Stormy more than twice!The transcript of the Shenzhen brokerage business department was released in June.

Author:Broker China Time:2022.08.04

The changes in the performance of the business department reflect the quality of the overall performance of the brokerage firm to a certain extent.

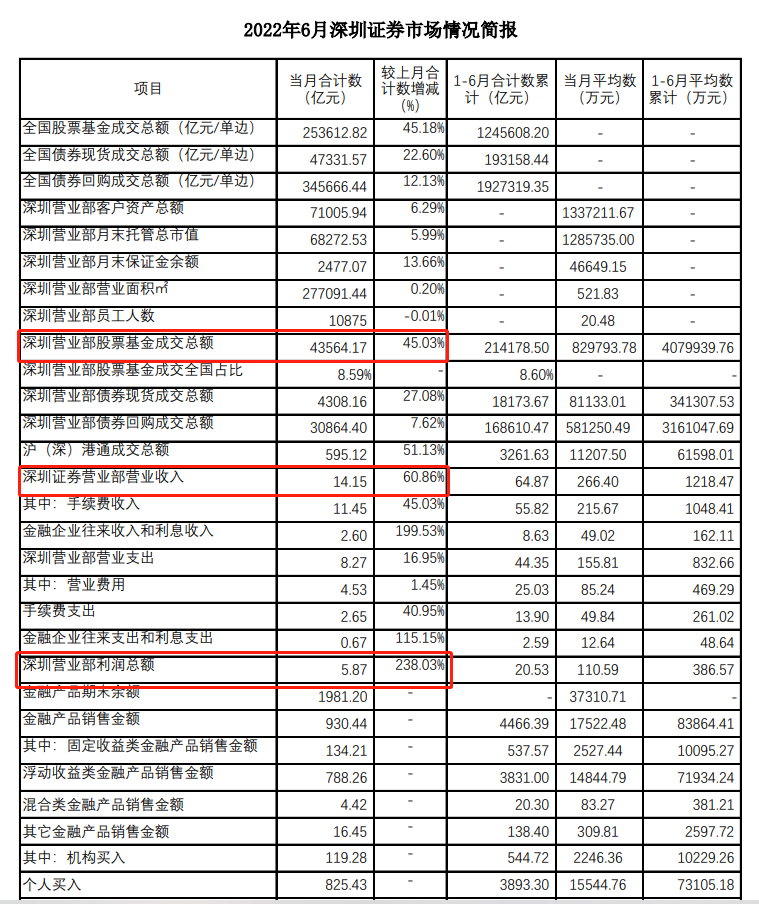

Recently, the Shenzhen Securities Industry Association disclosed the overall situation and business data of the Shenzhen Securities market in the month and the first half of the year in June and the first half of the year. Looking back at the A -share market in June, the market continued to rebound, and the turnover was significantly warmed up, which also caused Shenzhen Securities Business Department to "return blood" in June and change the operating performance of the one after the two months. In June, the business department of Shenzhen's jurisdiction achieved a total of 587 million yuan in profits, an increase of 238.03%month -on -month. At the same time, the number of losses in the business department in June decreased significantly.

In the first half of the year, the Shenzhen Securities Business Department achieved operating income of 6.487 billion yuan, and the total profit was 2.053 billion yuan, an increase of 2.7%and 12.74%year -on -year, respectively. Industry insiders believe that the improvement of the Securities Sales Department in June is conducive to the restoration of the overall performance of brokers in the first half of the year.

The total profit of the Shenzhen Sales Department increased by two times the total profit in June

The performance of the Securities Business Department is closely related to the "sky" of the market. In June, the market improved, and the performance of the Securities Sales Department became popular.

Data show that in June, the business department of Shenzhen's jurisdiction achieved a total of 1.415 billion yuan in operating income, an increase of 60.86%month -on -month; the total profit was 587 million yuan, an increase of 238.03%month -on -month.

Looking back at June this year, the A -share market continued to start a rebound. The Shanghai Index recovered the 3,200 points and 3300 points. The closing of 3398 points in the month was 212 points from May, an increase of 6.66%. At the same time, the A -share index rose across the board, and the leading increase was the GEM Index, the Shenzhen Certificate Index and the Shenzhen Certificate Composite Index. The A -share transactions of the two cities were 2.32 trillion, an increase of 7.21 trillion yuan from May.

From the perspective of the income composition of the Securities Business Department, the handling fee income is still the main source, with a total of 1.145 billion yuan in June, an increase of 45.03%month -on -month, accounting for 80.92%of the entire operating income ratio. At the same time, financial enterprises' income and interest income increased significantly, reaching 260 million yuan, a significant increase of nearly two times from the previous month.

Under the active transactions of the market, the performance indicators of the Shenzhen Securities Business Department are considerable. Among them, the total transaction volume of stock funds was 4.36 trillion yuan, a month -on -month growth rate of 45.03%, accounting for 8.59%of the national stock fund turnover; the final data of the shareholding transactions from January to June was 2.142 trillion yuan.

