Must News: The management scale of public fundraising funds in my country increased to 26.79 trillion yuan

Author:Securities daily Time:2022.08.03

Must News Speed August 222, August 2, 2022 Securities Daily www.zqrb.cn1. Finance Department: Strengthen the financial management and maintain state -owned financial capital rights on August 2nd, the Ministry of Finance issued the "Funds to further strengthen the financial management of state -owned financial enterprises "Notice, further strengthen the financial management of state -owned financial enterprises, effectively prevent financial risks, and safeguard the rights of state -owned financial capital. The "Notice" adheres to the problem -oriented, and the income and expenditure management found in the financial management management of financial enterprises, the poor classification of asset risks, the inadequate management after verification, weak overseas asset management, and inaccurate accounting accounting. Standardize the financial behavior of financial enterprises, strengthen financial management of financial enterprises: First, standardize the management of financial enterprises' revenue and expenditure, consolidate the financial foundation, and promote high -quality development of cost reduction and efficiency; second, strengthen financial asset management, maintain financial debt, and effectively prevent financial risks; The third is to compact the main responsibility of financial enterprises, accurately implement accounting accounting, and truly disclose the financial accounting report; fourth, the financial department must actively fulfill the duties of state -owned financial capital investors and effectively safeguard the owner's rights. (Securities Daily) 2. The Ministry of Finance revised and issued the "Financial System of High Schools" to promote the improvement of the level of financial management level of colleges and universities. Management level. The principle of implementing the spirit of reform, adhering to the problem of problems, and reflecting the financial characteristics of colleges and universities is the principle, and it is connected with the newly revised "Financial Rules of Institutions" (the Ministry of Finance No. 108) and revised the relevant content. The first is to adhere to and strengthen the party's comprehensive leadership of colleges and universities, and the principal responsibility system under the leadership of the party committee of colleges and universities. Second, in accordance with the "Institutions' Finance Rules", the "System" should be adjusted and refined accordingly, and it is clear that comprehensive implementation of performance management, income that has not been included in the budget must not arrange expenditures, and truthfully reflect borrowing debts in accordance with the law. Regulations for accounting, adjust financial reports and asset management related terms. The third is to improve the level of finance management of universities, and in accordance with the relevant spirit of the "Accounting Law", it proposes a clear requirements for the financial management related professional background of financial management. The fourth is to implement the relevant requirements of the "Promoting the Transformation of Scientific and Technological Achievements" and "Interim Measures for the Management of State -owned Assets State -owned Assets in Public Institutions". Higher universities can independently decide to transfer, license or price investment in accordance with regulations, and obtain the results of transformation of scientific and technological achievements in accordance with regulations. All income is left to the unit. The Ministry of Finance stated that the next step will pay close attention to the implementation of the "System" with the Ministry of Education and other departments, promote the interpretation of relevant training, continue to follow up and ask, guide colleges and universities to effectively improve the level of financial management, and better serve the reform and development of higher education. (China News Network) 3. The scale of public fund management in my country increased to 26.79 trillion yuan at 5 pm on August 2, and the China Fund Industry Association released the public fund market data in June 2022. Data show that as of the end of June 2022, the net value of public fund assets was 26.79 trillion yuan, an increase of 2%from the month of 26.26 trillion yuan at the end of May, and the number of fund products reached 10010. As of the end of June 2022, there were 139 fund management companies in my country, of which 45 foreign investment fund management companies and 94 domestic fund management companies. 2 insurance asset management companies. (Securities Daily) 4. The China Banking Regulatory Commission publicly solicited opinions on the disclosure of personal insurance product information on the "Administrative Measures for the Discovery of Personal Insurance Product Information (Draft for Opinions)" to protect the legitimate rights and interests of the insured, the insured, and the beneficiary , Promoting the healthy development of the industry, according to laws and documents such as the "Insurance Law of the People's Republic of China", the China Banking Regulatory Commission drafted the "Administrative Measures for the Management of Personal Insurance Product Information Disclosure (Draft for Opinions)" (hereinafter referred to as the "Measures"), and now to society Public comments: "Measures" have six chapters and 32 articles. The first chapter "General Principles" clarify the legislative purpose, scope, and principles of the method. Chapter 2 "Information Disclosure and Discovery Method" clarifies the main body of the insurance company's disclosure of product information. The object of information disclosure includes the insured, the insured, the beneficiary, and the public. At the same time, it is clear that the China Insurance Industry Association, China Banking Insurance Credit and other institutions are industry public platforms for the disclosure of insurance product information, and provide authoritative information query channels for the public and insurance consumers. Chapter III "Information Discovery Content and Discovery Time" clarifies the product material information that insurance companies should disclose, including information on product terms, rates, cash value sheets, etc. closely related to consumer rights. Clarify the content of information disclosure of insurance products in the process of pre -sales, mid -sales, and after -sales, as well as information disclosure requirements for special population. Chapter 4 "Information Disclosure Management" clarifies that insurance companies should improve the management mechanism of internal product information disclosure, and the disclosure of materials shall be managed by the insurance company's head office. Essence At the same time, it is clear that the privacy management and information security management of insurance companies are clarified. Chapter 5 "Legal Responsibility" clarifies the responsibilities of relevant management personnel of insurance institutions in product information disclosure management, materials formulation, and use. At the same time, the supervision measures of insurance institutions and relevant responsible persons violated the measures.

- END -

Chen Bing: The three major airlines in China signed a super large order with the Airbus.

Straight News: The three major airlines in China also signed a super large order w...

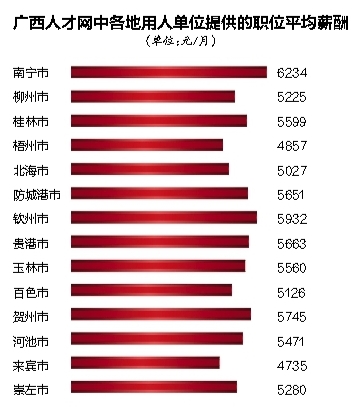

In the second quarter of 2022, the salary report of Guangxi Talent Network was released, the largest increase in this position

Recently, the salary report of Guangxi Talent Network in the second quarter of 202...