Caixinwen 丨 A -share weight loss nearly 3%over 4,400 stocks fell!what reason?When is it stable?

Author:Poster news Time:2022.08.02

Popular Network · Poster Journalist Shen Tong Jinan Report

On August 2nd, A shares and funds fell again!

On Tuesday, the volume plummeted, and the Shanghai Stock Exchange once killed the platform location near 3150.

On the market, nearly a hundred shares fell, and the popular stocks that were gathered by multiple capitals collapsed near the end. In terms of sectors, the breeding industry and military industry rose against the trend, and traffic, tourism, environmental protection and other declines. As of the close, the Shanghai Stock Exchange Index fell 2.26%to 3186.27 points, the Shenzhen Stock Exchange Index fell 2.37%, the GEM index fell 2.02%, the science and technology innovation fell 0.48%, and the market turned over several times. There was a significant amount of measurement during the fall in the morning. Judging from the specific performance of individual stocks, the number of rising companies is less than 400, the number of daily limit companies is 44, the number of decline companies will be more than 4,400, the number of daily limit companies will have a sharp spread of pessimism.

(Source; Wind data)

After a continuous sideways in the early stage, the market chooses a breakthrough, and at the same time, the closing position also hit a new low since the market adjustment in July. Can the market stabilize after the volume falls? At the same time, after the mergers and acquisitions and reorganizations have experienced many years, the case in 2022 has increased rapidly. According to incomplete statistics from reporters, a total of 113 companies have announced major restructuring incidents this year, and the stock price has also performed successively. Which points are worth noting?

What is the main cause of the plunge? Can the market be stable?

Regarding the plunge of A shares on Tuesday, Xingliang, the Guoxin Securities Shandong Branch, said that on the surface, the fuse is a fascination. It was an American politician intending to visit Taiwan, but the main reason should be analyzed from the macro side.