In terms of customer assets, the total assets of Shenzhen Business Department reached 7.1 trillion yuan, an increase of 6.29%month -on -month; the total market value of the custody at the end of June was 6.83 trillion yuan, an increase of 5.99%month -on -month.

The loss of losses of the business department has decreased significantly, and Guoxin Tai's profit fell to 2nd in September

From the perspective of May, the revenue and profits of the business departments of the securities firms in Shenzhen in June have improved, but the internal division is still obvious.

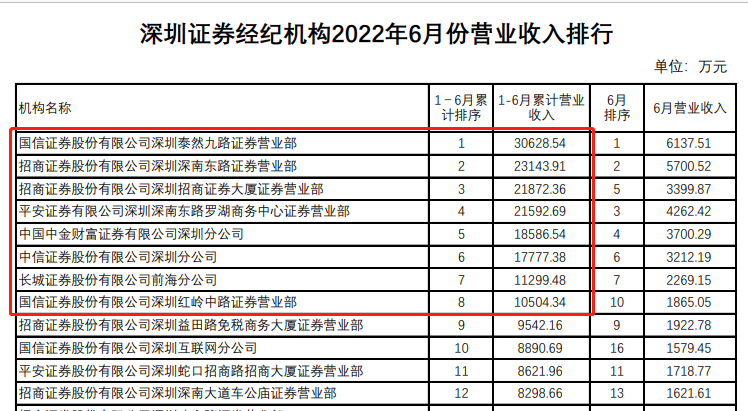

From the perspective of operating income, the securities business department with operating income of more than 10 million yuan has reached 30, an increase of more than 50 % from 19th in May.

Specifically, the 525 Securities Business Department included in the statistics of the business income in June is already "big households" with more than 20 million, with a total of 7, of which the top three operating income is still the three familiar outside world, namely Guoxin Securities Securities Securities Shenzhen Tairan Jiu Road Sales Department (613.755 million yuan), China Merchants Securities Shennan East Road Sales Department (570.552 million yuan), and Ping An Securities Shenzhen Shennan East Road Luohu Business Center Business Department (42.6242 million yuan).

However, in the first half of the year, the "big households" with income of more than 100 million yuan in these securities business departments in Shenzhen were only 8. Among them, the top three business departments of the total operating income were Guoxin Securities Shenzhen Tairan Jiu Road Sales Department (306 million 306 million Yuan), China Merchants Securities Shennan East Road Sales Department (231 million yuan) and China Merchants Securities Merchants Securities Building (219 million yuan), that is, two business departments of China Merchants Securities were shortlisted.

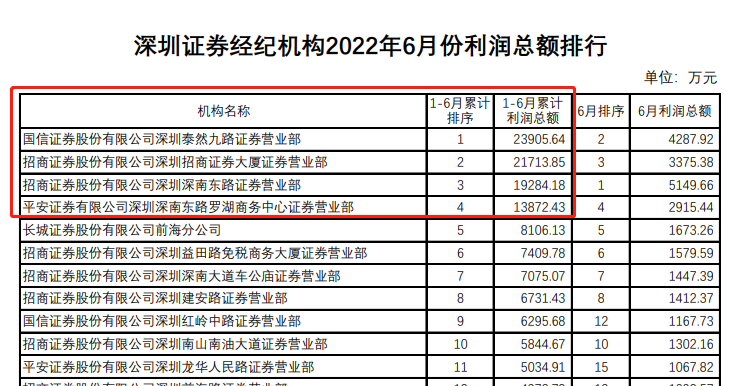

From the profits of the business department, the 533 Shenzhen Jurisdiction's business department included in the statistics of the business department. In June, there were 331 business departments achieved profitability. Significantly improved. It is worth noting that the status of the first place of Guoxin Securities Taijiu Business Department of the old business department was shaken, and it was surpassed by China Merchants Securities Shennan East Road Securities Business Department for nearly 9 million weak gaps.

From the perspective of the profitability of the business department in the first half of the year, the number of profitables and losses of 533 business departments was 257 and 276, respectively, and almost leveled the profit and loss. 53, and the business department with a total profit of more than 100 million yuan in the first half of the year belongs to the "rare horn", with a total of 4, which are Guoxin Securities Shenzhen Tairan Jiu Road Sales Department (239 million yuan) and China Merchants Securities Merchants Securities Building (217 million yuan. ), China Merchants Securities Shennan East Road Sales Department (193 million yuan) and Ping An Securities Shenzhen Shennan East Road Luohu Business Center Business Department (139 million yuan).

Editor -in -chief: Wang Lulu

- END -

Koda self -control disclosed the draft equity incentive plan: It is planned to grant a total of 4.5 million shares to 51 people

On July 19, 2022, Cada Self -Control (831832.BJ), a listed company of the Beijing Stock Exchange, released the 2022 equity incentive plan (draft).The announcement shows that Koda's self -control inten...

[Mind Guardians] Gulin County Administrative Examination and Approval Bureau: Do not worry about "cross -provincial running" to solve people's worries in different places

The medical expenses for reimbursement have been received. I didn't expect it to b...