The end of important economic conferences, the two major dividends of the 100ETF accurate layout of the China Promotion Corporation

Author:Capital state Time:2022.08.01

This summer is too hot and hot, and the high temperature of the world has announced the emergency of climate due to the high temperature of the world. Compared with the hot environment, people's "hot" is even more impatient. Affected by factors such as high inflation, global economic pressure. According to the latest point of view of IMF, the global economic growth rate will slow to 2.90%next year. However, my country's economic growth is expected to usher in a low rebound next year, rising from 3.30%to 4.60%, but still faces some challenges and risks.

Data source: IMF "World Economic Outlook", July 2022

Risk reminder: The above view is the current point of view. In the future, it may change with the changes in the market, and it does not constitute the guarantee of any investment proposal and fund investment income.

According to the "Analysis of the China Economic Situation in the Midsway 2022" released by the Academy of Social Sciences, my country's economy also faces three major risks: first, the impact of foreign demand on exports is uncertain; second, consumption confidence is still fragile; third The foundation of real estate sales is not firm.

In terms of currency, high -level conferences have stated that "increased credit support for enterprises and made good use of policy banks to build investment funds for new credit and infrastructure construction." Next, it is expected that the liquidity of the financial market may continue to be abundant, which will help the A -share risk appetite to improve.

Follow the macro general trend, the two major dividends of the precise layout

Investment depends on the environment, it is not advisable to believe in the horse. At present, investors should keep up with the macro general trend, focusing on the two major dividends behind macroeconomic growth and high -quality development.

Let's talk about macroeconomic growth. At present, due to policy support, the macroeconomic growth rate is relatively certain. So, how to seize this certain opportunity? The faucet width index may be a good choice. For example, CSI 300, Shanghai Stock Exchange 50, CSI 100, and MSCI China A50, which cover the representative leading listed companies in my country's major industries, can basically reflect the composition of the macroeconomic. Therefore, macroeconomic growth will directly benefit these broad -based indexes.

However, the preparation of these broad -foundation indexs is different. Among them, CSI 100 in the new economic field represented by electrical equipment and electrons is relatively high, which is relatively high in accordance with the current market hotspots, as shown below:

Data source: Wind, the official website of the CSI Index, data as of July 20, 2022, the industry classification is in the case of application.

Risk reminder: The above view is the current point of view. In the future, it may change with the changes in the market, and it does not constitute the guarantee of any investment proposal and fund investment income.

In the past six years, the cumulative increase, annualized increase and annualized Sharp ratio of CSI 100 are better than other broad -foundation indexes, as follows:

Data source: Wind, Data Statistics Division: August 1, 2016-July 31, 2022. The CSI 100 Index is based on December 30, 2005. The complete annual growth rate of the CSI 100 Index (2017 to 2021) in the last 5 years (2017 to 2021) was 30.21%(2017),-21.94%(2018), 35.54%(2019), 24.09%(2020), -10.55%(202111 (2021) To. Note: The calculation cycle of annualized volatility is selected, and the yield algorithm selects a normal yield, and the annualized volatility = volatility*52^0.5. Note: The Sharp ratio is a income index after total risk adjustment. Generally, the larger the value of the Sharp ratio, the higher the excess returns under the total risk of the unit; The fluctuation rate after / annualization; the calculation cycle selection week frequency, the yield algorithm selection of the normal yield, and the risk -free yield selection one -year fixed deposit interest rate (before tax).

Risk Tips: The CSI 100 Index and the Shanghai Stock Exchange 50 Index, the CSI 300 Index, the Shanghai Stock Exchange 180 Index and the CSI 800 Index are different in the aspects of the base day, the composition voucher composition, and the screening rules. The performance is not comparable and is for reference only. Index's past performance does not represent future performance, nor does it constitutes the guarantee of any investment advice and fund investment income. The index operating time is short and cannot reflect all stages of market development. The above view is the current point of view. In the future, it may change with the changes in the market, and it does not constitute the guarantee of any investment advice and fund investment income.

