Receive compensation for mortgage repayment in advance?The Bank of Communications has been deleted!Will other banks follow up in the future?

Author:Harbin Daily Time:2022.08.03

August 2nd

The Bank of Communications withdrew on the official website

Published the day before

Early repayment compensation for personal mortgage loans

Announcement of Toll Standard Adjustment

In the "Announcement on the Adjustment of Personal Mortgage Loans, Personal Online Mortgage (Consumption) Earlier Repayment Compensation Charges" issued on August 1, the Bank of China stated that it is to further do a good job of personal mortgage loans, personal online mortgage mortgage Loan (consumption) related financial services, standardize early repayment compensation charges, starting from November 1, 2022, personal mortgage loans (including personal housing loans, personal commercial housing loans, personal factory loans) and personal online mortgage Loan (consumption), advance repayment compensation collection shall be subject to the depends on the loan contract, and the compensation ratio is 1%of the amount of early repayment principal.

After the above announcement is released

Treating market attention

On August 2, the Bank of Communications deleted the above announcement on its official website

Reporter consulting customer service staff

The other party said, "I may complain too much to withdraw down"

But the specific reason is unclear

According to the First Financial Reporter, the relevant rules are not yet clear, and all local branch branch is still "waiting for notice." According to the staff of the local branch of Beijing, the bank has not collected compensation, whether it is part of the part and all of them in advance, and the notice is relatively "suddenly".

Some banks believe that the decrease in the threshold for compensation collection may be related to the current increase in early repayment and the reduction of new personal housing loan business.

In addition to the Bank of Communications

Are other banks also collect "compensation"?

Zhongxin Jingwei dialed the outlets of the four major banks of China Agricultural Industry in Beijing to consult a housing loan (loan) policy that it was learned that at present, the Bank of China, Industrial and Commercial Bank of China, and China Construction Bank have not collected compensation for early housing repayment behaviors.

Will other banks follow up in the future?

Dong Ximiao, chief researcher at Zhongguancun Internet Finance Research Institute, said that in practice, fewer banks collect liquidated damages to early repayment behaviors. He predicts that other banks will not follow up with the Bank of Communications.

"Personally, in the current environment, this approach is not encouraged." Wang Jianhui, a senior industry person, believes that this approach should not become a common phenomenon, because whether to supplement the compensation is related to the situation of various banks. For example, whether the funds are abundant. At the same time, it also has a certain relationship with the situation in various regions. If some areas are worried that customers will have new risks and cause non -performing assets, customers may encourage customers to repay in advance.

Source: First Finance, Surging News, Zhongxin Jingwei

PSAs

- END -

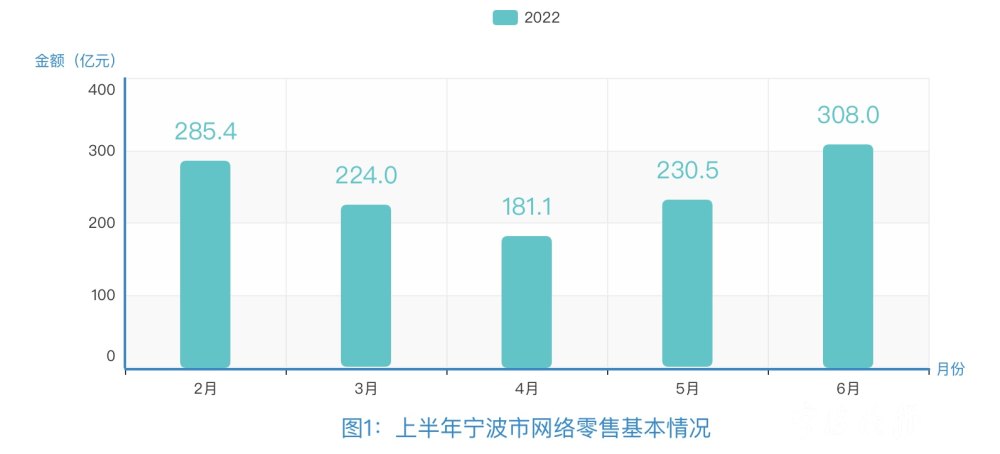

In the first half of the year, Ningbo's online retail sales exceeded 122.9 billion yuan!3C digital, clothing shoes and bags, home and home in the top three

A few days ago, the Analysis Report on the E -commerce Big Data Analysis of E -Com...

Follow the pig market!The Development and Reform Commission strictly hits the accumulation of strange and coaxing prices, and is studying the launch of pork reserves

The reporter learned on July 5 that in response to the recent irrational behavior such as blind selling fences in the pig market, the Price Department of the National Development and Reform Commission