness and dissolution of the day, so that this is The consumption investment that was stunned was even worse.

Why consumer investment has dropped to freezing points, how to reintegrate consumer investment enthusiasm, traffic dividends are drifting away, and how consumption should be invested as a key issue for the next consumer investment discussion.

Consumption is not bad, consumer investment is not intensive

The National Bureau of Statistics released data on July 15th. In the first half of 2022, China's GDP 5.626 trillion yuan, an increase of 2.5%year -on -year, of which the total retail sales of social consumer goods was 2.104 trillion yuan, a year -on -year decrease of 0.7%. According to the place where the operating unit is located, the retail sales of urban consumer goods were 1.827 trillion yuan, a decrease of 0.8%; the retail sales of rural consumer goods were 2.77 trillion yuan, a decrease of 0.3%. According to the type of consumption, retail sales of goods were 1.9 million yuan, an increase of 0.1%; catering revenue was 2 trillion yuan, a decrease of 7.7%, the largest decline since 2021. The consumption of basic living categories has grown steadily, and the retail sales of grain, oil, oil, and beverage products of units above the limit increased by 9.9%and 8.2%, respectively. The national online retail sales were 630 million yuan, an increase of 3.1%. Among them, the online retail sales of physical goods were 5.45 trillion yuan, an increase of 5.6%, accounting for 25.9%of the total retail sales of consumer goods. In the second quarter, the total retail sales of consumer goods decreased by 4.6%year -on -year. Among them, the total retail sales of social consumer goods in April decreased by 11.1%year -on -year; the decline in May narrowed to 6.7%; in June, it rose from a decrease, an increase of 3.1%year -on -year, and a month -on -month increase of 0.53%.

In addition to basic living consumption, services such as catering, cultural tourism, transportation, transportation and other services have been severely damaged.

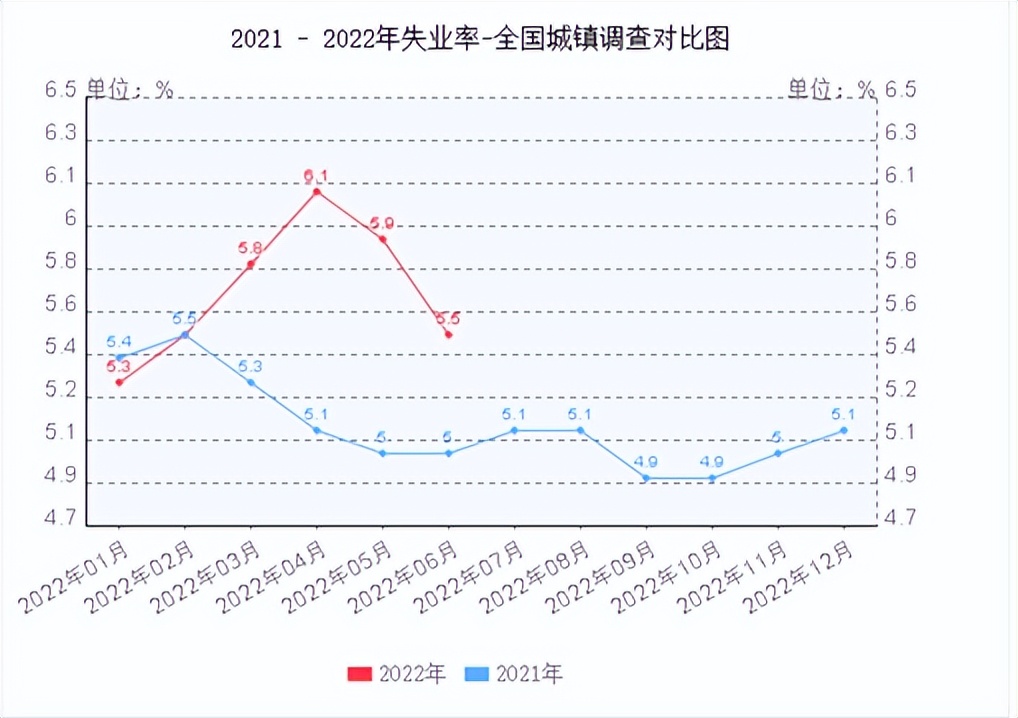

The unemployment rate since February 2022 has continued to rise, and the unemployment rate has reached 6.1%by April. As the epidemic relieves, the unemployment rate has declined in May and June, but the overall level is still higher than the level of 2021. In May 2022, the survey rate of unemployment rates in the age of 16-24 was 18.4%, far exceeding the international unemployment warning red line (safety line). In July 2022, my country will graduate with 10.76 million college students, which is overlapping with 18.4%of young people. The employment situation of young people in my country is very severe.

