The beverage market starts the summer "new war"

Author:Consumer Daily Time:2022.08.02

The temperature rises, the peak season for the consumption of a new round of beverages, and a variety of beverages on the shelves have become a must -have for many consumers to relieve heat. With the rapid development of the beverage industry, market competition has intensified, product updates have become faster, beverage categories are richer, and category innovation has also become a driving force for the development of the beverage industry.

At the same time, consumer scenes are also more diverse. Drinks are not only a tool for consumers to simply quench their thirst, but also show new consumption characteristics and trends, especially the "Gen Z generation", which is mainly based on post -95s, has become the consumer group with the largest potential growth potential. , Promote the continuous expansion of consumption in the beverage industry.

In such a market background, beverage brands have attacked the peak season of cool summer beverage and scrambled to "inner rolls" new, not only bringing more new choices to consumers, but also to promote a new round of growth in the beverage market.

Brand "inner volume" compete for new

In addition to the in -depth exploration of Nongfu Spring for "carbonic acid+tea", the vitality forest is in the new product, and the summer limited sea salt series bubble water launched by the vitality is hotly sold nationwide. Soda; Jinmai Lang has launched a number of new products such as juice tea, sugar -free bubble water, electrolyte drinks, sugar -free tea beverages ... The brands have continuously expanded new products, and the beverage market is full of flowers. Let consumers commit "choice of phobia."

Today, the beverage circle has also begun to "inner rolls." The reporter noticed that in order to further attract consumers' attention and purchase, many new brands of new products use "seasonal limits" and "seasonal" as gimmicks, combining products with seasonal fresh fruits. At the same time, by issuing promotional methods such as special vouchers and "1 yuan for purchasing" to rob the consumer market and help the promotion of new brand products.

"Delays" intensified

In recent years, as consumers continue to attach great importance to health, consumers will first look at the "a few pounds and two" before drinking drinks. Health and 0 sucrose will become the core appeal of consumers.

In fact, my country's sugar -free beverage market has shown a steady rise in rising, especially in 2018, the Qiqi Forest launched a sugar -free drink containing bubbles, leading the sugar -free beverage market in China.

In this context, whether it is a traditional carbonated beverage company or an emerging brand, after seeing the huge development space of the sugar -free beverage market, it is rushing into the sugar -free beverage market. In 2020, Yansan dairy water bubble water, Jianlibao micro -bubble water, Nestlin Youhuo live bubble water, and Xixiao tea air bubble water and other emerging sugar -free carbonated beverages were listed.

In carbonated beverages, the share of sugar-free categories has gradually increased, and the growth rate is fast. From 2014-2020, the size of the sugar-free carbonated beverage in my country increased from 600 million yuan to 6.69 billion yuan, with an average compound growth rate of 41.13%.

In response to consumers' pursuit of "sugar control", in 2011, Nongfu Spring also took the lead in launching sugar -free tea oriental leaves; in 2019, Yibao launched the "Saida Tea" sugar -free tea, and similar products are still emerging. Essence

It is worth mentioning that in the first half of this year, the Oriental leaves of Nongfu Spring's sugar -free tea brand maintained a high growth trend since last year. Among the "618" promotion of e -commerce platforms such as Tmall and JD.com, Oriental leaves were led. This summer will further drive the outbreak of sugar -free tea beverages.

Data show that from 2014 to 2020, the size of the sugar -free tea beverage market increased from 1.02 billion yuan to 4.85 billion yuan. From the perspective of the beverage market, whether it is traditional and old -fashioned drinks or newly rising emerging brands, they race to play the "upgrade battle" of raw materials formulas, and they have joined the "sugar -free camp". With the change of consumer health awareness and needs as the core, the "de -glycation" of the beverage industry has intensified.

With the continuous update of "sugar -free+" products, from the current specific products on the market, there are also many subdivided categories of sugar -free beverage tracks. Among them, sugar -free carbonated beverages and sugar -free tea beverages are the largest. According to the prediction of the Chinese Academy of Sciences, the market size of sugar -free beverages will further maintain a growth momentum. It is expected to double in the next 5 years. In 2025, it will increase to 22.74 billion yuan. In 2027, the market size will reach nearly 27.7 billion yuan.

