Warehouse Vane | Hua'an Fund Liu Changchang: In the second half of the year, the configuration of pharmaceutical creatures may be more balanced in the second half of the year

Author:China Fund News Time:2022.08.02

Editor's note: Recently, the Fund's second quarterly report has been disclosed. The changes and changes in the position and position of the star fund managers have also become the focus of the attention of the citizens. Behind each regular report, these outstanding manager's "investment secrets" are also hidden. Fund Jun will continue to update the character's database feature [positioning vane], decoding star fund product holding changes and its manager's investment philosophy.

After the cliffs of the first quarter management scale, with the recovery and valuation restoration of the market in the second quarter, Liu Changchang's products finally stopped falling back, but there were still many products that have not yet changed the annual income. In the second quarter, Liu Changchang maintained a higher equity position, and the concentration of heavy positions increased slightly.

In the second quarterly report, Liu Changchang, as before, adhered to the claim that "the new energy industry chain occupied the main line of economic growth in the future". Maintaining a higher level of configuration of the new energy industry chain, Liu Changchang's concentration in the power equipment industry has also further increased. It is worth noting that at a new low time in the public fund allocation of the pharmaceutical industry in the past ten years, Liu Changchang's representative products increased the configuration of pharmaceutical creatures in the second quarter.

Looking forward to the second half of 2022, in addition to paying attention to growth stocks and looking for market expectations, Liu Changchang said that under the circumstances of the continuous efforts of the steady growth policy, the real estate industry will gradually repair from the bottom, and the profit industry's profit will be guaranteed in policy insurance The environment of supply and coal price is gradually improved. In addition, the continuous repair, consumption, and offline services will also become an important direction for investing in stock selection. Therefore, in terms of configuration, it is possible to be balanced due to the increase in the number of sectors.

In this issue of [Warehouse Vane], the Fund will explain the second quarterly report and the change of positions of Hua'an Fund Liu Changchang.

Continue to force power equipment

The position of holding the position is slightly rising slightly

In the second quarter, as far as Liu Changchang's comprehensive heavy warehouse was in charge of all products, the concentration of the positions increased further to 22.29%, an increase of 0.5 percentage points compared to the first quarter. There are three top ten stocks in the top ten stocks, namely Ningde Times, Shanshan shares and Founder motors, replacing the azure lithium core, Zhongbing Red Arrow and Shi Da Shenghua in the first quarter; Hui Energy, Green, Xingyuan material, China -free and Fuhanwei; both Huadian International and Quartet have been reduced.

Among the heavy stock stocks, the industry concentration has further increased, and 6 stocks in the power equipment industry in their affiliated power equipment.

Among them, Penghui Energy replaced the Alan Lithium Core as Liu Changchang's largest heavy position in the management fund. Except for Liu Changchang's representative product, the remaining two funds increased to varying degrees of Penghui energy. Holding 25.814 million shares. In addition, the three funds have also increased their holdings at the same time.

(Penghui Energy in the second quarter of the institutional position)

(Penghui Energy in the first quarter of the institutional position)

The above three heavy stocks are all the power equipment industries, and the industry ushered in the deep V rebound in the second quarter. The inner industry index rose by 15.10%in the second quarter, and the lowest point (4.26) to the end of the second quarter. %.

Taking Liu Changchang's representative product as an example, the time to hold these three stocks has reached or exceeded three quarters. Although the positions have been increasing since the fourth quarter of 2021, due to the preliminary callback range and length of the period, they have exceeded expectations. It is still unable to return to the level of buying.

In addition to Green, Fu Hanwei has increased significantly, increasing its holdings of 529,700 shares, an increase of 40.20%.

The "Painting Line" encounters the record of Waterloo Request to break through the breakthrough

Adverse Shopping Pharmaceuticals

As a typical "trading" player, Liu Changchang's change rate has always been higher. Diversified holdings and high -frequency transactions, which is also the main reason for Liu Changchang to be called "painting line" players. However, since this year, due to the betting of the new energy industry chain, Liu Changchang represented the retracement record of the product. It is greatly surpassed with similar funds (mixed types).

Compared with the first quarter, there were four top ten heavy positions in the second quarter, namely Samsung Medical, Yaoming Kangde, International Medicine and Sanqi Mutual Entertainment. Among them, Samsung Medical and Yaoming Kant were first heavy in the third quarter of 2021, while international medicine and Sanqi Interactive entertainment entered the top ten in the first phase.