In addition, since this year, a number of Internet factories have announced layoffs, and its layoffs have also been rare in recent years. The risk of real estate mines and the shrinking family wealth has become a major obstacle to residents' assured consumption.

The unemployment rate is high. One of the most direct influences is that consumer stocks are not performing well.

According to the classification of Shenwan Industry, the A -share food and beverage industry has declined by 16%an annual decline, of which the largest declines are three squirrels, good products shops, and panda dairy products, with 49%, 45%, and 44%. "One", "The first 'cloud market' enterprise in A -share history" has fallen into the altar, and three squirrels have also been ridiculed by shareholders into "two squirrels" and "one squirrel". According to the classification of the Hong Kong Stock Exchange industry, the average annual decline of Hong Kong stocks must have a average annual decline of 6%. The well -known Yihai International, China Fei Crane, Zhou Hei Duck, etc., all of which have fallen by more than 30%.

Since 2020, consumer companies in Hong Kong stocks have fallen below the issuance price. The first day of the "Tide Play" bubble Mart has increased by 79.22%, the market value has exceeded 100 billion yuan, and the annual decline is 61%. A "Nai Xue's tea was launched on the day of listing, and the annual decline was 36%. The" Bar First Stock "Helen Si fell 26%year. The performance was relatively strong. More than doubled, the decline was about 10%during the year.

In addition to macro factors, the most important thing is high valuation. High valuation requires high growth to support. Once the growth rate of revenue slows down, it will face killing valuations. Naixue's tea and Yixian e -commerce companies have no profit. When the revenue growth rate slows down, the stock price will fall.

In March, the well -known coffee brand TIMS China became the first unicorn company to open valuation this year. The financing announcement issued by TIMS mentioned that "TIMS China’ s previous valuation was adjusted from 1.688 billion US dollars to 1.4 billion US dollars. "Some After the first demonstration of the leader, the industry is also taboo for the valuation.

Consumption willingness to be strongly consumed investment

Although the macroeconomic weak and consumer investment bubbles are shattered, this does not constitute a reason to see the consumption investment. As Zhang Ying said, the Chinese market is so large, the consumption willingness is so strong, the reason for stopping or significantly slows consumer investment, at most, at most, at most, at most, at most, the most. That is, there are not enough consumer companies with real vitality, but this is also a temporary talk.

Residents' willingness to consume is still very strong. Taking tourism as an example, after June 29, after the adjustment of Health Bao's "picking stars", the summer vacation was the peak tourist season, and the tourism industry quickly became active. Taking Xinjiang as an example, since July, Xinjiang's 5A -level tourist attractions day The average number of receptions increased by 201.08%month -on -month, and the lease rate of Xinjiang Star Hotel reached more than 90%. The number of group tour in Xinjiang's travel agencies increased by 325.29%month -on -month. A friend who sent a friend to Xinjiang on July 24th wrote that last year, the Kanas cabin in Xinjiang was 500 nights. At this time, it was 5,000 a night. Last year, Xinjiang car rental for 300 a day. From the perspective of the tourism market, the consumption willingness and consumption power of residents are still very strong, which is also the root of supporting consumer investment.

Investors have not lost confidence in consumption, which can be seen in the first and secondary markets.

In the secondary market, tourism, catering, and aviation sectors are eager to try. Especially with the gradual adjustment of epidemic prevention policies, tourism, aviation, and catering sections have risen sharply.

In the first -level market, Ms. Li, an investment director of a well -known consumer institution, told the author that the food group in the first half of this year has invested three projects, one less than the same period last year. From IT Orange is data, the number of investment in the e -commerce retail industry is 251, with an investment amount of 23.071 billion yuan.

Therefore, whether from consumer consumption willingness and consumption power, or investor's investment confidence, consumption is still a track worthy of capital attention.

Just as every crisis is a good opportunity for admission, investors need to make good use of every crisis. Ms. Li reports that the industry's confidence in consumption is obviously more rational this year, and she will feel that consumption is a long -term track, but the valuation has significantly lower.

This time, consumer investment is a rare opportunity for the industry. It not only allows entrepreneurs to withstand the test of the cycle, but also allows investors to rethink the essential logic of consumer investment.