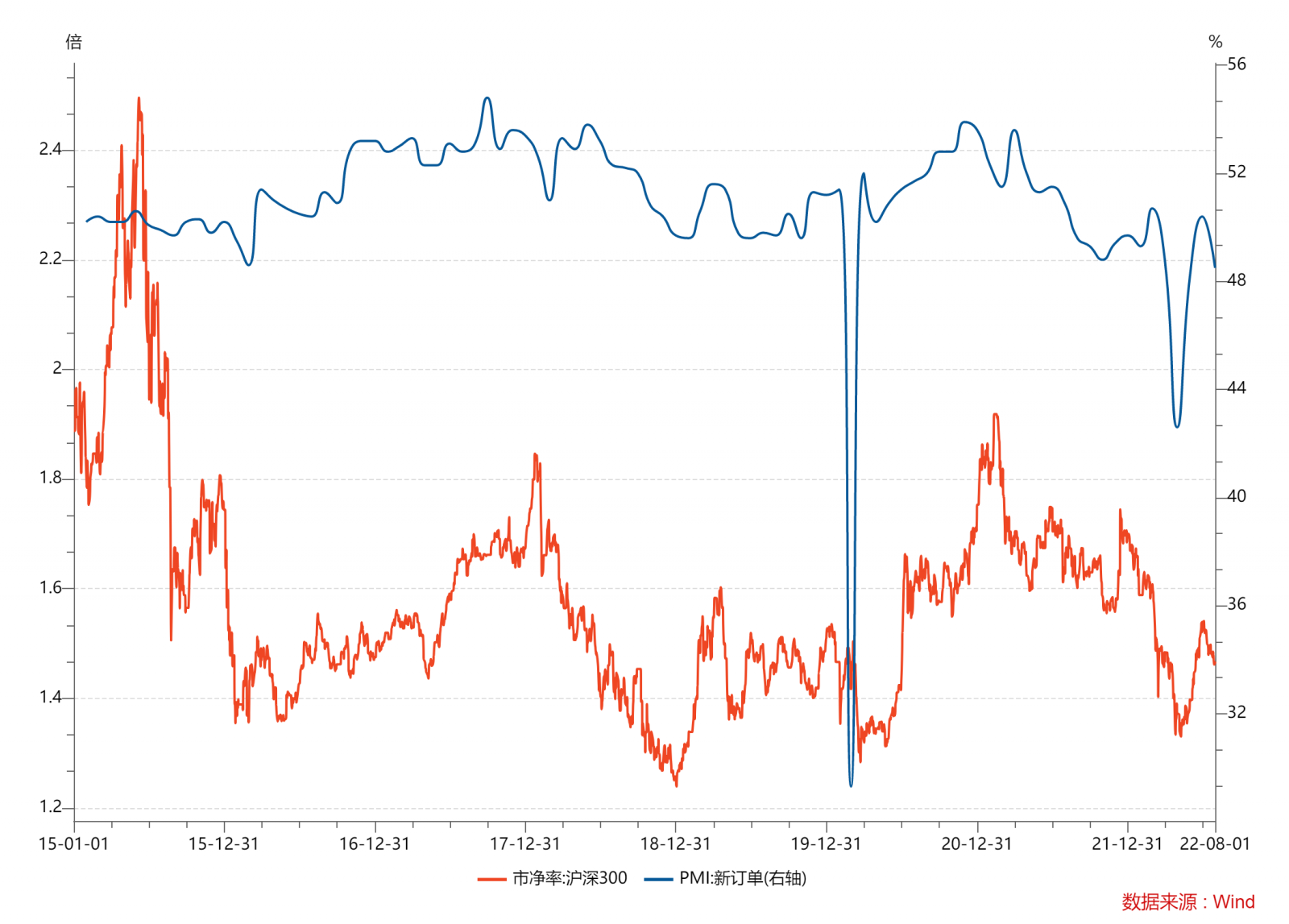

"The market's logic of the market in the second half of the year is facing the test, and the real estate, infrastructure, consumption and other sectors continue to weaken." Tsai Xingliang told reporters that it can be seen that the comparison chart of the net rate of the Shanghai and Shenzhen 300 city through the PMI new order index can be seen. The market's response to the macro economy is more effective. Therefore, it is expected that the economy will be relatively stable in the middle and second half of the year, which means that there is an opportunity to lack index.