"Gen Z" has become a new driving force for growth

In recent years, with the continuous update of beverage products, the continuous expansion of the category, the drink consumption scenario has also been extended. Whether it is family procurement, outdoor drinks, banquet sharing, or sports fitness, it has become a new scene of beverage consumption demand. New demand means meaningful. The increase in the number of consumers has also driven the continuous expansion of the beverage market.

Judging from the current consumer group, the "Gen Z" represented by the post -95s is the main incremental population driving the growth of drinks. The Shanghai Consumer Rights Protection Commission has released the "Genz" Beverage Consumption Survey Report "pointed out that the number of times of buying beverages within a week of" Gen Z "is 3 or more; over 40 % pay attention to health and health preferred" 0 sugar " Essence After the 95th, consumers' consumption growth rate on various beverages is higher than the overall population. The repurchase rate and the frequency of repurchase are outstanding, and the growth rate of the number of high -frequency repurchase after 95 is far ahead.

At the same time, the influx of online consumers drive the rapid development of the online beverage market. The "2021 Beverage Consumption Trends Insight" report shows that in 2021, the number of consumers and consumption frequency of the Tmall platform beverage industry has increased, driving the growth of the overall consumption amount. Four times the rapid development of beverage and food. The rise of new consumer groups provides opportunities for the development of the beverage industry. So from the perspective of the entire industry, how much room for development is there in the future?

With the development of the market, my country's total beverage output and retail sales have increased year by year. According to data from the National Bureau of Statistics, the cumulative national beverage output in 2020 was 160 million tons. In 2021, the national beverage production was 180 million tons, a cumulative increase of 12%. In 2021, my country's beverage retail sales reached 280.8 billion yuan, an increase of 20.4%year -on -year. From January to April 2022, the retail sales of beverage products increased by 10.4%year-on-year to 93.8 billion yuan.

At the same time, the consumption scale of the beverage industry has gradually expanded. From the perspective of the consumption scale of the beverage industry, the market size in 2019 has reached 991.4 billion yuan. It is expected that it will exceed 1.3 trillion yuan in 2024, and it has reached the overall drink food industry industry in the consumption growth rate. 4 times.

Taken together, the beverage industry will still be booming, and the demand for consumption upgrades will be continuously released. According to the CCTV Finance Channel's "Beverage Consumption Market Observation" column, the current beverage market in my country has developed rapidly with a stable trend, and my country's beverage market will still have room for development in the future. With the continuous expansion of the demographic dividend of the new generation, the Chinese beverage market will also usher in a new round of growth.

Text | Our reporter Ye Debao □ Niu Xiafeng

- END -

The interpretation of up to 6 months of rents in Sichuan Province State -owned Housing Rental Policy Come here

Cover reporter Liu XuqiangSince the beginning of this year, in order to help small...

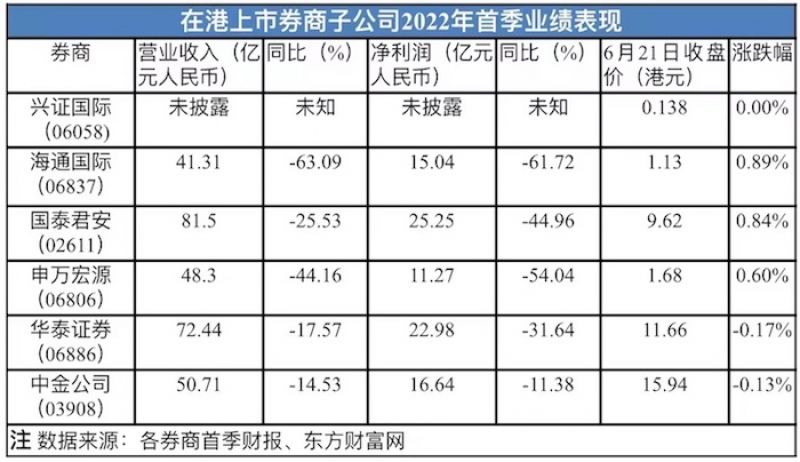

13 brokerage companies stopped business during the year!Under the epidemic, Hong Kong Voucher Commercial Accelerated Horchings

Huaxia Times (chinatimes.net.cn) reporter Wang Jingge Aifeng Shenzhen reportFor Ho...