Air China raised 15 billion yuan to purchase the rural aviation industry to accelerate the recovery?

Author:Cover news Time:2022.08.03

Cover reporter Liu Xuqiang

Following the longest -scale public purchase orders in the three years of Air China, China Eastern and China Eastern Airlines, and China Southern Airlines in the past three years, on the evening of August 2, Air China once again announced that it raised 22 aircraft.

Behind a large number of purchases is China Air China's prediction of accelerating the recovery of the civil aviation market. But at the same time, the company's high asset -liability ratio has also become a hidden concern.

As of the afternoon closing on August 3, the China National Navigation News reported 9.72 yuan/share, up 0.52%, with a market value of 141.2 billion yuan.

▲ Air China plans to raise 15 billion yuan to purchase aircraft and supplement cash flow

Two -degree stroke purchase machine

Asset -liability ratio is high, it is not a hidden concern

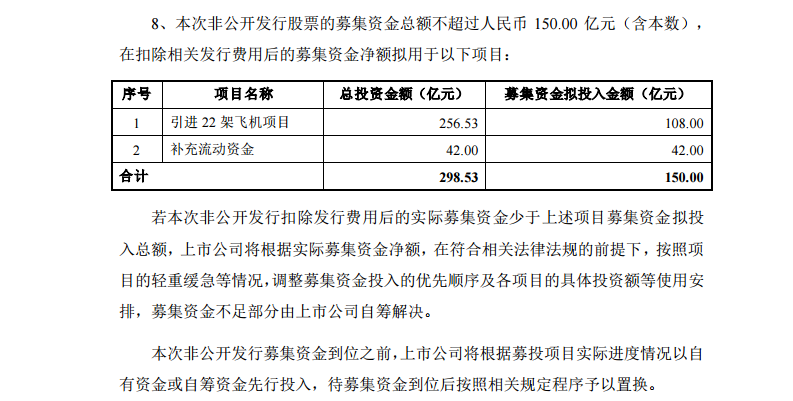

On the evening of August 2nd, Air China issued a fixed increase announcement that it was planned to raise funds of not more than 15 billion yuan, of which 10.8 billion yuan was used to introduce 22 aircraft projects and 4.2 billion yuan to supplement mobile funds. This fundraising will help the company to optimize the fleet structure and relieve the pressure of capital.

The targets of the fixed increase, including funds, securities, trusts, finance, insurance and other investors, and other investors, and not more than 35. Among them, China Airlines controlling shareholder AVIC Group plans to contribute less than 5.5 billion yuan. After the completion of the fixed increase, AVIC Group is still the controlling shareholder of China Air China.

The reporter noticed that the total investment of this purchase project was 25.6 billion yuan. In addition to 10.8 billion yuan of fundraising, Air China also needed to prepare nearly 15 billion yuan for the purchase of the machine, which means that the company's cash flow after the investment has further eaten further tightly Essence It is worth noting that the asset -liability ratio of Air China has remained high in recent years. Annual report data shows that in the end of 2019, at the end of 2020 and at the end of 2021, Air China ’s asset -liability ratio was 65.55%, 70.50%, and 77.93%, respectively, and exceeded 80%in the first quarter of this year. The asset -liability ratio has risen year by year, which has brought challenges to the company's cash flow management.

The announcement mentioned that Air China choosing to buy a machine at this time is to predict that the civil aviation market is expected to enter the accelerated recovery stage. This is also the second time Air China has bought a plane. As early as July this year, the company signed a large order of 292 aircraft with Airbus with the two major airlines of China Southern Airlines and China Eastern Airlines. It is the first time that China's civil aviation industry has announced a large -scale passenger aircraft order in the past three years. Purchase behavior has also been interpreted by the market as the airline company's strong confidence in the aviation market recovery.

Starting at the end of May

Civil Aviation Passenger Transport recovery obviously accelerating

From the perspective of performance, the operation of Air China in the second quarter of this year has improved to a certain extent. In the first half of 2022, the company had a pre -loss of 6.7 billion yuan, a decrease in losses year -on -year. In the first half of the year, the loss of 8 billion yuan was narrowed compared to the first quarter, which means that the company turned a profit in the second quarter.

Earlier, Air China also released data in June, and passenger transportation was still declining year -on -year, but fortunately, it improved significantly from the previous month. Passenger transportation capacity input decreased by 40.5%year -on -year, and 53.2%month -on -month; passenger turnover decreased by 47.6%year -on -year, and 73.3%month -on -month; the average passenger rate was 63.1%, a year -on -year decrease of 8.5 percentage points, an increase of 7.3 percentage points from the previous month.

The good news is that the civil aviation market is recovering in an orderly manner. The press conference of the Civil Aviation Administration held a few days ago was announced that since May, aviation transportation production has gradually reversed difficulties, and the V -shaped trend is generally present. In the first half of the year, the total turnover of the entire industry had decreased by 37.0%year -on -year to 46.7%in the same period in 2019. However, in June, the overall size of the industry's transportation production has resumed to more than half of the same period in 2019.

In this regard, Li Guijin, an associate professor of the School of Civil Aviation Management Cadre, analyzed that the three major markets of China Civil Aviation Passenger Transportation, the Yangtze River Delta, Beijing -Tianjin -Hebei, and Guangdong -Hong Kong -Macao Greater Bay Area. Essence It is worth noting that the recovery of civil aviation traffic from the three major markets has accelerated significantly since the end of May.

- END -

"Bear Market" focuses on American confidence, economist: US economist may be pushed to "hard landing"

[Global Times special reporter Zheng Ke Global Times reporter Ni Hao Yuwen] The faint light has disappeared and welcome to the bear market -A American media was full of frustration on the 13th. On

In the first half of the year, Hefei imports and exports ranked first in the "trillions of cities" in the long triangle of the triangle

How does foreign trade maintain rapid development?According to the relevant person...