Li Ning, is the soberness of coffee or the paralysis of alcohol?

Author:Lu Yan Business Review Time:2022.08.01

Li Ning continued to chase the trend, but gradually lost its core competitiveness. After the hustle and bustle, Li Ning still has to consider how to achieve a breakthrough in the main business track.

可能 Li Ning, who is "everything is possible", has the idea of selling wine again.

Recently, Li Ning, the founder of Li Ning, was exposed to officially entered the rice wine industry, investing and launching "twelve -reading" rice wine. This is the second time that Li Ning has been attracted by cross -border after the launch of Ning Coffee in May.

From athletes to sports clothing entrepreneurship, Li Ning's most successful cross -border entrepreneurship comes from insight and continuation of their own advantages. At the moment of the rise of the national tide, the national sports apparel brands that set foot on the wind have ushered in a wave of growth. However, compared to the different business of Anta, Tubu and other brands to consolidate their own business, Li Ning's recent brand attention mostly comes from cross -border operations that are far from their own business.

Compared with the popularity brought by strong marketing, Li Ning Company has been in a second -tier position for a long time in the global sports clothing brand, and has been deeply affected by the price pressure of the head brand. Under this pressure, Li Ning needs to find differentiation and strengthen its core competitiveness.

In other words, whether it is the soberness of coffee or the paralysis of alcohol, it is a temporary force for Li Ning. After the hustle and bustle, Li Ning still has to consider how to achieve a breakthrough in the main business track.

Coffee and wine, the more you drink?

The popularity of Li Ning's cross -border coffee has just passed. Li Ning's personal investment in rice wine has also appeared on the hot search of the wine industry.

Public information shows that Twelve Reading rice wine is a product of Zhejiang Lao Shaofang Wine Co., Ltd. The company was established on May 17, 2021. The legal representative is Zhao Jianguo, the co -founder of Li Ning Group, and the shareholders behind it are Tianyang (Hong Kong) Co., Ltd. and Huzhou Lao Shaofang Wine Co., Ltd.

Although in terms of equity structure, Twelve Reading rice wine has nothing to do with listed company Li Ning Company, and it should belong to personal investment. Ms. Wang, who is engaged in brand strategic consultation in Henan, believes that this deep -binding IP effect is one of the main reasons for the twelve -reading rice wine to attract the attention of the industry.

Blessing, the trouble is that for Li Ning, the founder Li Ning's personal IP has long been bound to the listed company. Even Li Ning's personal investment is invisible to endorse the goodwill of the listed company. If the twelve -reading rice wine has a negative impact, it will also be transmitted to the level of listed companies.

In recent years, Li Ning and Li Ning have been alone in cross -border love. Earlier this year, Li Ning Sports (Shanghai) Co., Ltd. applied to register the "Ning Coffee" trademark; on April 30, the first "Ning Coffee" was opened in a Li Ning flag ship in Xiamen, Fujian.

However, Ning Coffee was just two months from fiery to ebb, and finally failed to escape the fate of most Internet celebrity products. "Li Ning's coffee is not easy to buy, standing on the shoulders of 499 yuan." A user had shared his experience of tasting "Ning Coffee" on the social platform. According to the user, it is necessary to consume 499 yuan in the store to get a cup of Ning coffee for free.

Li Ning has introduced the positioning of Ning Coffee in this way. A innovative attempt of the retail terminal consumption experience link is to improve the comfort and experience of customers during shopping. But according to the above user statement, this may be just a new way of "full gift" in the retail industry.

How many people are willing to consume a cup of coffee for a cup of coffee? A small red book user shared on the platform: "The quality of coffee is very ordinary, not a boutique coffee, and it is purely used as a thirst." According to Lu Yan's business review, many social platforms favored by young people are also No large tap water flow was found.

Why can't we satisfy Li Ning's appetite?

If it is said that the full -reduction gift Ning Ning coffee is still a very sober attempt: through the coffee loved by young people, it enhances the experience of the main retail link experience. Then, Li Ning personally launched twelve -reading rice wine, maybe a bit of paralysis with wine.

For many companies, cross -border and diversified operations are conventional operations. But Li Ning is a special brand, because consumers are not only paying attention to the products and design of "Li Ning", but also the honor and national feelings behind Li Ning. Li Ning and Li Ning, who were labeled on the national tide, have been sent by the public to the national brand's "curve overtaking". Even Ning Coffee, which was ultimately dissipated in the end, some netizens at that time claimed that as long as "the taste is not particularly difficult to drink, it is willing to support it for a long time when the price is affordable."

However, in recent years, Li Ning's performance report has not seen the sharpness and will of the head of the head of the championship.

At present, Chinese sports clothing listed companies mainly include Anta Sports, Li Ning, Tubu International, and 361 degrees. In 2012, after Li Ning was surpassed by Anta, he was in a state of followers and continued to widen the gap.