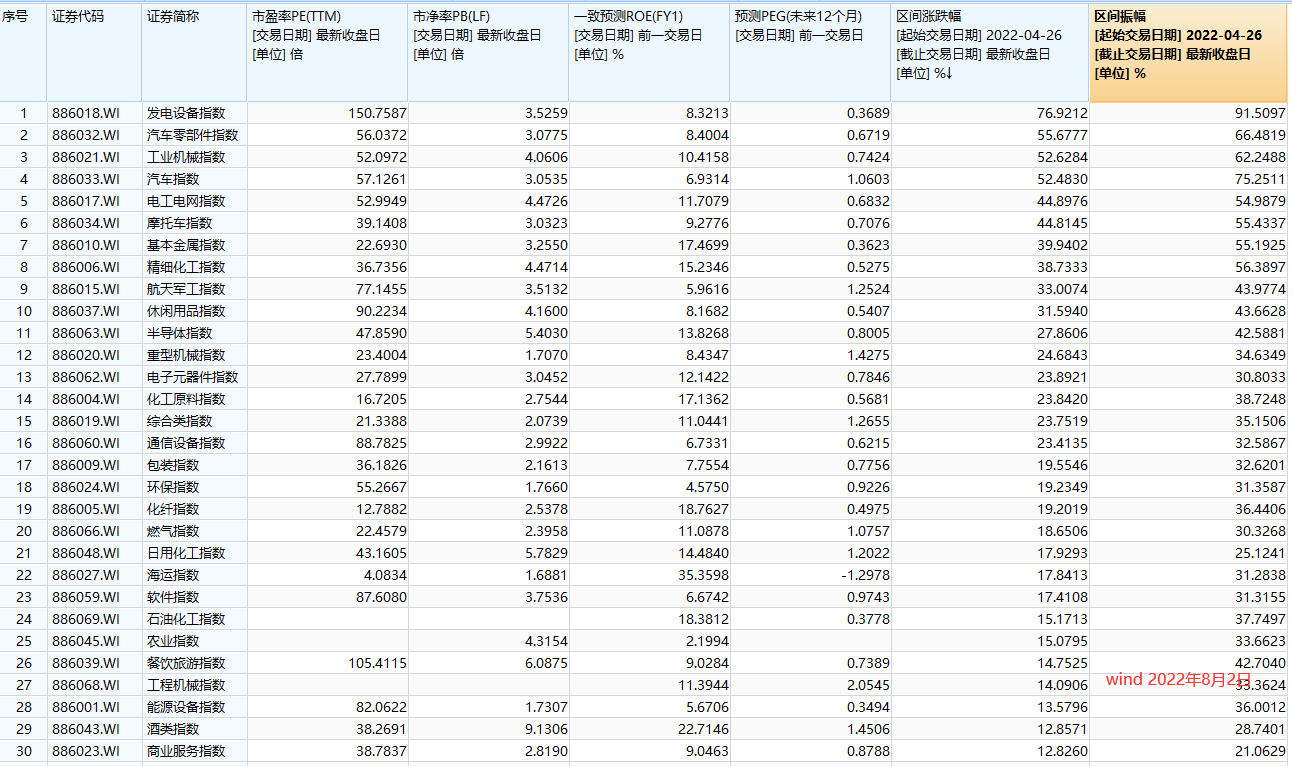

In fact, this wave of rebounds from the end of April this year can be described as "the sweetest rebound". Both monetary policy and fiscal policy are very friendly, and the rebound of most sectors is also amazing. Among them, the overall increase of power generation equipment, automotive parts, industrial machinery, and automobile sectors has increased by more than 50%, and most of the other sectors are on the rise.

Based on this, Xingliang believes that in the market -based strategy, the ideas of the ups and downs of the ups and downs should be abandoned, and they should start carefully and seize the structural market and stage opportunities. For a reasonable valuation, a stagnation section with good fundamentals or expected improvements, timely and stop loss. Similar sections include over -declined specialty, new infrastructure, digital economy, and breeding. However, it is worth noting that although the fundamental expectations of military industry have improved, because the general valuation is high, the requirements for timing selection are correspondingly high.

M & A and reorganization was deeply sought after by funds. During the year, 43 stocks rose 3 to double up

In addition, the reporter noticed that after the trough of the mergers and acquisitions after many years, with the relaxation of economic recovery and mergers and acquisitions policies, the case in 2022 increased rapidly. A total of 113 companies announced major restructuring incidents this year, and their stock prices also performed successively.

Specifically, on August 2nd, Tongda Venture announced the reorganization listing plan, and the daily limit after resumption. As of the close, the share reported at 23.3 yuan per share, with a total market value of 3.24 billion yuan.

According to the plan, the company intends to issue shares+payment of cash to acquire Pioneer Green Energy 100%equity at a price of 14.76 yuan/share. After completing the acquisition, the company will change from trade and asset management to the investment, construction, operation and service of comprehensive energy.

According to the data, Pioneer Green Energy is a systematic solution service provider with electricity as a bond to provide customers with a clean energy sources. It revolves around the "integrated integrated source of the source network and load" and contributes to the large -scale oil and gas resources of China's large -scale oil and gas resources in China. clean energy.

Data show that Pioneer Green Energy achieved operating income in the first half of 2019, 2020, 2021, and 2022, respectively, 90.6237 million yuan, 409.777 million yuan, 404.15 million yuan, and 457.557 million yuan. 161.435 million yuan, 688,526 million yuan, 114.0557 million yuan.

According to incomplete statistics, a reorganized listing case similar to Tongda Venture has announced the plan since 2022, but in addition to Nangling Men's Explosion, Hua Lian Zong Chao, Zhongyida, Qilian Mountain, Fuda Alloy, Pulida, Pulida Sheng is currently being actively declared, and Ai Sikai, ST thermal power, and CNCC have ended in failure.

At the same time, individual stocks related to mergers and acquisitions are also frequent bull stocks. On August 2nd, Lukang Biochemical opened a daily limit, and there are currently two consecutive trading days.

