In July, the market performance of the securities firm's gold stock market exceeded half of the market.

Author:Securities daily Time:2022.08.03

Reporter reporter Zhou Shang 者

The recommendation of the monthly gold stocks of the securities firms reflects the research team of the brokerage company and judgment of the general trend of the month, and can test the investment and research strength of major brokers to a certain extent.

Looking back on July, the performance of the monthly gold stock market recommended by the securities firm is very different. In early July, a total of 51 securities firms recommended 356 gold stocks. In the month of the Shanghai Stock Exchange Index fell by 4.28%, 40%of the gold stocks increased their stock prices in the month, and 13%of the gold stock price fell, but still won the Shanghai Stock Exchange Index.

In July, 7 of the 356 stocks recommended by the securities firm rose more than 40%, and 9 stocks fell more than 20%. Among them, the Shen Ling environment recommended by Zhongtai Securities ranked first with 93.95%of the increase; Tongfei shares recommended by South China Technology and Open Source Securities recommended by China Merchants Securities, respectively, followed by 89.92%and 61.02%, respectively. After the rise in July, of the above 7 stocks, four stocks including Shen Ling Environment, Jie Jiawei, Xusheng, and Yinlun shares were recommended by brokers as gold stocks in August.

It is worth noting that the market performance of the monthly popular gold stocks recommended by different brokers in July is not satisfactory. Among the 356 gold stocks recommended by securities firms in July, 19 stocks were recommended by more than 4 securities firms. As a result, all of them fell in July. Among them, China, which was jointly recommended by 17 securities firms, fell 9.24%of the month; Guizhou Moutai, which was jointly recommended by 9 securities firms, fell 7.17%; Wuliangye, Oriental Wealth, Tianci Materials, Guolian Securities, TCL Central, China Air China, etc. The decline of gold stocks also exceeded 10%; the strong five golds, which were jointly recommended by Debon Securities, open source securities, and CITIC Construction Investment, plummeted by 37.75%in July.

According to Wind data, as of the press release, 37 brokerage companies have announced the monthly gold stocks recommended in August, involving a total of 332 stocks. The reporter found that a large area of popular gold stocks recommended by the securities firm in August, and many new faces appeared on the list of gold stocks. So far, Poly Development has been jointly recommended by 10 securities firms as a gold stock in August, and the number of recommendations for Moutai in Guizhou has also been the same as last month.

As the largest popular gold stock recommended by brokers in July, China -free's popularity in the minds of securities firms in August has declined significantly. It is only recommended by 4 brokerage firms and decreased by 13 from July. In July, there were 8 popular gold stocks recommended by five or more securities firms, namely China -free, Guizhou Maotai, Wuliangye, Oriental Fortune, Luzhou Laojiao, Hang Seng Electronics, Poly Development, and Tsingtao Beer. However, there were only 4 popular gold stocks recommended by five or more brokers in August, namely Poly Development, Guizhou Maotai, Longji Green Energy, and AVIC.

After the A -share market shocks in July, how will the investment wind direction in August be performed?

"In July, the overall callback of the A -share market was mainly due to two reasons. One is that the global recession expects to intensify, the price of commodities falls, and it constitutes a certain impact on the A -share market. . "Chen Li, chief economist of Chuancai Securities and director of the Institute, said that in the context of the domestic economy continues to recover, the profit of listed companies has risen, and abundant liquidity, the stock market is expected to shake and strengthen. The valuation of the sector is in the relatively low power industry chain, digital economy, agriculture, military industry and other industries.

The Zhang Xia team of China Merchants Securities also believes that after the adjustment of the major indexes in the A -share market in July, after the internal economic expected target, the external Federal Reserve ’s interest rate hikes, etc. Back to the row cycle.

The research team of CICC stated that in July, the Chinese economy continued to recover, but the real estate industry chain faced certain operating pressure, and the disturbance of the geographical situation also brought certain concerns. Under the comprehensive influence of internal and external factors, in July, the A -share market shifted from the previous "unilateral rise" to "bilateral fluctuations". The impact on the configuration in August. It is expected that the short -term A -share market may maintain a weak vibration pattern. Pay attention to grasping the rhythm of the market and enhancing the flexibility of allocation.

- END -

Tokyo stock market rises slightly

Xinhua News Agency, Tokyo, July 19 (Reporter Liu Chunyan) The two major stock inde...

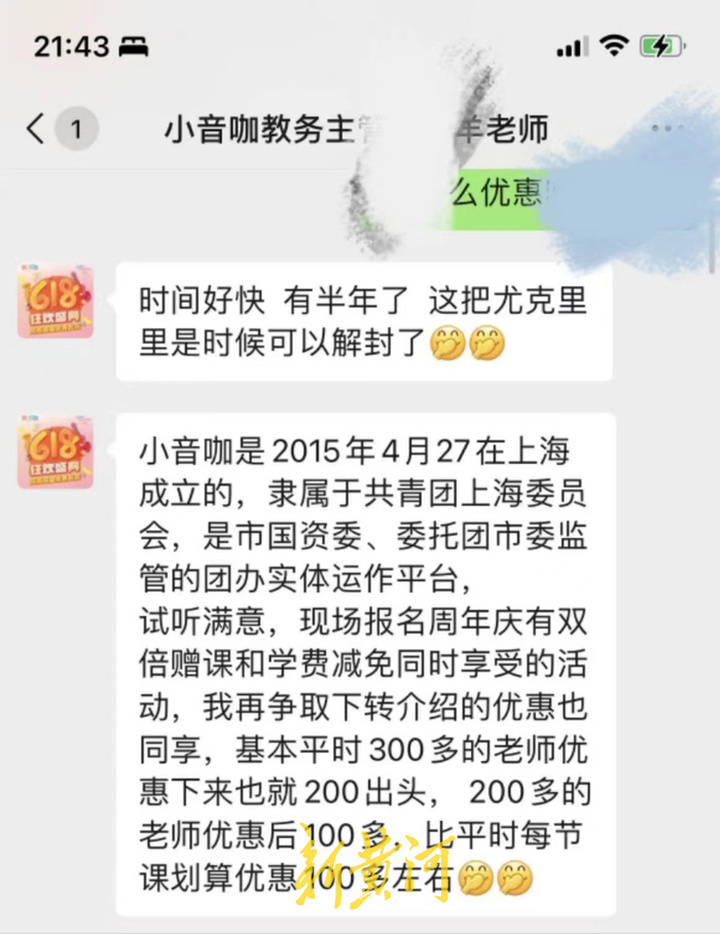

Music education institution "small sound coffee" mines?Millions of fans Vs V, the amount involved may reach 600 million yuan

New Yellow River Reporter: Li YunhengA letter of To the Parents and Teachers of th...