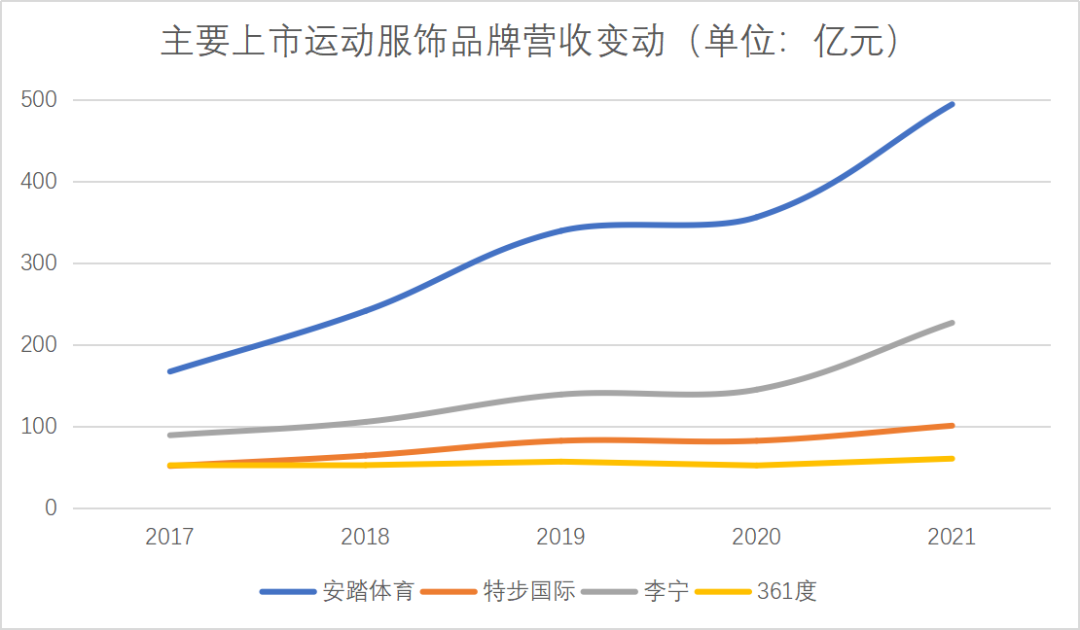

It can be seen from the figure below that from 2017 to 2021, the domestic sports brand market maintained a growth trend as a whole. Li Ning's revenue was in a medium position among the four head brands, and the growth rate was slightly higher than Tibu and 361 degrees, but Anta was farther and farther. In 2017, the gap between Li Ning and Anta's revenue was less than 8 billion, and by 2021, the number had increased to 26 billion yuan.

Based on the number of numbers in the table, the annual compound growth rate of Anta during the 5 years was about 24.25%, and Li Ning Company was about 20.59%. In 2021, the revenue of only Anta's single brand under Anta Sports was higher than the total income of Li Ning. For Li Ning Company, the good news is that it still won the growth rate of the total size of the Chinese sports apparel market during the same period (from about 221.5 billion yuan to about 371.8 billion yuan, a compound annual growth rate of 10.9%).