According to statistics from Haitong Securities, as of the second quarter of 2022, among the heavy stock stocks of public funds, the proportion of pharmaceutical over -assignment reached a new low of 13 years. Essence Recently, institutions have strengthened their research on pharmaceutical stocks. People in the industry believe that there may be a semi -annual report in pharmaceutical stocks. Whether this sector will usher in valuation restoration in the second half of the year has also become the focus of investors' attention.

Earlier, due to the product requirements of the "stylistic" and "health" related themes, Liu Changchang's representative products were criticized by many basic people's "style drift". Especially after the four seasons of 2021, the emergence of performance fluctuations also made this this one. The problem was intensified again.

From the perspective of Liu Changchang's management of the product, her ability circle may be more concentrated in the areas where new energy and other favorable areas. In the quarterly report, Liu Changchang also emphasized again that "the new energy industry chain will continue to become the main line to drive economic growth in the future." This time, the increase in the pharmaceutical industry is a compromise made by the "style drift", or because of the consideration of the current price -performance ratio of the pharmaceutical industry. verify. The maximum stress has passed

Configuration or more balanced in the second half of the year

After the significant adjustment of the first quarter, the risk of the overall market valuation was largely released. By the end of the second quarter, the market valuation had been repaired. In Liu Changchang's view, the most stressed stage of market pressure has passed. After a rapid rebound in the past quarter, although the future rate of return may be reduced, the performance growth of some industries can still be shared in the future.

Always firmly choose to highlight the growth of stocks, and find the market's expectations in this area. In the second quarter, Liu Changchang still recognized that the new energy industry chain will continue to become the main position of economic growth in the future. While this area will always maintain a relatively high level of configuration, Liu Changchang pointed out that many new growth opportunities are still born in the manufacturing industry. market share.

In addition to growth opportunities, looking forward to the second half of 22 years, Liu Changchang believes that under the continuous efforts of the stable growth policy, the real estate industry will gradually repair from the bottom, and the profit industry's profit will be Gradually improved. After the epidemic, these sectors of travel, consumption, and offline services will continue to be repaired, which will become an important direction for investing in stock selection, because in the future, it may be balanced due to the increase in the number of sectors in the future.

Risk reminder: The fund has risks, and investment needs to be cautious. Fund's past performance does not indicate its future performance. Fund research and analysis do not constitute investment consulting or consulting services, nor does it constitute any substantial investment suggestions or commitments to readers or investors. Please read the "Fund Contract", "Recruitment Manual" and related announcements carefully.

- END -

The increase in volume before the suspension was required to check Cuihua jewelry to receive a letter of attention due to the change of control rights

Wen | Li YongOn June 21, the Shenzhen Stock Exchange issued a letter of attention ...

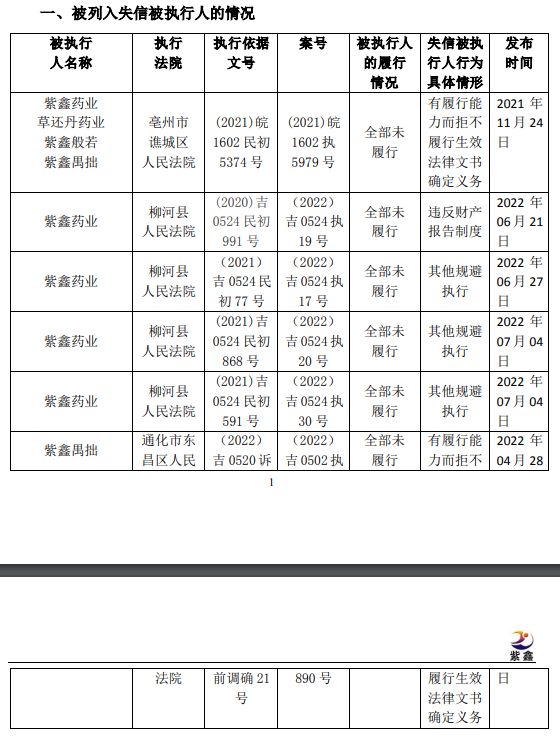

V Guan Finance Report | Zixin Pharmaceutical and many subsidiaries have become "Lao Lai", which lost nearly 1 billion last year

Zhongxin Jingwei, July 18th. Zixin Pharmaceutical issued an announcement on the 18...