Dazhou Taxation: Tax and benefit "living water" precise drip irrigation to help companies relieve the "vitality"

Author:Cover news Time:2022.08.02

Chen Jinglin Yang Shuwei Cover Journalist Zengye

Since the implementation of the new combined tax support policy, the Dazhou Taxation Bureau has established awareness of "prematurely, retreat, and retirement", with the goal of careful implementation of tax policies, refined tax services, and accurate tax bonus bonus. Demand and problems, ensure the fast, efficient, and stable landing of various tax and benefit policies, and introduce "real gold and silver" funds for the enterprise.

Learn about corporate needs

Accurately identify the key project of "seeing the door" "see effectiveness"

In the factory area of Sichuan Daxing Energy Co., Ltd., the newly built coal yard has been officially put into use. The coal farm adopts a full -closed mode, equipped with dust suppression, fire protection, and safety facilities, which can better improve the operating environment.

The completion and investment of the Daxing Energy New Coal Farm project is inseparable from the implementation of Dazhou tax and benefit policy. In July 2021, due to the flooding of heavy rain, Daxing Energy's coal -preserved coal yard for thousands of tons of coal was washed away by floods, and the corporate economic loss was serious. As a key enterprise project, the construction of the new coal workshop is expected to cost 10 million yuan. However, due to the international situation, the cost of raw materials has continued to rise, and the rate of return of funds is slow, which brings great funding pressure on enterprises.

"We learned that Daxing Energy was facing difficulties. We took the initiative to contact the company's financial staff to promote them in the recent preferential tax policies for manufacturing, especially VAT tax refund policies, and the taxpayer successfully handled more than 1,300 million yuan in tax refund for taxpayers. "Cao Yang, director of the Tax Source Management of the Second Taxation Bureau of Dazhou Taxation Bureau, introduced it.

It is reported that in order to do a good job of reserved tax refund smoothly and efficiently, Dazhou's taxation department gives full play to the analysis of the tax "big data", screening out the list of eligible tax refund benefit enterprises that meet the qualified tax refund benefit enterprises within the city, and let the large -scale retain tax refundable tax refund Find people, find people, find people, and organize the backbone of business to "guarantee to the household" to ensure that the dividend of the retaining tax refund policy is fully released.

Xu Kai, the financial staff of Sichuan Daxing Energy Co., Ltd., is grateful for the initiative of the tax department: "More than 13 million yuan in tax refund to our company's account in time, let us have a confidence in the new coal workshop. Improve production efficiency and also achieve good environmental protection benefits. The flood season is here, and we no longer need to worry about it, we can feel at ease. "

Understand product production

Carefully serve "qi blood" enterprises to eat "Xinxin Pill"

Dachuan District, Dazhou City, Sichuan Province is Umei's native resource and main producing area. Sichuan Danmei Biotechnology Co., Ltd., located in Dawagawa Umei Industrial Park. Relying on Umei, the production of preserved fruits, fruit wines, fruit and drinks such as Dazhou, Chongqing, Chengdu, and most areas of Yunnan. The comprehensive implementation of taxes support policies provides convenience for enterprises to further expand production and expand sales channels.

"Under the guidance of the national tax policy, the enterprise's value -added tax retain tax refund has solved the actual difficulties for our company. From the application to the refund tax, it takes a day to take a total of 4.96 million yuan." Xiao Gangfu, deputy general manager of Technology Co., Ltd. said, said, "We immediately put the funds into the company's second phase construction to ensure the normal operation of our company."

The taxation department of Dazhou City has continuously explored the new field of "non -contact" tax payment payment, based on the 24 -hour smart tax "cloud assistant", WeChat enterprise exchange group, and grid management staff online one -to -one "trio". The "cloud" service system provides "quantitative and tailored" service, and enjoys a list of preferential policies for enterprises to accurately create a list of preferential policies, helping market players to meet difficulties, and overcome time, and provide a strong guarantee for the stable economic operation.

Fine sought -up "adding power" manufacturing development "strong enough"

In order to allow the policy to "rain in time" to reach the market entity faster, the Dazhou Taxation Bureau strengthened the linkage of the two -level tax department of the city and county to ensure the implementation of the policy. Taxpayers accurately grasp the policy and declare requirements for policy enjoyment, and explore and innovate in the tax refund process, optimize the links and processes, and promote the policy dividends to enjoy the quick enjoyment.

Li Jiayin, executive deputy general manager of Vichi Optoelectronics, Sichuan Province, said with emotion: "This year's retaining tax refund policy is strong, which we have not expected. The company has been in contact with this preferential policy for the first time this year. It has enjoyed the full refund of the value -added tax reserved and refunded 700. For more than 10,000 yuan, the manufacturing industry has also been slowly paid by nearly 7 million yuan. The company's cash flow is even more sufficient. We are more confident in future development. "

Tan Kaijun, chairman of Southwest Fuji Elevator Co., Ltd., also praised the policy of retention of the VAT tax refund: "The repeated epidemic in the past two years has brought great difficulties to the company's production and operation. , Avoiding and slowing, adding strength to the enterprise and promoting the development of the enterprise. Such a good policy allows me to like him from the heart. "

In order to promote the implementation of preferential policies, Dazhou Taxation Department uses a concentrated tax refund and electronic tax bureau to carry out convenient tax refund in the case of ensuring accuracy, process specifications and risks of the electronic tax bureau. The problems existing in the process of policy implementation are coordinated in a timely manner, and the "strong heart agent" is sent to the enterprise to help market players develop better and faster.

