Relief in risk shelter!The Asia -Pacific stock market plummeted, the yen rose crazy

Author:First financial Time:2022.08.03

02.08.2022

Number of this text: 2543, the reading time is about 4 minutes older

Guide: The stock market fluctuates large, but the interest rate market and RMB exchange rate are relatively stable.

Author | First Finance Zhou Erin

As geopolitical risks rise, the market emotions have soared -the rise of risk aversion currency yen that has been sluggish for more than half a year. On August 2, the US dollar jumped directly from nearly 140 to 131; the Asia -Pacific stock market fell. The Hang Seng Index has fallen by more than 2%, and the net outflow of the northbound capital exceeds 2.3 billion yuan; the panic index VIX and gold prices have risen.

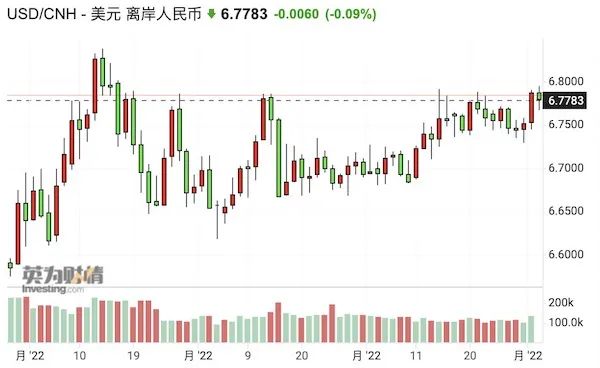

Several traders and strategists interviewed by the First Financial Reporter believed that the stock market fluctuated large, but the interest rate market and most foreign exchange varieties were relatively stable. Compared with panic, the wait -and -see mood still dominates, and the RMB exchange rate remains in a narrow fluctuation range of 6.76 ~ 6.79. In addition, the stock market also has its own adjustment. For example, after a market rebound, investors are waiting for the August financial report, so the short -term watching emotions is heavier.

Panic and look up

In mid -July, the US dollar/yen set the highest since September 1998, and it has exceeded 139. It seems to be expected to touch to 140. During the year, nearly 20 % of the yen came out of a large level of rebound in just one week. As of August 2, Beijing time, USD/yen was reported to 130.9.

The reason why the yen is considered a risk aversion currency is the mainstream explanation is the yen's facilities. Setting trading is an investment strategy, that is, investors borrow currency (financing currency) at a lower interest rate and invest in currency (target currency) with higher interest rates. To make this strategy profitable, the basic assumption is that the exchange rate changes will not eliminate the spread during the investment period. Because these positions contain leverage and are not hedge, the appreciation of financing currencies (or concerns about future appreciation) will cause significant reduction in these positions, and this will in turn strengthen the initial appreciation. As Japan's interest rates have been connected nearly zero in the past 20 years, the Japanese yen has always been a popular financing currency, which has made the yen exchange rate easily affected by chaocated transactions. When risk incidents occur, funds often return from high -risk assets to Japan.

However, the recent plunge in US debt yields has also led to the decline in the US dollar and pushing non -US currency to rise. The US debt yields have plummeted from the previous 3.5%high to 2.6%, which is closely related to the Fed's rapid interest rate hike cycle and the risk of recession have intensified. The yield of Japanese government bonds, which has long been overwhelmed due to the continuous intervention of the Bank of Japan, has just declined to a certain extent, which has also supported the Japanese yen to continue to strengthen.

In addition to the yen, the gold -absorbing assets have been eager to move in the near future, and the price of gold has soared from a period of $ 1690 in July to $ 1790. Due to the Fed ’s rapid interest rate hike 225bp during the year, it once caused gold to fall from a straight line above $ 2,000, and now it seems to have the bottom of the bottom.

However, investors' views on gold are still differentiated. The Office of UBS Wealth Management Investment (CIO) told reporters that it is not optimistic about the view of gold. As U.S. interest rates rise, inflation, quantitative tightening, and US dollar continues to strengthen, the price of gold may soften to $ 1,600 at the end of the year. "We don't think that gold is a good tool for hedging economy. , Credit credit bonds and Swiss francs. "

Need to adjust the stock market

This time, the fluctuation of the stock market is obviously greater.

A foreign bank strategist told reporters: "The stock market seems to be temporarily dominated by short emotions, but most foreign exchange and interest rate market response is relatively small. The market does not seem to be priced at major risks or accidents."