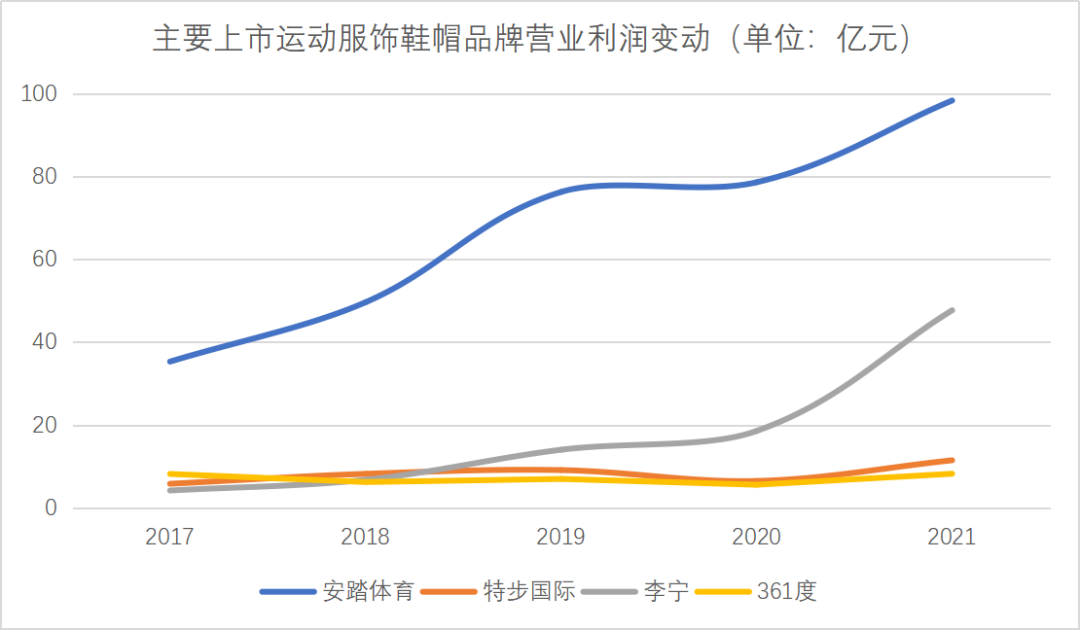

Another good news is that Li Ning is still a very profitable enterprise. In terms of operating profit, Li Ning's compound annual growth rate exceeds 67%, and the main competitor Anta is only 22.7%. Although this may be due to the low operating profit base of Li Ning. From the dimension of net profit margin, Li Ning (17.77%) is still lower than Anta (20.45%).

But for Li Ning, Xiao Fu must not be safe. In the Winter Olympics in 2022, Anta made a big hit and repeat Li Ning's myth 14 years ago. In the future, it may become inevitable. If Li Ning is unwilling to be the second child, it will need a higher growth rate. Li Ning did not work hard. In the past three years, three high -end brands such as Castle Lion Dragon, Iron Lion, and Clarks have been acquired. However, from the current figures, Li Ning's acquisition has not been able to look like FILA to Anta. Similarly, it brings a significant second growth curve.

Continuously trying cross -border business outside the sportswear, perhaps Li Ning's latest efforts to find a stronger growth momentum.

Chasing the trend and lost core competitiveness?

In the early years, Li Ning joined Jianlibao after retiring, and began to find business under the leadership of Jianlibao Cao Di Li Jingwei and founded Li Ning Company. Li Jingwei once said to Li Ning: "Li Ning, your name and face are the greatest value."

As the saying goes, the sense of honor and national feelings behind Li Ning's name brings the inherent cultural barriers to the Li Ning brand. In recent years, the rise of the national tide is similar to the early days of the birth of the Li Ning brand. It is the strengthening of the national self -confidence in culture, not just a blind chase trend.

After being surpassed by Anta in 2012, Li Ning also tried to break the national tide and cross -border other areas. But the ace that seems to be able to overtake the curve instead has trapped Li Ning's company in the national tide "mud". This is because Li Ning gradually forgot the core competitiveness in the process of chasing the trend.

Compared with the most important competitors Anta never let go of any sports event, Li Ning is constantly diluting sports elements. Taking brand spokespersons as an example, Li Ning chose Lin Zhiling as a TV advertising spokesperson in the early days; in 2021, Xiao Zhan signed Xiao Zhan as a global spokesperson. The information transmitted by this brand connotation made the outside world think that Li Ning was swaying between fashion and professional movements, which blurred the brand image.

The more questionable choice is that in 2018, "China Li Ning" was shining in two fashion shows in New York and Paris. The Li Ning brand then moved out in the fashion circle. But the bad news is that, from the perspective of fashion, Li Ning has never been like Anta, and has sports fashion brands like FILA. Through brand isolation, consumers have the minds of consumer mindset and collaboration. A sports brand, both professional and fashionable, is difficult to do both.

In addition, the long -term sales volume of sportswear and sports shoes depends on the professional value of the brand. Through continuous research and development, it can maintain the material and design in order to gain the favor of users in the sports projects in each vertical division.

R & D data show that although Li Ning has increased its research and development investment in recent years, its R & D cost rate has declined. In 2021, Li Ning's expenditure increased from 323 million yuan in the previous year by 28.2%to 414 million yuan, but the proportion of R & D expenditure fell from 2.2%in 2020 to 1.8%.

On the contrary, the other two head players in the industry, Anta and Tsobe's R & D rates accounted for greater than Li Ning. Anta's R & D expenses accounted for 2.3%in 2021, while Tubu's research and development expenses accounted for 2.5%in 2021. At the same time, Anta's annual revenue is much higher than Li Ning, which means that the gap between the R & D expenses of both parties is also increasing.

In short, in the international market, it is difficult for Li Ning to obtain the position of the head, but it is necessary to prevent the latecomers behind them. This state may be accompanied by Li Ning Company for a long time.

After "breaking the circle", you must also "keep the circle". If you want to "eat a fresh and eat the sky" by relying on the national tide and various Internet celebrity flows, Li Ning will probably repeat the 2010 inventory crisis.

- END -

Fat and strong and affordable!Have you ever adopted this year's first bun crab?

With the opening of the East China Sea, the fat barracuda crabs are fresh on the m...

Shenzhen launched the fifth stable growth "30" this year

Yesterday, the Shenzhen Municipal Government released the Several Measures on Prom...