The price of gold is empty, it is expected to impact this price

Author:China Gold News Time:2022.08.01

At 2 am on Thursday, July 28, the Federal Reserve Federal Public Marketing Committee announced about the July interest rate resolution, raising the target range of federal funds from 1.5%to 1.75%to 2.25%in the second consecutive month. By 2.5%, in line with market expectations, the Fed's interest rate hike in the past five months is equivalent to the sum of interest rate hikes from 2015 to 2018.

On July 25th, the gold price collected the sun.

At the subsequent monetary policy press conference, the Federal Reserve Chairman Powell hinted that it might raise interest rates at 75 base points in September, denied that the US economy was in a recession period, and at the same time proposed the possibility of slowing interest rate hikes. Inflation is still high, and the committee pays high attention to inflation risks, and is firmly committed to letting inflation returns to its 2%goal. Powell said that the Fed will make decisions on monetary policy one by one at each interest rate meeting to avoid issuing specific guidelines. It will not provide specific guidelines for the September meeting and will pay attention to all data before the September meeting.

Powell emphasized that it is necessary to maintain flexibility and work hard to avoid increasing uncertainty. The Fed FOMC statement fully meets market expectations. After the interest rate was announced, the market response was relatively flat. At the subsequent press conference, Powell talked about the need to maintain flexibility and slowed down the interest rate hike. Fall, the price of gold rebounded at a low level.

In the second quarter of the United States, the initial value of GDP in the second quarter (GDP) was -0.9%, 0.5%expected, and a previous value of -1.60%. The official arbitration agency (National Economic Research Bureau) of the economic recession defines the decline as "the economic activity has declined significantly in the entire economy for several months, and is usually visible in production, employment, actual income and other indicators." In the first half of this year, the average monthly employment increased by 456,700, which brought strong wage growth, but the risk of decline in economic decline has increased. After the data was announced, the US dollar was further softened, which continued to provide momentum for the rebound of gold prices.

In terms of capital flow, as of July 30, 2022, the world's largest gold ETF gold holding volume was 1005.29 tons, a total of 0.58 tons of positions this week, the world's largest silver ETF holding volume was 15043.43 tons. Essence

Technical aspect: From the perspective of the Japanese K line, the Bollinger is closed, and the short -term moving average is a golden fork upward. The multi -headed market has emerged. If it can stabilize the Bollinger's mid -rail nearly $ 1751/ounce, it is expected to impact nearly $ 1,836/ounce in the Bollinger rail, and it will still be nearly $ 1680/ounce as an important support.

- END -

Quick comments 丨 Credit card holders are accepted by violence, and they are alert to the vicious circle of dual losses

On the one hand, I was anxious to return the account and collect it crazy, but they were unable to pay back the money, complain, or find a side door trail to deal with. To some extent, this will fal

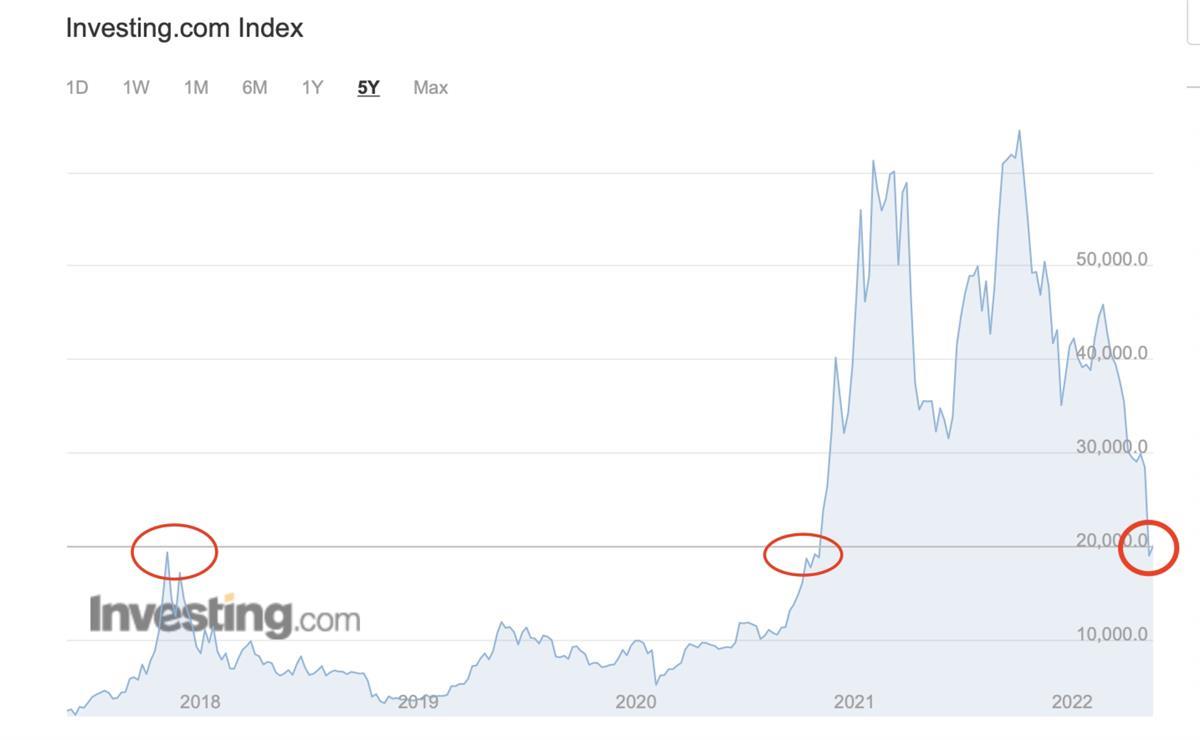

Bitcoin plunge has shrunk the wealth of many rich people around the world, which has little impact on China

Jimu Journalist Zeng LingzhengAfter two consecutive days, after the market panic w...