Flow dividends Retirement Consumption Investment Return to the essence

In the era when traffic is king, consumer investment reveals the taste of the Internet everywhere. Whether it is an "brand" that entrepreneurs or investors value. Entrepreneurs are busy creating "brands", telling stories, current traffic, and trying to use marketing operations in the short term in the short term. Inside can occupy the minds of consumers, the most lacking of consumers in the Internet era is loyalty. Wherever wool goes is the main consumer psychology of consumers in the Internet era.

Investors value the brand's high growth rate, but the brand's hematopoietic ability is relatively ignored. In order to facilitate financing and lift the valuation, entrepreneurs are getting more and more to VCs, and buying traffic will grow. In two or three years, they can quickly grow into a "fat".

With the ebb of the era of traffic, the traffic dividend gradually disappeared, and the shortcomings of the Internet celebrity brand represented by three squirrels and Zhong Xuegao were repeatedly reflected.

Consumption is considered to be a low -threshold industry. Whether it is entrepreneurial or investment, it is not easy to make consumer investment. It is even more difficult to make consumer entrepreneurship. Take tea as an example, the three brands of Xixue's tea, Naixue's tea, and Honey Snow Bingcheng represent the three models. The ability to require the three modes is also very different. Investors will change when judging as non -cars. You have to be "fascinating to the eyes".

Zhang Ying mentioned the consumer investment logic of Jingwei: 1) performance speaking, based on the comprehensive quality of the founder, and continued to heavy positions to increase the head consumer company that has been invested in Jingwei. 2) Actively return to the layout of high -quality new consumer companies with tenacious survival and continuous business growth in adversity. 3) According to our industry thinking and large -scale judgment, we will continue to desperate early consumer startups. Ms. Li is more agreed with these three logic, but these three investment logic can be said to be the logic of all four seas. How to use it is wise.

For example, based on the comprehensive quality of the founder, how to judge the comprehensive quality of the founder? Taking Zhong Xuegao, who has invested in Jingwei as an example, must be involved in the comprehensive quality of Jingwei's founder Lin Sheng when he invested it at first, but it is obvious that it is treated with the "ice cream assassin". When discussing this incident, emergency public relations capabilities are obviously insufficient.

The logic of stubborn survival in adversity and continuous business growth can be understood by cases, such as Ruixing Coffee, and Ruixing Coffee summarizes the following points when mentioning its own advantages. , Powerful brand potential energy, continuous product innovation capabilities, and comprehensive emergency plans. This is a reflection of the comprehensive strength of a consumer company. These advantages have made Ruixing coffee reborn and let it stand out on the crowded coffee track. Ruixing's first quarter financial report shows that the number of net new stores in the first quarter was 556. As of the first first, the first first, as of the first, the first first, as of the first, the first first, as of the first, the first, the first of the first, was first. At the end of the quarter, Ruixing Coffee had a total of 6,580 stores, including 4,675 self -operated stores and 1905 joint camp stores, surpassing the number of Starbucks China 5654 stores. It also performed well in terms of performance, net income increased by 89.5%, and achieved the first comprehensive profit quarter since its establishment.

Consumption investment transferred from brand to supply chain. In the consumer investment layout we are looking for some brands with supply chain support, Ms. Li said. It is self -evident how important the supply chain is for consumer companies. In the past, the gameplay of heavy brands was challenged in the context of global raw materials rising in 2021. Taking coffee as an example, since 2021, the supply chain of coffee has gone through the largest fluctuations in 20 years, and Brazil has experienced the worst coffee beans in this century. Some coffee beans in the area have risen more than 35%. In the fluctuations of this wave of coffee supply chain, the brand without preparation is afraid that it will not be able to support it.

Consumption investment is like long -slope and thick snow, like consumer entrepreneurship, long -term persistence, seeing enough projects, and accumulating enough experience, maybe to resonate with Zhang Ying.

Zhang Ying shouted, Jingwei is very optimistic about the future opportunities in the field of consumption in China, and also maintains our investment rhythm according to our own ideas and logic. But don't listen to what he said, depending on what he does. What consumer projects have been invested in Jingwei? Here I also look forward to Jingwei as head institutions to lead consumer investment in the cold winter with actual actions.

- END -

The central bank's multiple measures to maintain a reasonable and abundant level. Experts are expected to flexibly regulate and maintain the capital stability in the later stage.

Reporter Liu QiA few days ago, the meeting of the Political Bureau of the Central Committee of the Communist Party of China emphasized that monetary policy should maintain reasonable liquidity, incre

Huabao Securities IPO: 90 % of wealth management and self -employment. How can we break the homogeneous competition?

Huabao Securities ranked 71st last year, facing fierce competition and compliance ...