Institutions believe that the stock market has its own needs in the near future. Yuan Yuwei, a senior global macro trader, told reporters: "The Shanghai Composite Index and IC (CSI 500 Stock Index Futures) have become a" head and shoulder top ", which may be large. Futures) exposed to macro risks of real estate and banks, IM (1,000 stock index futures) of the IM (China Stock Exchange) is quantified and gathered for money. The rhythm is more difficult to predict, but the relative valuation is higher and there is a risk of callback. "

In terms of policy, the Politburo Meeting last week filed a "maintaining strategic determination". This meeting did not propose incremental measures. The focus of the macro policy in the second half of the year was to make good use of the existing policies that had been introduced. Especially in terms of finance, that is, "make good use of local government bond funds and support local governments to use the full use of special debt limits", which means that there may be no room for local bonds and special government bonds in the second half of the year.

Before and after the interim, the market's wait -and -see mood was heavier. Meng Lei, a UBS securities stock analyst, told reporters: "Considering the rapid rebound of the A -share market to the stock price level in early March, we believe that the market has largely reflected the renewal and policy support to the stock price. May enter the staged consolidation in the short term. "

He said that it is expected that profit is expected to be reduced during the upcoming second -quarter report. After the return of funds from the north in June, 73 billion yuan, the funds continued to flow out in July. "In the benchmark situation, we expect universal profit expectations to reduce the end at the end of the third quarter. At that time, the market is expected to usher in a more obvious valuation improvement. Therefore, the possible market recovery in the next two months will provide attractiveness to be attractive. Investment opportunities. "On August 2, Hong Kong stocks also fell across the board, and Tencent Holdings and Alibaba plummeted. After nearly 5 months, Tencent's stock price fell below the 300 Hong Kong dollar mark on August 1, and the valuation returned to the bottom of history; Ali's stock price fell more than 80%, the market value evaporated nearly 624.6 billion U.S. dollars, the listing of 8 years, the market value returned to the return of the market value, and the market value returned to the market value. origin.

CICC believes that from the perspective of Hong Kong stocks, it is expected that the profit growth rate in the first half of the year will drop significantly to 5%, which is significantly slowed down from 2021, which is significantly slowed from the economic slowdown in the first half of the year. On the one hand, the domestic epidemic rebounded in the second quarter, the downstream consumption and investment of the real estate cycle dragged downstream consumption and investment, and dragged down the income of corporate income; on the other hand, the price of international commodities was still high under the global supply impact in the first half of the year. ease.

At present, major institutions still have a differentiation attitude towards Internet giants. Claire Liang, a senior analyst of Morningstar, told reporters that the optimistic faction believes that the Politburo meeting proposes to "complete the rectification of the platform economy and implement normalized supervision of the platform economy", and will also "focus on launching a batch of 'green light' investment cases" Essence However, some institutions also hold a more cautious attitude, and concerns include: in the context of supervision, the growth rate of related companies may not be as high as before; slowing economic activities may affect advertising revenue; starting in the first quarter of this year, there are already more than 100 more than 100. The company's stock company is included in the "pre -delisting list" and so on.

RMB exchange rate stable

Faced with uncertainty, the RMB exchange rate is still relatively stable, and the offshore RMB is maintained in the 6.7 range.

Charlie Lay, an analyst at the German commercial bank, told reporters: "There are many headlines about China this week, but so far, the renminbi and offshore RMB are relatively stable. The recovery part of the loss is also regained. The central bank will basically remain the middle price of the renminbi from Monday morning on Tuesday morning, issuing a clear signal of stable -centered. "

In addition, when the Bayeng government decided whether to cancel Trump's tariffs on imported goods in China, this also added an uncertainty to the market.

Charlie Lai told reporters that the first batch of tariffs imposed by the United States on US $ 34 billion in Chinese imported goods expired on July 6, and another batch of tariffs on imported products imported by US $ 16 billion will also expire on August 23. There will be a batch (US $ 200 billion) will expire on September 24.

Overall, most institutions do not think that RMB will depreciate sharply. Zhang Meng, a macro and foreign exchange strategist in Barclays, previously told reporters: "The still strong trade surplus means the restricted space for the sharp decline in the RMB to the US dollar. The unexpected rise of exports promotes the historical high in June ($ 98 billion), reflecting the reflection The relief of the supply chain interruption, the new export order also shows that external demand is still elastic. "

- END -

[Central Media see Gansu] "One Village Wanshu" Gansu Province Huachi County Innovation Green Open Method

The ecological environment is fragile, the soil and soil loss is severe, and the bald mountains and gullies are vertical and horizontal ... It was once a true portrayal of Huachi County, Gansu. Today,

Dry goods Q & A 丨 It is worth looking forward to!We have to change in front of our door

recentlyYunnan Province is issuedYunnan Provincial People's Government on the impl...