Four large banks will start a specific pilot savings pilot third pillar pillar pension and add new products

Author:Economic Daily Time:2022.08.03

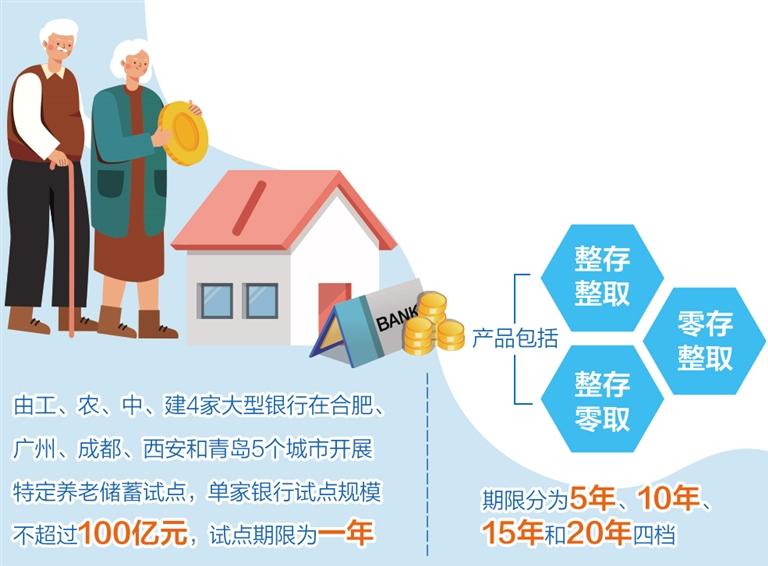

Recently, the China Banking Regulatory Commission and the People's Bank of China jointly issued the "Notice on Carrying out the Pilot Work of Specific Pension Savings", which clearly states that from November 20, 2022, ICBC, Agricultural Bank, Bank of China and Construction Bank in Hefei, Guangzhou, Chengdu in Hefei, Guangzhou, Chengdu , Xi'an and Qingdao carry out a pilot pilot of specific pension savings. Among them, the scale of the pilot of a single bank does not exceed 10 billion yuan, and the pilot period is one year.

"The financial regulatory authorities have decided to conduct pilots in five large banks in 5 cities to explore the launch of pension savings products and services. Pension savings pilots are based on my country's public savings preferences to innovate products and services. Products such as pension wealth management, pension insurance and pension funds are supplemented. "Said Dong Ximiao, chief researcher at Zhailian Financial.

Specifically, in terms of product design, specific pension savings products include three types: complete deposit, zero deposit, and zero deposit. The product period is divided into 5 years, 10 years, 15 years, and 20 years. The product interest rate is slightly higher than the listing interest rate of the five -year deposit of the five -year -old bank. The principal of the deposit of a special pilot savings product in a single pilot bank is 500,000 yuan. Dong Ximiao said that from the perspective of the product itself, the time limit for specific pension savings products launched this time is long. In 5 to 20 years, the interest rates are more moderate. It is compatible with the long -term care needs of residents.

In recent years, in order to enrich the supply of the third pillar pillar pension financial products, my country has continued to promote the reform of the business pension financial market, mainly focusing on investment, wealth management, consumption and other derivative needs related to the elderly, including pension savings, commercial pension financial management, business, business Pension insurance, commercial pensions and other products have achieved certain results. "However, compared with the basic pension guarantee system that is relatively comprehensive in the first and second pillars, the problem of imbalance in the development of the third pillar pillar pillar pension financial system in my country is currently prominent, and financial products such as pension savings, commercial pension insurance, and pension wealth management are small. "Du Yang, a researcher at the Bank of China Research Institute, said that compared with other pension financial products, pension savings are more popular with aging groups. According to the data disclosed by the China Pension Financial Survey Report (2021), more than half of the survey objects are willing to choose bank deposits as a means to accumulate wealth. The development of this specific pension savings provides a strong starting point to solve the problem of imbalance in the development of the third pillar pillar pension financial system in my country, which will help weave the bottom -up pension service network and promote and standardize the development of the third pillar pillar pension financial supply.

At present, my country's population over 60 years of age has reached 264 million, and it will exceed 300 million people during the "14th Five -Year Plan" period. my country will enter the stage of medium aging, and the potential for commercial pension financial markets will be huge. Dong Ximiao said that in combination with mature experience, domestic market needs and development status, my country should give full play to the different market advantages of the insurance industry and the capital market, strengthen industry collaboration and resource integration, explore new pension products and emerging pension models, create a cycle, long cycle, long -term long -term, long -term, long -term, long -term, long -term, long -term, long -term, long -term, long -term, long -term, long -term, long -term, long -term, long -term, long -term, long -term, long -term, long -term, long -term, long periods Duration, diversified asset allocation model and investment products. Through the innovation of financial products in the pension field, we will continue to develop products with exclusive financial management, funds, and trusts, and better provide rich and diverse financial services for the pension field.

In addition, the "Notice" requires the pilot bank to do a good job of product design, internal control, risk management and consumer protection to ensure the steady operation of specific pension savings business. "The risk management of a specific pension savings business is the deserved meaning to prevent financial risks. Pilot banks should establish a product system that focuses on long -term income and risk considerations. Differential and systematic product portfolios. "Du Yang said that the quality and efficiency of improving the development of pilot banking business should be compacted in three aspects: first, to clarify the division of responsibilities and organizational structure, and allocate a reasonable and sufficient resources for product development With operations, formulate and improve the business process, and ensure the smooth progress of pilot work; secondly, we must seize the opportunities and give full play to the advantages of pilot banks in terms of customers, channels, funds, and technology. Highlight the pension attributes of savings products; in the end, we must do a good job of risk management of the elderly savings business, establish a product system that focuses on long -term income and risk considerations, and form differentiated, systematically, and other characteristics of different risk preferences, wealth accumulation, and cash flow. The combination of product combinations to further strengthen the characteristics and inclusiveness of pension savings products.

In the long run, in order to promote the healthy development of specific pension savings business, on the basis of the pilot, the pilot experience and lessons should be summarized as soon as possible to better meet the public's demand for pension savings. Dong Ximiao suggested that the scale of pilot products and pilot cities in a timely manner, and expanded the pilot to other large banks and small and medium banks to further enrich the pension savings products and optimize the period structure. For example, some temporary liquidity support measures can also be taken. In case of illness and other conditions, some services such as in -handing and deposit pledge can be provided.

- END -

Sickle girl AI intelligent writing | August 3rd, Hunan stocks rising and falling 5

Changsha Evening News, Changsha, August 3rd, closed on August 3: The Shanghai Inde...

101 years old, happy birthday!@Ichtish you

July 1, 2022The 101th anniversary of the founding of the Communist Party of ChinaH...