Besides high -quality development. The important concept of high -quality development is innovation, coordination, green, openness, and sharing to promote the long -term sustainable development of economic and society. In recent years, the rectification of policies to education, medical and housing markets is to move away the three mountains on residents to promote social harmony. This concept deeply affects the capital market and brings the rise of the "ESG assessment". ESG focuses on the performance of the three dimensions of enterprises in the three dimensions of the environment, society and governance. It not only emphasizes the long -term development momentum of the enterprise, but also to prevent or reduce losses caused by risk events and reduce investors' investment risks.

At present, CSI 100 is the only index of ESG negative elimination of all Broad -based indexes of A shares, which makes it have more sustainable long -term investment value.

It is worth mentioning that the ESG concept originated from overseas, so overseas investors have a higher degree of recognition of such assets. The sample stocks of the CSI 100 Index come from the Land and Port Interconnection list, and it is also very convenient for foreign participation in the configuration.

So, is the valuation of the CSI 100 index attractive now? According to Wind data, the P / E ratio of the index P-TTM is 13.64, which is at a low level of history. As shown in the figure below: Data Source: Wind, Data Interval: 2014.10.17-20222.07.22, Note: Rolling P / E ratio PE-TTM refers The ratio of the stock market price to the profit per share usually, the larger the value, the higher the valuation; the rolling price-earnings ratio PE-TTM = stock price/in the last 12 months of earnings per share.

The low valuation corresponds to a higher risk premium. At present, the CSI 100 Index's risk premium on 10 -year Treasury bonds is as high as 4.55%, and the configuration value is obvious (data source: Wind, data as of: 2022.07.22, Note: Risk premium refers to investors The compensation obtained by risks, the greater the risk premium value, the higher the compensation obtained by the unit's risk; the risk premium = 1/P/E ratio) -The 10-year Treasury yield. To.

Risk reminder: The above view is the current point of view. In the future, it may change with the changes in the market, and it does not constitute the guarantee of any investment proposal and fund investment income.

In summary, CSI 100 is a very good investment target that is suitable for stable investor layout. In order to seize this investment opportunity, China Merchants 100ETF (code: 159631) opened subscriptions from August 1st, 2022 -August 12, 2022. The fund tracks the 100 index of CSI, which may be worth looking forward to.

Risk reminder: The fund has risks, and investment must be cautious.

- END -

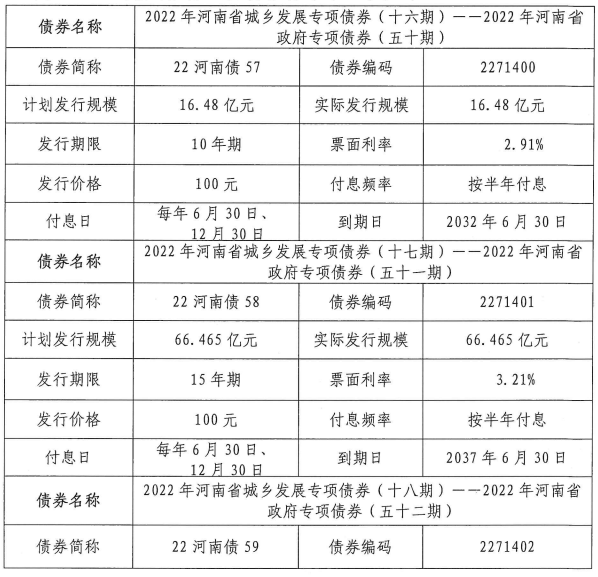

Henan 34.824 billion yuan of special debt was issued for issuance (contribution project form)

[Dahecai Cube News] On June 29, according to the China Bond Information Network, t...

International investment institutions are optimistic about the "highlight" of the Chinese stock market

[Global Times Comprehensive Report] With the increasing concerns about the decline...