Zhang Sheng, Secretary of the Party Committee and Director of Dazhou Taxation Bureau, said that the new combined tax support policy is an important measure for my country's current stabilization of the economic market and promoting the stable and healthy development of the economy. Services, from stability, fast, accurate, do not discount tax refund policies, continuously stimulate the vitality of the market subject, help enterprises through difficult periods, and contribute more tax forces to Dazhou's economic and social development.

- END -

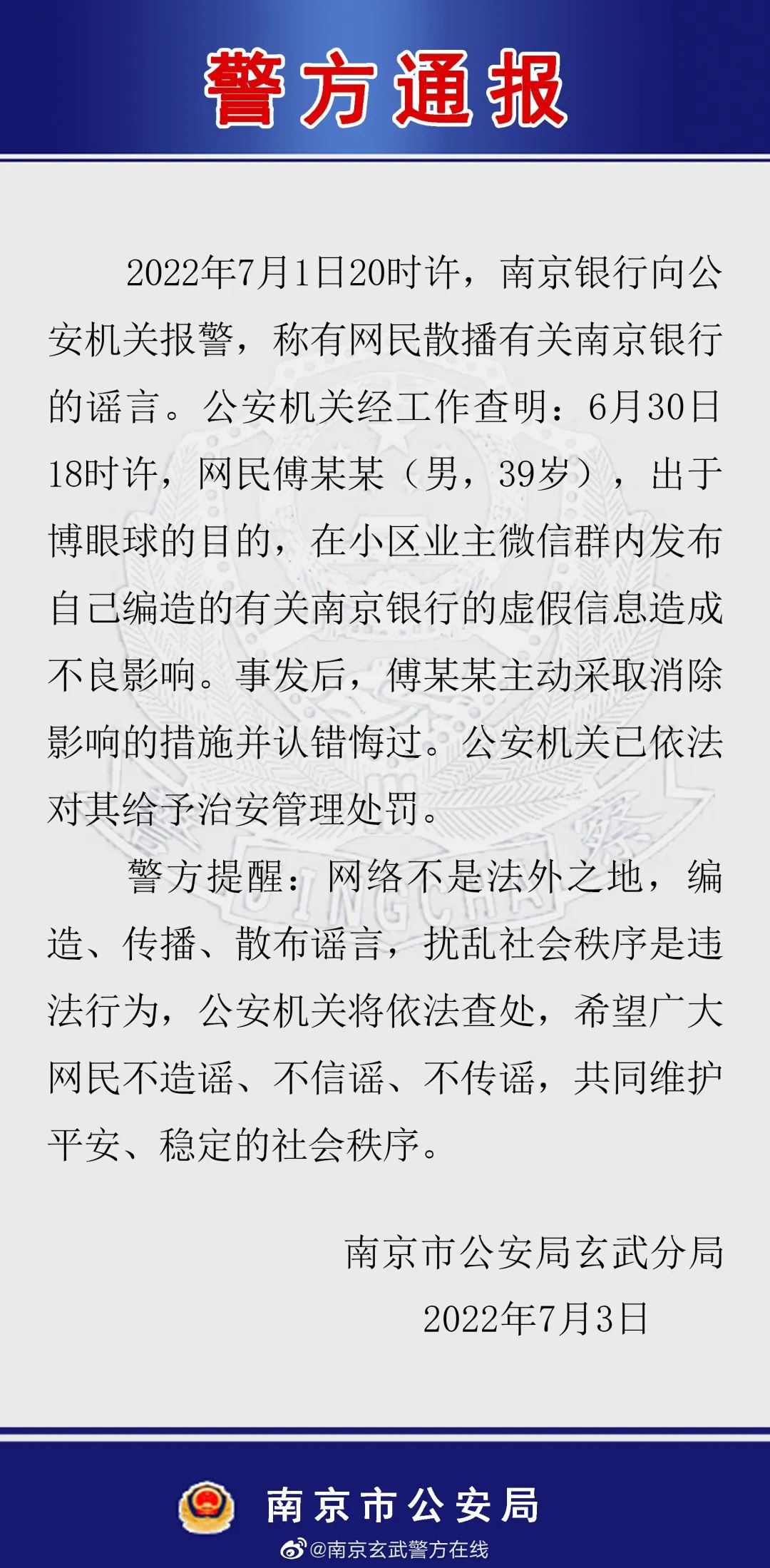

Brokerage analysts fabricated Nanjing Bank's "something", Nanjing Police: Punishment of law and order to Fu Moumou!The bank's stock price once touched the daily limit

On July 3, the Xuanwu Branch of the Nanjing Public Security Bureau reported that a...

Why is Shenzhen house "unable to sell"?

China Economic Weekly reporter Wu Suwen 丨 Guangdong reportIn the Shenzhen propert...