According to the announcement issued by Lukang Biochemical, because of the promising future development prospects of the photovoltaic glue film industry, it is planned to acquire 100%of the equity of Jiangxi Weike from Wanghong Center and Wang Meijun in cash; With the expansion of the production capacity of the entire industry chain, the policy support of local governments is superimposed, and the installation volume of photovoltaic is expected to achieve high growth throughout the year. Through this asset acquisition, we have entered the film industry in depth, in order to contribute new performance growth points to listed companies.

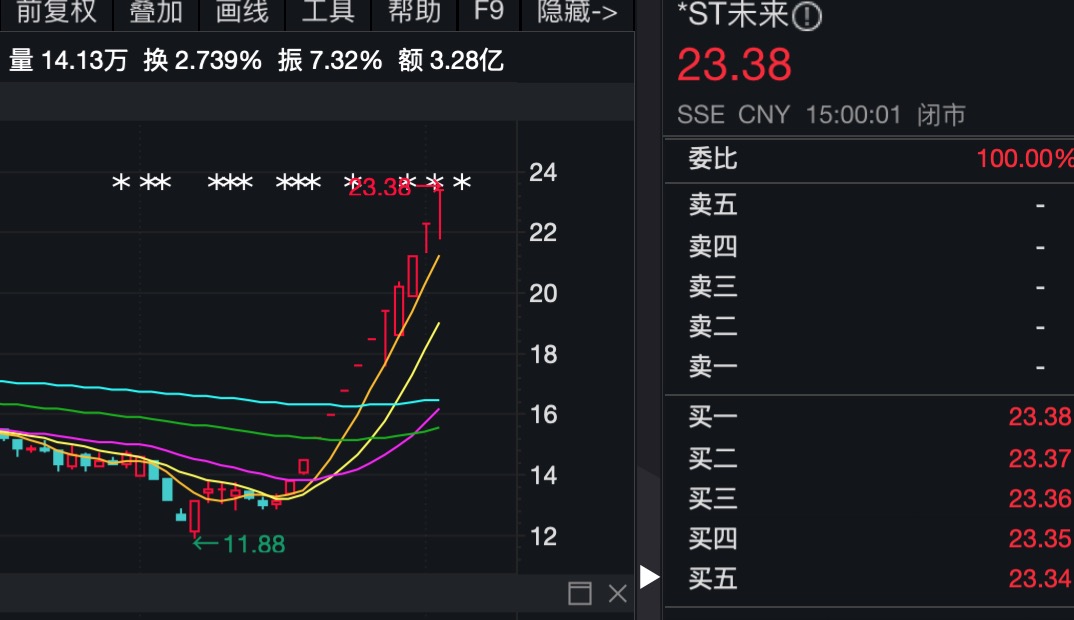

After the announcement of 70%equity of Ruifu Lithium and 70%of Xinjiang Dongli,*ST has daily limit for 12 consecutive trading days in the future.

(*ST for 12 consecutive daily limit boards in the future)

In addition, the extension mergers and acquisitions that can quickly do large -scale companies and achieve rapid performance are also favored by funds.According to Wind statistics, excluding the failure of the issuance of the issuance committee and the failure company, a total of 113 companies announced a major merger and acquisition reorganization incident this year, of which 43 stocks have increased.As of August 2, Guanghui Logistics, Junda Co., Ltd., and Taijia shares have doubled; Mubang Hi -Tech, Haigou Group, Tongda Entrepreneurship, Shenhuo, and Sino -Porcelain Electronics have risen more than 60 %;Snowy salt industry, Yue Hydropower, and Crich and other eight stocks rose more than 30 %.

(Risk reminder: Investment is risky, information is for reference only. The listed companies listed above only state that it is related to the incident and does not act as a specific recommendation. Investors should make investment decisions and bear investment risks by themselves.)

- END -

"Economic Daily" pays attention

Extensive releaseOn July 14, the 3rd edition of the Economic Daily published the H...

The interest difference between different banks deposits the dollar is 9 times!The lowest is China Merchants Bank, with an annual interest rate of only 0.35%

After the Federal Reserve ’s maximum interest rate hike in 28 years, does the dom...